Sam Bankman-Fried Had Dinner With NYC Mayor Prior to FTX Collapse – Here’s What You Need to Know

Sam Bankman-Fried was in constant contact with prominent political and financial figures in New York City in the months leading up to the collapse of FTX and his subsequent arrest.

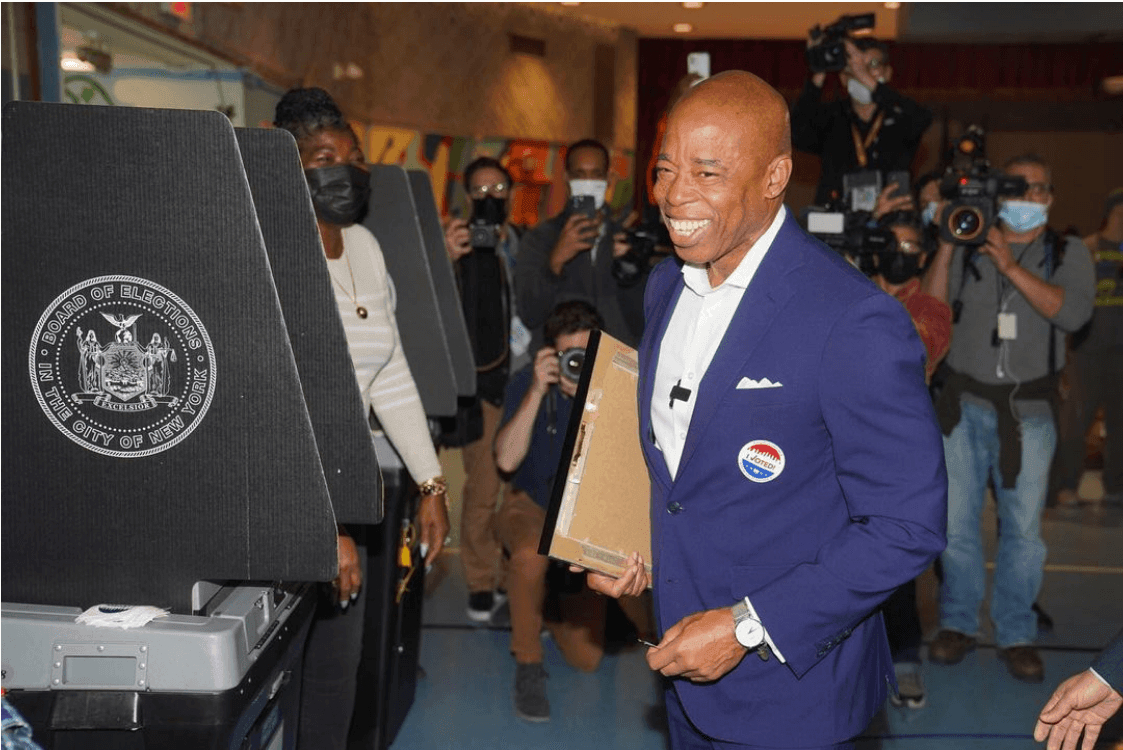

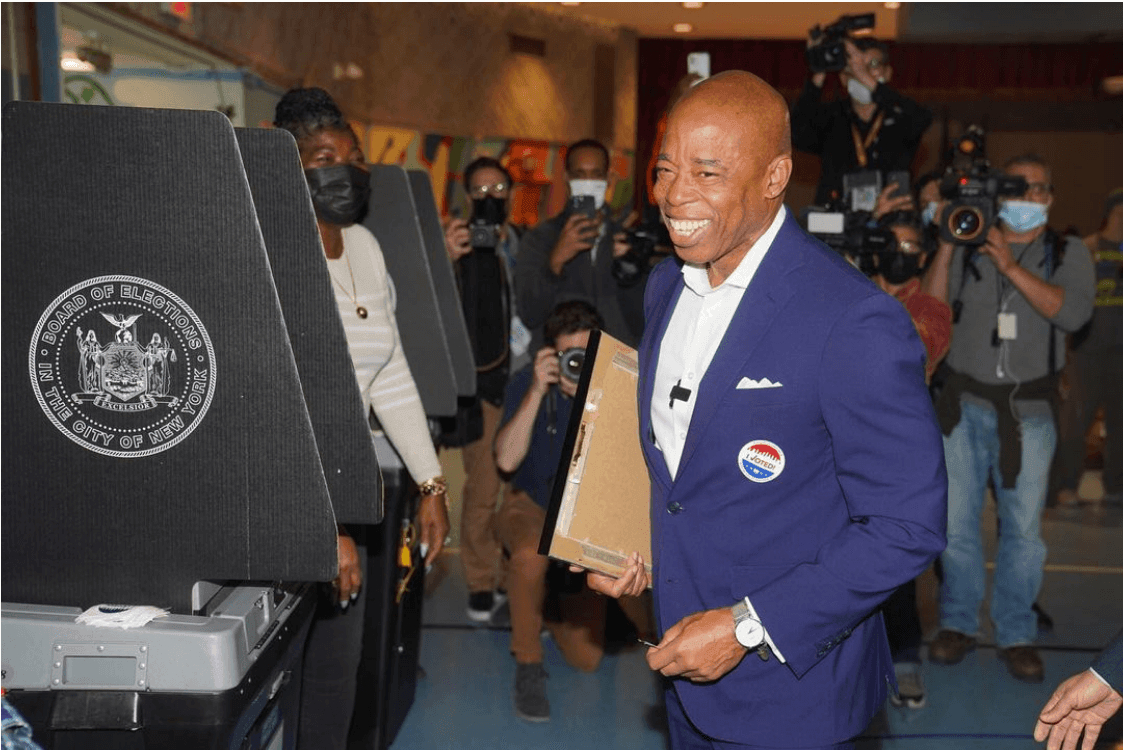

In March 2022, the disgraced crypto boss had dinner with New York City Mayor Eric Adams at Osteria La Baia, an Italian restaurant near the Museum of Modern Art.

The establishment is known to be a preferred late-night meeting spot for the mayor.

Although the mayor’s public schedule confirmed the meeting, it did not disclose the specifics of their discussion.

Additionally, in September 2022, Bankman-Fried was scheduled to meet with New York Governor Kathy Hochul at The Capital Grille steakhouse, an unconventional choice given Bankman-Fried’s vegan lifestyle.

Selected emails presented by the prosecution highlighted the high demand for Bankman-Fried’s presence and insights prior to the collapse of FTX.

Various investment firms, including those associated with George Soros and Morgan Stanley, sought access to group dinners organized to engage with the crypto prodigy.

In his testimony, Special Agent Richard Busick said Bankman-Fried’s schedule was filled with high-profile encounters.

One moment, he would attend a brief photoshoot with Forbes in midtown, and the next, he would have appointments with influential figures such as Saudi Arabia’s finance minister, Khalid A. Al-Falih, and the head of its sovereign wealth fund, Yasir Al-Rumayyan.

All of Bankman-Fried’s engagements were meticulously coordinated by his personal assistant, Natalie Tien, whose experiences managing the CEO’s hectic schedule were detailed in Michael Lewis’ book, “Going Infinite.”

New York Mayor Remains a Strong Crypto Supporter

Mayor Adams has demonstrated enthusiasm for cryptocurrencies, even receiving his first mayoral paycheck denominated in Bitcoin and Ether, albeit immediately converted into U.S. dollars.

He has expressed interest in establishing New York City as a prominent crypto hub.

Meanwhile, New York is among the few states that require businesses that engage in the transmission of fiat currency as well as a virtual currency to have both a BitLicense and a traditional money transmitter license.

The state also requires firms to undergo examinations to ensure they are in line with requirements and comply with know-your-customer, anti-money laundering rules.

The New York State Department of Financial Services (NYSDFS) has introduced several new rules for crypto companies since the high-profile collapse of crypto exchange FTX.

Earlier this year, the regulator released new guidance that mandates companies to separate their own crypto assets from that of customers.

The move came after it was revealed that there was co-mingling of funds between the now-bankrupt cryptocurrency exchange FTX and its trading arm Alameda Research.

In April, the NYSDFS also passed a new law that requires companies holding a BitLicense to pay assessment fees similar to insurance and banking firms.

The legislation put digital asset firms in the same row as insurance and banking companies, which pay assessment fees that fund the agency’s operations.