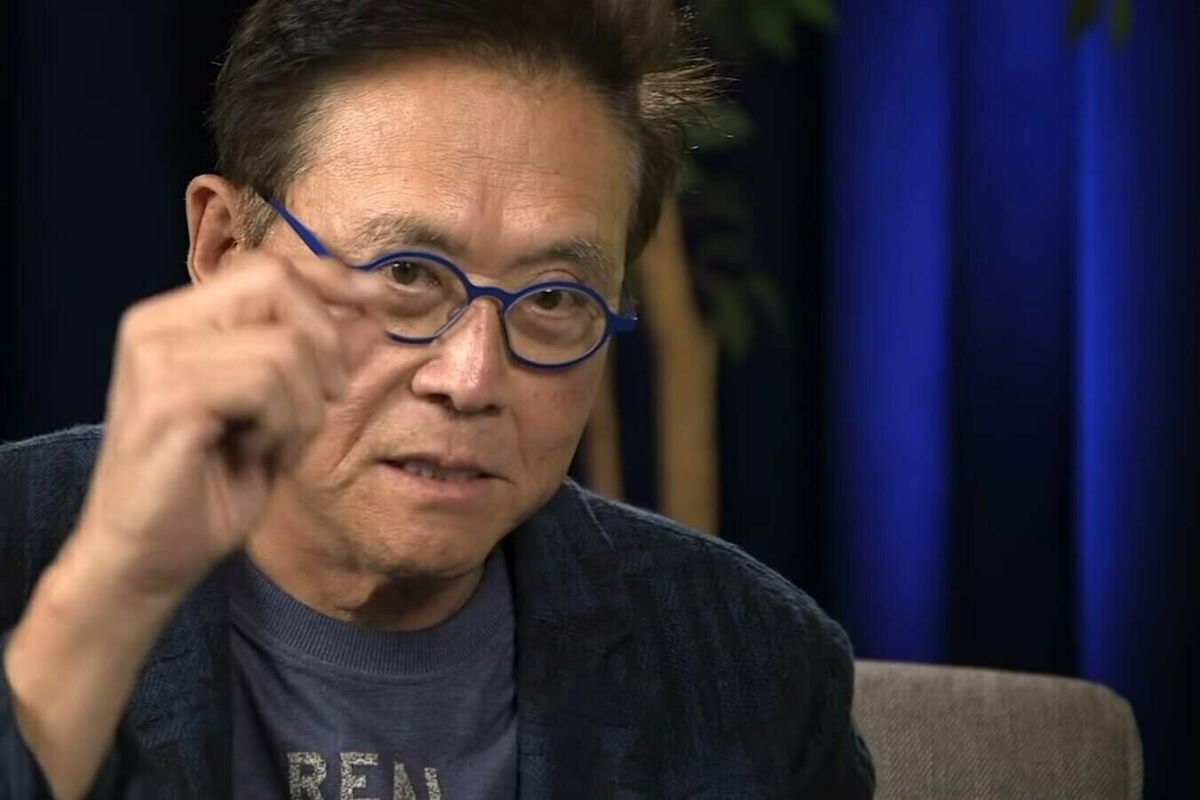

Next Target for Bitcoin is $135,000, Predicts Rich Dad Poor Dad Author

Best-selling author of Rich Dad Poor Dad, Robert Kiyosaki, thinks the next target for Bitcoin, after hitting $30,000 over the weekend, is $135,000

In a post on X, formerly Twitter, Kiyosaki expressed his optimism about Gold, Silver and Bitcoin. He suggested that gold was on the verge of breaking through the $2,100 mark, and he expected its price to continue rising. His long-term outlook for gold was even more optimistic, with a projection of $3,700.

Kiyosaki’s prediction for the leading cryptocurrency was considerably more bullish, as he believes that BTC’s next target is a staggering $135,000.

At the time of writing, Bitcoin is trading just above $30,800, nearly 11% up in the last 7 days.

Gold will soon break through $2,100 and then take off. You will wish you had bought gold below $2,000. Next stop gold $3,700. Bitcoin testing $30,000. Next stop Bitcoin $135,000. Silver from $23 to $68 an ounce. Savers of fake dollars F’d. Please tell your friends to “Wake up.”…

— Robert Kiyosaki (@theRealKiyosaki) October 20, 2023

Kiyosaki Remains Bullish on Bitcoin

Kiyosaki has been a vocal advocate for Bitcoin and its potential as a long-term investment.

In February this year, the financial literacy advocate had predicted that the price of bitcoin will skyrocket to $500,000 by 2025.

In July, he had foreseen the possibility of Bitcoin reaching $120,000 in the near future.

His positive outlook aligns with the predictions of financial institutions like Standard Chartered Bank, which also foresaw Bitcoin reaching $120,000 by the end of 2024.

Kiyosaki frequently emphasizes the potential of assets like Bitcoin, Gold, and Silver as hedges against potential economic crises fueled by government actions.

Despite these predictions, Kiyosaki encourages investors to focus not just on the future price of these assets but also on how much of them they currently own.

In a post on X last month, the best selling author warned against the impending stock market crash, predicting that the decline in stock markets, bonds, and real estate would drive people toward assets like Bitcoin, Gold, and Silver.