India to Consider Country-Specific Characteristics and Risks in Regulating Crypto: Finance Ministry

Last updated: December 13, 2023 01:05 EST

. 1 min read

India’s Finance Ministry will consider country-specific characteristics and risks before implementing any measures related to crypto assets.

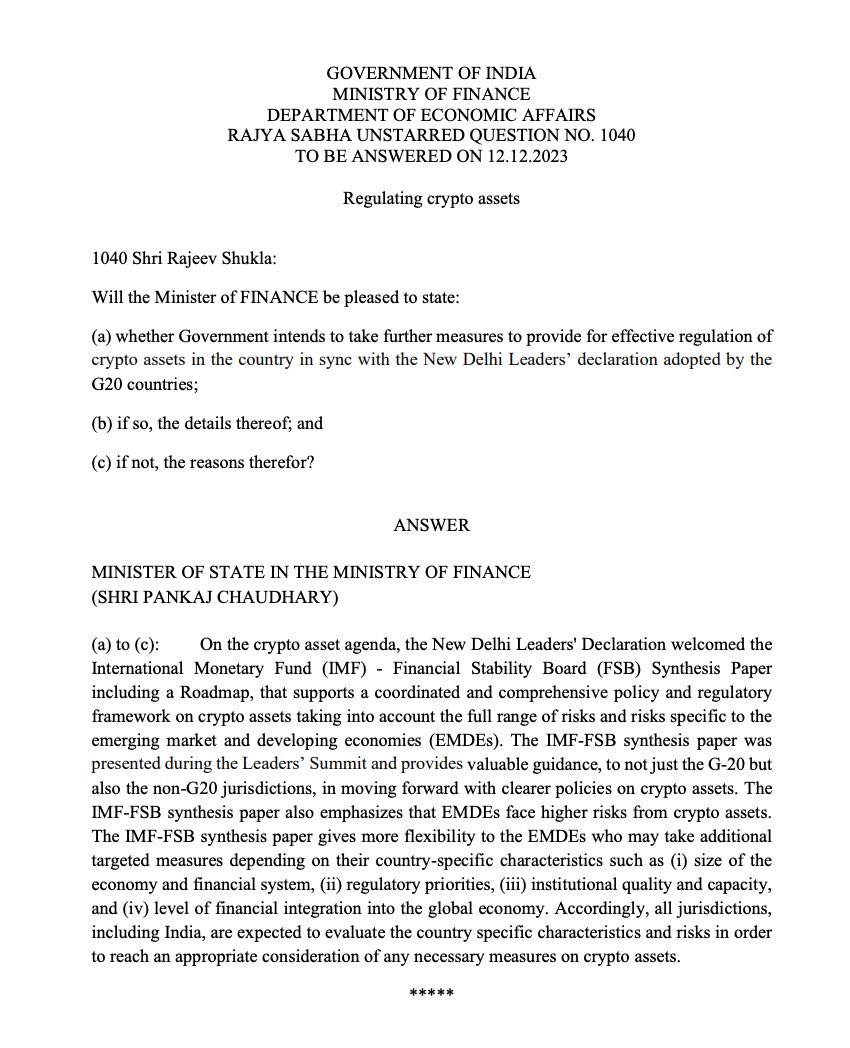

Minister of State for Finance Pankaj Chaudhary, during a session in the Rajya Sabha, highlighted the significance of the New Delhi Leaders’ Declaration at G20 summit earlier this year.

The declaration welcomed the International Monetary Fund (IMF) – Financial Stability Board (FSB) Synthesis Paper and its accompanying roadmap. This comprehensive policy framework aims to address the unique risks associated with crypto assets, particularly in emerging markets and developing economies (EMDEs).

IMF-FSB Synthesis to Provide Guidelines in Regulating Crypto

Chaudhary emphasized that the IMF-FSB synthesis paper, presented during the Leaders’ Summit, provides valuable guidance not only to G-20 nations but also to non-G20 jurisdictions.

The paper underscores the heightened risks that EMDEs face in the realm of crypto assets.

Moreover, Chaudhary pointed out the flexibility afforded by the paper to EMDEs, allowing them to adopt additional targeted measures based on specific characteristics such as economic size, financial system structure, regulatory priorities, institutional quality, and global financial integration.

The Finance Minister highlighted the global cooperation on crypto policy after the G20 Finance Minister-Central Bank Governor meeting in Maracas (Morocco), held under India’s presidency.

As reported earlier, the leaders adopted a roadmap outlined in the synthesis paper, emphasizing its action-oriented approach. The roadmap aims to achieve macro-economic and financial stability through the effective, flexible, and coordinated implementation of a comprehensive policy framework for crypto assets.

India Continues to See High Crypto Adoption

In a separate development, a report by US-based blockchain data platform Chainalysis showcased India’s leading position in grassroots adaptation to cryptocurrencies.

Despite challenges such as a 30% tax on gains and a 1% tax deducted at source, India has emerged as the second-largest crypto market globally, with transactions exceeding $260 billion. The report positions the US at the forefront, with India surpassing wealthier nations in raw estimated transaction volume.