Spot Bitcoin Trading Volumes Remain Weak – A Threat to the BTC Bull Market Thesis?

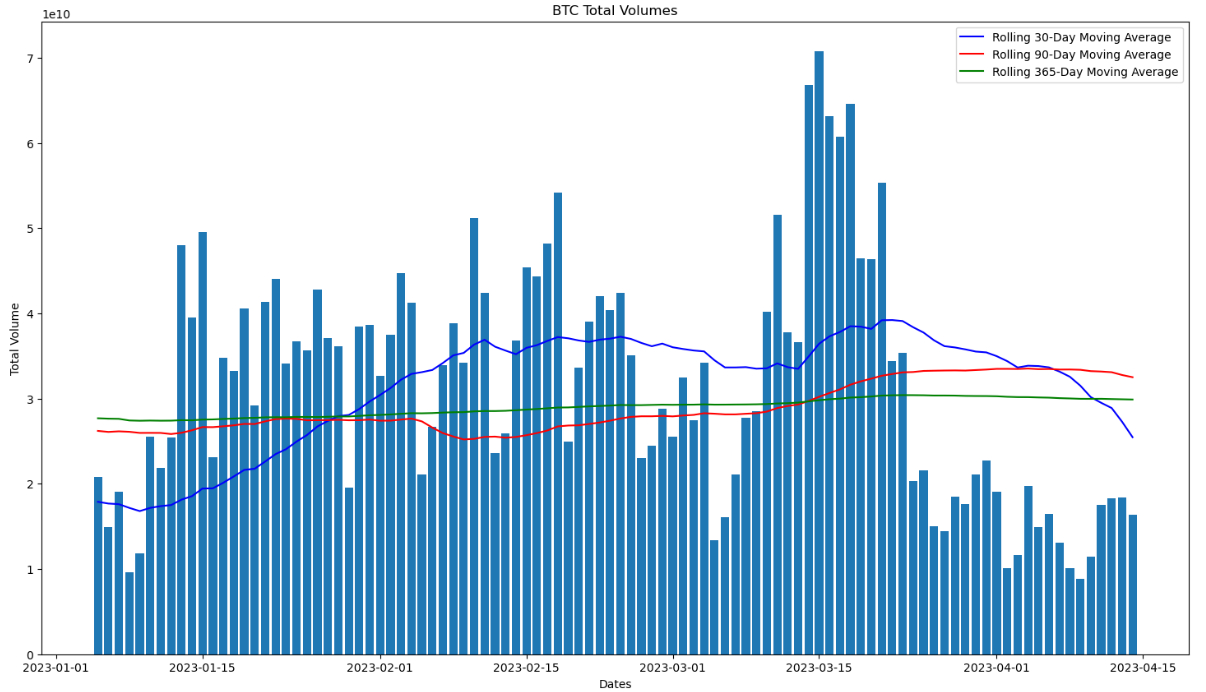

After hitting their highest levels last month since the aftermath of the FTX cryptocurrency exchange collapse last November thanks to significant volatility and zero trading fees on BTC pairs on Binance, spot Bitcoin trading volumes have fallen significantly.

According to data pulled from CoinGecko’s API, spot Bitcoin trading volumes across major exchanges were around $16.4 billion on Friday.

That compares to close to $70 billion this time last month.

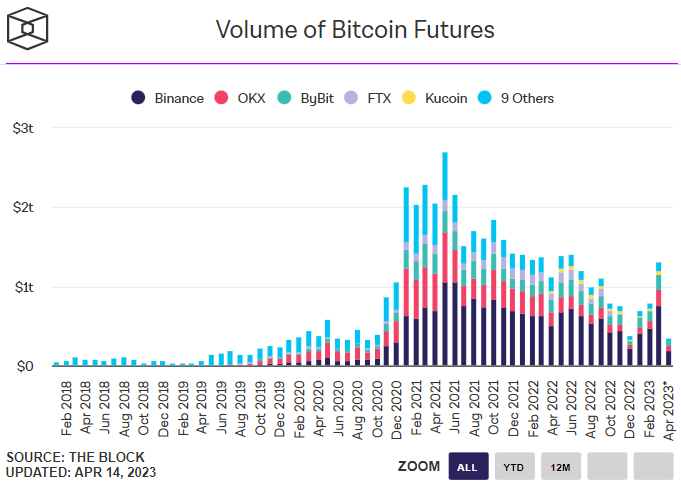

And it’s not just spot volumes that have weakened recently.

According to data presented by crypto analytics website The Block, mid-way through April, Bitcoin futures trading volume have only reached around $350 billion month-to-date.

For the full month of March, Bitcoin futures trading volumes were around $1.3 trillion.

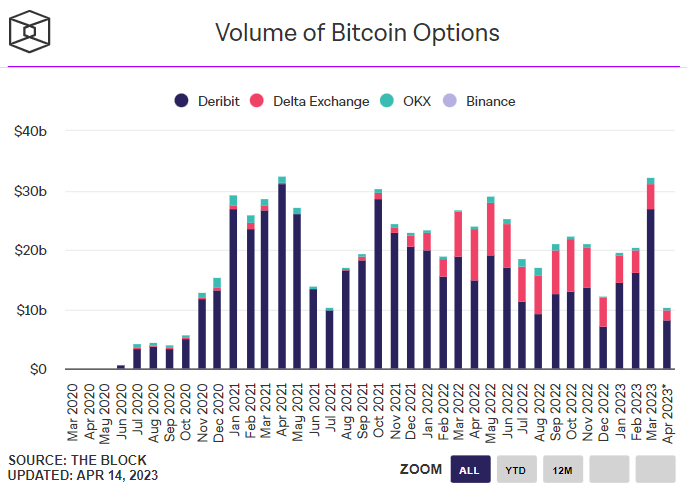

Options trading volumes are also tracking for a weaker month, according to another chart presented by The Block.

Weaker Volumes a Threat to the Bull Market Thesis?

Some might interpret weaker trading volumes as indicative of softening demand for Bitcoin.

While it’s true that past major trading volume spikes have coincided with price spikes, such as for Bitcoin in the first half of 2021, the relationship between higher volumes and higher prices is weak.

That’s borne out by the fact that Bitcoin has been able to continue advancing to the upside in recent weeks, despite trading volumes fading.

Indeed, the BTC price rose above $31,000 for the first time since last June on Friday, taking its gains for the month to around 7.0% – a month that has seen volumes drop off substantially versus March.

For now, while a trading volume spike would be welcome (if driven by an influx on new demand for Bitcoin), the BTC price may well be able to continue pushing higher.

That’s because Bitcoin has a lot of very important tailwinds right now.

Bitcoin Set to Continue Benefitting from Technical, Macro and On-chain Tailwinds

Chart analysis suggests that continued Bitcoin price upside remains a distinct likelihood.

Since breaking to the north of last month’s highs in the mid-$29,000s, the door has now been opened for BTC to hit the next major resistance area around $32,300 (the late-May/June 2022 highs).

All of BTC’s major moving averages are moving higher in consecutive order and the 21-Day Moving Average recently offered strong support, a vote of confidence in Bitcoin’s short-term momentum.

Other longer-term technical signals from the major moving averages also positive.

Bitcoin’s powerful rebound in mid-March from a retest of the 200DMA (and realized price) just under $20,000 was interpreted by many as bull market confirmation at the time, and continues to offer tailwinds.

Moreover, the golden cross enjoyed by the BTC price back in early February – historically a very bullish signal for BTC – is another longer-term technical tailwind for the price action.

Bitcoin’s 14-Day Relative Strength Index (RSI) is flirting with being in overbought territory, suggesting that the risk of short-term profit-taking is on the rise.

But this doesn’t always prevent BTC from continuing on a decent run of short-term gains, with the recent price rally from mid-January to February a good example of this.

Positive on chain trends are also indicative that Bitcoin’s trading bias in the medium to long-term will remain decidedly to the upside.

Firstly, core on-chain metrics pertaining to network utilization (which thus act as a proxy of “demand” for the Bitcoin network).

Metrics such as daily active address numbers, number of addresses with a non-zero balance, number of new addresses and number of daily transactions all continue to trend higher, according to data presented by crypto analytics firm Glassnode.

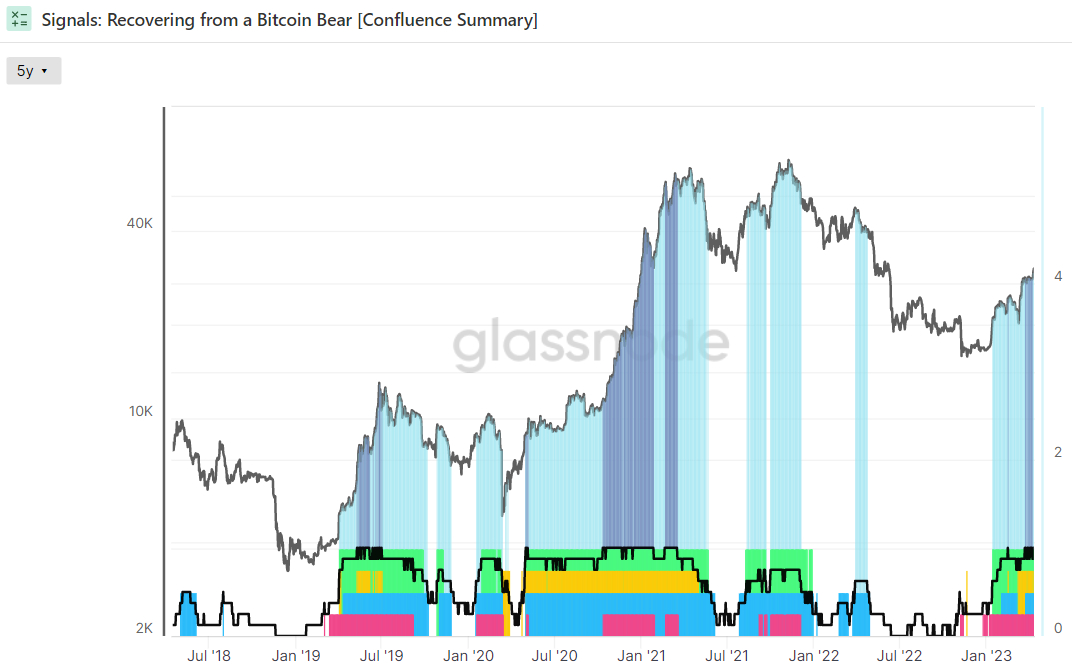

Meanwhile, other on-chain metrics, such as those monitored in Glassnode’s “Recovering from a Bitcoin Bear” dashboard, are all screaming bull market.

This dashboard tracks eight indicators to ascertain whether Bitcoin is trading above key pricing models, whether or not network utilization momentum is increasing, whether market profitability is returning and whether the balance of USD-denominated Bitcoin wealth favors the long-term HODLers.

All eight indicators have now more or less been flashing green in unison since mid-March, the longest such spell in just over two years.

Historically, the moment when all of the dashboard’s indicators turn green (i.e. right now) has been a great long-term buy opportunity.

If the US economy is headed towards recession and deflation and a Fed interest rate cutting cycle is coming, the macro conditions are certainly there for a continued Bitcoin bull market.

That’s not to mention a widely anticipated continuation of Bitcoin’s (and more generally, crypto’s) global adoption, which is really the main long-term bullish argument.