Moscow Claims Russia Will Be Using Digital Ruble in LATAM by 2025

A senior Russian politician says domestic firms will be using the digital ruble, the nation’s CBDC, in Latin America no later than 2025.

The comments were made by Anatoly Aksakov, the Chairman of the State Duma Committee on the Financial Markets.

Per Tass, Aksakov, who is also the MP for Chuvashia’s Kanash constituency, stated that the digital ruble “will enter the international arena in 2025.”

He also stated that it could be used in “mutual settlements” with Latin American countries.

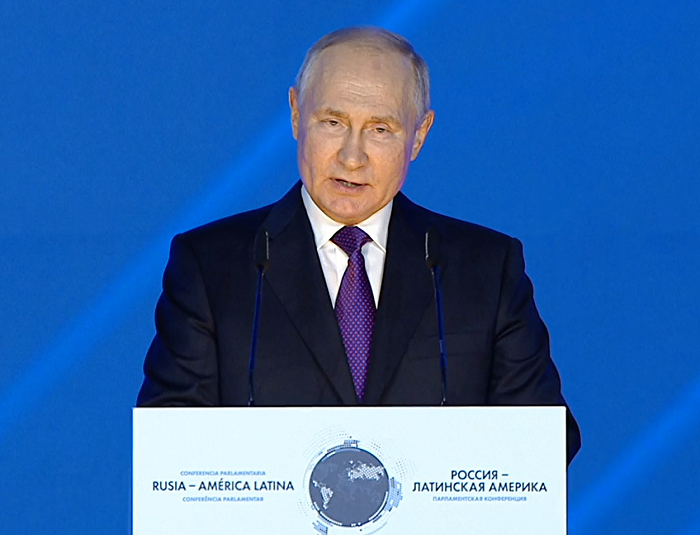

The MP was speaking at a Moscow-based summit named “Russia – Latin America.”

He appealed to LATAM central bankers to forge closer links with Moscow on CBDC-related matters.

Aksakov said:

“In 2025, I am sure that the digital ruble will enter the international space. And it will be available for use in mutual settlements, including for companies in Latin American countries.”

The MP continued:

“We are ready to share our blockchain technology-related experience and our development capabilities with you. That will allow your central banks and companies to make wider use of this new [digital payments] channel.”

Aksakov added that the pilot would likely expand next year, and conclude with a national rollout in early 2025.

He said:

“We are now testing the digital ruble. I think that the digital ruble pilot will continue for about one year: Several months this year and into next year.”

The Central Bank has previously been more guarded with its own time frames for CBDC rollout.

The bank’s Deputy Governor claimed a rollout was expected “between 2025 and 2027.”

But with Western sanctions continuing to hamper Russian trade efforts, business leaders and politicians alike have eyed CBDC, BRICS digital currency, and even crypto-powered trading as alternatives to USD-denominated trade.

Russian CBDC Plans Include LATAM Expansion?

The long-serving Aksakov is the chief architect of the nation’s crypto and “digital financial assets” legislation, as well as the Duma’s chief interlocutor with the Central Bank.

He has made a number of bullish comments on the digital ruble’s future prospects.

This year, he has claimed that Russia’s coin could be compatible with China’s digital yuan.

He has also stated that buying caps on digital ruble holdings should be lifted for overseas buyers – allowing non-Russians to buy “millions” of tokens.