SEC Holds Meetings with Grayscale, BlackRock on Bitcoin ETFs

Last updated: December 18, 2023 20:47 EST

. 2 min read

The U.S. Securities and Exchange Commission (SEC) has recently held meetings with Grayscale and BlackRock to discuss their filed applications regarding spot Bitcoin exchange-traded funds (ETFs).

SEC Meets with Grayscale to Discuss its Bitcoin ETF Filing

A memorandum published by the SEC indicates that officials from the agency’s Division of Trading and Markets met with Grayscale Investments on Nov. 29 to consider the proposed conversion of Grayscale’s listed Bitcoin Trust into a spot Bitcoin ETF.

According to the memo, the discussion “concerned NYSE Arca, Inc.’s proposed rule change to list and trade shares of the Grayscale Bitcoin Trust (BTC) under NYSE Arca Rule 8.201-E.”

The participants of the meeting included David Shillman, the Associate Director in the SEC’s Division of Trading and Markets, who oversees the U.S. equity, options and fixed income markets, and Michael Sonnenshein, the CEO at Grayscale Investments. Grayscale’s external representatives from Davis Polk & Wardwell LLP also attended the meeting.

BlackRock Revises its In-Kind Model Design

On Nov.28, the SEC officials also met with BlackRock and the Nasdaq, as indicated by another memo. While the SEC’s side was led by Eric Juzenas, the Associate Director in the SEC’s Division of Trading and Markets, BlackRock’s Digital Assets Head Robert Mitchnick and Nasdaq’s Principal Associate General Counsel Jonathan Cayne participated in the discussion, specifically about revising BlackRock’s Bitcoin ETF model.

According to the published memo’s note, BlackRock revised its In-Kind model design to address to the SEC’s concerns and “unresolved” questions regarding the model.

BlackRock’s proposed “In-Kind” redemption model involves market makers adjusting ETF shares supply and directly redeeming them for Bitcoin. This aims to closely link the share price with Bitcoin’s value.

However, the SEC has concerns with this model, mainly because it requires U.S. broker-dealers to directly handle Bitcoin, posing potential risks to their investments. In response, the SEC suggested a “Cash” model, which, though safer for broker-dealers, could make the fund’s operation more complex and involve more steps for BlackRock.

“This [revised] model appears to address the Staff’s concern with In-kind, addressing the critical dimension on which the In-kind model would otherwise be not preferred to the Cash model,” said the note.

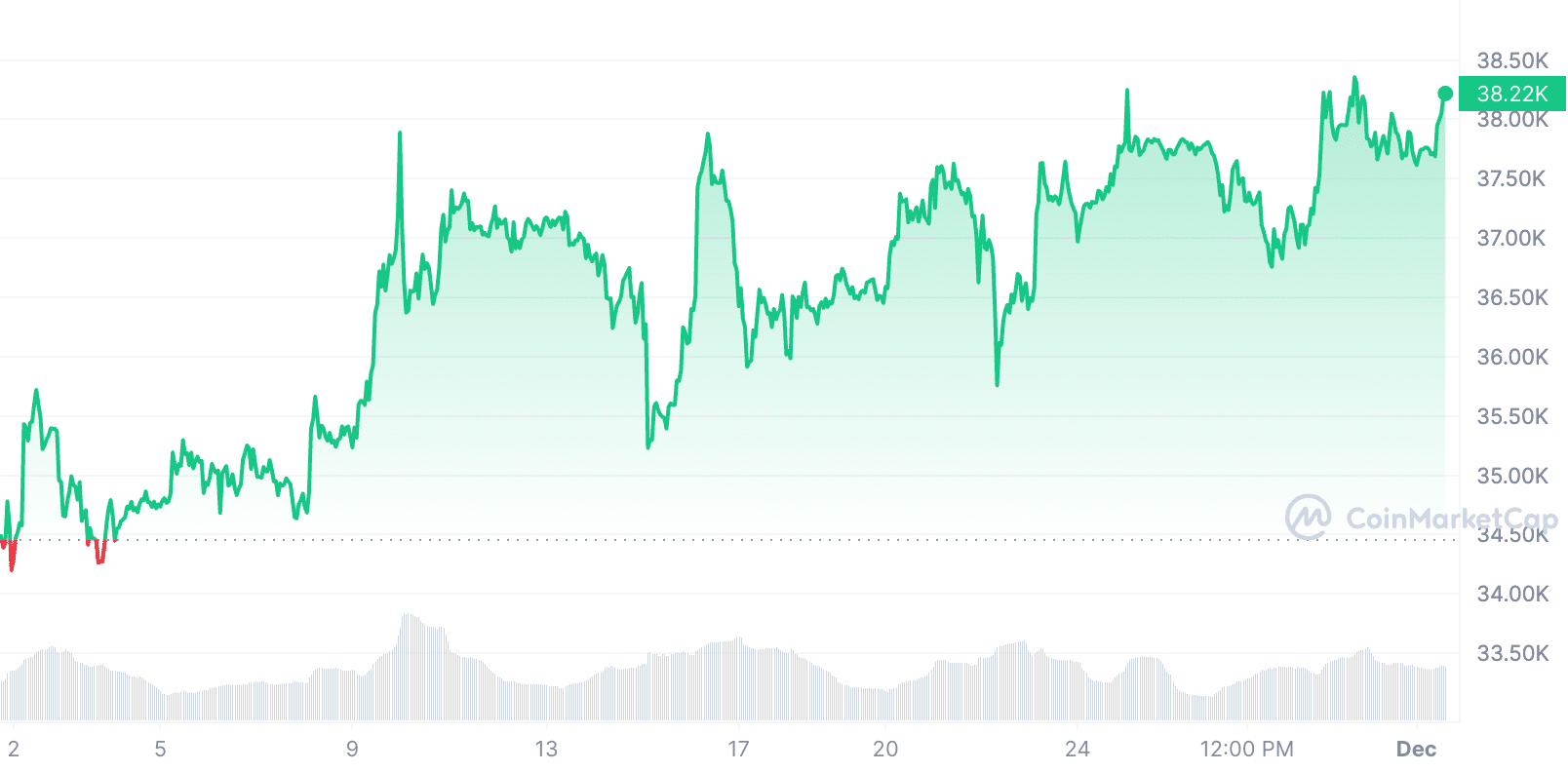

Bitcoin is currently trading at $38,223, almost 1% up from yesterday and 11% up from 30 days ago, according to CoinMarketCap. The SEC’s pending approval of the spot Bitcoin ETFs could potentially drive the Bitcoin price to skyrocket.