If nice flowers cost a dollar would you buy them more often?

If it costs $5 for someone to mow your lawn, would you outsource your lawn mowing?

How many vehicles would you purchase if a nice car only cost 500 USD, or better yet, would you spend $5,000 on a jetpack that flies you around quicker than a car?

These are intriguing questions but something that seems like a pipe dream in an inflationary system.

—

As an advocate of anarchocapitalism I firmly believe that the free market is the most efficient and equitable way to allocate resources and generate wealth. In a system without government intervention, individuals are free to pursue their own interests and engage in voluntary transactions with others. This creates a vast network of decentralized markets that can quickly adapt to changing circumstances and individual preferences.

Some may argue that central planning is necessary for economic stability and efficiency, but I disagree. Central planners may have good intentions, but they lack the ability to fully understand and respond to the nuanced needs and preferences of individuals and communities. Moreover, voluntary exchange can be corrupted if a third party rent-seeks on the activities going on between the two parties who want to exchange value.

Of course there is no perfect way to implement any system. Everything has tradeoffs. If we somehow found a way to limit government we should make sure we don’t go too far and end up in society where it is just survival of the fittest.

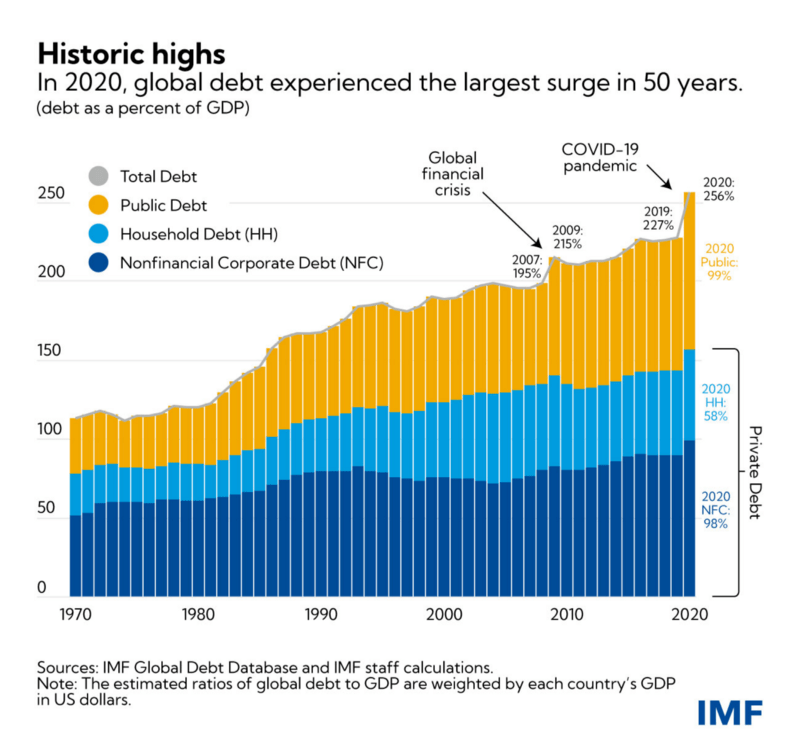

I just believe that in a system with fewer middlemen, more options would be available. This is where Bitcoin comes in. Technology should be making everything cheaper as productivity increases mean we get more for less. That is not happening today because the whole monetary system is based on debt. By allowing individuals to opt into a decentralized economy we can create a more dynamic and adaptive system that better reflects the needs and desires of its users. Money is to market actors what water is to a fish. We need clean water, not water that has been polluted by a broken social agreement.

I’d argue taxation is theft but I can see why others think it’s necessary. After all, who would build the damn roads? What I can’t understand is how some justify the idea that inflation is not theft. If everyone could borrow money from themselves — endlessly — they would always be borrowing more and more. Since inflation is perpetual, governments end up borrowing until the money becomes worthless. The public also borrows more because those who are paying attention realize the way to win in a backwards system is to take on more debt.

Another key advantage of anarchocapitalism is that it would eliminate the barriers of entry that often prevent smaller businesses and entrepreneurs from competing with established corporations. Without government regulations and licensing requirements, new businesses could enter the market more easily. Deloitte estimates, “Compared to pre-financial crisis spending levels, operating costs spent on compliance have increased by over 60 percent for retail and corporate banks.” Imagine the innovations that have not occurred because more people are focused on compliance than meeting the needs of the end consumer.

When you don’t have smaller or more local governments, there is a loss of accountability. It’s easy for someone not providing any value to point the finger if something goes wrong. When the incentives break down you end up with wealthy countries telling smaller ones how to live.

“the tragedy about that is, it’s always easier to stop something new than to stop something old. So the biggest victims of the anti-fossil-fuel movement, but more broadly the anti-energy movement, are third world countries, but also nuclear.”

With @WesleyHuntTX pic.twitter.com/9JRNajj1YD

— Alex Epstein (@AlexEpstein) February 23, 2023

What if you could get free energy by letting someone use your computer when you didn’t need it? Anarchocapitalism allows for a diversity of market structures, including cooperatives, mutual aid societies, and worker-owned firms. These alternative forms of economic organization would provide workers and consumers with greater agency and control over their economic lives. There would still be wealth and power concentrated in the hands of elites, but it wouldn’t matter because everyone would be so much wealthier. If the cost of goods and services got exponentially cheaper, rather than more expensive, everyone would be happier. Well almost everyone; maybe not the people who in the fiat system got to create money out of thin air.

Proponents of central planning argue that it can help address market failures such as externalities, natural monopolies, and public goods. For example, a centralized agency could coordinate efforts to reduce pollution or manage a shared resource like a river or forest. Additionally, central planning could be used to promote social welfare goals such as reducing inequality or providing universal access to healthcare. However, most cases turn out to yield the opposite results. Price ceilings create shortages and price floors create excess. The history of central planning in the 20th century is littered with examples of failure and inefficiency, from the Soviet Union to Maoist China. The problem with central planning is that it requires a vast amount of information and expertise to make effective decisions, and this information is dispersed and impossible to collect. Central planners face the same incentive problems as market actors, and are susceptible to corruption, bias, and rent-seeking. For crypto it has gotten so bad that even people who try and do things by the book still get slammed by the regulators.

If the Kraken and Custodia CEOs could focus more on providing value to the market instead of dealing with regulators, I wonder what cool financial products they could come up with. I’m not a fan of the Ponzi schemes in crypto but the problem for fixing that is more education about the difference between bitcoin and other cryptocurrencies. Not government agencies flexing on social media about giving Kraken a 30-million dollar fine for staking, right after FTX wrecked a massive number of retail investors because they ended up 8 billion in the hole.