This article was originally published by Dominic Frisby on his Substack, “The Flying Frisby.”

In your time bestriding the narrow world like a Colossus, you might have heard the term, “bearer asset” or “bearer instrument.”

That would be an asset that you take physical possession of — cash or bullion, for example — an asset that is effectively owned by whoever has possession of it; it can be transferred from one person to another by just handing it over.

The ownership of the asset is not registered with a central authority, so that makes it vulnerable to theft or loss, but it also means the asset is nobody else’s liability. Unlike money in the bank or a government bond, it carries no promise from a third party. The value of the asset is thus not dependent on the creditworthiness of any issuer or guarantor, but rather on the inherent value of the asset itself.

So, in today’s interlinked financial world, a bearer asset becomes an asset outside the system.

Like Tottenham Hotspur, bearer assets have their strengths and their weaknesses. Their strength is that they are nobody else’s liability. Their weakness is that their liability is yours.

The two main bearer assets in today’s financial marketplace are gold and bitcoin.

Bitcoin rallies as investors seek safety

Bitcoin is not a physical asset, of course. But the technological genius behind it means that it is a “digital bearer asset.” No such thing previously existed.

With bank runs, bail-outs and another banking crisis now upon us, both gold and bitcoin have suddenly fetched a bid. No surprise: they both are means to store value outside the system. You don’t have to rely on third parties.

I thought, given everything, we should check in on both today.

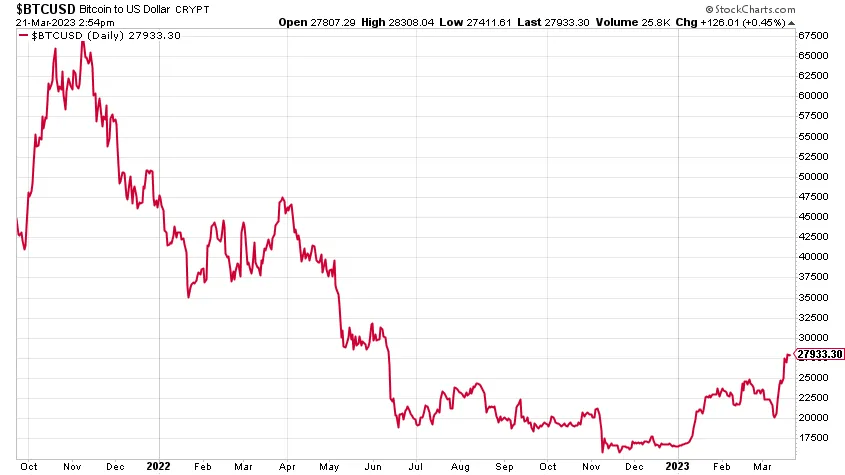

Here’s bitcoin, which, at $28,000, has broken out to 9-month highs:

Is that a bullish, inverted head-and-shoulders pattern I see before me? I think so.

On that basis, what would the target be? The distance from the top of the head (around $15,000) to the shoulder line at c.$25,000 is $10,000 — so you would have a target of around $35,000, perhaps a little higher.

Some are even calling out for “hyperbitcoinization,” a hypothetical scenario in which the widespread adoption of bitcoin occurs so rapidly that its price rises dramatically and it becomes the dominant form of money.

In this scenario, bitcoin would be widely accepted by merchants and individuals alike. The term “hyper” refers to the extreme and rapid level of adoption.

In a way, it is an inversion of hyperinflation. The fiat system would remain. It wouldn’t necessarily collapse, but just be overtaken and superseded by bitcoin.

There are many who believe hyperbitcoinization is both inevitable and desirable. Bitcoin is better money than fiat. The traditional banking model is dysfunctional and dependent on constant bailouts.

One such advocate is billionaire Balaji Srinivasan, who has grown so concerned at the goings-on in American banking that he has made a million-dollar bet that bitcoin will hit $1 million by June 17.

The odds are against him. Some are suggesting he is just doing it for the attention. But to be fair to Balaji, he has a good track record of spotting trends.

I’m a bitcoin bull, but maybe I lack ambition. I can see it getting to $35,000 or $40,000 by June. I’m not so sure about $1 million. But hey, I’ll take $1 million dollar bitcoin if it’s offered.

I’ve heard this kind of prediction before. You used to hear them all the time about silver. I’m not holding my breath.

My rather drab observation is that, after a miserable 2022, tech has suddenly caught a bid. Even Meta (Facebook, WhatsApp, and Instagram’s parent company) is going up. Bond yields have fallen with the banking panic, and suddenly growth stocks look attractive again. Sorry to be so prosaic and un-sensationalist.

Meanwhile, that other bearer asset, gold, has also found a bid, and with it silver and platinum. Gold this week has been flirting with $2,000.

The gold price surged after bank collapse

My buddy Josh Saul at the Pure Gold Company reports to me that, with the panic at Silicon Valley Bank, his company saw a 385% increase in new enquiries last weekend and a 274% increase in investors purchasing physical gold bars and coins last Monday, compared to its normal daily average. “One client said they are moving £16 million out of their current bank provider owing to fears of instability,”, he says.

Volatility in the stock market isn’t helping either. “This year, we have also seen a 712% increase in people removing exposure to equities and cash in their pensions and SIPPs in order to purchase physical gold bullion in the same vehicle.”

My other buddy Ross Norman reports that visitors to his site Metals Daily have risen 763% in a month.

Gold is now at all-time highs in almost all currencies, except the U.S. dollar. What do new highs normally lead to?

In the short term, gold is a little overbought by most sentiment readings. The miners have been quite flat in comparison, which is not a good sign. That suggests the spike is temporary.

But longer term I think it goes higher. I have long argued that everybody should have exposure to both gold and bitcoin in their portfolio, and it is crises like this one that demonstrate why.

Few people realize that by keeping your money in a bank, you are lending the bank money. The difference between money and credit has become conflated, along with many other things in this mad world. Even Switzerland no longer looks safe.

All the same arguments we heard in 2008 are coming back. At the heart of them lie fundamental questions as to the nature of money and banking. Fractional reserve banking, and even full reserve banking, became sujets du jour. The words fiat money entered the lexicon.

In 2008 there was a chance to address and put right the fundamental flaws in the system. It was not taken. Bailouts brushed the problems under the carpet, and left them for another day.

The free market meanwhile came out with an alternative, bitcoin. It is now a trillion-dollar economy, and there are no bailouts. With each collapse — there have been plenty and there will be plenty more — the system gets stronger.

But with traditional banking, however, the more you bail out the system, the more precarious it becomes. You can’t take the risk out of a market. Without risk, you have no market. With risk comes responsibility.

Don’t blame the players. It’s the game that’s at fault.

If you are interested in buying bitcoin, my guide (for U.K. residents) is here.