Solana Dominates Altcoin Inflows as Crypto Funds Experience Fourth Week of Gains

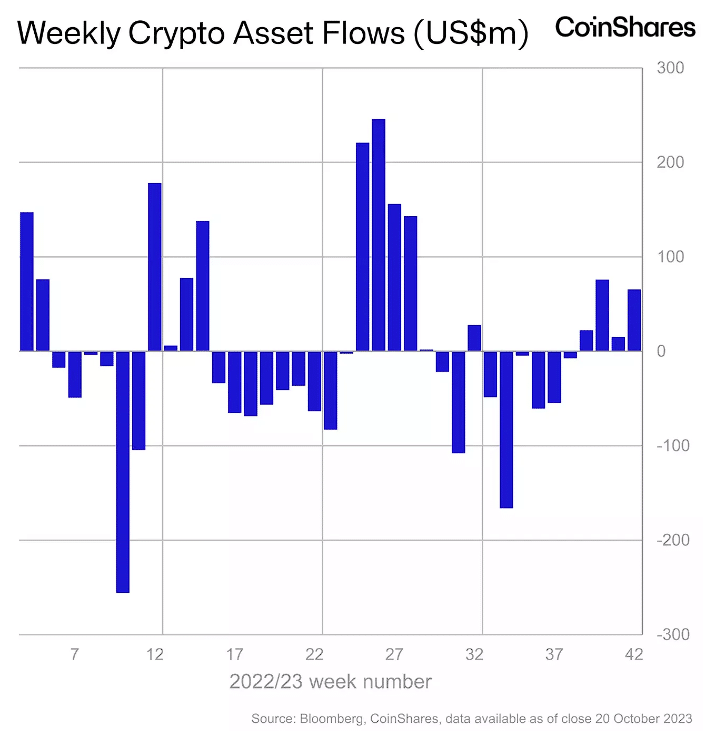

According to a recent report by CoinShares published on Monday, crypto funds have posted a net inflow for the fourth consecutive week, totaling $179 million. While Bitcoin products grabbed the largest slice of the influx, Solana led in altcoin investments, creating a dynamic shift in digital asset inflows.

Bitcoin and Solana Lead the Charge

The CoinShares Digital Asset Fund Flows report

revealed that last week’s inflows included $55.3 million allocated to Bitcoin, constituting about 84% of the total new investment. These numbers bring the total inflows for Bitcoin products in the year to date to $315 million.

Solana has also attracted substantial attention from investors. Last week, the cryptocurrency platform received an additional $15.5 million, pushing its total for the year to $74 million. Among all altcoins, Solana now claims the title as the most preferred altcoin by investors this year.

Ethereum Loses Ground Amid Inflows

While Bitcoin and Solana experience an influx of investment, Ethereum faces a contrasting trend. CoinShares reported that Ethereum was the only major altcoin to witness a net outflow, amounting to $7.4 million last week. The decrease brings Ethereum’s total assets under management to $6.7 billion.

Ethereum is a scam backed by a CCP investor

Has a lot of great stuff about it but it’s a scam with bad intentions.

I’ll only charge you $120 for a transaction on my blockchain 🤪 stupid scam

— Sesh (@TheRavenSkies) October 23, 2023

“Continued concerns over Ethereum have led to further outflows of $7.4 million, the only altcoin to see outflows last week,” the report stated.

The ETF Factor in Digital Asset Inflows

CoinShares Head of Research James Butterfill noted that the current inflows, although promising, have not matched the spikes observed after BlackRock announced its spot Bitcoin ETF application in June.

“While the most recent inflows are likely linked to excitement over a spot Bitcoin ETF launch in the U.S., they are relatively low in comparison to the initial inflows following BlackRock’s announcement in June,” Butterfill said.

The market has shown optimism about spot Bitcoin ETFs, which has further stimulated digital asset inflows. Positive reactions were noted when news broke about potential developments for BlackRock’s proposed iShares Bitcoin Trust.

Additionally, Grayscale’s recent legal victories buoyed market sentiment, following a mandate from the US Court of Appeals for the DC Circuit for the SEC to review Grayscale’s ETF application.

In short, four weeks of consecutive net inflows into crypto funds reveal a sustained investor interest in digital assets. While Bitcoin remains the most dominant, Solana’s rising prominence suggests a possible shift in investor preferences among altcoins. Ethereum’s outflows, however, could signify growing investor caution, possibly related to scalability or fee concerns. As spot Bitcoin ETF possibilities continue to influence the market, the patterns of digital asset inflows offer valuable insights into shifts in investor sentiment and strategy.