South Korean Crypto Exchanges Scrap for Survival as Upbit Dominance Wanes

A “tectonic rift” is threatening to separate the South Korean crypto exchange Upbit from its rivals, as tensions begin to fray between domestic platforms.

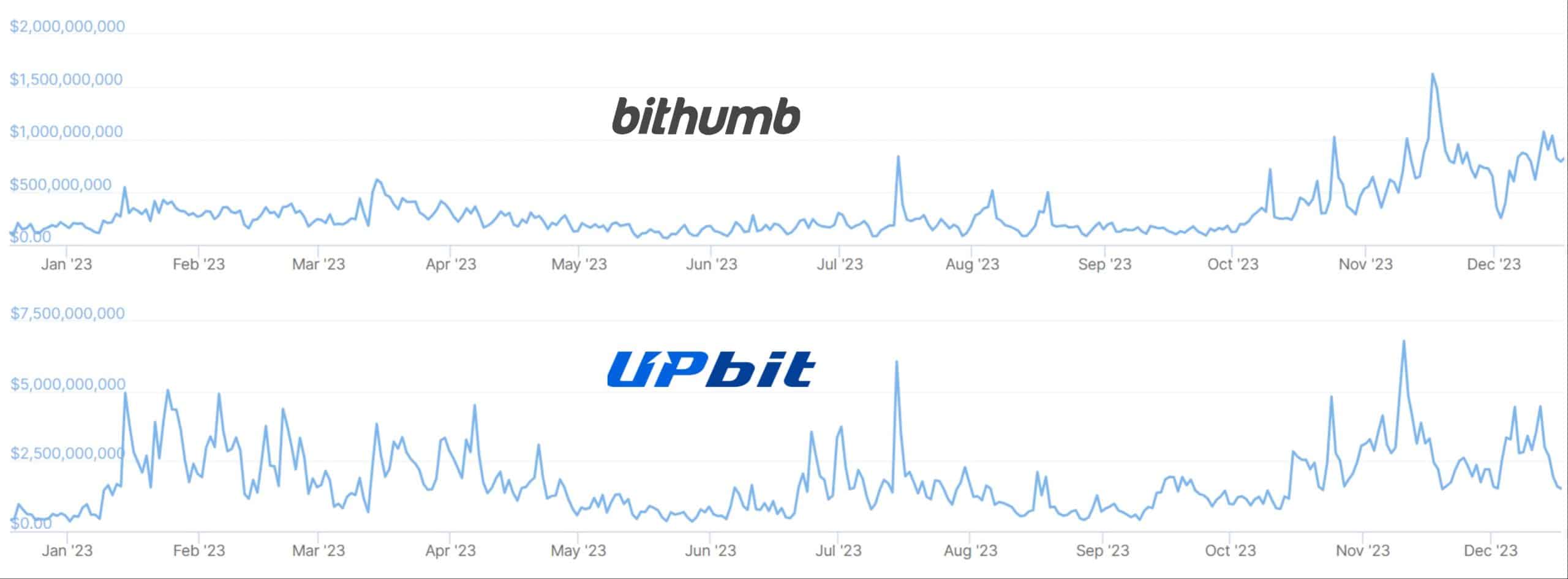

The newspaper Daehan Kyungjae reported that Upbit’s market share has dropped sharply in recent months, falling from 93% in June this year to under 62% on December 17.

Upbit’s biggest rival Bithumb has been the biggest winner, increasing its market share from under 6% in June to almost 36.5% in December.

More modest (but still statistically significant gains) were recorded by all three of Upbit’s other major rivals: Korbit, Coinone, and Gopax.

All five platforms are members of the Digital Asset Exchange Association (DAXA), the industry’s most important self-regulating body.

The DAXA members are the only exchanges in the country with the operating permits required to offer fiat won trading.

In a seemingly desperate bid for survival, Upbit’s rivals have been offering a range of services intended to boost their competitiveness.

These include commission-free trading. At present, Upbit is the only DAXA member that charges commission on crypto trades.

Analysts have called the move an act of desperation. The same media outlet noted that commission fees are “the main source of revenue” for domestic exchanges.

Bithumb initially offered commission-free trading on selected coins in August.

But in October, the firm extended the offer to its entire portfolio “until further notice.”

🇰🇷 South Korea to Prioritize Innovation in Next Phase of Crypto Regulations

South Korea’s authorities have expressed a commitment to balance investor protection with fostering technological innovation in the next phase of crypto regulations.#CryptoNewshttps://t.co/dTNCUZbzR5

— Cryptonews.com (@cryptonews) December 14, 2023

Competition Intensifies Among South Korean Crypto Exchanges

Per Business Post, the altcoin WEMIX has also become a major bone of contention among DAXA members.

On December 12, Bithumb announced it would re-list the coin that it and its fellow DAXA members decided to de-list around a year ago.

The move means that Upbit is now the only DAXA member that has not announced plans to relist WEMIX – although DAXA has not made any joint decision on WEMIX relisting.

The move has opened up old wounds. WEMIX was developed by WeMade, one of South Korea’s biggest gaming firms.

At the time of the delisting, the WeMade CEO called DAXA’s decision to delist the altcoin “an Upbit power play.”

Daehan Kyungjae noted that the market’s attention was now “focused on Upbit’s actions, as the exchange loses its [massive] market [dominance].”

An End to South Korean Commission-free Trading in Sight?

However, Bithumb’s commission-free trading drive could be under threat from pressure groups.

A previously unheard-of “crypto investors group” reported Bithumb’s “free transaction fee policy” to the Fair Trade Commission last week.

The group complained that the policy was “an attempt to exclude rival businesses from the market.”

The DAXA tension is emerging despite the group’s recent announcement that it would begin cooperating with regulators to block unregistered crypto trading platforms.

Earlier this month, Bithumb became the second biggest exchange in the nation to launch support for the coin stablecoin USDT.

The USDT listing was also an apparent bid to corner more of the market.

The Tether-run USD-pegged token was listed by Coinone in November, and enjoys high popularity in East Asian markets.