Crypto Taxes Statistics Explained Around the World 2023

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Crypto taxes can no longer be ignored – with most countries taxing digital currencies the same way as stocks and other assets. In most cases, taxes are levied on realizable crypto gains and generated income, such as staking and yield farming

Considering the complexities and varying rules in different regions, this guide covers everything there is to know about crypto taxes in 2023.

The Basics of Crypto Taxes Explained

Cryptocurrencies like Bitcoin are defined differently around the world. While some governments view cryptocurrencies as property, others classify them as a commodity. Either way, most governments levy taxes on cryptocurrencies – irrespective of how they are defined.

There is no one-size-fits-all framework for crypto taxes. There are many variables to consider, such as the jurisdiction and individual profile of the investor. For example, many countries have annual tax allowances on capital gains and dividends. Moreover, different tax rates can apply depending on the individual’s income brackets.

Nonetheless, in many countries, there are some common denominators when taxing cryptocurrencies:

- In most cases, investors will pay taxes on crypto gains. This is usually only on realizable gains, meaning that the cryptocurrencies will only be taxed once they are sold. Moreover, the tax is based on the profit element of the sale.

- Similarly, most governments will tax cryptocurrency income in the same way as dividends. This includes decentralized finance (DeFi) methods like staking, yields farming, and lending. The realizable tax event happens as soon as the income is received at the current market value.

- Additionally, using cryptocurrencies to pay for goods and services is also a taxable event. In this instance, the purchase is usually viewed as a disposal of the cryptocurrency. As such, the rules will mirror capital gains taxes, as explained below.

Cryptocurrency losses should also be taken into account when calculating taxes. This is because many countries allow investors to offset capital losses against their annual liabilities. This can help reduce the amount of tax owed in any particular year.

Crucially, there is a never-ending list of variables that need to be considered when exploring crypto taxes. While this guide provides insights into the basics, investors should consult with a qualified tax professional that has experience in cryptocurrencies and other digital assets.

Understanding Cryptocurrency Taxes 2023

We will now take a much closer look at how cryptocurrencies are taxed in many jurisdictions around the world.

Capital Gains Taxes

The vast majority of countries levy capital gains taxes on cryptocurrencies. This mirrors other asset classes, including stocks, ETFs, commodities, and real estate. Put otherwise, governments will tax the profit element of cryptocurrencies.

This means that, in many cases, taxes are only applicable once the cryptocurrencies have been sold. As such, if the investor is holding cryptocurrencies in their wallet, no taxes will apply. But once the cryptocurrency investment is cashed out, taxes will apply.

As we explain in more detail later, this allows some investors to make strategic sales. For example, the investor might wait until the following tax year to cash out. This might be because their country of residence offers annual allowances on capital gains.

Let’s look at an example of how capital gains taxes work in the world of cryptocurrencies:

- Let’s say an investor buys $3,000 worth of Bitcoin in January 2023

- The investor sells their Bitcoin investment in June 2023

- The sale generates $5,000

- This converts to capital gains of $2,000 ($5,000-$3,000)

- As such, the tax will be levied on the $2,000 capital gains

As noted above, residents of many countries receive an annual allowance before capital gains tax needs to be paid.

For example, in the UK, this currently stands at £6,000. In the US, things are done differently – as capital gains tax can be avoided if the individual’s income sits below $44,625.

There is often a misconception that capital gains tax is only applicable when converting cryptocurrencies back to fiat money. However, this simply isn’t the case. Many circumstances can trigger a taxable event, such as crypto-to-crypto trades and online purchases.

Income Taxes

Many investors will be unaware that crypto-related income is also taxed. In fact, the rules are even more stringent than capital gains. After all, crypto income is classed as a realizable tax event as soon as it is received.

So what is crypto income, and what investments does it cover?

Put simply, any passive income that is generated by holding a cryptocurrency, such as:

- Staking

- Yield farming

- Crypto savings accounts

The specific rules on crypto income taxes vary depending on the jurisdiction. However, we found that taxes are usually based on the cryptocurrency’s value on the date the income was received. This is where things can get very confusing. After all, the price of cryptocurrencies will change as every second passes.

This means that for tax reporting purposes, investors need to have solid records in place. Moreover, some crypto income products distribute yields every 24 hours. This increases the complexity of knowing how much tax to pay.

Let’s look at an example to help clear the mist:

- Let’s say that an investor deposits 1 ETH into an Ethereum staking pool

- The staking pool yields interest of 10% per year

- The rewards are distributed every 7 days

- This amounts to rewards of 0.1 ETH annually, or approximately 0.0019 ETH every week

- The first weekly reward of 0.0019 ETH arrives. On this date, this values the income at $3.69

- When the second weekly reward of 0.0019 ETH arrives, the income is valued at $4.50

As per the above example, the investor already has two taxable events. In most cases, this needs to be added to the individual’s total income for the respective tax year. But importantly, the specific amount should be based on the value of the cryptocurrency when it arrives.

Moreover, even if the cryptocurrencies being staked are not sold in the same tax year, the income element still needs to be paid. Of course, many countries do not levy taxes on income until a certain amount has been earned for the year. This is why there is no universal framework for crypto taxes.

Crypto Taxes by Country

We have empathized that the rules on crypto taxes can vary widely from one country to the next. To offer some insight, we will now explore a selection of jurisdictions and how they specifically tax cryptocurrencies.

USA

Let’s start with how crypto is taxed in the US. The US Internal Revenue Service (IRS) views cryptocurrencies as property, rather than currency. In simple terms, this means that cryptocurrencies are taxed the same as stocks and ETFs.

Like many countries, the IRS will only level capital gains tax once the profit element is realized. In other words, once the cryptocurrencies are sold for a profit.

Now, how the capital gains tax is applied depends on how long the cryptocurrency investment was held.

- For example, suppose an investor buys $5,000 worth of Bitcoin in January 2023 and cashes out at $15,000 in March 2023.

- Because the investment was held for less than 12 months, ‘short-term capital gains tax’ applies.

- This means that the investor will pay taxes on the $10,000 profit at their standard income tax rate.

However, if the cryptocurrency investment was held for longer than 12 months, ‘long-term capital gains taxes apply.’ The specific capital gains tax rate will depend on the individual’s income for the respective year.

For example:

- If the individual earned $44,625 or less, the capital gains tax rate is 0%.

- Income of between $44,626 and $492,300 will attract a capital gains tax rate of 15%.

- Anything over $492,300 will be taxed at 20%.

In addition to capital gains, the IRS also levies taxes on crypto-related income. As mentioned earlier, this includes DeFi products, like yield farming crypto platforms.

This is defined in the same way as standard income, such as a salary. For example, suppose the investor generates $5,000 worth of staking rewards. In the same year, they received an annual salary of $50,000. This takes the total taxable income to $55,000.

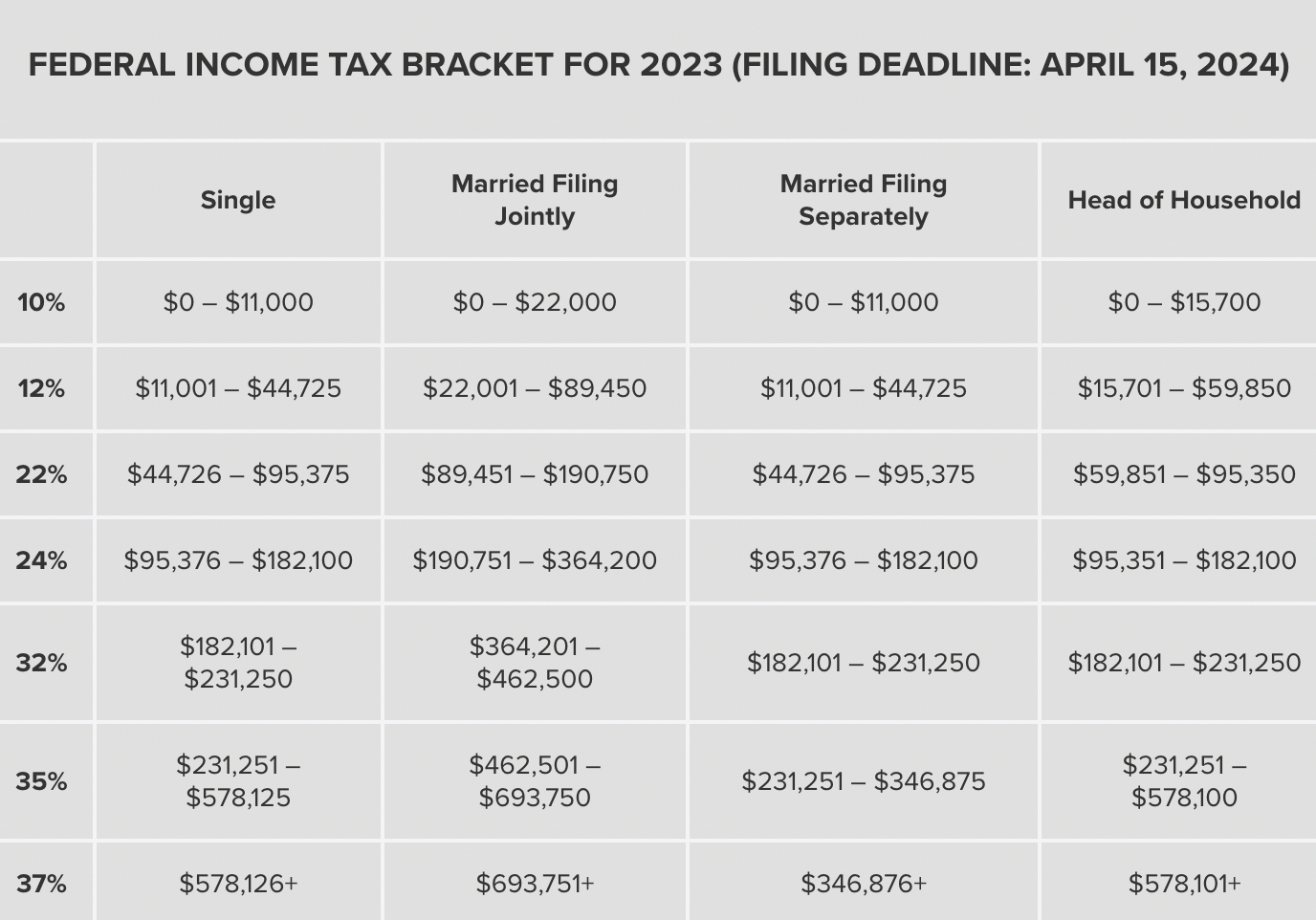

The specific tax rate on crypto income will depend on the amount earned during the year, as per the image above.

Can you claim crypto losses on taxes in the US? The simple answer is yes – the IRS allows US residents to make tax deductions from crypto trading losses.

| Country | USA |

| Capital Gains Tax? | Yes – on crypto taxes in the US on realizable gains |

| Held for Under 1 Year | Classed as short-term capital gains. Tax is payable at the same income tax rate for the year. |

| Held for Over 1 Year | Classed as long-term capital gains. Tax rate of 0%, 15%, or 20% – depending on the income for the year. |

| Income Tax? | Yes – on all crypto-related income, including staking and yield farming. Paid in the same year as the income was received. Added to the individual’s total income for the year and taxed accordingly. |

| Capital Losses? | Yes – crypto losses can be offset against liabilities |

UK

The UK has many similarities with the US when it comes to crypto taxes. For example, capital gains are taxed on realizable profits – meaning when the cryptocurrencies are disposed of. As such, no capital gains taxes apply while cryptocurrencies remain untouched in a portfolio.

Once the cryptocurrency is sold, this triggers a taxable event. This is also the case if the cryptocurrencies are exchanged for another digital asset. Or if a purchase was made with the cryptocurrencies.

The good news is that UK residents have an annual capital gains tax allowance. The bad news is that this was reduced from £12,300 in 2022/23 to £6,000 in 2023/24. Nonetheless, this still potentially means that UK investors might not need to pay any tax on their crypto capital gains. Moreover, it also enables them to be strategic when deciding when to cash out.

For example:

- Let’s say that a UK investor buys £10,000 worth of XRP in June 2023

- The XRP investment is worth £17,000 in December 2023

- This amounts to capital gains of £7,000

In one scenario, the investor might decide to sell their entire XRP holdings. This would result in the £7,000 profit being realized. The investor gets £6,000 in capital gains allowance, meaning only £1,000 would be liable for tax.

That said, if they reduced their XRP sale to just £16,000 – this would mean only £6,000 worth of capital gains have been realized. As such, no capital gains tax would be liable. This is on the assumption that the investor has not made capital gains elsewhere in the same tax year. For example, by selling stocks or property.

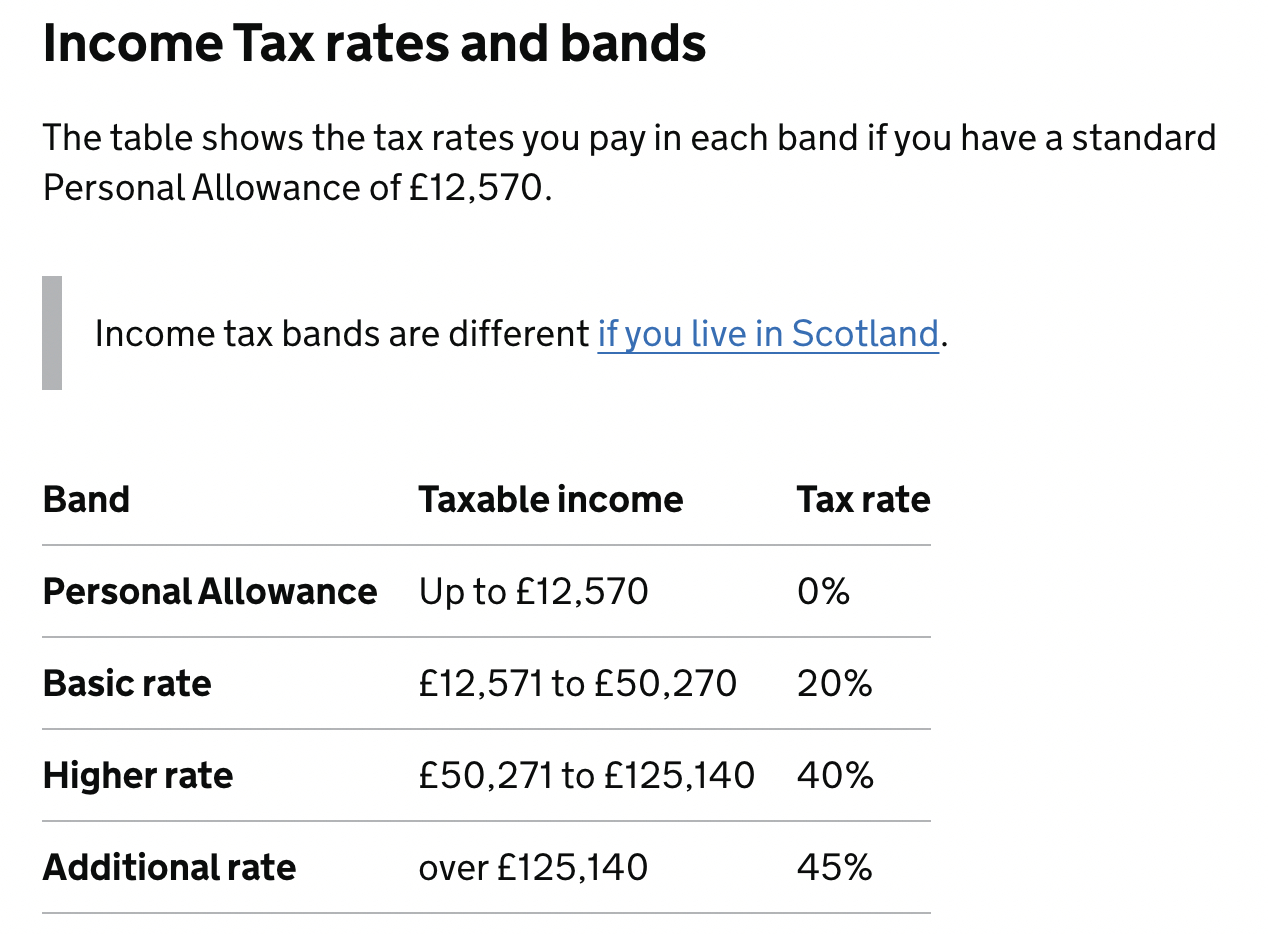

Specific capital gains tax rates in the UK depend on the income tax bracket. For example, basic rate payers will be taxed at 10%. While those on the higher or additional tax band will pay 20%.

Just like US residents, those in the UK also need to consider crypto taxes on income. The UK tax authorities define this as ‘miscellaneous income’. There is a £1,000 miscellaneous income allowance in the UK. As such, any crypto income under £1,000 would not be subject to tax.

Anything above the £1,000 allowance will need to be added to the annual income for the year. Taxes on personal income in the UK depends on the amount earned. For example, income below £12,570 is not taxed at all. And anything between £12,571 and £50,270 is taxed at 20%.

| Country | UK |

| Capital Gains Tax? | Yes – on realizable gains |

| Held for Under 1 Year | UK residents get £6,000 capital gains allowance in 2023/24. Anything that exceeds this will be charged at 10% or 20%, depending on the income tax bracket. |

| Held for Over 1 Year | Same as the above. |

| Income Tax? | Yes – on all crypto-related income, including staking and yield farming. Defined as miscellaneous income. UK residents get £1,000 in miscellaneous income allowances in 2023/24. Anything above this is added to the annual income amount. There is also a £12,571 annual income tax allowance for 2023/24. The tax rate depends on the income tax bracket, ranging from 0% to 45%. |

| Capital Losses? | Yes – crypto losses can be offset against liabilities. Does not include ‘lost’ crypto, as the funds have not been sold. |

Australia

Crypto taxes are also applicable in Australia. Put simply, Australian authorities define cryptocurrencies as capital gains tax (CGT) assets. This is the same as traditional assets like stocks and ETFs.

That said, capital gains tax is only applied when the profit has been realized. Moreover, the amount of tax owed will depend on how long the investment was held.

- For example, if the cryptocurrencies were held for at least 12 months, the individual will receive a 50% reduction on the capital gains tax levied.

- However, no reduction is offered if the cryptocurrencies were bought and sold within a 12-month period.

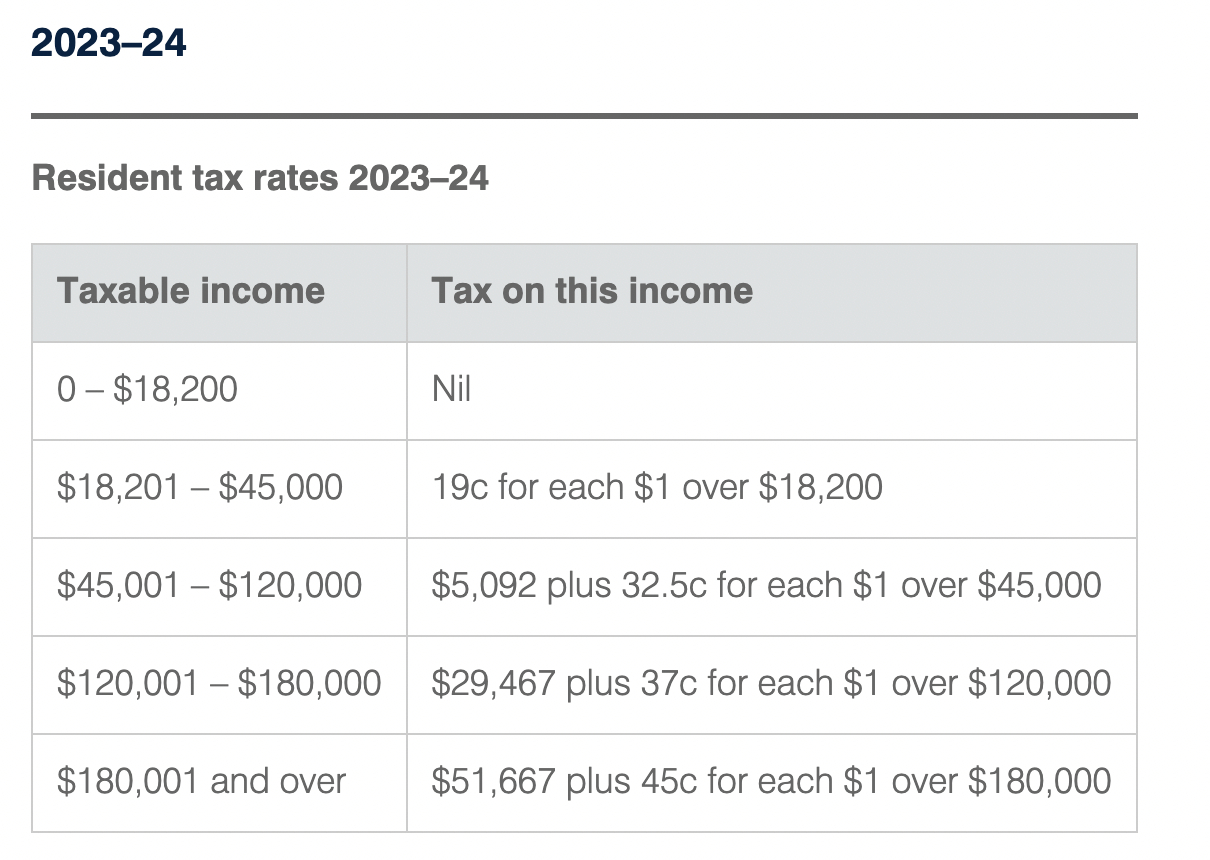

Either way, the capital gains will be added to the individual’s total income for the year. This will collectively be taxed at the Australian income tax rate, which ranges from 0% to 45%.

Let’s look at an example of how crypto taxes work in Australia:

- Let’s say an Australian resident invests $15,000 into Bitcoin in September 2023

- The investor cashes out their Bitcoin in December 2023 for $25,000

- That’s capital gains of $10,000

- In the same year, we’ll say the individual has a salary of $45,000.

- This takes the total taxable income to $55,000

- The individual would pay $5,092 in income taxes on the first $45,000. They would then pay $0.325 for every $1 earned thereon. On $10,000, that’s $3,250.

Now let’s consider the same outcome, but with the investor holding onto their Bitcoin for over 12 months.

- The investor made capital gains of $10,000. But they will receive a 50% reduction for holding over 12 months. As such, this is reduced to $5,000.

- The $5,000 capital gain is added to the annual income of $45,000.

- This takes the total taxable income to $50,000

- The individual would pay $5,092 in income taxes on the first $45,000. They would then pay $0.325 for every $1 earned thereon. On $5,000, that’s $1,625.

As per the above, by holding onto their cryptocurrency investment for at least one year, the investor reduced their tax liability from $3,250 to $1,625. This highlights the importance of strategic selling.

In terms of crypto income, such as staking, this is simply added to the annual income for the year. refer to the example above for additional clarity.

| Country | Australia |

| Capital Gains Tax? | Yes – on realizable gains |

| Held for Under 1 Year | Capital gains are added to the total income for the year and taxed accordingly. |

| Held for Over 1 Year | If the cryptocurrency investment is held for at least one year, there is a 50% reduction in capital gains. The balance is then added to the total income for the year and taxed accordingly. |

| Income Tax? | Yes – on all crypto-related income, including staking and yield farming. The income received is added to the total income for the year and taxed accordingly. |

| Capital Losses? | Yes – crypto losses can be offset against capital gains tax liabilities. |

Canada

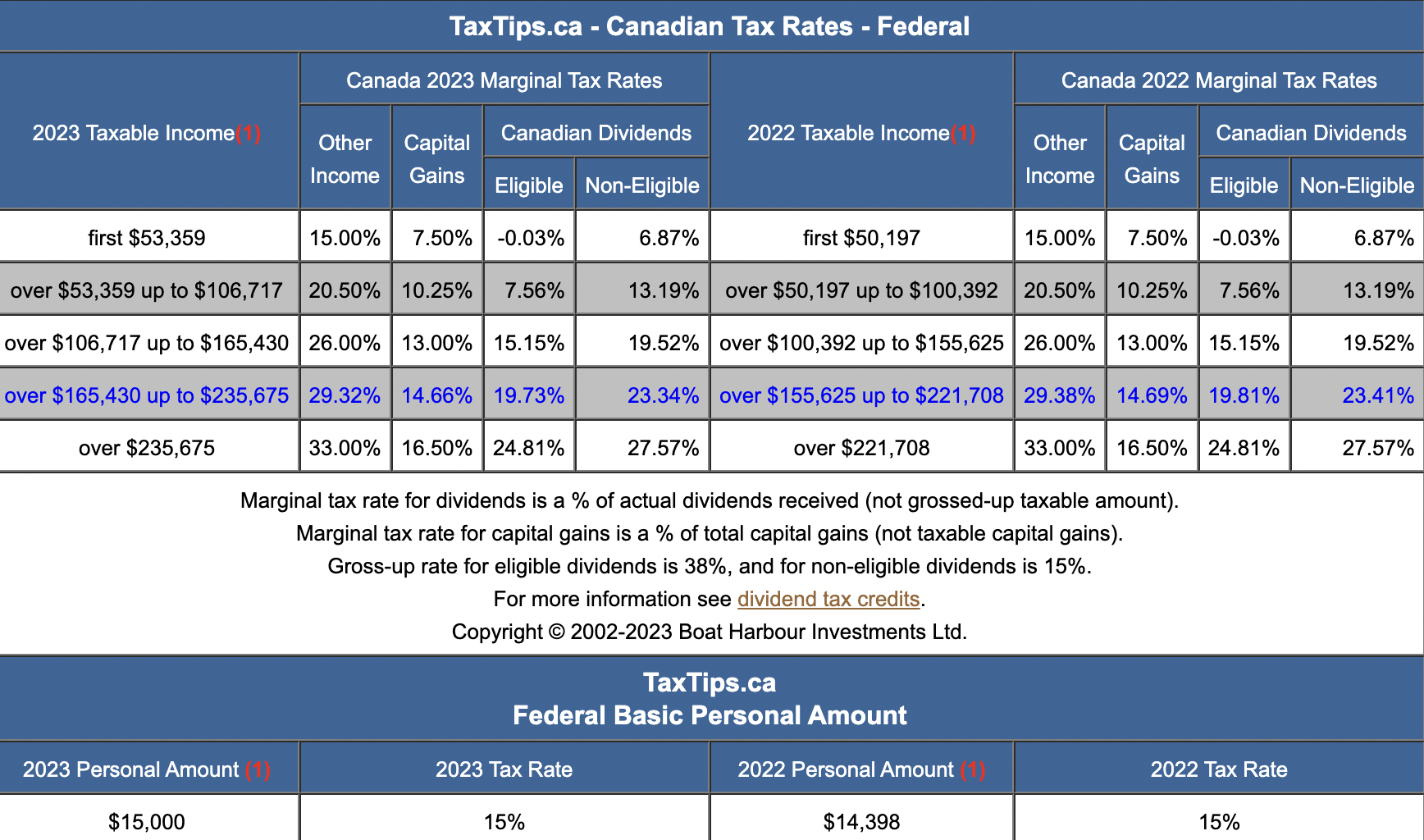

The Canada Revenue Agency (CRA) defines cryptocurrencies as commodities. This means that the cryptocurrency proceeds can be taxed as either income or capital gains. That said, it will be taxed as capital gains in the vast majority of cases. The proceeds are only viewed as income if cryptocurrencies form part of a commercial business.

- For example, a full-time cryptocurrency trader would pay income tax. Crypto mining taxes would also fall within the income tax category.

- While a casual investor buying and selling cryptocurrencies occasionally would pay capital gains tax.

Capital gains are only realized once the cryptocurrencies are sold, traded, gifted, or used to buy goods. In this instance, only 50% of the capital gains are liable for tax. This amount is then added to the individual’s income for the respective tax year. In Canada, the income tax rate can range from 15% to 33%, depending on the amount earned.

Let’s look at an example of how crypto taxes work in Canada:

- Let’s say a Canadian investor buys $10,000 worth of Ethereum

- They cash out their Ethereum investment for $17,000

- That’s capital gains of $7,000

- Only 50% contributes to the annual tax liability, so that’s $3,500

- In the same year Ethereum was sold, the investor earned a salary of $40,000

- The $3,500 capital gains are added to the $40,000 salary, so that’s $43,500

- As the total income sits below $53,359, the investor pays income tax of 15%

Depending on the investor’s individual circumstances, tax deductions may be available.

In terms of tax on staking, yield farming, and other crypto income – this is simply added to the total income for the year.

| Country | Canada |

| Capital Gains Tax? | Yes – on realizable gains |

| Held for Under 1 Year | Once realized, 50% of the capital gains is added to the individual’s total income for the year and taxed accordingly. |

| Held for Over 1 Year | Same as the above. |

| Income Tax? | Yes – on all crypto-related income, including staking and yield farming. The income received is added to the total income for the year and taxed accordingly. |

| Capital Losses? | Yes – but only 50% of the losses can be offset against capital gains liabilities. |

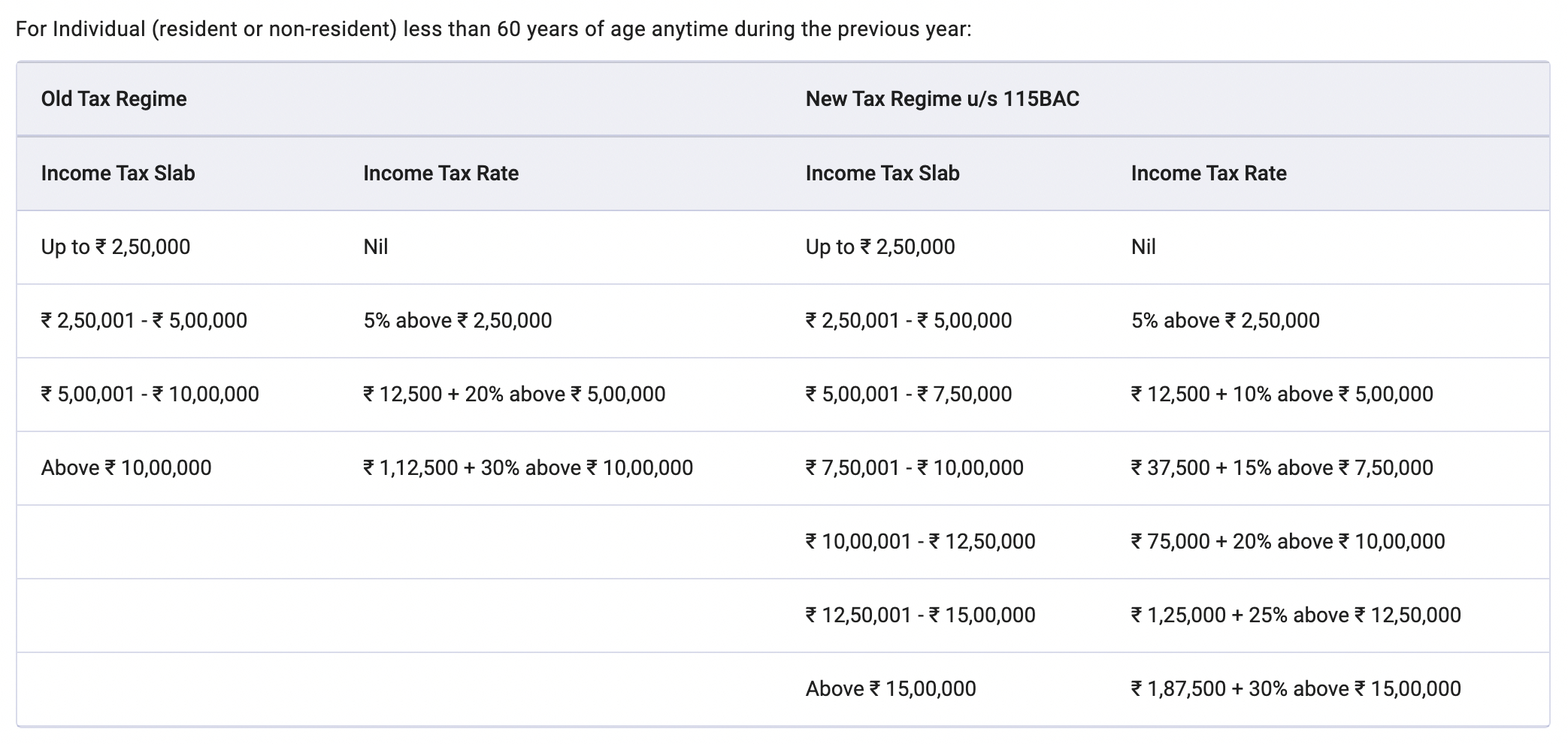

India

Crypto taxes in India are some of the strictest globally. Put simply, realized cryptocurrency gains are charged at 30%. There are no deductions available, not even on capital losses.

Additionally, there is also a 1% tax deducted at source (TDS). This is the responsibility of crypto exchanges, meaning this will be deducted before a withdrawal is processed. If an Indian resident uses a peer-to-peer platform, the buyer is responsible for implementing the TDS.

Either way, the 1% TDS is taken on the total sale, not the capital gains.

Here’s an example of how crypto taxes work in India:

- An investor buys RS500,000 worth of Bitcoin

- When the investor cases out, they receive RS900,000

- The exchange takes a 1% TDS, so that’s RS9,000 (1% of RS900,000)

- The capital gains on this trade amount to RS391,000

- The investor pays a 30% capital gains tax, so that’s RS117,300

- In total, the investor has paid RS126,300 in crypto taxes

- Based on their ‘real’ capital gains of RS400,000 – that’s a tax rate of 31.57%

Additionally, Indian residents will pay tax on crypto income. This is added to the individual’s income for the year and taxed accordingly.

If and when the cryptocurrencies received as income are sold or traded, the capital gains tax of 30% will apply.

| Country | India |

| Capital Gains Tax? | Yes – on realizable gains |

| Held for Under 1 Year | 30% of the capital gains, no deductions are available. Plus, a 1% tax on the total proceeds of the sale, taken at the source. |

| Held for Over 1 Year | Same as the above. |

| Income Tax? | Yes – on all crypto-related income, including staking and yield farming. The income received is added to the total income for the year and taxed accordingly. Once the crypto income is sold, 30% capital gains will apply to the profit, if applicable. |

| Capital Losses? | No deductions are possible. |

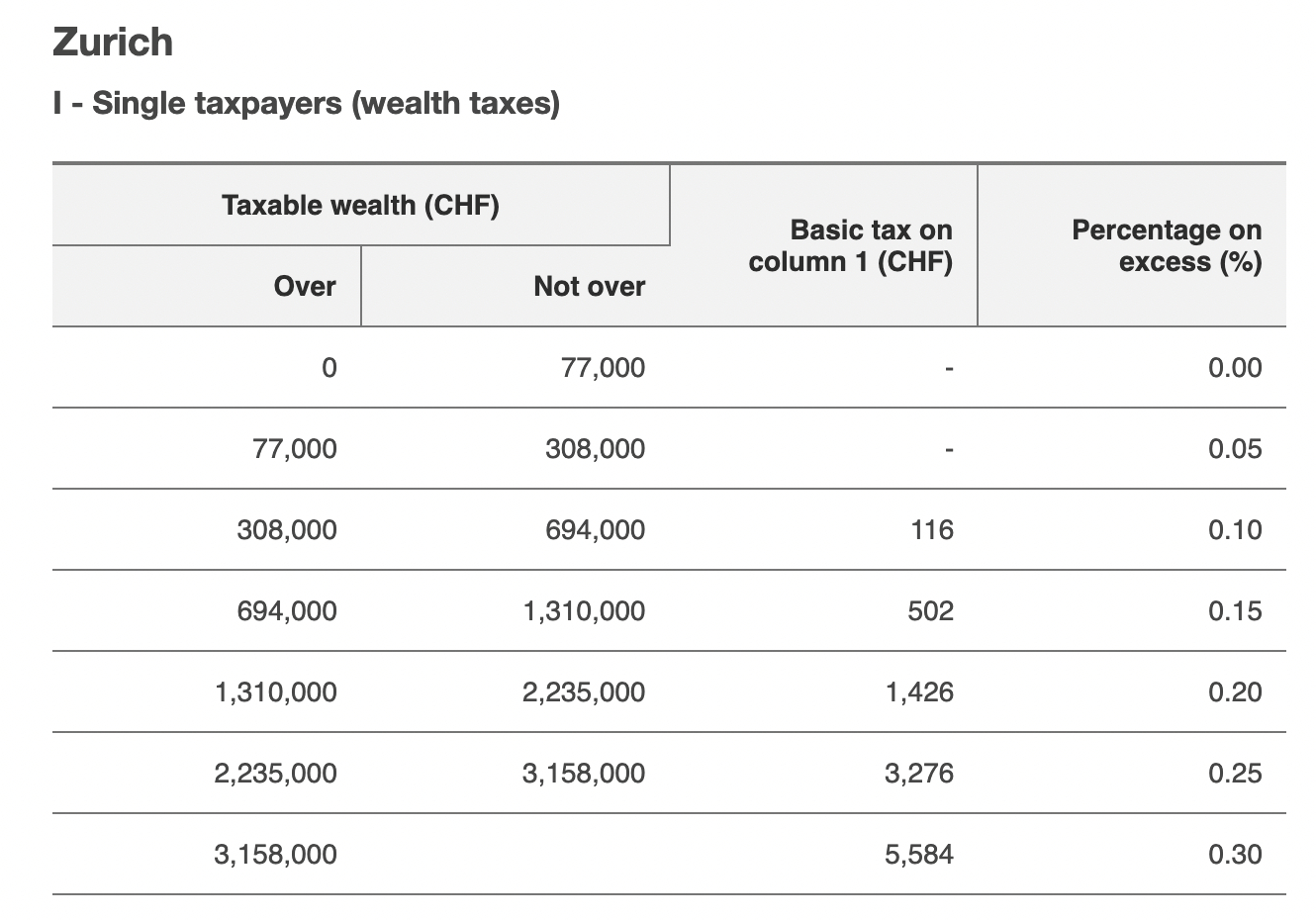

Switzerland

Investors based in Switzerland will be pleased to know that some of the most crypto-friendly tax rules are in place. In a nutshell, cryptocurrencies fall within the remit of the Wealth Tax system, just like stocks and other traditional securities.

This means that, in many cases, individuals will not pay any capital gains taxes on cryptocurrencies. However, there are some eligibility requirements that need to be met.

This includes:

- The cryptocurrency investment must have been held for at least six months before it was sold.

- The capital gains from the sale must not be more than 50% of the total income earned for the year.

- The individual is considered a private investor and not a business

If the above eligibility is met, the investor will pay the Wealth Tax as opposed to capital gains. This ranges between 0.13% to 1.1%, depending on the municipality the investor resides. Importantly, this is based on the total net worth of the individual and also includes other assets.

In terms of staking, mining, yield farming, and other crypto income products, this will be taxed. In Switzerland, the specific income tax rate will depend on various factors. For instance, the amount earned in the year and the municipality that the individual lives in.

| Country | Switzerland |

| Capital Gains Tax? |

Depends – there are no capital gains taxes if:

In this instance, no capital gains tax is applied. Instead, Wealth Tax is paid on the total value of the individual’s net worth. This ranges from 0.13% to 1.1%. If the above criteria are not met, capital gains tax might apply. |

| Held for Under 1 Year | See the above. |

| Held for Over 1 Year | See the above. |

| Income Tax? | Yes – specific tax rates depend on many factors, such as the total income earned and the municipality. |

| Capital Losses? | Factored into the individual’s total net worth. |

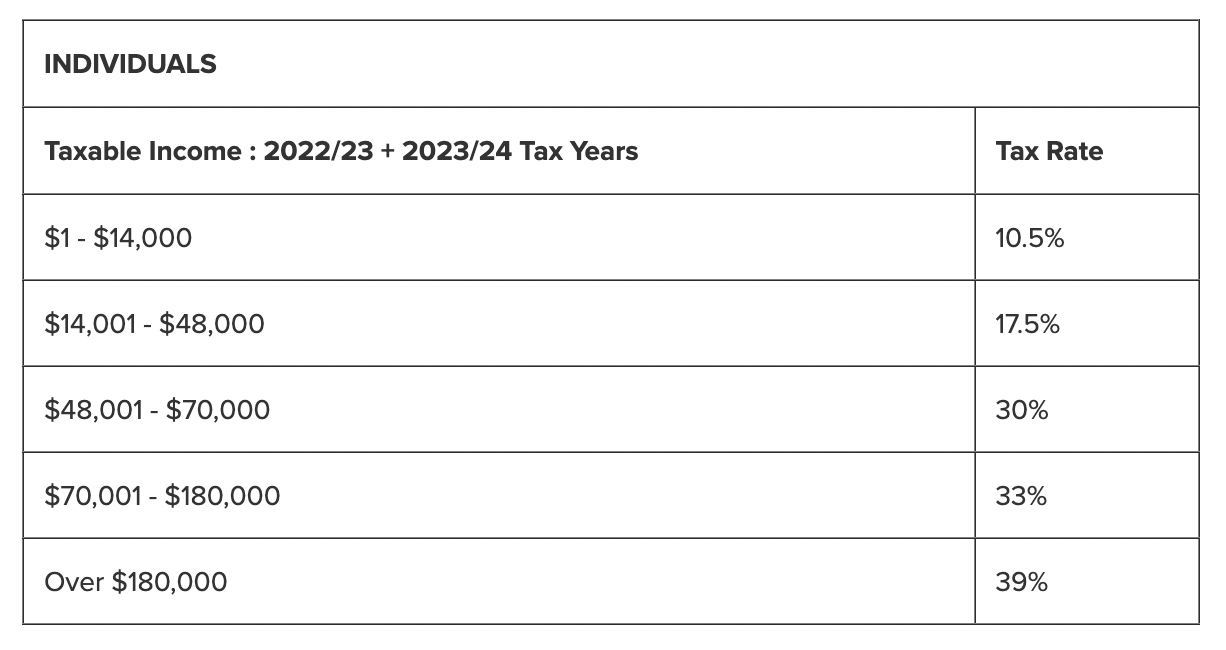

New Zealand

As per the New Zealand Income Revenue, cryptocurrencies are classed as property. Like other tradable assets, New Zealand does not have a capital gains tax system. Instead, capital gains are simply added to the individual’s income for the year.

It is then taxed at the individual’s tax bracket. This is also the case for income from crypto staking platforms, crypto airdrops, and other DeFi products.

- For example, suppose an investor buys $20,000 worth of Bitcoin and sells it in the same year for $30,000. That’s capital gains of $10,000.

- Additionally, the investor receives $2,000 in staking rewards

- The investor also earned a salary of $30,000

- This takes the total income to $42,000

In this instance, the investor would pay a 10.5% tax on the first $14,000. Then, 17.5% on the rest.

| Country | New Zealand |

| Capital Gains Tax? | No. The capital gains are added to the investor’s total income. |

| Held for Under 1 Year | Added to the individual’s total income for the year and taxed accordingly. Progressive tax rates from 10.5% to 39%, depending on the total income. |

| Held for Over 1 Year | Same as the above. |

| Income Tax? | Yes – on all crypto-related income, including staking and yield farming. Paid in the same year as the income was received. Added to the individual’s total income for the year and taxed accordingly. |

| Capital Losses? | Yes – crypto losses can be offset against liabilities |

Crypto Taxes in Other Global Regions

Now let’s explore some of the crypto taxes applicable in other regions of the world:

Europe

Wondering about crypto taxes in Europe? The European Union does not have a uniform tax system. As such, individual member states each have their own rules on crypto taxes.

In the vast majority of cases, capital gains are taxed once realized. This will be at the jurisdiction’s respective tax rate. This is also the case with income earned, such as staking.

Surprisingly, one of the main exceptions to this rule is Germany. While Germany has some of the highest tax rates globally, residents can avoid paying capital gains taxes on cryptocurrency investments. The only requirement is that the cryptocurrencies were held for at least one year.

Portugal is another example of favorable tax rules for long-term cryptocurrency holders. According to Bloomberg, no capital gains tax is applicable if the investment was held for at least one year. Otherwise, the capital gains will be taxed at 28%.

| Germany | No capital gains tax on cryptocurrencies if the investment was held for at least 12 months. Short-term cryptocurrency investments are charged at the individual’s respective rate. |

| Portugal | No capital gains tax on cryptocurrencies if the investment was held for at least 12 months. Short-term cryptocurrency investments attract a capital gains tax of 28%. |

Asia

Similar to Europe, crypto taxes in Asia will vary widely depending on the jurisdiction. Singapore and Hong Kong, for example, do not levy capital gains tax on cryptocurrencies or any other assets.

Residents of Malaysia will also benefit from tax-free cryptocurrency profits. However, this is only applicable to individuals that do not generate their main source of income from cryptocurrencies.

In contrast, profits made from cryptocurrency trades in Thailand are taxed at up to 35%. The specific rate will vary depending on the individual circumstances, such as the total income earned for the year.

Additionally, a withholding tax of 15% can apply if the cryptocurrency sale was made on a crypto exchange that hasn’t been approved by the Thailand SEC.

| Hong Kong | No capital gains tax system exists. |

| Singapore | No capital gains tax system exists. |

| Thailand | Capital gains are taxed at up to 35%, depending on the individual’s personal circumstances. 15% withholding tax when trading on an exchange that hasn’t been approved by the Thailand SEC. |

Africa

Crypto taxes in Africa vary depending on the country.

For example, as of May 2023, investors based in Nigeria will now need to pay a 10% capital gains tax on trading profits. Previously, Nigeria was one of the best crypto tax-free countries.

In South Africa, residents follow a similar system to New Zealand. This is because capital gains from cryptocurrency investments are added to the total income earned for the year. It is then collectively taxed at the applicable tax rate.

| Nigeria | 10% capital gains tax on cryptocurrency profits |

| South Africa | Capital gains are added to the individual’s total income for the year and taxed accordingly. |

Examples of No Crypto Tax Countries

In this section, we explore some of the most crypto-friendly tax authorities globally.

Puerto Rico

Puerto Rico is one of the best countries for cryptocurrency investors that have generated capital gains.

This is because of Act 22 (Individual Investors Act), which enables residents to enjoy a 0% capital gains tax rate on realized profits.

However, this is on the proviso that the cryptocurrency was purchased while being resident in the country.

Hong Kong

Put simply, there is no capital gains tax in Hong Kong for individuals. As such, irrespective of whether the individual has made gains on cryptocurrencies, stocks, or any other asset – no taxes are required. The only exception is if the cryptocurrency sale is linked to commercial activity.

Germany

As we mentioned earlier, Germany is favorable to long-term cryptocurrency investors. As long as the cryptocurrencies were held for 12 months or more, there is no capital gains tax to pay.

What’s more, if the cryptocurrency was sold within 12 months of buying it, but the profit amounts to under €600 – there is no tax to pay.

Germany can also be favorable for individuals earning crypto income. This is because staking, yield farming, and other income activities are tax-free on one condition – the individual refrains from selling for at least 10 years.

This may appeal to investors that are super-bullish on the best staking coins, like Ethereum and Cardano.

Dubai

Dubai and the broader UAE are not only one of the most tax-friendly nations for cryptocurrencies but across most measurable metrics.

In a nutshell, residents in Dubai for tax purposes will not pay any capital gains tax. This is the case irrespective of how the amount or the length of time the cryptocurrencies were held.

Moreover, Dubai is also suitable for avoiding taxes on crypto income. As reported by PwC, there is no federal or Emirate-level personal income tax whatsoever.

How to File Crypto Taxes: What to Know About Reporting

First and foremost, it is important to remember that reporting requirements on crypto taxes will vary from one country to the next.

The vast majority of which global tax authorities are only interested in realizable gains. This means that there is rarely a requirement to report cryptocurrencies that have not been disposed of. Just remember, this not only includes selling cryptocurrencies back to cash, but trading and spending them.

Once cryptocurrencies have been disposed of, the specific reporting requirements will depend on the country of residence.

Similarly, in the vast majority of cases, crypto income will need to report in the same tax year that it was received. If the received income is sold, revert to the rules surrounding capital gains.

For example:

- In the US, investors will need to report cryptocurrency disposals on IRS Form 8949. For staking and other interest-bearing income, this will need to be reported as income on IRS Form 1040.

- In the UK, cryptocurrency disposals should be reported via self-assessment tax returns. Any interest made from crypto income products should be included within the ‘miscellaneous income’ part of the tax return.

It is important to remember that crypto taxes are often complex. As such, investors should consider using a qualified professional when completing their tax returns.

This is especially the case with crypto income. For example, the best crypto interest accounts make distributions daily. This means that each and every day rewards are received, the income will need to be reported. Not only that, but at the market value on the specific day the income was received.

In this instance, it could be worth using a crypto tax service. This allows individuals to link their crypto wallets to the platform, which then automatically calculates the value of the income.

What Crypto Transactions Are Taxable?

There are many different types of transactions that can occur in the cryptocurrency space. And from the perspective of tax authorities, not all transactions are treated the same.

Here’s a breakdown of the most common crypto transactions and how they are generally taxed.

Do note that these are generalizations for the majority of countries and are not applicable in all jurisdictions.

Buying and HODLing Crypto

Buying cryptocurrencies will not trigger a taxable event. Nor will holding cryptocurrencies in a wallet. Most countries only consider cryptocurrencies a taxable event once they have been disposed of.

As such, investors can HODL for as long as they want without needing to worry about paying taxes.

Selling Crypto

Once a cryptocurrency investment has been sold, this will trigger a taxable event in most countries. The profit made from the sale could be liable for capital gains. For example, buying $5,000 worth of Bitcoin and selling at $7,500 – that’s a capital gain of $2,500.

Just remember, some countries offer benefits if the sale was made after a certain time period. For example, Australians receive a 50% reduction in capital gains taxes if the investment was held for at least 12 months. In Germany, a minimum holding time of 12 months means that no capital gains taxes are owed at all.

Transferring Between Crypto Wallets

Transferring cryptocurrencies from one wallet to another will not trigger a tax event. This is because the cryptocurrencies have not been sold or exchanged.

Instead, they are simply being stored with a new provider. This is similar to transferring shares to a new stock broker.

Buying Goods and Services With Crypto

Ever wondered how many people use Bitcoin in 2023 to buy goods and services? One of the biggest misconceptions is that paying for goods and services with crypto is a way to avoid tax. This is simply not true.

On the contrary, the purchase will be considered the same as selling crypto back to fiat.

For example:

- An investor buys 1 ETH at $500

- 1 ETH is now worth $750

- The investor uses their 1 ETH to make an online purchase

In this instance, the difference between the original cost and purchase value is $250. This will be viewed as capital gains by most tax authorities.

Crypto-to-Crypto Swaps

Another common misconception is that crypto-to-crypto swaps do not trigger a taxable event. Once again, this is not correct.

Instead, the difference between the cost and sale price needs to be taken into account.

For example:

- An investor buys 1 BTC for $10,000

- 1 BTC is now worth $15,000

- The investor swaps their 1 BTC for 10 ETH

- As soon as the exchange is made, capital gains will have been made

- This is because the investor originally paid $10,000 for their 1 BTC

- But when they exchanged the 1 BTC, it was valued at $15,000

As such, this crypto-to-crypto swap yielded capital gains of $5,000

Crypto Gifts

In most countries, cryptocurrencies can be given as a gift without triggering a taxable event. Individuals will usually have annual gifting limits, depending on their country of residence.

For instance, the UK’s HMRC notes that gifting limits for 2023/24 are £3,000.

However, the recipient will likely need to pay tax on the gifted cryptocurrency once they cash out. The cost price is usually based on the market value when the crypto was received.

For example:

- The recipient is gifted 1 BTC

- When the Bitcoin is gifted, it is valued at $15,000

- When the recipient sells the 1 BTC, it is valued at $25,000

- The capital gains on the sale is $10,000

In some countries, the cost price is based on the original market value when the crypto was initially purchased.

Crypto Loans

Whether or not crypto loans are taxed varies between lenders and borrowers.

For example, someone lending cryptocurrency to another person will likely charge interest. The interest will be considered as income, just like staking and yield farming.

On the flip side, the borrower might be able to offset the interest they pay on the loan from their annual tax liability.

The specifics will vary widely depending on the country of residence.

Crypto Interest and Staking,

Most countries will define crypto interest, staking, and other DeFi products as income.

First, this is realized as soon as the interest is received.

- For example, suppose an investor receives 1 XRP on day one.

- If XRP is valued at $0.50 on this date, $0.50 will be added to the investor’s income.

- This will be added to their overall income for the year and taxed accordingly.

- This process needs to be repeated for each day that income is received.

Additionally, investors also need to consider what happens when they dispose of their received crypto income. For example, if the 1 XRP is sold for cash, traded for another cryptocurrency, or used to make a purchase.

At this stage, capital gains will likely be applicable if the 1 XRP has since increased. This will be the difference between the prices when the income was received and disposed of.

Crypto Derivatives

In most cases, profits on crypto derivatives are treated as capital gains.

For example, suppose an investor stakes $1,000 on a Bitcoin futures contract. When the contract expires in three months’ time, it is worth $2,500. Therefore, capital gains will be applied to $1,500.

In rarer cases, some crypto derivative trades will remain in place for at least a year.

For example, a Bitcoin futures contract with a 12-month expiry. In this case, investors in some countries might benefit from reduced tax liabilities. For example, in Australia, the capital gains on this position will be reduced by 50%.

Crypto derivatives will usually attract interest too. This is because they are leveraged financial products. Rarely will tax authorities allow investors to claim to offset these costs against their tax liabilities. This is because derivative interest is considered a core cost of entering the trade.

Crypto Donations

Donating cryptocurrencies to charity will rarely trigger a taxable event. This is because the investor is giving their cryptocurrencies away without making any gains.

Moreover, the investor can usually make tax deductions on the donation. This is usually at the original cost price.

For example, suppose an investor buys 10 ETH for $10,000. When they make the donation, 10 ETH is valued at $15,000. However, the tax deduction will likely be made at $10,000.

Can Tax Authorities Monitor Your Crypto?

Centralized financial regulators, such as tax authorities, do not have the resources or means to track cryptocurrency transactions. This would be an unrealistic undertaking, considering the decentralized and pseudonymous nature of cryptocurrencies.

However, tax authorities can and will actively request information from centralized exchanges. This is often only feasible if the investor has gone through a KYC process, and thus, their cryptocurrency holdings are tied to their identity. This is the case even if the cryptocurrencies have since been withdrawn from the centralized exchange and into a private, anonymous wallet.

Consequences of Not Reporting Crypto Taxes

Bloomberg recently reported that the popular crypto exchange Kraken has been ordered by a judge to turn over client information to the IRS. The IRS has demanded information on clients that have traded at least $20,000 worth of cryptocurrency in any 12-month period, between 2016 and 2020.

The consequences? Well, if it turns out that US residents have made capital gains on Kraken but have not reported the income to the IRS, this could be classed as tax evasion.

Moreover, in most countries, it is a legal requirement for residents to report cryptocurrency capital gains to their respective tax authorities. This is often only a requirement for realizable gains. Crypto income from staking and other DeFi methods need to be reported in the year the income was received. Failure to do so can result in serious consequences.

Best Methods to Minimize Crypto Taxes

While tax evasion is a criminal act, tax avoidance isn’t. This means that investors in most countries can legally reduce their crypto taxes.

Some of the most common crypto tax avoidance methods are briefly discussed below.

Annual Capital Gains Allowances

Some countries offer their residents annual capital gains allowances. This means that residents can generate a certain amount of capital gains each year without paying any tax.

For example, in the 2023/24 tax year, UK residents have £6,000 in annual capital gains allowance. As long as the individual does not make more than £6,000 in capital gains, no taxes will be due.

This allowance also allows investors to be strategic with when they sell.

- For example, suppose a UK resident initially invested £10,000 in Bitcoin.

- We’ll say that currently, the Bitcoin investment is now worth £18,000.

Should the investor cash out just £16,000, this would represent £6,000 in capital gains. (£16,000-£10,000) No capital gains tax would be required, assuming that no other profits were made on other assets.

The investor could then leave the remaining £2,000 worth of Bitcoin in their portfolio until the following tax year.

Tax-Efficient Accounts

Some countries allow their residents to invest in cryptocurrencies via tax-efficient accounts.

For example, US residents under the age of 50 can invest $6,500 into an IRA in 2023. Any investments made in an IRA (Individual Retirement Account) can grow tax-free. Bitcoin IRA is a popular investment platform for this purpose.

In the UK, residents are not allowed to put cryptocurrencies in an ISA (Individual Savings Account). However, they might be able to gain exposure to cryptocurrency-related stocks and ETFs – which ISAs do permit.

Meet Minimum Holding Requirements

Some countries offer incentives to long-term cryptocurrency holders.

As noted, Australians receive a 50% reduction in capital gains tax when holding for at least 12 months.

No capital gains tax is required at all when German residents hold for 12 months or more.

In the US, residents switch from short-term to long-term capital tax rates when holding for at least a year. This is almost always more favorable.

Make Strategic Losses

Another strategy is to make strategic losses to reduce tax liability for the year. This is known as tax harvesting.

- For example, suppose an individual currently owes $5,000 in capital gains taxes.

- The individual currently has 1 BTC in their portfolio.

- They originally paid $15,000 for 1 BTC, but it’s currently worth just $10,000.

- By selling now, they would make a $5,000 loss.

- But equally, the loss could be offset against the $5,000 owed in capital gains tax.

This strategy is often taken during bear markets when broader crypto prices are down.

Wondering where to report crypto losses on taxes in the US? Any capital losses for the year should be reported on Schedule D and Form 8949.

How to Calculate Crypto Taxes

The simple way of calculating crypto taxes is to assess the difference between the cost and the sale price. The difference between the two will yield capital gains or losses.

For instance:

- An investor buys $10,000 worth of Ethereum

- The investor sells their Ethereum investment for $14,000

- The capital gains on this trade are $4,000, which might be taxable

However, whether or not capital tax needs to be paid depends on many variables, such as:

- Total income for the year: US residents do not pay capital gains tax when their annual income is below $44,625

- Total capital gains for the year: Cryptocurrencies are just one type of investment product that contributes towards capital gains liabilities. As such, investors also need to include other investment profits, such as from stocks, ETFs, or bonds.

- Annual allowances: Some countries do not collect capital gains tax below a certain threshold. For example, UK investors will not pay tax if the total capital gains for the year are below £6,000.

- Investment Timeframe: Capital gains can be reduced or alleviated completely if the cryptocurrencies were held for a minimum timeframe. For example, German residents do not pay crypto capital gains tax if the investment was held for 12 months or more.

These are just some of the variables that need to be considered when calculating crypto taxes.

Additionally, crypto-related income also needs to be considered.

- Crypto income covers DeFi products like staking and savings accounts

- Whenever interest is received, this goes toward the investor’s income for the year

- This should be calculated at the market value on the day the cryptocurrency interest was received.

As we explain shortly, crypto tax software can be of great assistance. This will help investors automatically calculate their capital gains, losses, and income – based on their country of residence.

Cost Basis: Best Methods to Use for Crypto Taxes

The two most commonly used accounting methods to calculate crypto taxes are FIFO and LIFO.

These methods are useful when multiple purchases have been made during the year.

FIFO

When selling cryptocurrencies using the First in, First out (FIFO) method, the oldest purchases will be disposed of first.

This method is best suited for investors that have access to long-term capital gains tax benefits.

For example:

- An investor buys 1 BTC at $4,000 in January 2021

- They also buy 1 BTC at $10,000 in January 2022

- The investor sells 1 BTC in February 2022 at $15,000

- Using the FIFO method, the cost price for the sale is $4,000

- This means that capital gains of $11,000 have been made ($15,000-$4,000)

Investors in Germany, for example, would benefit from a 0% capital gains tax rate on this trade. This is because, using the FIFO method, the investment was held for at least 12 months.

LIFO

When offloading cryptocurrencies using the Last in, First out (FIFO) method, the most recent purchases will be disposed of first.

This method can help reduce tax liabilities during bullish markets.

Sticking with the same example:

- This time, the investor uses the LIFO method when cashing out 1 BTC for $15,000

- This means the cost price for the sale is $10,000

- This means that capital gains of $5,000 have been made ($15,000-$10,000)

As such, a much lower tax liability has been secured.

The rules of using FIFO and LIFO will vary from one jurisdiction to the next. It is wise to consult with a qualified tax professional to see what options are available.

Do Crypto Exchanges Submit Tax Forms?

Some crypto exchanges provide users with tax forms for their country of residence. This is often the case with platforms that are regulated in the US.

For example, Coinbase states that it will report staking rewards of $600 or more directly to the IRS, using Form 1099-MISC. Moreover, Coinbase allows US clients to manage their cost basis. For instance, displaying capital gains and losses for either FIFO or LIFO.

Moreover, the US Infrastructure Bill means that crypto exchanges are now legally required to report transactions made by US clients.

However, it is likely that the information provided to the IRS will not accurately represent the individual’s circumstances. This is because of transferability.

- For example, suppose an investor buys 1 BTC on Binance when it is worth $15,000.

- The investor used ETH to pay for their 1 BTC

- The investor withdraws the 1 Bitcoin to a private wallet

- A few months later, the investor deposits their 1 BTC into Coinbase

- The 1 BTC is now worth $25,000, and they sell it for US dollars

Coinbase will not have the full picture of the end-to-end trade. After all, it only knows that the investor deposited 1 BTC into their Coinbase account and cashed out. Coinbase doesn’t know how much the investor originally paid – let alone that they used ETH to pay for the purchase.

It is important that investors do not rely on crypto exchanges to report information to tax authorities. Instead, everything should go through a qualified tax professional. This ensures that the information submitted to tax authorities is accurate – meaning that fines or prosecution are avoided.

Reporting Crypto Trading Statistics: Important Metrics

When calculating crypto taxes for reporting purposes, it is important to ensure the following metrics are recorded correctly:

- Date of Purchase: The specific date that the cryptocurrency was purchased is very important. This can determine whether short and long-term capital gains taxes are applied to the investment.

- Cost Price: Additionally, the exact cost price of the cryptocurrency should be recorded. This information can usually be found in the ‘account section’ of the respective exchange. For example, $1,000 was invested in Bitcoin at a cost price of $17,560.01.

- Date of Sale: Equally important, the exact date that the cryptocurrency was sold should be recorded.

- Sale Price: Be sure to record the price that the purchased cryptocurrency was sold.

- Cost Basis: It is also important to understand the cost basis being used when calculating taxes. The most common methods are FIFO and LIFO, as discussed earlier.

- Capital Gains/Losses: A solid record of all capital gains and losses should be made. This should align with the cost basis used.

- Crypto Income Rewards: Every time crypto income is received, such as staking rewards, a record should be made. Not only the amount received (e.g. 10 XRP) but the market price on that specific date (e.g. $0.71).

Ultimately, regular crypto traders should get into the habit of keeping records. While doing this on a daily basis is unlikely to be feasible, it’s best not to leave everything until the tax return is due.

Additionally, there will always be some variance in reporting figures, due to the volatile nature of cryptocurrencies. For example, the price of a cryptocurrency can rise or fall by more than 10% in a single day. This means that cost prices will vary depending on the time of the day.

Crypto Tax Software: The Basics

Depending on the number of transactions executed, crypto tax software can streamline the reporting process. In fact, this removes the need to manually record transactions or use a crypto taxes calculator.

Here’s how it works:

The investor will initially need to connect their exchange accounts and wallets to the software. This is done via APIs, meaning that the software is not able to access the funds. Instead, it views the data in read-only mode. If an API isn’t supported, then CSV files can usually be uploaded to the software.

The investor will also need to set some parameters. For example, the country of tax residence, preferred cost basis, and the tax accounting period.

The software will then run a scan, taking each and every transaction into account. This includes the cost and sale price on each specific date. The software will then present the data in a simplified format.

This can then be provided to a tax advisor, which will complete the tax return on behalf of the investor. Or, the investor might elect to fill out the tax return themselves, based on the data the software provides.

Keeping Tabs on Crypto Tax News

Tax laws can change at a moment’s notice. Therefore, it is important to stay updated with the latest crypto tax news.

Here are some best practices on how to achieve this:

- Regular Google Searches: It makes sense to search Google at least every few months to see if there are any new developments on crypto taxes. Make sure the search query is relevant to the country of residence. For example, “Crypto Tax UK”.

- Follow the Tax Authority on Social Media: Many tax authorities have a presence on social media. For example, the IRS shares tax updates on Facebook, YouTube, and even Instagram.

- Crypto Taxes Reddit: Consider joining the CryptoTax subreddit for developments and updates. This subreddit is also useful for finding legal tax avoidance strategies.

The Verdict

In summary, while crypto taxes are complex, they cannot be ignored.

Investors should have a firm grasp of the crypto tax laws in their country of residence, especially those related to capital gains and income.

Ultimately, investors are best advised to seek guidance from a professional tax advisor that has experience with cryptocurrencies.

References

https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets

https://www.gov.uk/guidance/capital-gains-tax-rates-and-allowances

https://taxsummaries.pwc.com/united-kingdom/individual/taxes-on-personal-income

https://www.ato.gov.au/Rates/Individual-income-tax-rates/

https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/compliance/digital-currency/cryptocurrency-guide.html

https://www.india.gov.in/official-website-income-tax-department

https://www.estv.admin.ch/estv/en/home.html

https://www.ird.govt.nz/cryptoassets

https://www.bloomberg.com/news/newsletters/2022-10-18/portugal-s-new-crypto-taxes-can-t-stop-the-party

https://taxsummaries.pwc.com/united-arab-emirates/individual/taxes-on-personal-income

https://www.irs.gov/pub/irs-pdf/f8949.pdf

https://www.irs.gov/forms-pubs/about-form-1040

https://www.gov.uk/inheritance-tax/gifts

https://www.bzst.de/DE/Home/home_node.html

https://www.coinbase.com/learn/your-crypto/tax-documents-explained#irs-forms

https://taxsummaries.pwc.com/puerto-rico/individual/other-tax-credits-and-incentives

https://www.cnbc.com/2021/11/29/infrastructure-bill-cracks-down-on-crypto-tax-reporting-what-to-know.html

https://www.irs.gov/newsroom/irs-social-media

https://www.reddit.com/r/CryptoTax/

https://triple-a.io/crypto-ownership-data/

FAQs

Do I need to pay crypto taxes?

Yes, in most countries, capital gains tax must be paid on cryptocurrency profits.

Do you have to report unrealizable crypto gains?

No, most tax authorities (including the IRS) only require ‘realizable’ gains or losses to be reported – meaning the cryptocurrencies have been disposed of.

Can you offset losses on crypto taxes?

Many countries, including the US, UK, and Australia, allow residents to claim capital losses on their unsuccessful crypto investments.

Which countries use cryptocurrency the most?

Triple-A research suggests – which studied cryptocurrency statistics by country, found that most investors are based in the US.

How to claim crypto losses on taxes?

Unsuccessful crypto trades can be reported as capital losses when submitting a tax return to the relevant authority.

How to report crypto on taxes?

While the specifics will vary from one country to the next, US investors can submit their crypto capital gains to the IRS via Form 8949.

Is crypto staking taxable?

Yes, in most countries, crypto staking is classed as income and taxed accordingly.

Which crypto exchanges report to IRS?

All regulated exchanges that serve US clients – including Coinbase and Gemini, must report crypto transactions to the IRS.

Is crypto taxed like stocks?

Crypto is taxed like stocks in most countries, meaning that capital gains are liable for tax.

When are crypto taxes due?

Crypto trading activity in 2022 should have been declared to the IRS by no later than 18th April 2023.

When did crypto start getting taxed?

The US started taxing crypto in March 2014, when digital assets like Bitcoin were declared ‘property’ for Federal tax purposes.

Which crypto tax software is best?

Some of the best crypto tax software include Koinly, CoinLedger, and TokenTax.

What percentage of the world uses cryptocurrency?

A Triple-A study claims that over 4.2% of the world’s population now owns crypto.

Is crypto taxed as capital gains?

Yes, with a few exceptions, most countries tax capital gains on cryptocurrencies.

Where to report crypto on tax returns?

US investors can report their crypto gains and losses on line 7 of their Form 1040.

Is crypto tax free in Dubai?

Yes, crypto capital gains and income is tax-free for residents of Dubai and the UAE.