The share price of Trump Media closed trading down more than 18% on Monday after the company disclosed plans that would allow existing investors to exercise stock warrants.

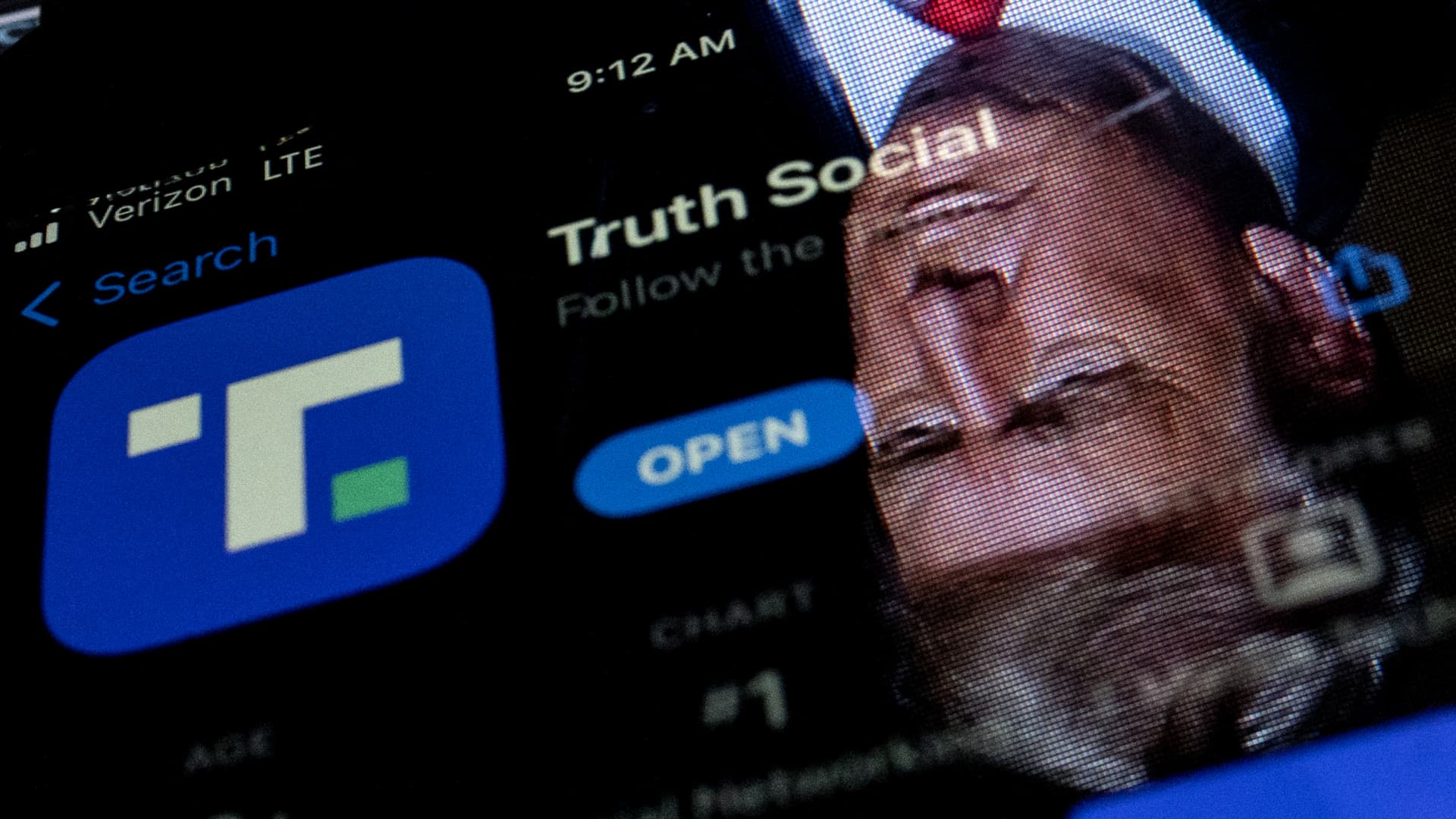

DJT shares closed at $26.61. Trump Media, which created the Truth Social app and trades on the Nasdaq, fell nearly 20% last week.

The company’s dramatic slide came as Donald Trump sat in a Manhattan courtroom for the start of his criminal trial on hush money-related charges. Trump is the majority stakeholder in the company.

Since it began public trading on March 26, Trump Media’s share price has fallen more than 62%, from an opening price of $70.90 that day down to around $27 on Monday.

As a result, its market capitalization has been slashed by nearly $6 billion, leaving it at around $3.7 billion as of Monday.

The company’s intent to issue more common stock was disclosed in a preliminary prospectus filed with the Securities and Exchange Commission.

The shares cannot be issued until a registration statement with the SEC takes effect.

The filing describes a plan to offer more than 21.4 million shares of common stock, issuable “upon the exercise of warrants,” the filing shows. Stock warrants give their holder the ability to buy shares at a predetermined price within a certain time frame.

Trump Media predicted in the filing that it will receive “up to an aggregate of approximately $247.1 million from the exercise of the Warrants.”

The closing price of Trump Media’s warrants was $13.69 as of Friday, according to the filing. The warrants are being traded on the Nasdaq under the ticker “DJTWW.” That ticker fell more than 15% on Monday.

The company also seeks to offer the resale of up to 146.1 million shares of stock from “selling securityholders,” 114.8 million of which are held by Trump himself. Trump owns 78.8 million shares of the company, and stands to obtain 36 million “earnout shares” if the stock stays above $17.50 for enough trading days.

Trump’s current stake in the company — nearly 60% of its shares — was worth more than $2.2 billion at Monday morning’s share price. Trump is not allowed to sell his shares until a six-month lockup period expires.

The lockup period is a condition of Trump Media’s long-delayed merger with the shell company Digital World Acquisition Corp., which was finalized March 25.

Trump, whose social media following was massively diminished after he switched to Truth Social following his suspension from Twitter and Facebook in 2021, has tried to encourage his followers to flock to the fledgling app. It is unclear if they have heeded Trump’s call: The company has not publicly released key performance indicators, including the number of active Truth Social users.

It has, however, revealed a net loss of $58.2 million on revenue of just $4.1 million in 2023.

“The stock valuation is detached from the reality of the financials,” said Ben Silverman, head of Verity Research.

But if the stock price holds high enough for the company to issue earnout shares, Trump and other insiders could be in line to receive a windfall worth more than $1 billion at current trading prices.