TORN Token Price Tanks 60% Following Binance Delisting News – Here’s What Happened

Last updated: November 27, 2023 20:23 EST

. 1 min read

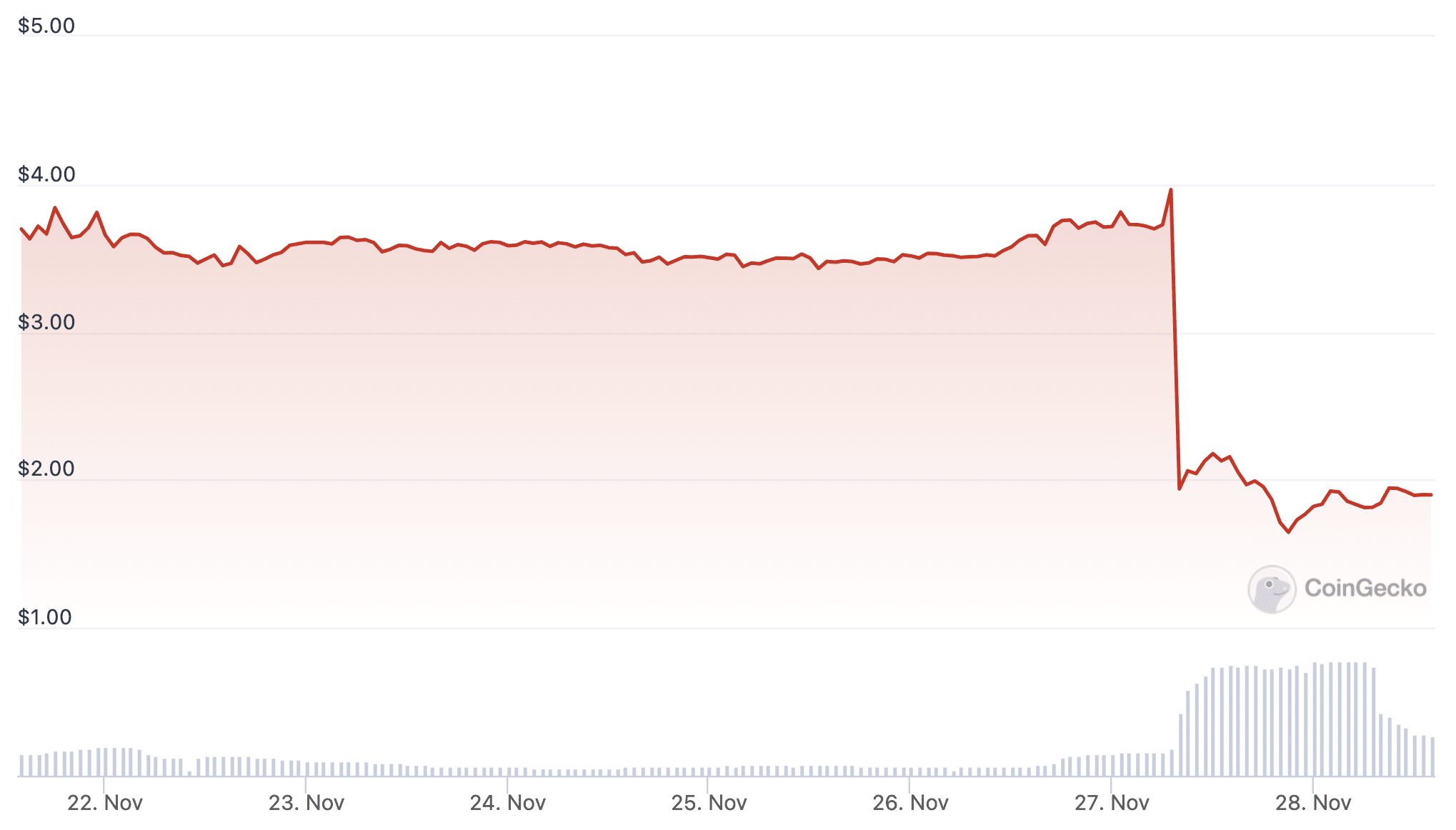

TORN, the governance token of the Ethereum-based coin mixing protocol Tornado Cash, lost more than half of its value within just an hour on Monday after Binance said it would delist the token.

From trading at a price right around $4 at 6 am UTC time on Monday, TORN one hour later had collapsed to $1.95, a loss of around 52%.

Following the massive crash, the token briefly regained some if its losses, before sellers once again took control, sending it to lows of around $1.6, or almost 60% below the pre-announcement price.

In its announcement, Binance said the delisting follows a standard periodical review of listed assets “to ensure that it continues to meet the high level of standard we expect.”

“When a coin or token no longer meets this standard, or the industry changes, we conduct a more in-depth review and potentially delist it,” the statement added.

#Binance will delist the following tokens on December 07, 2023.

🔸 $BTS

🔸 $PERL

🔸 $TORN

🔸 $WTCFull details here ⬇️https://t.co/0a1a1Zu8oS

— Binance (@binance) November 27, 2023

Binance to focus on regulatory compliance

Trading on Binance in the TORN/BUSD pair currently makes up more than 57% of the trading volume in TORN, and the delisting is therefore significant for the overall liquidity of the token.

At the same time, a review and delisting by a major exchange like Binance could very likely be followed by delistings from other exchanges, making the liquidity situation for TORN holders even worse.

The announcement from Binance came shortly after Richard Teng took over for Changpeng Zhao (CZ) as CEO of the exchange.

Among other things, Teng has vowed to do more to make Binance compliant with regulations around the world.

Controversial mixing service

Tornado Cash is a so-called coin mixing service that is used to obfuscate who the sender and receiver of an Ethereum transaction is.

The protocol has received its fair share of negative news coverage due to its popularity among hackers and cybercriminals.

In August of 2022, the US Treasury Department sanctioned Tornado Cash, saying the mixing service “has repeatedly failed to impose effective controls designed to stop it from laundering funds for malicious cyber actors.”

In November the same year, the department redesignated the sanctions, saying North Korea’s Lazarus Group has used the service to launder more than $100 million in stolen funds.