Should I Buy Bitcoin? 8 Reasons Bitcoin is a Good Investment in 2023

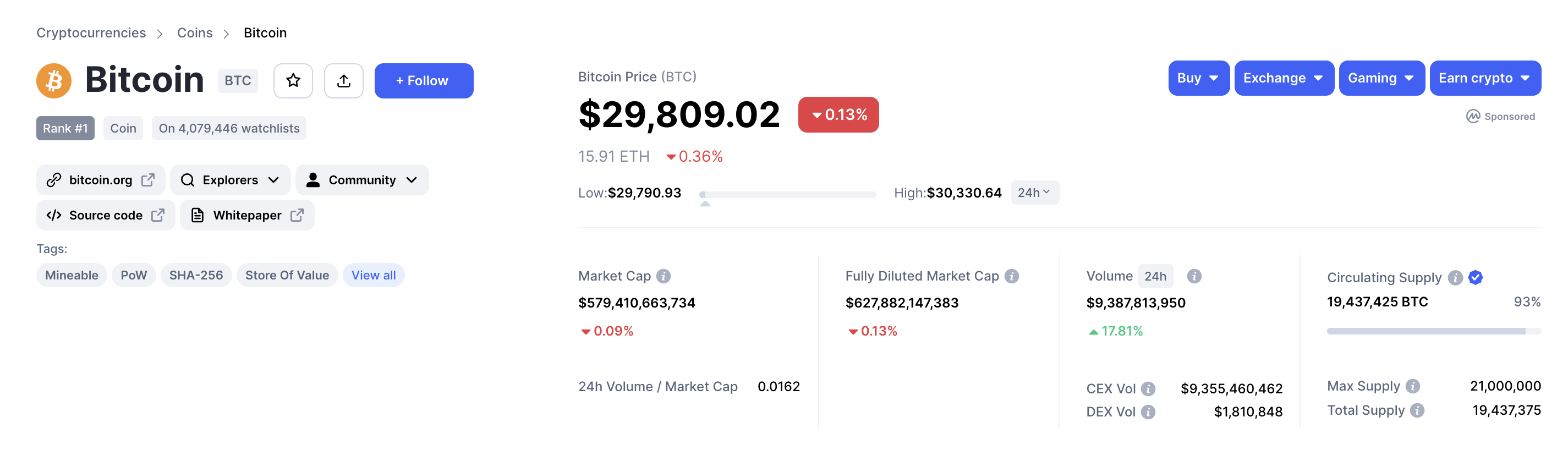

Although Bitcoin is trading 55% below its all-time high, the world’s leading cryptocurrency is up 80% year-to-date. But that begs the question – Should you buy Bitcoin in 2023?

In this guide, we explore the investment thesis for Bitcoin. We examine its price performance, future prospects, and the key reasons why Bitcoin remains a popular alternative asset.

Should You Buy Bitcoin Now? Our Verdict

Overall, the investment thesis for Bitcoin is very strong. Starting with the fundamentals, Bitcoin is a finite asset. Just 21 million BTC tokens will ever exist – and more than 93% of the overall supply is already in existence. This makes Bitcoin ideal as a store of value. Bitcoin is also a decentralized asset, meaning that no single authority has control over the network.

This means that investors retain full control of their BTC tokens – so there is no requirement to trust a third party. Bitcoin is also popular for fixed supply. Currently, 6.25 BTC tokens enter circulation every 10 minutes. This ensures that the Bitcoin supply cannot be manipulated. Unlike traditional currencies, Bitcoin does not suffer from central bank policies that lead to inflation.

The 10-minute supply of Bitcoin will soon be reduced to 3.125 BTC. This is known as ‘Bitcoin Halving’ and it happens approximately every four years. This is good news for investors, as the Bitcoin halving event has historically spurned a new bull rally. In terms of pricing, Bitcoin is trading 55% below its former all-time high of almost $69,000.

This offers an attractive entry point for first-time investors. What’s more, Bitcoin is one of the best-performing assets in 2023, with year-to-date gains of 80%. In contrast, the S&P 500 has grown by just 18%. First-time investors will also appreciate that Bitcoin can be fractionized. This enables investors to buy small amounts of Bitcoin.

8 Reasons to Invest in Bitcoin in 2023

In this section, we take a much closer look at the question – Should you buy Bitcoin?

We explore eight reasons why this alternative asset class remains a viable long-term investment.

Reason 1: Bitcoin has a Finite Supply

The first benefit of buying Bitcoin is that it has a finite supply. This is crucial from an investment perspective, as it creates scarcity in the market. Moreover, the supply of Bitcoin is fixed, with new BTC tokens entering circulation every 10 minutes. This will continue until approximately 2140 when Bitcoin hits its maximum supply of 21 million tokens.

Finite assets like Bitcoin are attractive to investors that seek stores and value. After all, once Bitcoin hits its maximum supply, no more tokens will ever enter circulation. In theory, if demand for Bitcoin remains consistent, a lack of new supply can help BTC appreciate over time. A good comparison to make is gold.

Consider that gold has been used as a store of value for thousands of years. Even today, investors, financial institutions, and central banks increase their gold holdings because of its intrinsic value. Crucially, just like Bitcoin, gold is also a finite asset. New gold enters the circulating supply when it is mined. But there isn’t an unlimited amount of gold in existence – so it will one day reach its maximum supply.

In contrast to Bitcoin and gold, traditional currencies like the US dollar have an unlimited supply. In fact, the Federal Reserve ‘printed’ over 3.3 trillion dollars in 2020 alone. And every time new US dollars are printed, this devalues the currency.

In turn, US dollar savings accounts become less valuable as each year passes. This is because continued money printing causes inflation, meaning the cost of goods and services increases. Bitcoin doesn’t experience the same issues because of its finite supply. As such, Bitcoin enables investors to protect their wealth against rising inflation levels – more on this later.

Looking to learn more about Bitcoin’s supply? Read our in-depth guide on How Many Bitcoins Are There in 2023.

Reason 2: Bitcoin is a Top-Performing Asset

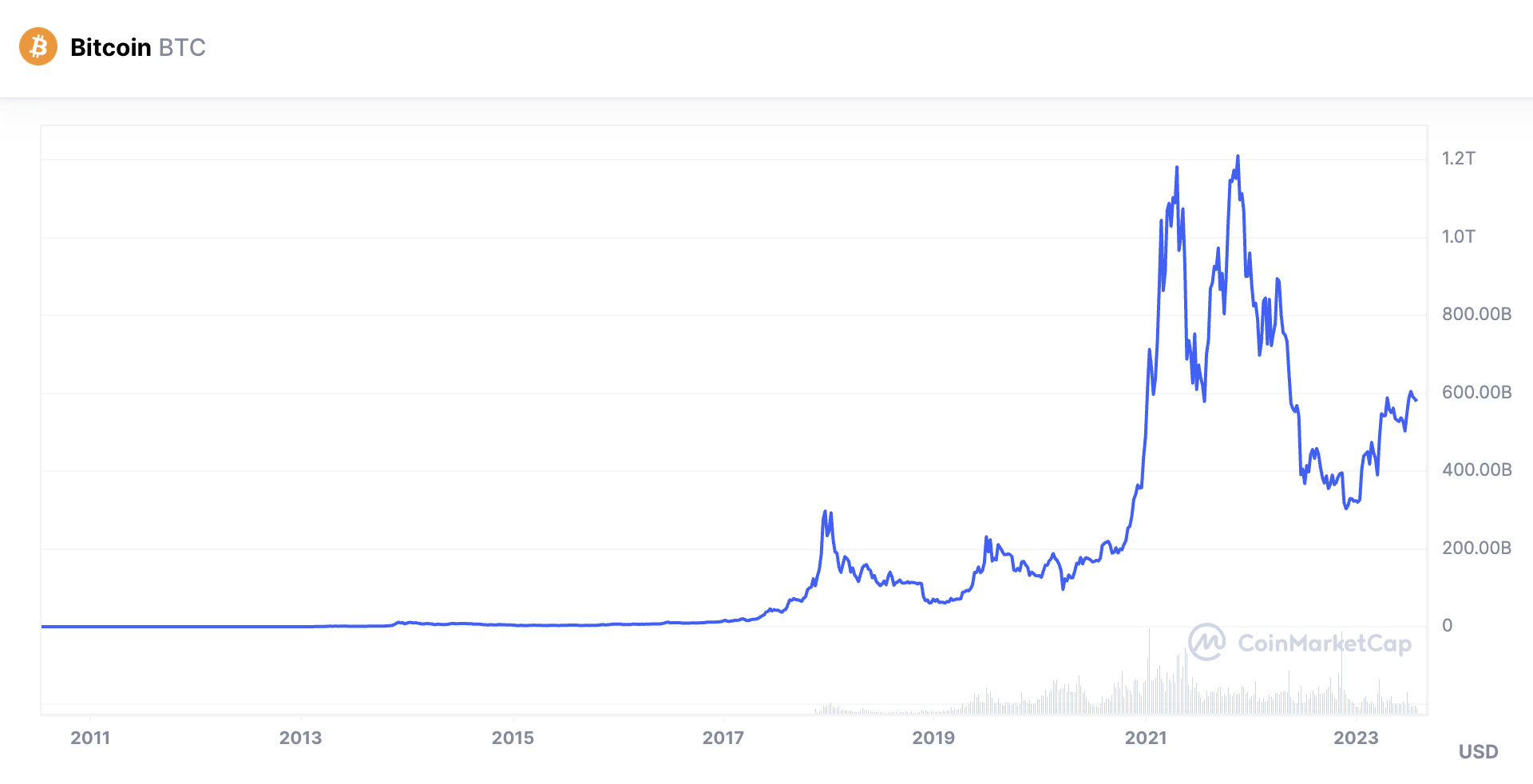

Historical price action should also be considered when asking the question – Should I buy Bitcoin? In a nutshell, since Bitcoin was launched in 2009, it remains one of the best-performing asset classes in the market. CoinMarketCap data shows that in 2011, Bitcoin was trading at $0.061. This means that an investment of just $100 would have yielded 1,639 BTC tokens.

Fast forward to late 2021 when Bitcoin hit its all-time high of almost $69,000. Compared to 2011, this represents growth of over 111 million percent. Put otherwise, a $100 investment in 2011 would have made worth over $111 million. However, it is important to note that Bitcoin’s performance has gone through many market cycles.

Just like stocks and other assets, the Bitcoin price witnesses bullish and bearish cycles. History suggests that long-term investors always do better than short-term speculators. This is because long-term holders can ride out short-term volatility. For example, 2017 was a very good year for Bitcoin. It entered 2017 at just $1,000 per BTC.

By the end of the year, Bitcoin hit a then-all-time-high of $20,000. Therefore, this represented yearly gains of 1,900%. However, consider an investor that bought Bitcoin at its peak of $20,000. Just one year later, Bitcoin hit lows of $3,400. Those selling at this price point would have witnessed investment losses of over 80%.

In contrast, those holding on to their Bitcoin would have eventually seen a complete reversal. After all, Bitcoin hit almost $69,000 in late 2021 – so that’s growth of nearly 2,000% from its 2018 lows. Nonetheless, Bitcoin has offered significantly higher returns when compared to other asset classes, as we explain below.

Bitcoin vs the Stock Market

When asking the question – “Should I buy Bitcoin?”, it makes sense to compare its performance with the broader stock market.

In the first seven months of 2023, the S&P 500 has grown by 18%. During the same period, Bitcoin has increased in value by over 80%. Over a 1-year period, the S&P 500 has grown by 14%, while Bitcoin has increased by over 32%.

Long-term Bitcoin investors have done even better. For instance, over a 5-year period, Bitcoin has increased by almost 330%. Over the same period, the S&P 500 has grown by 61%. Things become even clearer when we compare Bitcoin and the S&P 500 over the prior decade.

10 years ago, the S&P 500 was trading at 1,680 points. Today, the index is at 4,536 points – meaning 10-year returns of 170%. In contrast, Bitcoin was trading at just $96 in 2013. This means that Bitcoin has generated 10-year returns of over 31,000%.

When making comparisons with other global index funds, the case for stocks becomes even bleaker.

The UK’s FTSE100 index has declined by under 1% since 2018. While Australia’s ASX200 has grown by 16% over the same period. Japan’s Nikkei 225 has performed better over the prior five years, with growth of nearly 44%. However, this is still just a fraction of Bitcoin’s growth of almost 330%.

Reason 3: Bitcoin is Decentralized

Decentralization should also be explored when asking the question – Should you buy Bitcoin? Put simply, Bitcoin’s decentralized framework means that no single person or authority controls the network. On the contrary, Bitcoin is a global ecosystem that is controlled by the masses. This is because of the ‘mining’ system that keeps the network operational.

Here’s how it works:

- Every 10 minutes, transactions are bundled into a ‘block’.

- Miners – who connect specialist hardware to their devices, will attempt to solve a cryptographic equation.

- The equation is so complex that it takes vast energy resources to solve it.

- The first miner to solve the equation will receive the block reward.

- Currently, this stands at 6.25 BTC. The successful miner will also receive the transaction fees paid by senders.

Crucially, anyone can become a miner, which ensures that Bitcoin is inclusive. So why does this matter when exploring the Bitcoin investment thesis? Well, decentralization is important to many Bitcoin investors, especially when making comparisons to traditional financial systems.

For instance, consider an investor that has US dollars stored in a bank account. The investor has no option but to trust that the financial institution will keep their money safe. But history suggests that this isn’t always the case. For example, in response to the global financial crisis, the Cyprus government took money from domestic bank accounts.

As reported by the BBC, bank accounts with under €100,000 lost 6.75% of their savings. Accounts with more than €100,000 lost 9.9%. In contrast, Bitcoin investors do not need to trust third parties when storing their wealth. Instead, BTC tokens held in a self-custody wallet can only be accessed by its owner.

This means that investors are not at risk of having their funds stolen by financial institutions. Moreover, there is no risk of bank failures, as the BTC tokens are stored safely in a wallet. In addition, Bitcoin’s decentralized nature ensures a smooth and trustless transaction process. This is because transactions do not need to be approved by a third party.

This is the case regardless of how much Bitcoin is being transferred – or where the sender and receiver are located. For example, somebody in the UK could transfer $1 million worth of Bitcoin to a beneficiary in Australia. Not only would the transaction take just 10 minutes but fees would amount to a couple of dollars.

Now compare the same transaction when using a financial institution. The sender’s bank would likely need to perform enhanced due diligence on the transaction. This might include KYC on both the sender and receiver, as well as a request for proof of source of funds. The bank’s investigation process could take several days or weeks.

Not only that but once the transaction is approved, the receiver’s bank will likely need to perform the same enhanced due diligence. This could mean waiting days or weeks before the receiver can access their money. Ultimately, these regulatory hurdles do not exist when sending and receiving Bitcoin. This makes Bitcoin ideal as both a medium of exchange and a store of value.

Reason 4: Bitcoin is an Ideal Store of Value

We mentioned above that Bitcoin is ideal as a store of value. Let’s explore this sentiment in a lot more detail. In a nutshell, stores of value retain their value over the course of time. Stores of value usually have a finite supply, while demand remains consistent. Examples of stores of value include gold, silver, fine art, and real estate.

However, there is a growing case for Bitcoin as a more suitable store of value. Especially when compared to precious metals like gold. For example, transferring gold is not only cumbersome – but costly. Consider the process of selling physical gold back to cash. A visit to a local gold broker would be required, usually at a below-market rate.

Furthermore, gold loses value when it is not stored correctly. Then there’s the risk of the gold being stolen or damaged. This is why investors will often store gold in an insured vault. But again, this can be costly. Another issue is that gold isn’t easily fractionized. This makes it challenging to sell a small segment of the physical gold investment.

All of these issues are alleviated when using Bitcoin as a store of value. First and foremost, Bitcoin can be fractionized into small units. In fact, 1 full Bitcoin token can be split into 100 million ‘Satoshis’. This is similar to splitting a dollar into 100 cents. But with each Bitcoin, this can be done up to 100 million times – making it ideal for smaller transactions.

What’s more, unlike gold, Bitcoin is easily transferred. As we mentioned earlier, it takes just 10 minutes to transfer Bitcoin. This is the case irrespective of where the transacting parties are located. Let alone the amount being transferred. Bitcoin is also a lot more seamless and cost-effective to store.

Bitcoin is stored in a private wallet, controlled only by its owner. Moreover, there are no fees to store Bitcoin in a wallet. And most importantly, there is no requirement to trust a third party when storing Bitcoin. This isn’t the case when storing gold in a vault. Bitcoin is also a lot more secure to store when compared to gold.

For instance, Bitcoin can be stored in a hardware wallet that remains offline at all times. This removes the risk of the Bitcoin being stolen remotely. If the hardware device is physically stolen, the thief would not be able to access the Bitcoin without knowing the PIN or backup passphrase. The owner of the wallet could then recover the Bitcoin remotely.

Gold, however, is at risk of theft when stored at home. Once in possession, the thief could easily sell the gold – either through the legal or black market. And of course, Bitcoin’s status as a store of value is backed by its finite supply. As we covered earlier, there will only ever be 21 million BTC tokens. Once the maximum supply is reached, Bitcoin will be a deflationary asset.

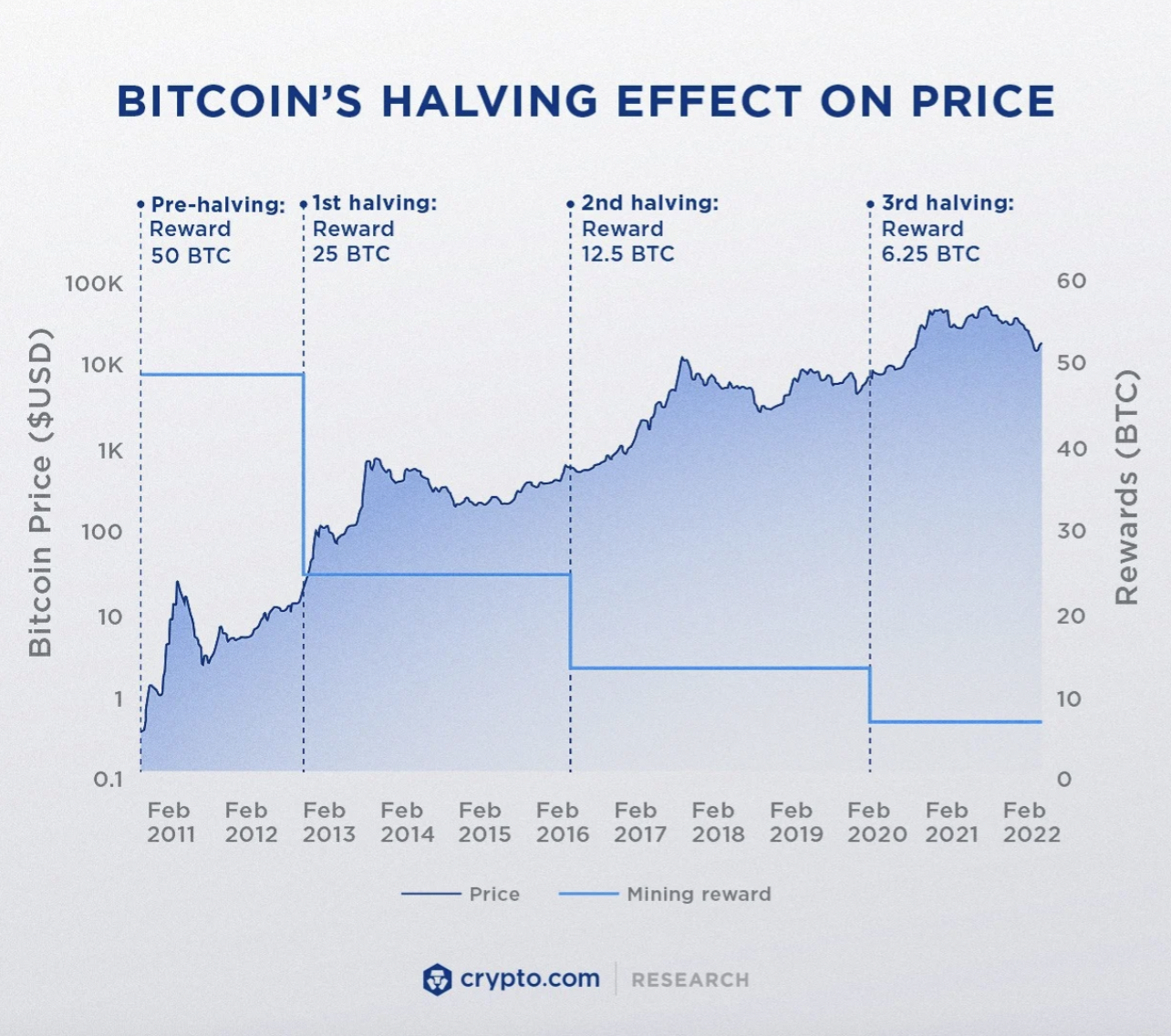

Reason 5: The Next Bitcoin Halving is Approaching

Still asking the question – Should I buy Bitcoin? Another reason supporting Bitcoin’s investment thesis is its halving event. This reduces the amount of new BTC tokens entering the market and it happens approximately every four years.

When Bitcoin was first launched in 2009, the mining reward was 50 BTC. This was reduced to 25 BTC in 2012 and to 12.5 BTC in 2016. In 2020, the mining reward was again reduced by 50%, down to 6.25 BTC. The next Bitcoin halving event is expected in April 2024. So why does this matter?

Well, first and foremost, the Bitcoin halving means that there are fewer BTC tokens entering the circulating supply. So instead of 6.25 BTC entering the supply every 10 minutes, the next Bitcoin halving will reduce this to 3.125 BTC. Considering that there are approximately 144 blocks per day, there will be 450 new BTC tokens every 24 hours, rather than 900.

The theory is that when supply is reduced, Bitcoin is more attractive to investors. This is because there is less Bitcoin available, so it becomes more scarce. The same concept can be seen with other asset classes. For example, when production levels are reduced by OPEC (Organisation of the Petroleum Exporting Countries), this means that there are fewer barrels of oil in supply.

In turn, this usually results in oil prices increasing. Similarly, when gold production rates are reduced, this enables its value to appreciate. This is also the case with real estate. When new property developments are reduced, this can result in increased real estate prices. So that begs the question – How does the price of Bitcoin react to halving events?

Well, history suggests that Bitcoin halvings encourage a new, extended bull run. For example, consider the 2020 Bitcoin halving. On the day of the halving, Bitcoin was priced at $9,100. 17 months later, Bitcoin peaked at almost $69,000. Similarly, Bitcoin was priced at $580 when it halved in 2016. 17 months later, Bitcoin peaked at $20,000.

The prior halving took place in 2012, when Bitcoin was priced at $12. 12 months later, Bitcoin peaked at $1,079. Although past performance does not guarantee future returns, many investors are keeping a close eye on the next Bitcoin halving. If history repeats itself, the halving could result in a prolonged bull cycle.

Reason 6: Bitcoin is Highly Liquid and Affordable

Another benefit of buying Bitcoin is that it is highly liquid. In simple terms, the liquidity of an asset determines how easy or difficult it is to sell. Most stores of value are ‘illiquid’. This means that selling the asset back for money at a favorable price can take time. For example, Zillow explains that the average listing-to-sale duration for US property is 55-70 days.

This can be problematic for investors needing access to fast cash. They might be forced to accept a price below the property’s market value. Illiquidity is also an issue for other stores of value, such as gold and fine art. In contrast, Bitcoin is highly liquid. In fact, Bitcoin is even more liquid than stocks. This is because Bitcoin trades 24 hours per day, 7 days per week.

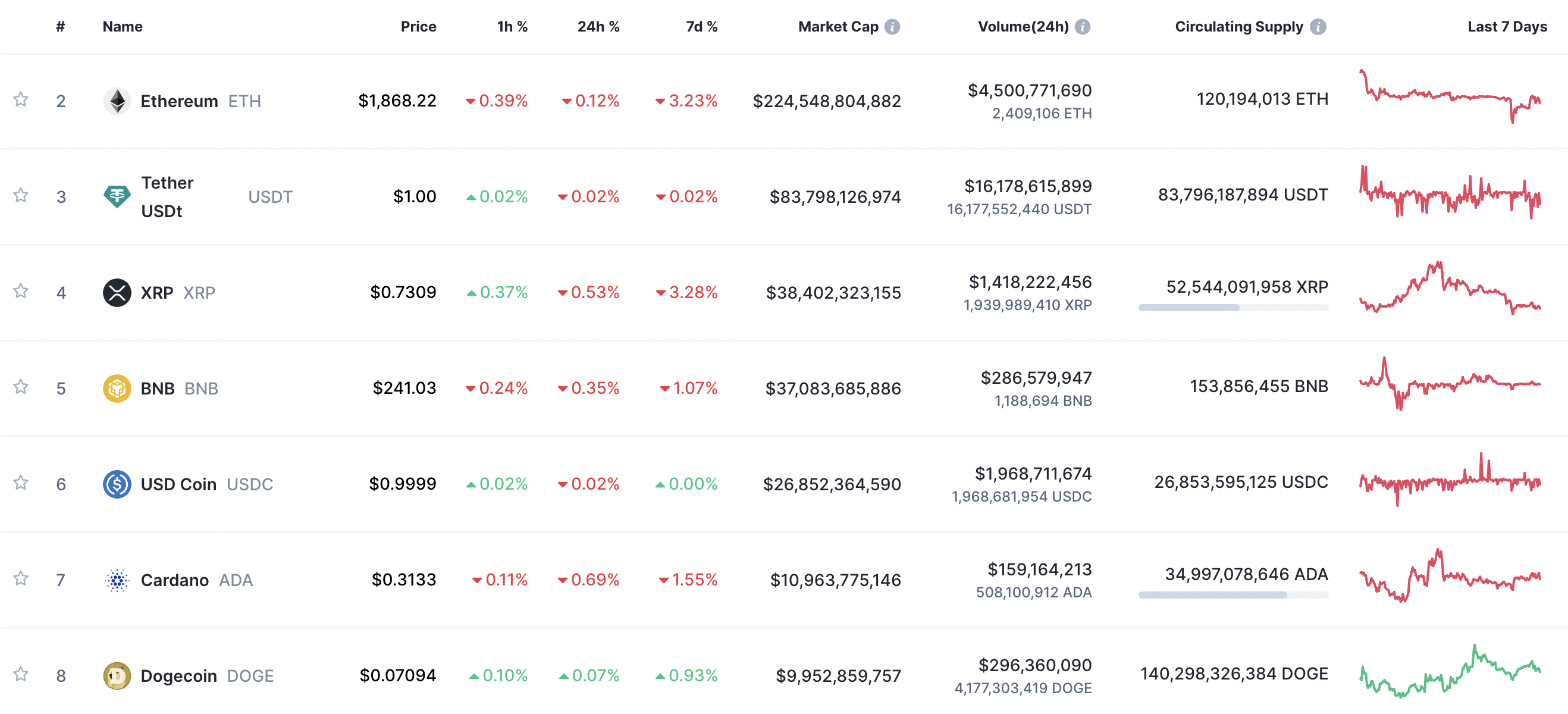

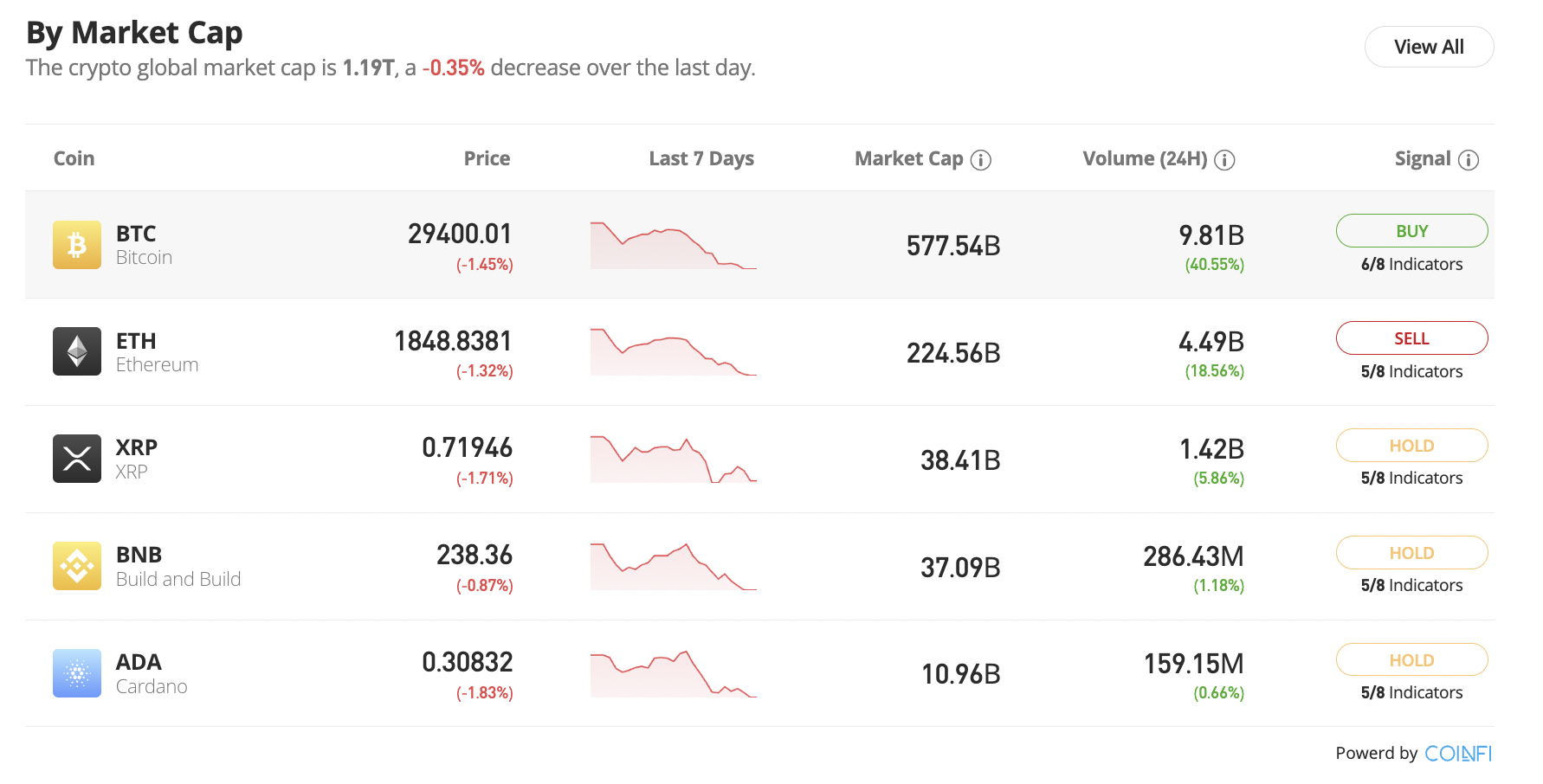

This means that investors can exchange their Bitcoin for money at any given time. Most importantly, there is sufficient liquidity in the trading markets. For example, according to CoinMarketCap data, Bitcoin has a market capitalization of over $580 billion. Over the prior 24 hours, more than $9 billion worth of Bitcoin was traded.

This means that investors can enter and exit the market with ease. There is no requirement to accept a below-market value price, nor wait days or weeks to receive payment. In addition, Bitcoin is one of the most affordable asset classes in the market. On the one hand, Bitcoin is currently trading at approximately $30,000.

However, there is no requirement to buy a ‘full’ Bitcoin token. On the contrary, Bitcoin can be fractionized 100 million times. As such, investors of all budgets and financial circumstances can gain exposure to Bitcoin. On eToro – a regulated crypto exchange with over 30 million users, investors can buy Bitcoin from just $10.

Not only is Bitcoin affordable but even complete beginners can easily navigate the market. For instance, many Bitcoin exchanges accept convenient payment methods, such as debit/credit cards and e-wallets. Investors simply need to open an account with the exchange, upload some ID, and proceed to make payment.

Beginners also have the option of storing their Bitcoin with a regulated custodian. This removes the need to learn about crypto wallets, private keys, and blockchain security. Ultimately, investing in Bitcoin has never been simpler. Even without any prior experience, leading Bitcoin exchanges have been designed with beginners in mind.

Reason 7: Institutional Interest in Bitcoin Continues to Grow

For many years, financial institutions and global companies stayed away from the Bitcoin market. In fact, some of the world’s most influential people called Bitcoin a ‘scam’. However, in recent years, there has been a complete sea-change in institutional interest in Bitcoin. For example, in late 2017, the world’s first regulated Bitcoin futures market launched.

The Bitcoin futures market was backed by CME Group – one of the largest derivatives exchanges globally. What’s more, some of the largest investment houses worldwide have applied to the SEC to launch a Bitcoin ETF. According to Bloomberg, this includes Fidelity, BlackRock, and Invesco. Collectively, these three companies alone manage trillions of dollars worth of assets.

Additionally, there is also growing interest in the technology that backs Bitcoin – the blockchain. This includes IBM, Amazon, Walmart, Microsoft, Oracle, and Accenture. Some of the world’s largest financial institutions are using the Ripple blockchain for cross-border transactions. This includes Standard Chartered Bank, Santander, Bank of America, and Siam Commercial Bank.

There is also an increasing number of companies accepting Bitcoin as payment. Examples include Microsoft, AMC Theatres, AT&T, Overstock, and Shopify. This makes a solid case for Bitcoin as a medium of exchange and a store of value. Crucially, as institutional interest in Bitcoin continues to rise, this gives the digital asset real-world legitimacy.

Reason 8: Price Predictions Suggest Bitcoin is Undervalued

Price predictions are also useful when assessing the question – Should you buy Bitcoin? At its peak in November 2021, Bitcoin was priced at just under $69,000. This gave Bitcoin a market capitalization of over $1.2 trillion. Currently, Bitcoin remains in a consolidation zone around the $30,000 level.

This means that Bitcoin is trading 55% below its prior all-time high. If Bitcoin is able to get back to $69,000, this would generate an upside of 130%. But some believe that during the next bull cycle, Bitcoin could far exceed its prior all-time high. But how big can Bitcoin realistically get? To answer this question, let’s explore the market capitalization of other asset classes.

According to Gold.org, there are currently 209,000 tonnes of gold in circulation – giving it an approximate market capitalization of $12 trillion. This consists of jewelry, bars and coins, central bank holdings, and physically-backed gold ETFs. If Bitcoin is able to replicate gold’s $12 trillion market capitalization, it would be priced at approximately $690,000.

That’s 10 times its former peak of almost $69,000. And from current levels of $30,000, a $12 trillion market capitalization offers an upside of 2,200%. Another angle to consider is real estate. According to the World Property Journal, all US real estate combined is worth over $33 trillion. This market capitalization would require Bitcoin to hit a price of $1.9 million.

At $1.9 million per BTC token, that’s an upside of over 6,200% from current pricing levels. Is this realistic? It all relies on continued Bitcoin adoption as both a store of value and a medium of exchange. Regarding the latter, Bitcoin is a global asset that is not hindered by borders. Transactions can be sent on a peer-to-peer basis, averaging just 10 minutes.

Anyone can buy and store Bitcoin in a self-custody wallet, ensuring that people can hold wealth without needing to trust third parties. This will particularly appeal to people based in countries with weak financial systems and/or high inflation levels. So what do the experts believe the future holds for Bitcoin as an investment?

According to Steve Wozniak – the co-founder of Apple, Bitcoin will eventually hit $100,000. From current levels, this would generate an upside of over 230%. ARK Investment – a leading FinTech ETF managed by Cathie Wood, believes that Bitcoin will reach $1 million within the next decade. In doing so, this would give Bitcoin a market capitalization of $19.4 trillion.

This market capitalization would surpass gold but still fall short of the US real estate market. Hal Finney, one of the original Bitcoin pioneers, argued that a price of $10 million was possible. This would give Bitcoin a market capitalization of over $194 trillion. This could be beyond the realm of possibility, considering it would exceed the entire value of gold, real estate, and US dollars.

Nonetheless, most Bitcoin proponents argue that at current prices, the digital asset is heavily undervalued. And although Bitcoin now trades for $30,000 – there is still plenty of upside available. That said, there is no guarantee that Bitcoin will ever return to its former all-time high – let alone exceed $1 million per token. As such, investors should proceed with caution.

What is the Best Time to Invest in Bitcoin?

The best time to invest in Bitcoin depends on the investor’s financial goals and risk tolerance. Overall, history suggests that long-term Bitcoin investors have been the most successful. Bitcoin is extremely volatile and it can remain in a bearish market for several years. But by holding Bitcoin through critical market conditions, there is often light at the end of the tunnel.

Bitcoin’s performance in the midst of COVID-19 is a prime example of this.

- After peaking at $10,000 on February 18th, 2020, Bitcoin hit lows of $4,800 within a month.

- Those that cashed out at this price point would have seen losses of over 50%.

- Now consider an investor that stayed strong by holding their Bitcoin while prices were capitulating.

- At the close of 2020, Bitcoin was trading at $28,000.

- 11 months later, Bitcoin was trading at highs of almost $69,000.

- So from its 2020 lows of $4,800 – Bitcoin went on to generate growth of over 1,300%.

This example shows that while Bitcoin is highly volatile, long-term investors have seen great success. Additionally, some investors find success by buying Bitcoin when prices are down. The current bear market, for example, offers a great opportunity to buy Bitcoin at a discounted price. So should I buy BTC now?

Based on current prices of $30,000, investors can secure a discount of 55%. This is based on Bitcoin’s prior all-time high of nearly $69,000. That said, the most risk-averse strategy is to create a dollar-cost averaging schedule. This requires great discipline but can yield attractive long-term results.

The dollar-cost averaging concept removes the need to worry about short-term volatility. Let alone when to enter and exit the market. This is because dollar-cost averaging involves buying Bitcoin at fixed intervals, at the same amount each time. For instance, buying $200 worth of Bitcoin at the end of each month.

After each monthly investment is made, the average cost price is adjusted. This will align with broader market trends. This means that when Bitcoin prices are falling, investors will buy Bitcoin at a discount. And when Bitcoin prices are rising, the portfolio value will also increase.

Here’s an example of how dollar-cost averaging works:

- Month 1: $30,000

- Month 2: $25,000

- Month 3: $27,000

- Month 4: $28,000

- Month 5: $30,000

- Month 6: $33,000

- Month 7: $41,000

- Month 8: $45,000

- Month 9: $44,000

- Month 10: $41,000

- Average Cost Price: $34,400

As per the above, the investor made 10 monthly investments at the same amount each time. Although Bitcoin was volatile, the investor has an average cost price of $34,400.

How Much Should You Invest in Bitcoin?

Just like when to buy Bitcoin, the amount of money that should be invested is subjective. This will depend on the investor’s individual circumstances, budget, risk tolerance, and more.

Let’s explore the most important factors to consider when assessing how much to invest in Bitcoin.

Budget and Expenses

The most important metric is the investor’s individual financial circumstances.

The best course of action is to create a budget. This should outline the individual’s income, alongside their core monthly expenses. For example, rent, food, energy, taxes, and savings. Anything left over can be considered disposable income.

Just remember, Bitcoin is a risky asset class. Like all investments, the price of Bitcoin will rise and fall. That said, Bitcoin is highly liquid. As such, if the investor has an emergency and needs access to fast cash, Bitcoin can be sold 24/7.

Risk and Volatility Tolerance

Investors should also assess their individual tolerance for risk before investing in Bitcoin. On the one hand, Bitcoin is one of the best-performing assets over the prior 10 years. But equally, there is no guarantee that Bitcoin will produce investment gains.

Bitcoin is still an emerging asset class, especially when compared to stocks. After all, Bitcoin was only launched in 2009. While the S&P 500, for example, was established in 1926. In addition, investors should evaluate how comfortable they are with Bitcoin’s volatility.

To offer some insight, Bitcoin was priced at almost $68,000 in November 2021. 12 months later, Bitcoin hit lows of under $16,000. This means that in just one year of trading, Bitcoin declined by over 75%.

History shows that Bitcoin has witnessed many similar declines. But it has always rebounded and gone on to set new highs. This means that investors should be prepared to hold onto their Bitcoin investment even when prices are capitulating.

Diversification

When asking yourself the question should I buy BTC, investors should avoid going ‘all in’ on Bitcoin. On the contrary, crypto investors should have a well-balanced portfolio that distributes risk across multiple asset classes and markets.

For example, suppose the investor has $10,000. A risk-averse investor might only allocate 5% or $500 to Bitcoin. They might allocate the rest of the portfolio to blue-chip stocks, ETFs, commodities, and REITs. Ultimately, the more diversified the portfolio is – the better.

Some investors will also diversify into other cryptocurrencies. For example, while Bitcoin remains the best cryptocurrency to buy, investors are also bullish on altcoins.

While there are over 26,000 to choose from, some of the best altcoins include BTC20, Ethereum, XRP, BNB, and Cardano. Some investors will also consider buying the best meme coins, such as Shiba Inu, Floki, and Dogecoin.

Financial Goals

Investors should also consider their financial goals before buying Bitcoin. For instance, Bitcoin is best suited for long-term investors. This enables investors to ride volatile Bitcoin cycles. For added risk management, long-term investors might consider a dollar-cost averaging strategy.

That said, Bitcoin is also suitable for short-term traders. This entails buying and selling Bitcoin to benefit from volatile market prices. This strategy does, however, require an understanding of technical analysis.

Additionally, investors should remember that like many other stores of value, Bitcoin does not generate income. Instead, investment gains are only realized if the Bitcoin is sold at a higher price than the investor paid.

How to Buy Bitcoin for Beginners

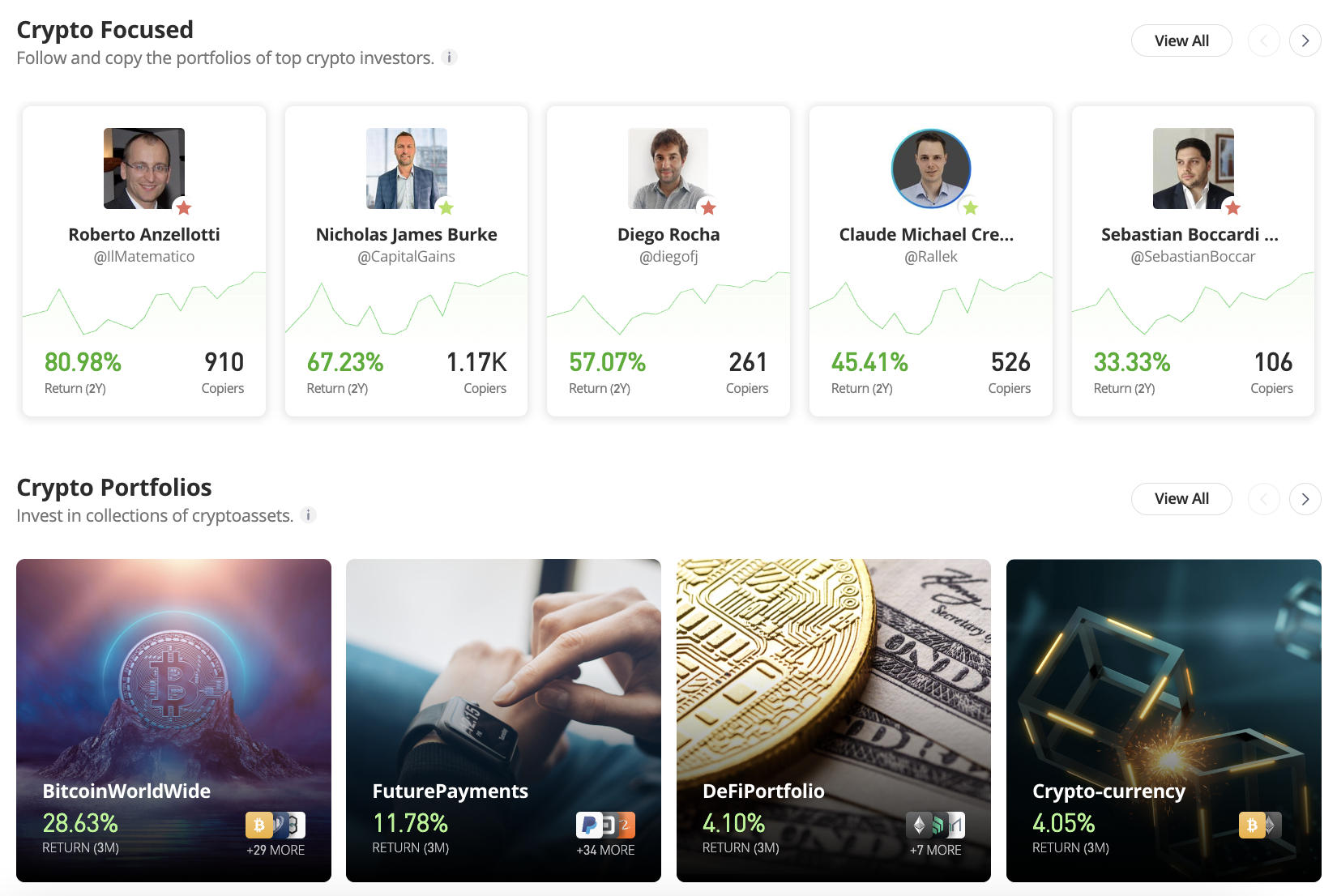

We have now answered the question – Should you buy Bitcoin? The next step is to learn how to buy Bitcoin in a safe and cost-effective way. We found that overall, eToro is the best place to invest in Bitcoin as a beginner – here’s why:

eToro Review – Overall Best Place to Buy Bitcoin for Beginners

eToro is a popular Bitcoin exchange used by over 30 million investors. It offers a simple yet highly secure way of investing in Bitcoin for the first time. It takes just two minutes to open a verified account and payments are processed instantly. Supported payment methods include Visa, MasterCard, Maestro, PayPal, Skrill, and Neteller.

Although most Bitcoin exchanges charge between 3-5% when depositing money, this isn’t the case with eToro. In fact, there are no fees to pay when depositing US dollars. This is the case with all supported payment methods. eToro also accepts other currencies – it simply charges a small FX fee of 0.5%. So that’s just £5 for every £1,000 deposited, or the currency equivalent.

After making a deposit, eToro users can then buy Bitcoin. The exchange has a low minimum trade requirement of just $10. This will appeal to investors deploying a dollar-cost averaging strategy. Not to mention investors on a budget. The eToro Bitcoin exchange operates 24/7 and plenty of liquidity is available around the clock.

This means that investors can sell their Bitcoin tokens at the click of a button. We also like that eToro offers a safe way to store Bitcoin. It offers an in-built custodial wallet that requires no prior experience. eToro keeps the vast majority of Bitcoin tokens in cold storage, meaning the funds are offline and away from hackers.

Plus, eToro users can secure their accounts with two-factor authentication. Unlike most Bitcoin exchanges, eToro is heavily regulated. It holds a license with many tier-one bodies, including FINRA, FCA, CySEC, and ASIC. In addition, eToro is one of the best Bitcoin exchanges for diversification – a key strategy to mitigate risk.

For example, it supports dozens of altcoins, ranging from Dogecoin and BNB to Ethereum, XRP, and Cardano. What’s more, eToro supports thousands of US and international stocks, as well as ETFs, commodities, forex, and indices. eToro will also appeal to those wanting to manage their Bitcoin investments on the move. The platform offers a user-friendly app for iOS and Android.

All that being said, the best features of eToro are ‘copy trading’ and ‘smart portfolios’. Both features allow users to invest in Bitcoin and other cryptocurrencies passively. For instance, copy trading entails copying a seasoned crypto trader. All trades will be mirrored like-for-like. While smart portfolios offer diversified baskets of crypto assets – managed and rebalanced by eToro.

Here’s a quick walkthrough on how to buy Bitcoin on eToro:

- Step 1: Open an account – First, register an account with eToro. Enter some personal information and upload some ID – such as a passport or driver’s license.

- Step 2: Deposit funds – Next, make a deposit into the eToro account. A minimum deposit of $10 is required for US/UK investors. At least $50 is needed for other nationalities. Accepted payment types include debit/credit cards, e-wallets, and bank transfers.

- Step 3: Search for Bitcoin – Type ‘Bitcoin’ into the search box. Then, click on the ‘trade’ button.

- Step 4: Buy Bitcoin – In the ‘Amount’ box, enter the size of the Bitcoin investment (in USD). Then, click on the ‘Open Trade’ button to complete the purchase.

- Step 5: Sell Bitcoin – To sell Bitcoin, click on the ‘Portfolio’ button. Click on ‘Bitcoin’ followed by the ‘Close All’ button. Finally, click on the ‘Close Trade’ button and eToro will sell the Bitcoin at the current market price. US dollars will then be added to the user’s account balance.

Could BTC20 Be a Better Investment Than Bitcoin?

This guide has helped answer the question – Should I invest in Bitcoin? Overall, the investment thesis is very positive. Especially when considering its finite supply, decentralized framework, past performance, upside potential, and the upcoming Bitcoin halving event.

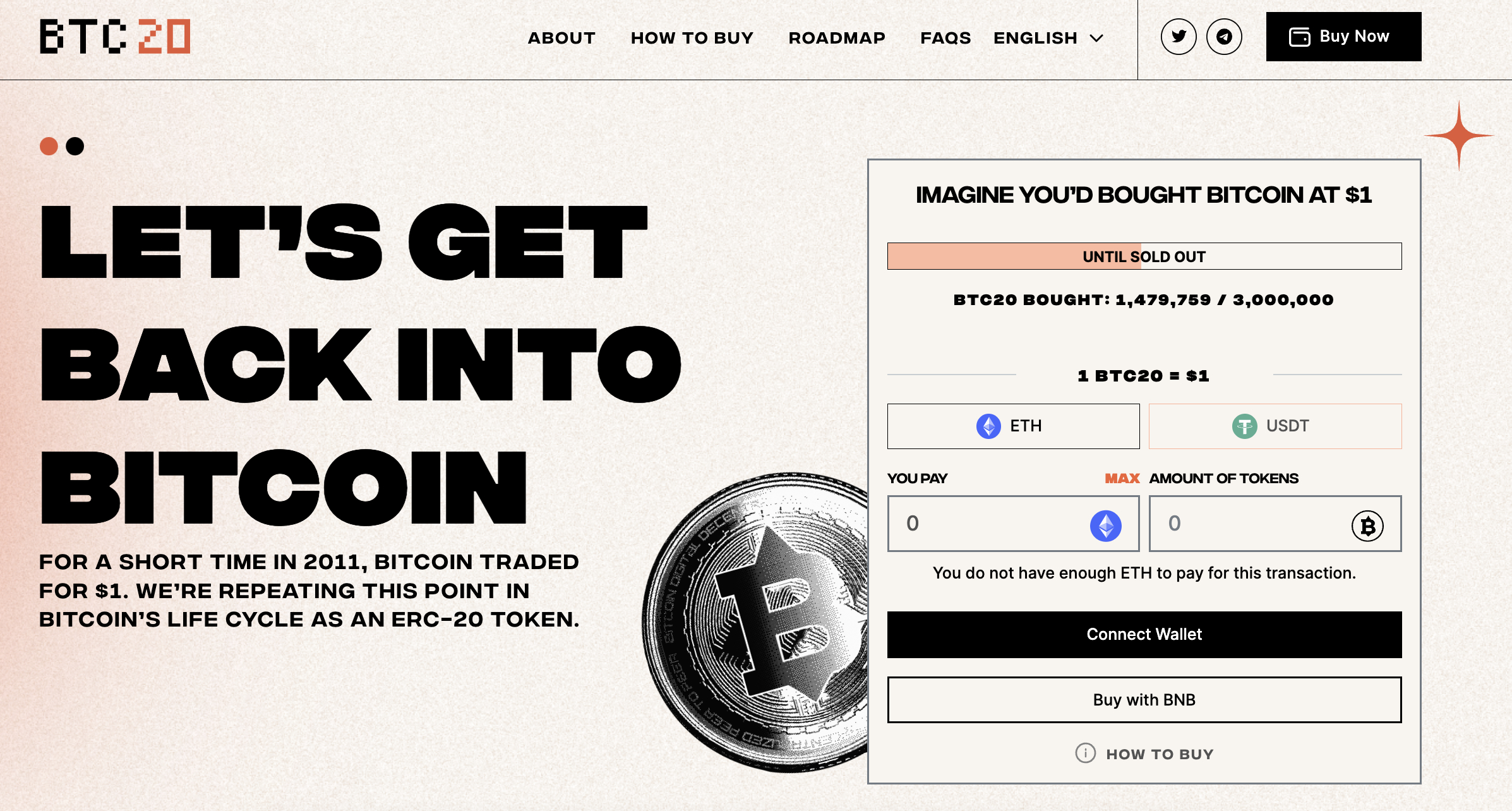

That said, a well-balanced portfolio should consider other assets in addition to Bitcoin. In this regard, we found that BTC20 could be the next cryptocurrency to explode. So what is BTC20 and why is it generating a lot of hype in the crypto market?

In a nutshell, BTC20 is a brand-new cryptocurrency that solves many of Bitcoin’s shortcomings. At the forefront of this is the value proposition. While Bitcoin has the potential to generate long-term gains, it has already increased by many millions of percentage points. It is beyond the realms of possibility for Bitcoin to replicate similar returns – considering its large market capitalization.

In contrast, BTC20 is currently in presale. This means that BTC20 is yet to launch on crypto exchanges. Instead, it is currently raising funds from early investors. This means that presale buyers will gain exposure to a Bitcoin alternative from the ground up. The BTC20 presale has already raised almost $1.5 million.

Early investors will pay just $1 for each token purchased. This means that even a small investment of just $100 will yield 100 BTC20 tokens. Just like the original Bitcoin, BTC20 has a maximum supply of 21 million tokens. Once the maximum supply is reached, no new BTC20 tokens will enter circulation.

This finite supply makes BTC20 attractive as a long-term investment. Just 6.05 million BTC20 tokens will be sold during the presale campaign. The balance will be locked in a staking contract – ensuring that BTC20 does not witness hyperinflation. Unlike the original Bitcoin, BTC20 operates on the Ethereum blockchain.

This means that BTC20 requires significantly less energy consumption, making it more sustainable in the long run. In addition, BTC20 also enables token holders to generate passive income. This is because staking pools will be launched. To invest in the BTC20 presale, investors will need Ethereum or Tether to pay for their purchase.

Conclusion

In summary, Bitcoin remains one of the best-performing asset classes – and offers an attractive upside for many.

That said, Bitcoin is already a large-cap asset – so the growth potential is somewhat limited. Instead, investors might consider BTC20 – a brand-new alternative to Bitcoin.

BTC20 is currently selling its tokens for just $1 each. The BTC20 presale has already raised almost $1.5 million.

References

https://www.google.com/finance/quote/BTC-USD

https://coinmarketcap.com/currencies/bitcoin/

https://www.cityam.com/almost-a-fifth-of-all-us-dollars-were-created-this-year/

https://www.bloomberg.com/quote/SPX:IND

https://www.londonstockexchange.com/indices/ftse-100

https://www.spglobal.com/spdji/en/indices/equity/sp-asx-200/

https://www.google.com/finance/quote/NI225:INDEXNIKKEI

https://www.bbc.com/news/world-europe-21814325

https://www.ig.com/en/bitcoin-btc/bitcoin-halving

https://www.zillow.com/sellers-guide/average-time-to-sell-a-house/

https://www.bloomberg.com/news/articles/2023-07-05/what-s-happening-with-spot-bitcoin-etfs-from-blackrock-fidelity

https://www.gold.org/goldhub/research/market-primer/gold-market-primer-market-size-and-structure

https://www.worldpropertyjournal.com/real-estate-news/united-states/los-angeles-real-estate-news/real-estate-news-zillow-housing-data-for-2020-combined-housing-market-value-in-2020-us-gdp-china-gdp-rising-home-value-data-11769.php

https://www.thestreet.com/investing/apples-wozniak-says-bitcoin-to-hit-100000

https://www.spglobal.com/spdji/en/research-insights/index-literacy/the-sp-500-and-the-dow/

https://changelly.com/blog/bitcoin-price-prediction/

https://finance.yahoo.com/news/bitcoin-dominance-rises-highest-level-171927101.html

https://www.coindesk.com/learn/bitcoin-halving-explained/

https://www.cnbc.com/2022/05/09/40percent-of-bitcoin-investors-underwater-glassnode-data.html

FAQs

Should I buy Bitcoin?

While Bitcoin is a top-performing asset that has produced incredible returns since launching in 2009 – first-time investors should consider the added risks.

Is Bitcoin a good investment in 2023?

Bitcoin remains one of the best-performing assets in 2023, with the digital currency appreciating by over 80% year-to-date.

What will Bitcoin be worth in 2025?

According to Changelly, Bitcoin will be worth between $69,432 and $83,420 in 2025.

What will Bitcoin be worth in 2030?

According to Changelly price predictions, Bitcoin could be worth up to $553,269 in 2030.

How much Bitcoin should I buy?

Investors should only risk money on Bitcoin that they can realistically afford to lose. Consider the risks, volatility, and long-term potential of Bitcoin before proceeding.