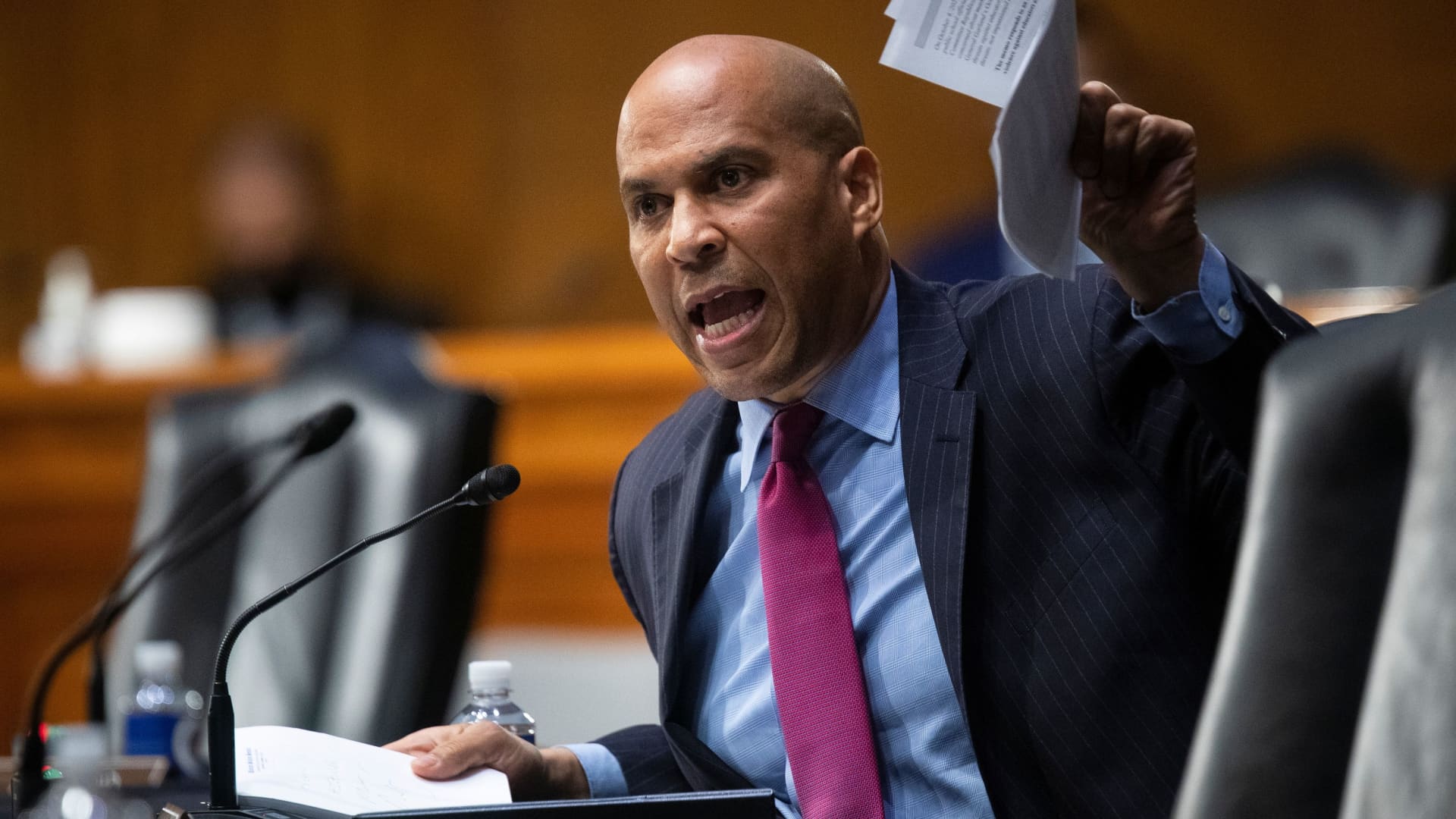

WASHINGTON — Sens. Cory Booker and Raphael Warnock have urged the CEOs of 10 major banks to waive overdraft and nonsufficient fund fees that could cost some Americans more than $100 a day in the wake of the failures of Silicon Valley Bank and Signature Bank.

In letters dated Tuesday, the New Jersey and Georgia Democrats asked banks to help customers whose payments were delayed or missing due to the collapse of SVB and Signature earlier this month. The letters went to the CEOs of Wells Fargo, U.S. Bank, Truist Financial Corp., TD Bank, Regions Financial Corp., PNC Bank, JPMorgan Chase, Huntington National Bank, Citizens Bank and Bank of America.

The senators separately urged key regulators to place a brief moratorium on the fees “while the disruption in payments is resolved.” The letter was sent to Federal Reserve Chair Jerome Powell; Michael Hsu, acting comptroller of the Currency; Todd Harper, chairman of the National Credit Union Administration; and Martin Gruenberg, chairman of the Federal Reserve Insurance Corp.

“Disruptions across the banking industry this month rattled consumers and threw into jeopardy the paychecks of millions of American workers,” wrote Booker, who is a member of the Senate Committee on Small Business and Entrepreneurship, and Warnock.

The fees, which can reach up to $111 a day for low account balances or up to $175 on low account fees, “compound the difficult financial situation customers find themselves in, particularly when their lack of funds is due to an unprecedented, unexpected delay,” the senators said.

Wells Fargo and PNC Bank declined to comment. JPMorgan Chase said through a representative that a team is “assessing whether any of our customers were impacted and how we can support them.”

A representative for TD Bank told CNBC that it is reviewing the letter and that it “implements changes for our customers that are designed to help them better manage their money and take control of their finances.”

The other banks that received the letters did not immediately respond to requests for comment.

The FDIC closed SVB on March 10 after the bank announced a nearly $2 billion loss in asset sales. The agency said SVB’s official checks would continue to clear and assets would be accessible the following day.

Regulators shuttered New York-based Signature Bank days later in an effort to stall a potential banking crisis. Many of its assets have since been sold to Flagstar Bank, a subsidiary of New York Community Bancorp.

Booker and Warnock said banking customers whose paydays fell between March 10 and March 13 were unable to receive or deposit checks from payroll providers banking with SVB and Signature Bank. They also noted that online merchant Etsy notified customers of payment delays because it used SVB payment processing.

The senators also cited an unrelated, nationwide technical glitch on the March 10 that caused missing payments and incorrect balances for Wells Fargo customers.

“These delays will disproportionately harm the impacted customers who are part of the sixty-four percent of Americans living paycheck-to-paycheck, who are often ‘minutes to hours away from having the money necessary to cover’ expenses that lead to overdraft nonsufficient fund fees,” Booker and Warnock wrote.

They praised steps taken by the Treasury Department and the FDIC to stem a possible economic catastrophe by ensuring access to depositor funds over the $250,000 FDIC-guarantee threshold and creating a new, one-year loan to financial institutions to safeguard deposits in times of stress.

Treasury Secretary Janet Yellen on Tuesday said the department is prepared to guarantee all deposits for financial institutions beyond SVB and Signature Bank if the crisis worsens.

“In line with quick, decisive government response to assist the businesses and individuals who were helped immediately in order to contain the broader fallout of these bank failures, we urge you to act with similar urgency to backstop American families from unexpected and undeserved charges,” the senators wrote to the bank CEOs.