Chainalysis Report: India Ranks Second in Global Transaction Volume Despite Tax Law Challenges

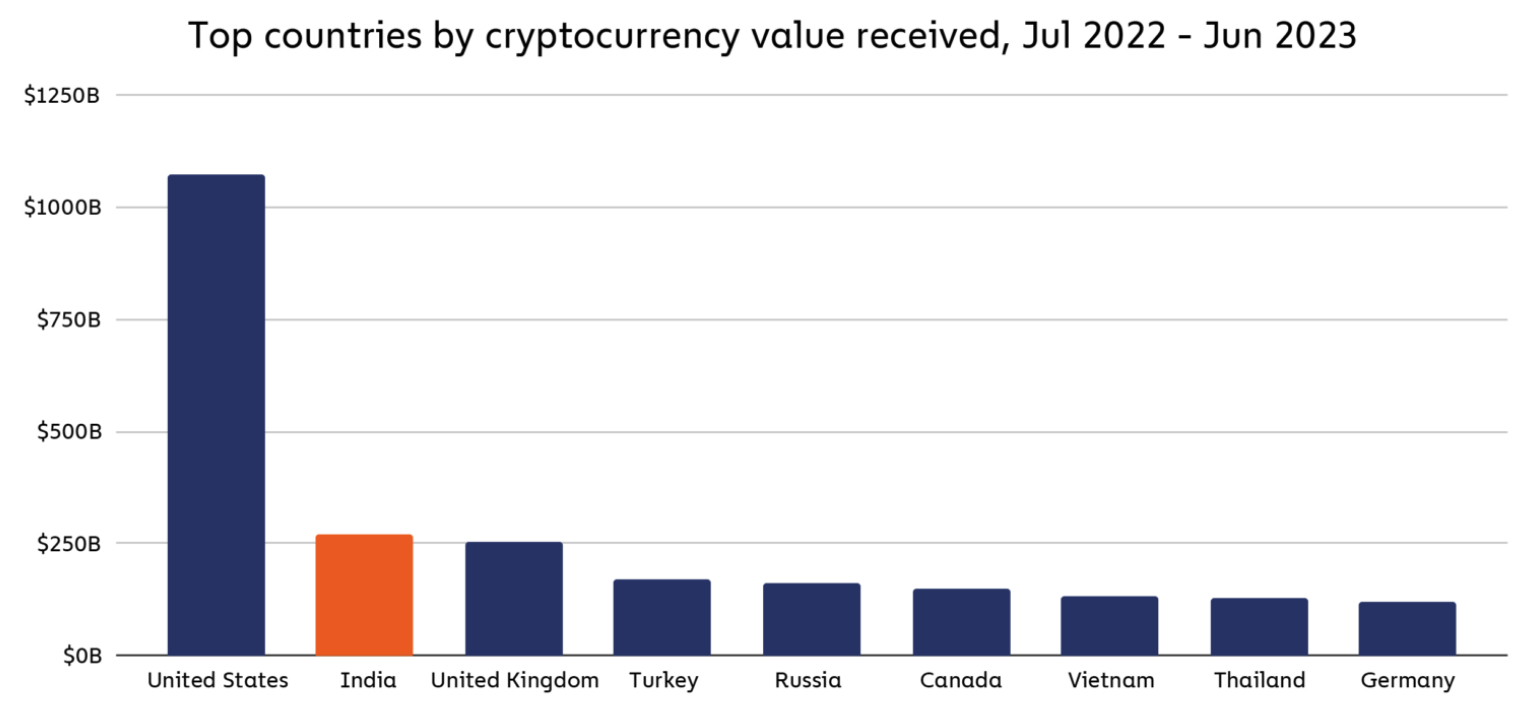

India has claimed the second-largest position in the global crypto market, surpassing the UK, Turkey, and Russia in raw transaction volume.

This achievement is notable given that it comes despite challenges posed by India’s anti-crypto regulatory and tax environment, a recent report from blockchain intelligence firm Chainalysis said.

India leads in grassroots crypto adoption

In the report, Chainalysis revealed that India leads the world in grassroots crypto adoption, as indicated by its Global Crypto Adoption Index.

Over the period from July 2022 to June 2023, cryptocurrency transaction volumes in India reached nearly $269 billion.

Challenging tax landscape

Notably, this growth has occurred in the midst of a tax landscape that can be demanding for the crypto industry, with a 30% tax on gains and a 1% tax on all crypto transactions.

However, Chainalysis suggests that the inconsistent application of the transaction tax might hinder local exchanges’ ability to compete effectively.

Despite these regulatory and tax challenges, the demand for cryptocurrency in India remains robust. Chainalysis emphasizes that as long as this demand persists, cryptocurrency will maintain a significant presence in the world’s second-most populous country.

Central & Southern Asia and Oceania

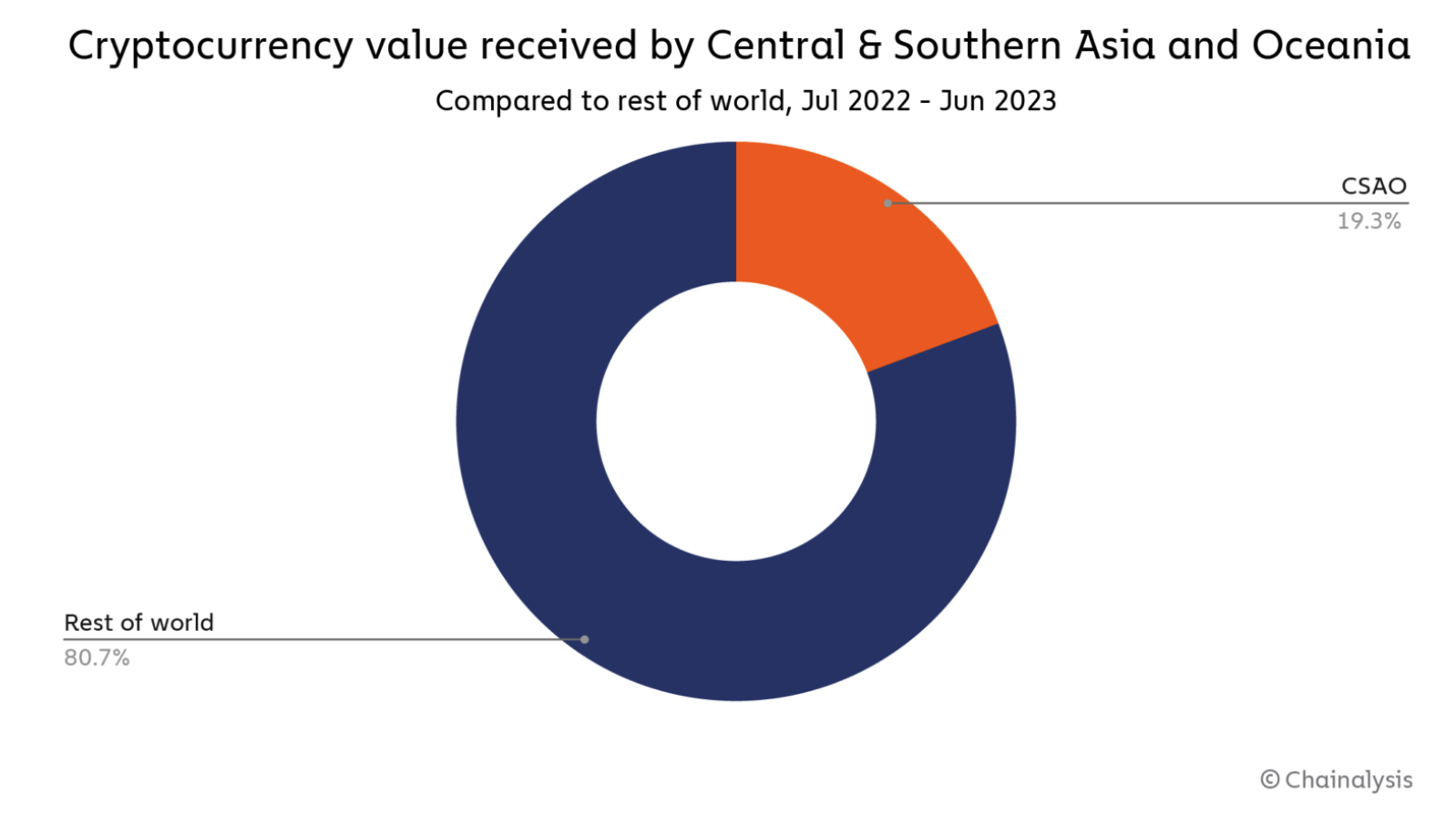

While India’s crypto market growth is remarkable, the wider region, referred to as Central & Southern Asia and Oceania (CSAO) in the report, also has a strong footprint in the global crypto market.

In terms of raw transaction volume, the CSAO region is now the third-largest crypto market in the world, following closely behind North America and Central, Northern & Western Europe, and accounting for just under 20% of all global crypto transaction volume.

“[CSAO] hosts what may be the world’s most dynamic and fascinating cryptocurrency market,” the report said about the region.

According to the report, the United States has retained its position as the largest crypto market globally, far surpassing other nations.