US Fed Reserve Banks State Stablecoins Could Inject Instability in Economy

The United States Federal Reserve Banks of Boston and New York have published a data-driven report that delves into the potential impact of stablecoins on the broader economic landscape.

In the 49-page report titled “Runs and Flights to Safety: Are Stablecoins the New Money Market,” stablecoins are likened to certain traditional finance vehicles, notably money market funds (MMFs).

The comprehensive report also highlighted that stablecoins and MMFs provide money-like assets to investors due to their stable nominal value by engaging in liquidity transformation.

However, like conventional bank deposits, issuing continuous liquidity may render them vulnerable to runs.

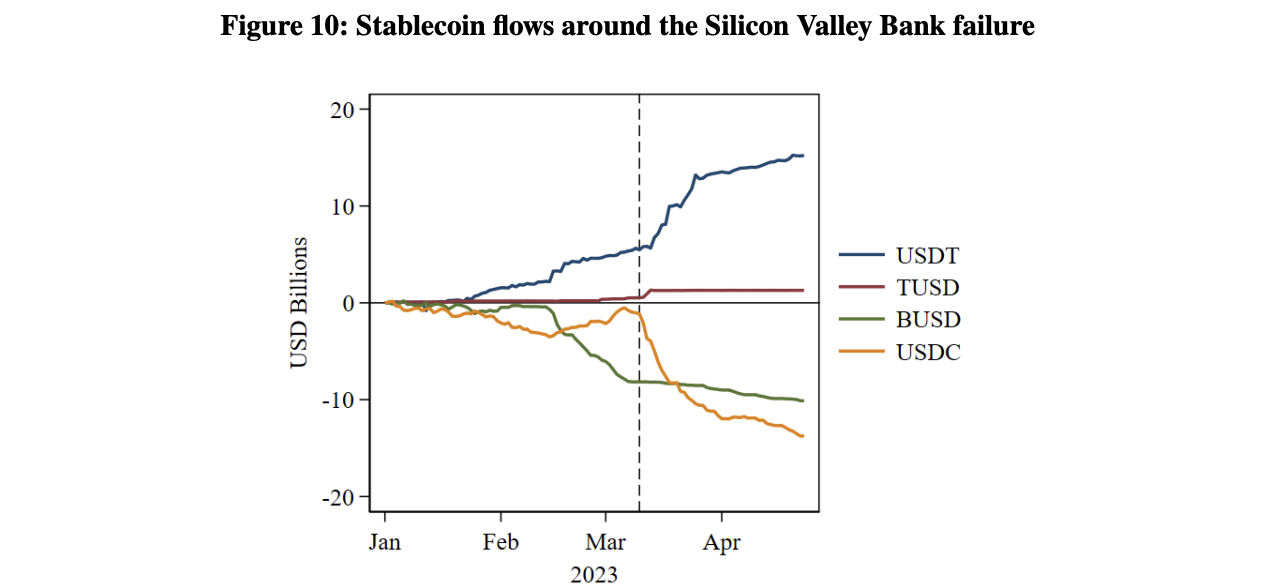

The report also includes a case study of stablecoin runs, specifically focusing on incidents involving USDT and USDC in 2022 and 2023. It draws similarities and differences between these events and the runs experienced by money market funds in 2008 and 2020.

As per the investigative research, stablecoins are vulnerable during downtrends in the broader cryptocurrency market or when unexpected issues arise.

If stablecoins become increasingly intertwined with critical financial markets like short-term funding, they could pose a risk to the overall economic system.

Other key findings reveal that stablecoins exhibit a broader spectrum of risk profiles than MMFs.

The report also cited that certain stablecoins are backed by safe assets such as cash and U.S. Treasuries, while others rely on riskier collateral, including other crypto assets or even corporate debt.

In cases where the collateral supporting some stablecoins loses value, they are likely to deviate from their peg and trigger significant loss.

Additionally, stablecoins that maintain their pegs through algorithms based on demand and supply are not immune to such risks and may experience runs if investor confidence deteriorates.

The data-based document also emphasized stressful events that have already led to the loss of billions of dollars.

Some notable mentions include the collapse of Terra in May 2022 and USDC’s link to the now-liquidated Silicon Valley Bank (SVB).

Another key finding is the tendency of investors to offload stablecoin assets when their value drops from $1 to $0.99. When investors rush to exit, the asset completely depegs and crashes for remaining investors.

Similarly, like stablecoins, MMFs are typically valued at $1.00 and maintain a threshold of $0.995. When the market price falls below this threshold, investors seek safer alternatives, resulting in an automatic decrease.

Stablecoin Safe Haven Status on a Thread

The start of 2023 showed signs of a broader market recovery. However, the U.S. Securities and Exchange Commission (SEC) has propelled uncertainty.

Top exchanges like Binance and Coinbase were slammed with litigations due to the alleged trade of unregistered securities and uncleared literature of the “securities” and “commodities” categories for assets.

Stablecoins, which are usually the go-to haven in market turbulences to hedge inflation and mitigate loss, are now considered ineffective by investors.

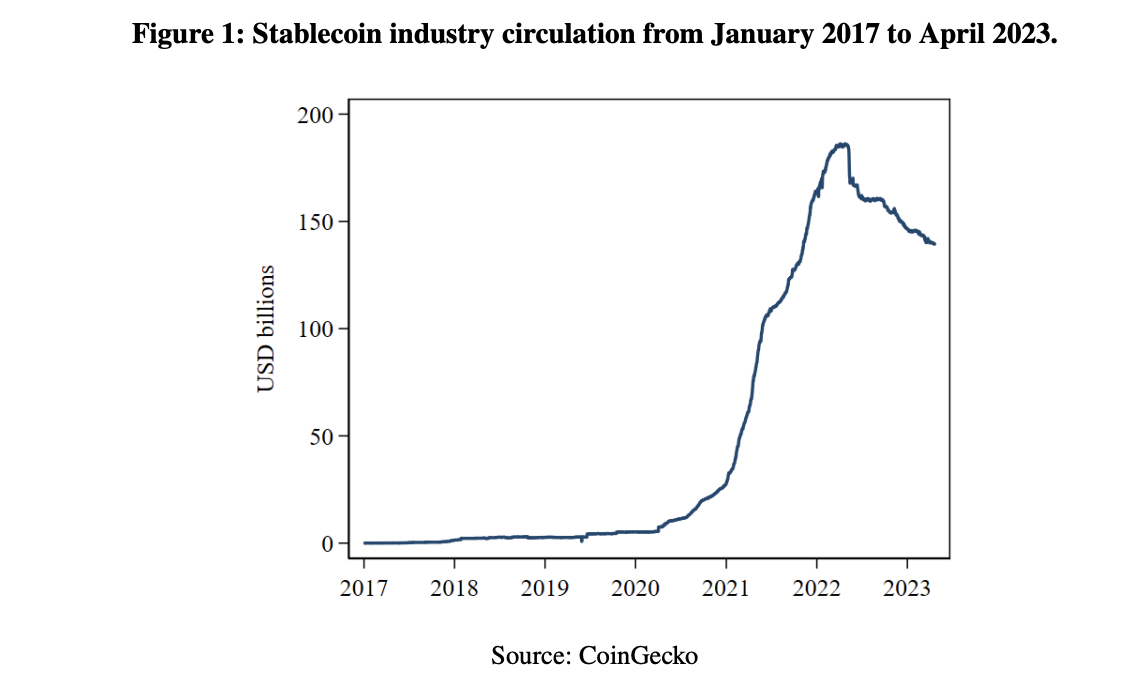

According to a recent CCData report, the total market cap of the stablecoin sector was $124 billion in July, a downtrend of 11.6%, after an 18-month doldrum that affected most asset sectors.

Several factors contributed to this downturn, including Binance.US’s suspension of fiat deposits due to legal action initiated by the SEC and MakerDAO’s decision to delist USDP because it failed to generate additional revenue.

Additionally, the global exchange Binance has announced its intention to delist all stablecoins in Europe by June 30, 2024.

If negative activities continue to plague the stablecoin sector, investors may explore alternative options, potentially leading to the complete collapse of a market that was once flourishing.