South Korean Analysts: Global Crypto Market Cap to Hit $5T in 2024

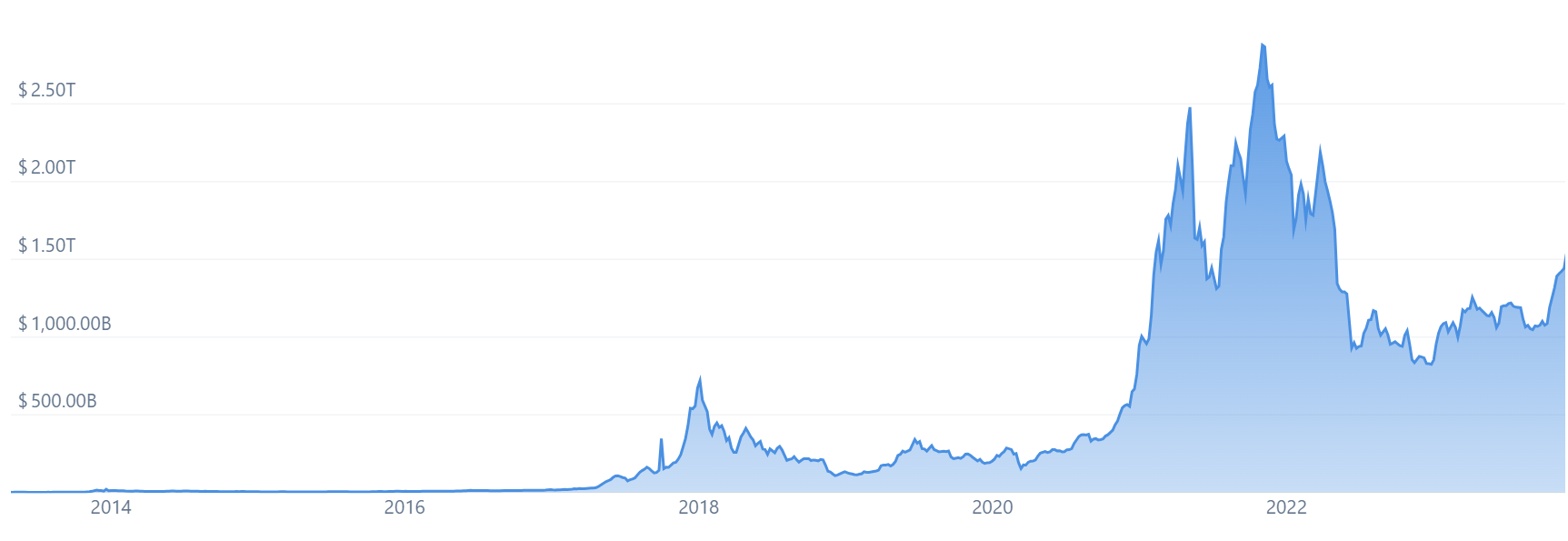

South Korean crypto market analysts think the worldwide crypto market cap could hit the $5 trillion mark in 2024 as global adoption continues.

Per Hanguk Kyungjae, the claims were made in a report published by the Korbit Research Center, part of the Korbit crypto exchange group.

The center’s director Jeong Seok-moon predicted that “the total market capitalization of [the cryptoasset market] next year will range from $4.5 trillion to a maximum of $5 trillion.”

Jeong stated that the market cap stood at $1.6 trillion as of December 11, 2023.

He claimed the massive rise would come after a “triple dose of good news,” namely:

- The United States Federal Reserve’s increasing willingness to cut interest rates

- The possibility of regulatory approval for crypto spot ETFs

- The forthcoming Bitcoin (BTC) halving event (expected to take place in April 2024)

Jeong claimed that these three events would “have a positive effect on cryptoasset investment sentiment.” The director said:

“The market has rebounded this year and the upward trend is expected to expand into next year. I think this will further increase the general public’s interest in the cryptoasset market.”

Big Year Ahead for Crypto, Say South Korean Researchers

Another Korbit researcher claimed that 2024 would be the year of tokenization, as the Real World Assets (RWA) sector gets into gear.

RWA are tokenized “tangible” assets, and the term is usually used to refer to tokenized real estate, treasury bonds, loans, and more.

Another Korbit analyst claimed that 2024 would see more progress made in the “institutionalization” of the crypto market.

The same analyst claimed this would be a positive step for the market, allowing the industry to “reorganize” and “sort the wheat from the chaff.”

🇰🇷 South Korea to Prioritize Innovation in Next Phase of Crypto Regulations

South Korea’s authorities have expressed a commitment to balance investor protection with fostering technological innovation in the next phase of crypto regulations.#CryptoNewshttps://t.co/dTNCUZbzR5

— Cryptonews.com (@cryptonews) December 14, 2023

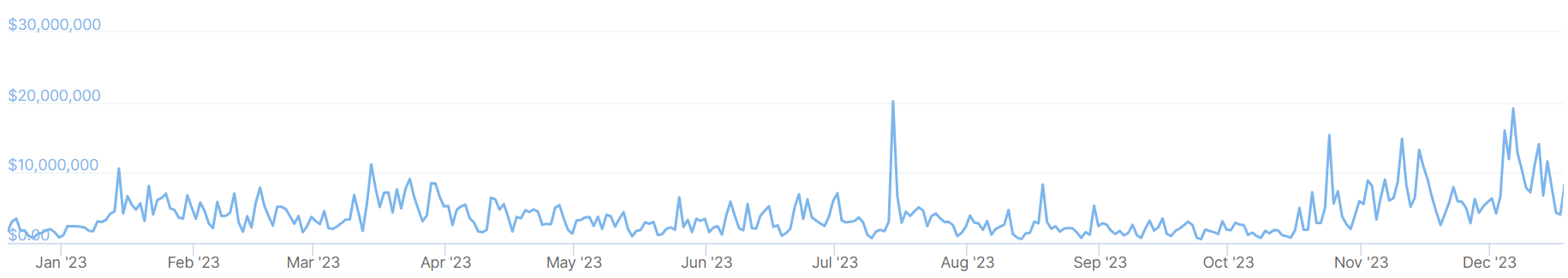

The prolonged bear market and a sluggish 2023 have taken a heavy toll on South Korea’s crypto exchange market.

Despite a flurry of crypto activity in recent weeks, transaction volumes have fallen in 2023. Exchange competitiveness has also shrunk.

In June, the market-leading exchange Upbit’s market share stood at over 90%.

This factor led Korbit and other chasing-pack exchanges to indefinitely do away with commission fees, their main source of income.