Breaking: BlackRock Registers iShares Ethereum Trust in Delaware – Is a Spot ETH ETF Coming?

The price of Ether (ETH), the cryptocurrency that powers the Ethereum blockchain, is shooting higher on Thursday in wake of the news that US asset management giant BlackRock just registered the iShares Ethereum Trust in Delaware.

BlackRock, the world’s largest asset manager with over $8.5 trillion in investor funds under management, made a similar move registered its iShares Bitcoin Trust seven days ahead of filing for its spot Bitcoin ETF application back in June.

The iShares Ethereum Trust has just been registered in Delaware.

For context, BlackRock’s iShares Bitcoin Trust was registered in a similar manner 7 days before they filed the ETF application with the SEC. Details below.

[announcement: I’m moving to @SynopticCom soon] pic.twitter.com/IYafIaxMzA

— Summers (@SummersThings) November 9, 2023

Analysts are thus anticipating that BlackRock is likewise on the verge of filing a new spot Ether ETF application and that this could kickstart a wave of applications from other major asset managers.

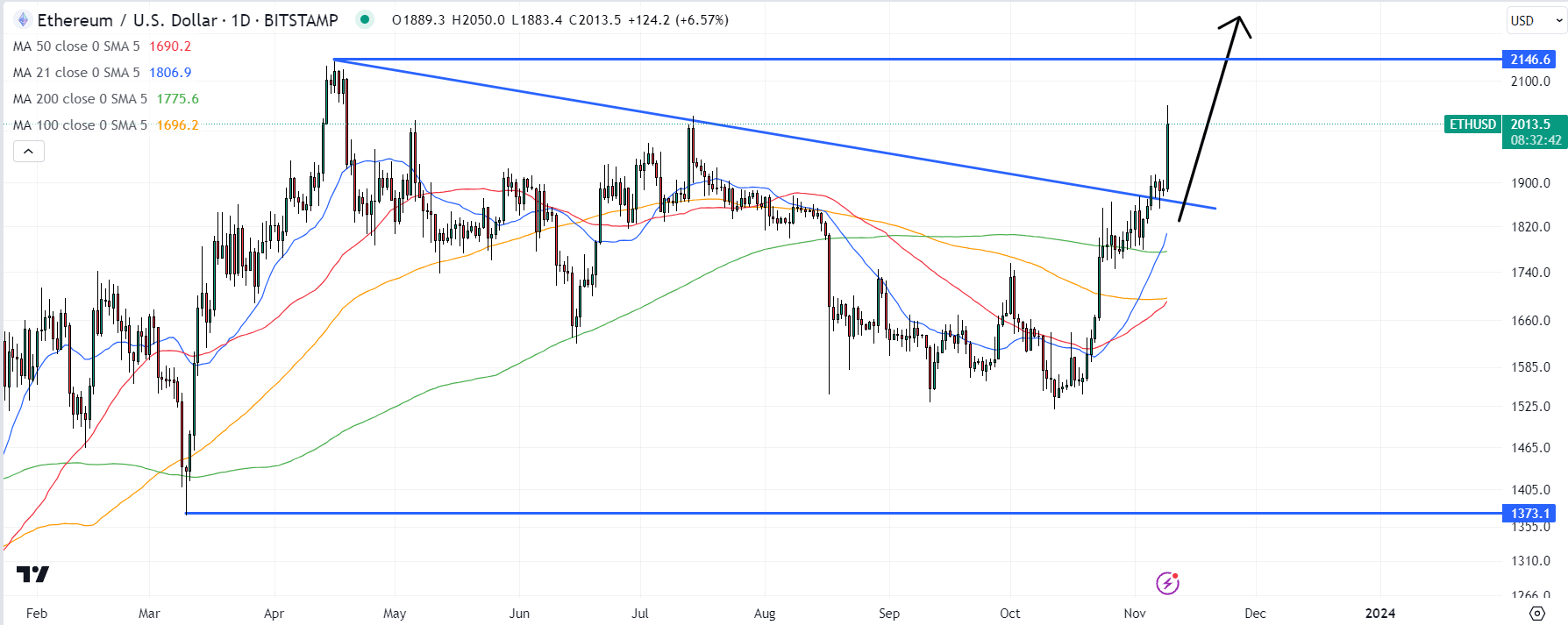

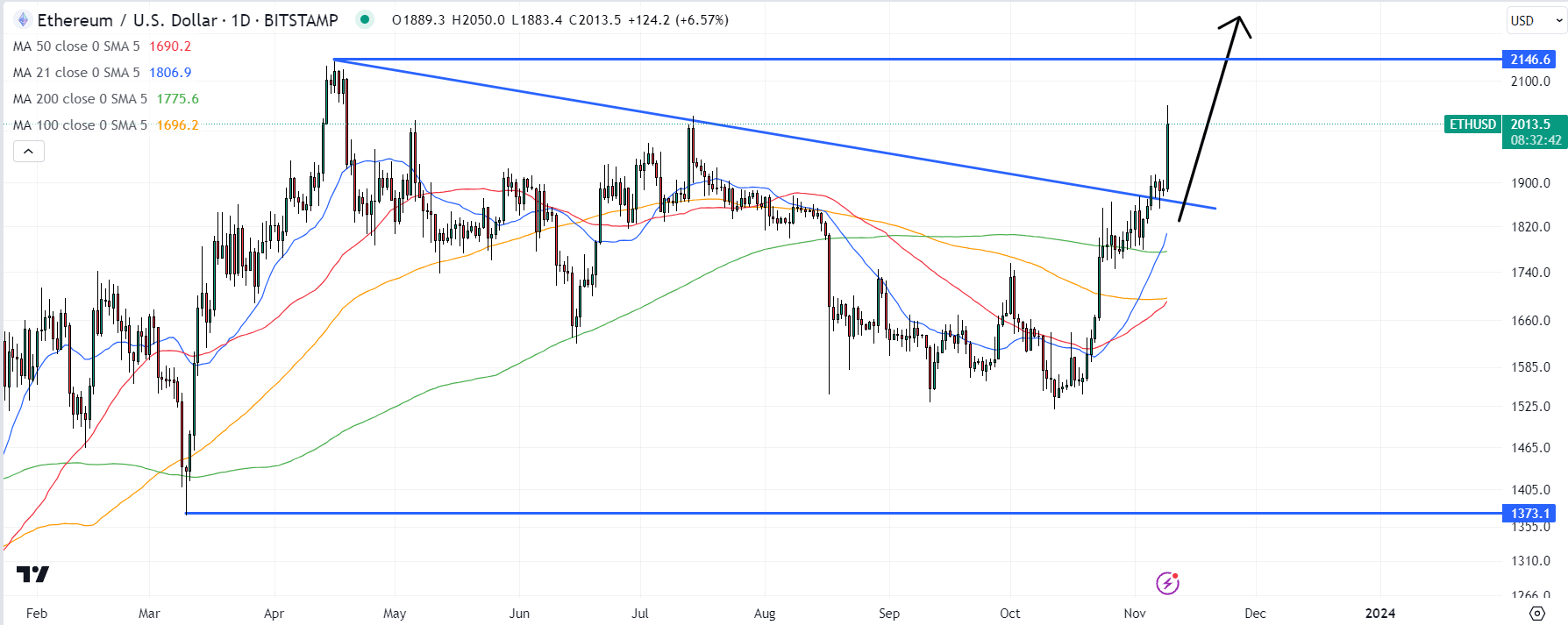

ETH was last changing hands around $2,040, its highest level since April.

Bitcoin, meanwhile, hit its highest levels of the year earlier on Thursday near $38,000, with the asset having seen a stunning 50% pump since mid-October, mostly as a result of optimism that the US SEC will soon approve spot Bitcoin ETFs.

With Ether up a more modest 33% from its mid-October lows, and still below its earlier yearly highs, there may be scope for a bit of “catch-up” to Bitcoin.

Few would be surprised to see the Ether price vault to the north of earlier yearly highs just under $2,150.