Large U.S banks including JPMorgan Chase, Wells Fargo and Morgan Stanley said Friday they plan to raise their quarterly dividends after clearing the Federal Reserve’s annual stress test.

JPMorgan plans to boost its payout to $1.05 a share from $1 a share starting in the third quarter, subject to board approval, the New York-based bank said in a statement.

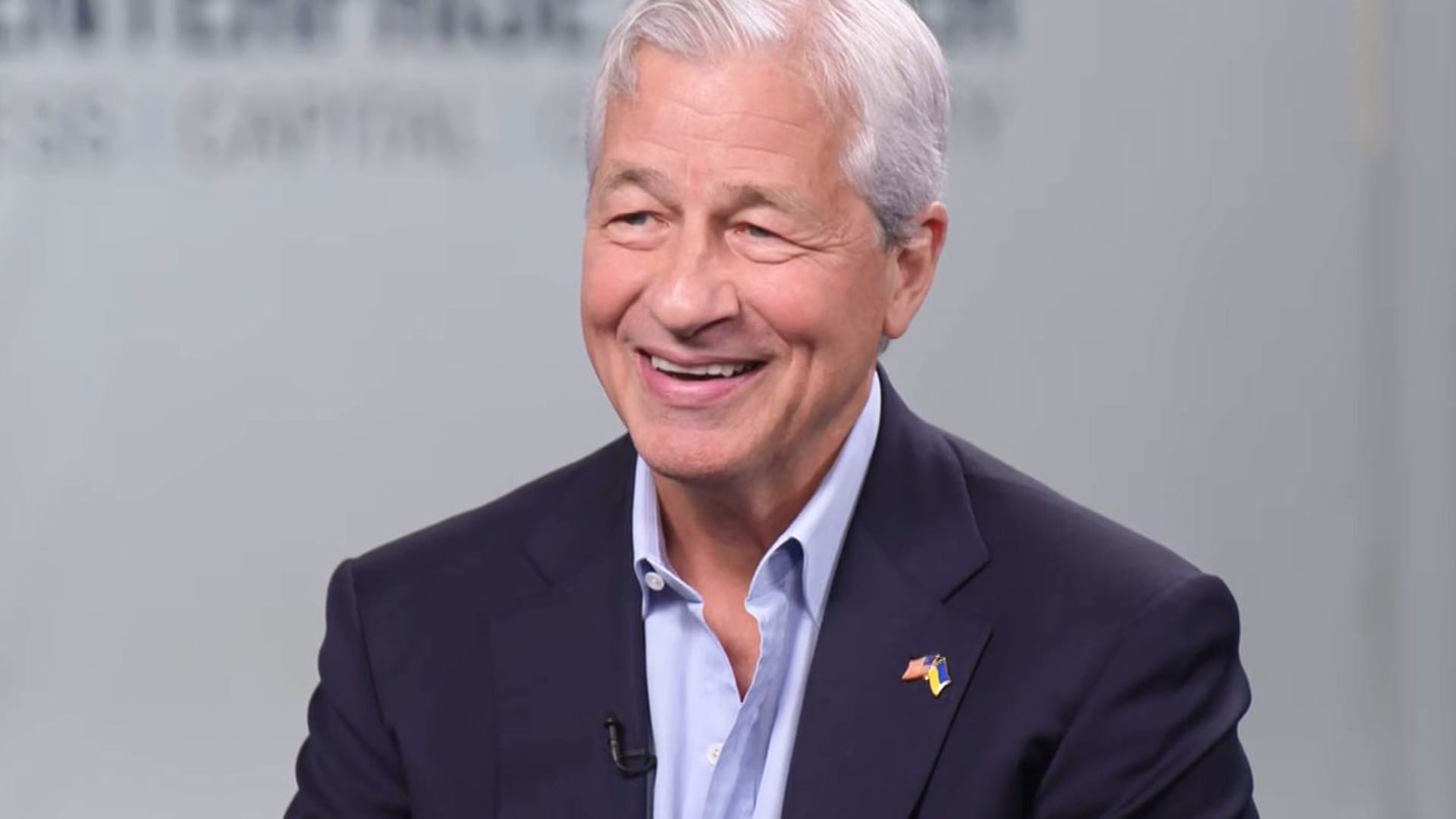

“The Federal Reserve’s 2023 stress test results show that banks are resilient – even while withstanding severe shocks – and continue to serve as a pillar of strength to the financial system and broader economy,” JPMorgan CEO Jamie Dimon said in the release. “The Board’s intended dividend increase represents a sustainable and modestly higher level of capital distribution to our shareholders.”

On Wednesday, the Fed released results from its annual exercise and said that all 23 banks that participated cleared the regulatory hurdle. The test dictates how much capital banks can return to shareholders via buybacks and dividends. In this year’s exam, the banks underwent a “severe global recession” with unemployment surging to 10%, a 40% decline in commercial real estate values and a 38% drop in housing prices.

After they cleared the test, Wells Fargo said it will increase its dividend to 35 cents a share from 30 cents a share, and Morgan Stanley said it would boost its payout to 85 cents a share from 77.5 cents a share.

Goldman Sachs announced the largest per share boost among big banks, taking its dividend to $2.75 a share from $2.50 a share.

Meanwhile, Citigroup said it would boost its quarterly payout to 53 cents a share from 51 cents a share, the smallest increase among its peers.

That’s likely because while JPMorgan and Goldman surprised analysts this week with better-than-expected results that allowed for smaller capital buffers, Citigroup was among banks that saw their buffers increase after the stress test.

“While we would have clearly preferred not to see an increase in our stress capital buffer, these results still demonstrate Citi’s financial resilience through all economic environments,” Citigroup CEO Jane Fraser said in her company’s release.

All of the big banks held back on announcing specific plans to boost share repurchases. For instance, JPMorgan and Morgan Stanley each said they could buy back shares using previously-announced repurchase plans; Wells Fargo said it had the “capacity to repurchase common stock” over the next year.

Analysts have said that banks would likely be more conservative with their capital-return plans this year. That’s because the finalization of international banking regulations is expected to boost the levels of capital the biggest global firms like JPMorgan would need to maintain.

There are other reasons for banks to hold onto capital: Regional banks may also be held to higher standards as part of regulators’ response to the Silicon Valley Bank collapse in March, and a potential recession could boost future loan losses for the industry.