Fetch.ai CEO Shares Insights on 2023 Roadmap and Micro Agent Launch – Future of AI and Crypto?

The rise of ChatGPT and Google Bard has fuelled an explosion of interest in artificial intelligence (AI) technology this year, and crypto markets haven’t missed a beat.

February’s ‘AI narrative’ saw blockchain-based AI projects skyrocket in value. As the paramount AI ecosystem in the space, Fetch.ai saw a jaw-dropping 550% surge as the promise of a decentralized P2P AI framework gained huge traction.

This has never been more important, with AI technology increasingly centralized into the hands of the ‘big five’.

In an exclusive conversation with Cryptonews, Fetch.ai CEO Humayun Sheikh sat down to discuss micro agents, the Fetch.ai 2023 roadmap, and $FET’s explosive price action.

Despite a difficult crypto winter for the entire industry, $FET’s skyrocket comeback has been a big vote of confidence in Fetch.ai’s multi-year ecosystem build-out.

FET’s 550% Rally is ‘Timely’ says Fetch.ai CEO

Humayun explained how market cycles impact on the project.

“Fetch.ai has been in existence for more than four years, and in this time, we have been through several hype cycles and many bull [and] bear markets,” said Sheikh.

“AI has been at the heart of that mission since our inception, so we are pleased that it is now capturing public attention.

“From our perspective, ChatGPT and generative AI’s provided an ‘Aha’ moment for many people who can now imagine how their work and lives may be impacted and how business models can be disrupted.

“And these technologies are the tip of the iceberg. At Fetch.ai, our agent technology can learn, intuit and take action independently on behalf of users and on behalf of other agents.”

“So for us, the break out [AI] narrative is timely, and we hope to continue expanding on the story.”

Indeed, the timely 550% $FET rally came just weeks ahead of the Fetch.ai 2023 Roadmap launch.

“Microagents Are The Enablers Of A New Economy”

The highly-anticipated roadmap revealed that Fetch.ai would be deploying an innovative new protocol to introduce microagents this year. Humayun broke down just how this would build upon the P2P network of Autonomous Economic Agents (which are basically P2P AI bots that are trained to automate specific commercial and industrial functions).

“The Autonomous Economic Agent (AEA) framework … gave the first glimpse of what you can do with [AI] agent tech. But we realized that we had to overcome the steep learning curve of AEAs, and help with an easy transition from Web2’s microservices architecture – Micro-agents were born to address this challenge,” explained the CEO.

“Like microservices, microagents are domain-specific business logic that can be coupled with other microagents to achieve higher business logic. And unlike microservices, microagents are naturally inter-organizational and can leverage the open Fetch Network to search and discover each other.

“Micro-agents are also similar to AEAs, where agents have unique identities and autonomously act on behalf of their human, organization, or machine actors to perform the tasks coded in their business logic”.

At its core, microagents will enable new developers to rapidly scale projects horizontally. Early-stage building will be as easy as composing modular P2P AI microservices instead of having to develop more complex AEAs from the get-go.

Indeed, Fetch.ai believes microagents are set to unlock huge ecosystem growth, the CEO went on to explain.

“We see microagents becoming the enablers of a new economy … closer in spirit to the original vision of the world wide web where a peer-to-peer economy creates shared value amongst participants,” said Humayun.

“Under the hood, these new peer-to-peer business models will leverage a web of smart autonomous services powered by Fetch.ai’s micro-agents

“This open platform of smart autonomous services will power a new peer-to-peer economy without intermediaries in mobility, household services, finance, and many other verticals.”

Seemingly hinting towards a recent partnership with industrial appliance giant Bosch, which will see the launch of a Fetch.ai Foundation with the goal of driving industrial AI solution adoption.

“We are working on applications in some verticals that will be released in the coming months,” added Sheikh.

“Binance Bicasso Validates NFT as a Financial Asset”

Another key component of the 2023 project roadmap exciting the Fetch.ai community is the news that NFT compatibility will be coming to the Fetch.ai wallet.

This follows early Fetch.ai experimentation around AI art which has seen the ecosystem participate in impressive AEA showcases such as CoLearn Paint.

Speaking to the NFT compatibility being delivered to Fetch.ai wallets, Humayun highlighted the importance of NFTs for Web3 and the growing traction around AI art.

“Binance Bicasso validates the importance of NFT as a financial asset in Web3,” said Sheikh.

“We have long viewed the Fetch.ai wallet as a gateway to experiencing Web3 and, true to its name, acting as a finance hub to house different assets. With this in mind, NFT is an asset that needs to be accessible.”

FET Price Prediction

With such bullish news around the project and great insight from a leader in the sector, 2023 is set to be a fantastic year for Fetch.ai. Read on as Cryptonews.com break down FET price action for March.

Fetch.ai’s native token $FET, is currently trading at $0.429 (a 24-hour change of +1.80%).

FET is undertaking a huge bounce back from lower trendline support after the tail-end of the AI narrative hype left FET in a challenging retracement pattern.

The massive +22% rally since Monday has seen FET break back above the 20-Day MA, which is now forming solid footing.

Marking an end to weeks of retracement, the alt season bounce could see February’s AI rally supercharge if bulls can crack ongoing resistance at $0.50.

The RSI cooled off quickly from the leg up, currently standing at 54.36 in a significant move out of ‘oversold’ territory. This leaves FET poised to push up further.

The MACD is sat on the fence, with a minor bullish divergence at 0.0026, reflecting the slow-grinding progress as FET bulls continue to battle with the $0.50 resistant level.

FET in Accumulation Period?

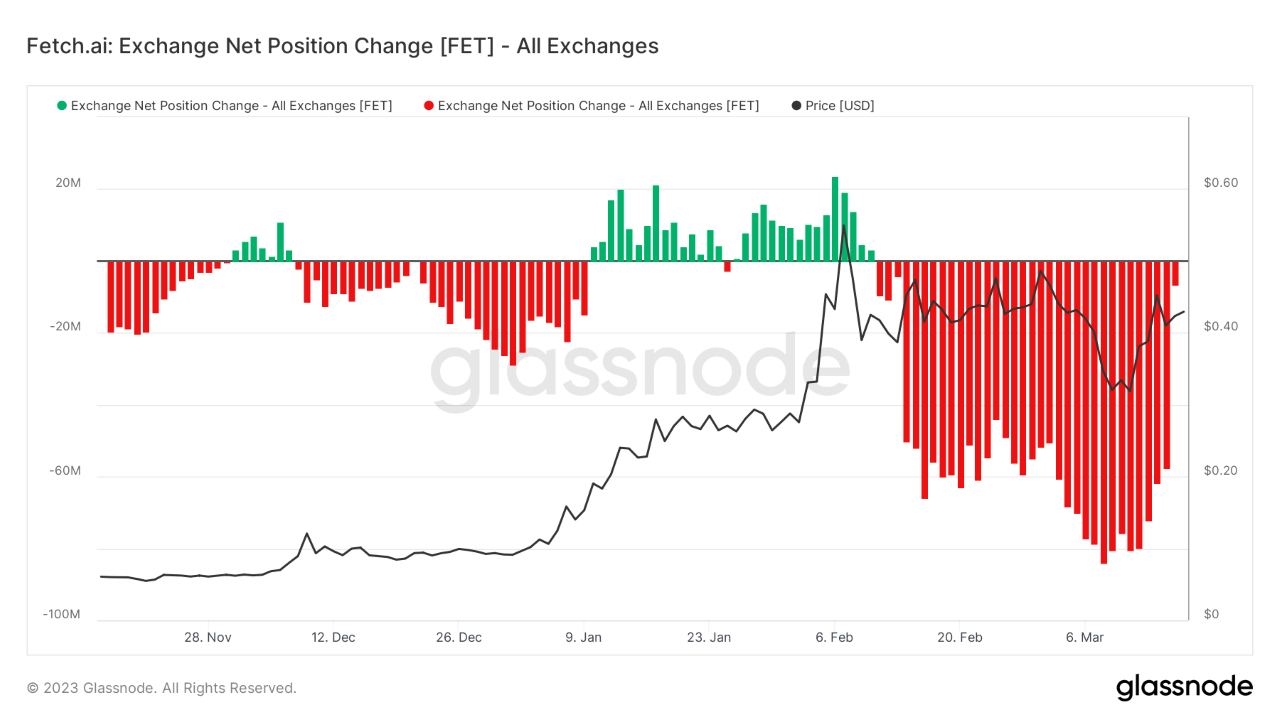

Looking on-chain, $FET has been in a serious period of accumulation for more than a month.

Exchange Net Position Change reveals Fetch.ai is now in its 34th day of accumulation outflows – a clear signal that supply is reducing and investors are stacking.

With on-chain data signaling that there is no imminent sell-off, it seems likely that FET will continue to push higher to a realistic break above the ongoing resistance level.

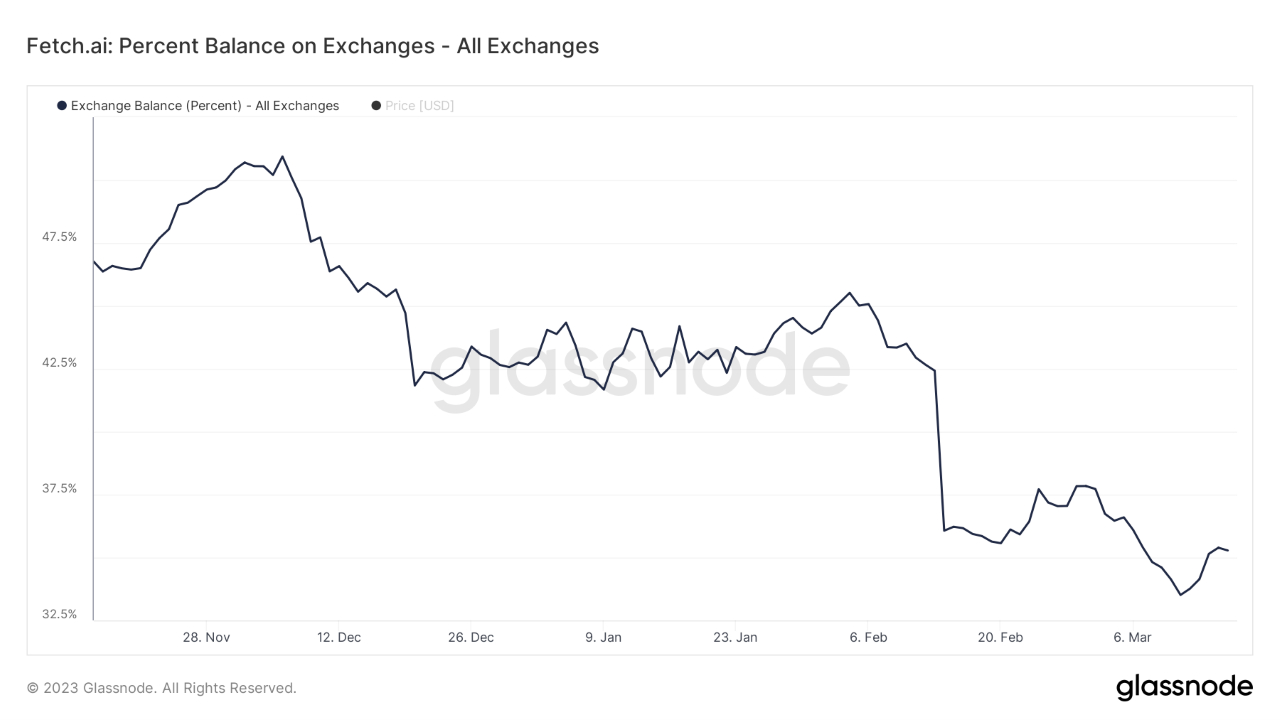

This paints a positive picture of FET supply distribution, with the percentage balance of FET on exchanges tumbling to less than a third of supply in recent months.

Overall, FET’s upside target, if $0.50 flips to support, would be $0.75 (a +75.1% move).

As for downside risk? A rejection here would like to see a tumble to the nearest lower support level at $0.30 (-29.9%).

This gives FET a Risk: Reward ratio of 2.51 – a very attractive entry for one of the most cutting-edge projects in the space.

Buy FET Now