Hong Kong Emerging as Crypto Hub Amid East Asia’s Regulatory Challenges – Is China Reversing Course?

Although Eastern Asia – once a top market – has seen a decline in crypto activity over the past several years, Hong Kong may provide the region with “a potential tailwind,” according to research firm Chainalysis.

While Hong Kong is rising as a global leader in the regulated digital asset market, it’s still unclear what it means for China as a whole – though it may signal an “evolution” in Beijing’s stance towards the industry.

The Region’s Decline

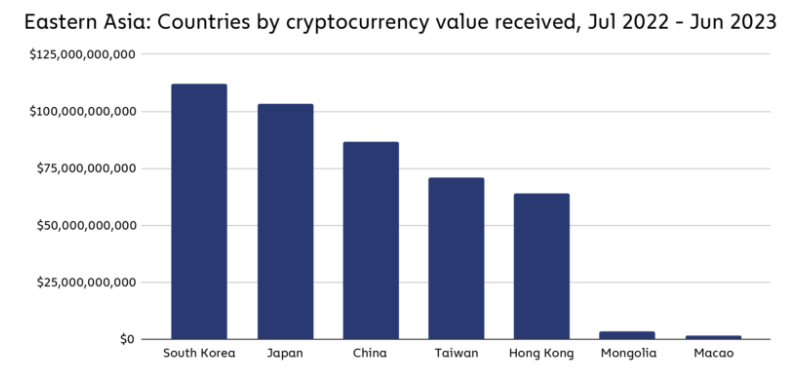

Eastern Asia is the fifth most active crypto market, per Chainalysis, accounting for 8.8% of global crypto activity between July 2022 and June 2023.

“Eastern Asia’s decline in cryptocurrency activity over the last few years has been notable,” the firm said. As recently as 2019, it was a top crypto market by transaction volume, “largely powered by China’s huge trading activity and mining sector.”

But the value of crypto transactions across China dropped as Beijing continued its crackdown on digital assets.

That said, Chainalysis argued that,

“A potential tailwind for East Asia comes from Hong Kong, where several crypto initiatives and industry-friendly regulations launched over the past year have fostered bubbling optimism.”

These developments have led to speculations that Beijing may be (re)warming up to crypto and that Hong Kong may be a testing ground for China’s crypto efforts.

Founder of Hong Kong-based OTC firm OSL Digital Securities, Dave Chapman, told Chainlaysis that,

“The promotion of Hong Kong as a potential crypto hub is not necessarily indicative of the Chinese government’s stance on crypto. However, we are seeing a number of Chinese state-backed entities indirectly supporting Hong Kong’s Web3 ventures, and this could be viewed as an exploratory approach to understanding digital assets without loosening mainland policies.”

Hong Kong is “an extremely active crypto market” by raw transaction volume, receiving $64 billion in crypto in a year – close to mainland China’s $86.4 billion, despite the former having a population 0.5% the size of the latter.

Most of this comes from Hong Kong’s “highly active” over-the-counter (OTC) market, said the report.

Hong Kong Attracting Foreign Users

Founder of Hong Kong-based OTC firm CryptoHK, Merton Lam, said that his company has many foreign users interested in moving wealth away from unstable economies or strict capital controls.

“Anecdotally, I hear from other crypto exchanges that many Russians and Ukrainians are coming to Hong Kong to get their money to safety using crypto. These aren’t multimillionaires either — ordinary people are doing this too.”

International payments are another use case in the region, Merton Lam pointed out: for example, it’s much easier for businesses to pay a supplier via stablecoins than banks.

____

Learn more:

– Hong Kong to Reveal List of Crypto License Applicants in the Wake of JPEX Scandal

– Hong Kong Aims to Thrive as an International Crypto Hub Despite Global Scrutiny

– Despite Crypto Ban, Chinese Citizens Trade on Binance and FTX Exchanges

– India Ranks Second in Global Transaction Volume Despite Tax Law Challenges