Bitcoin Slides Back Below $30,000, But These Metrics Show BTC Bulls Still Anticipating Further Upside

Bitcoin (BTC) fell back to the south of the $30,000 level on Monday to hit its lowest point since late June in the $29,600s.

The world’s most valuable cryptocurrency network by market capitalization has now pulled back around 6% from the more than one-year highs it hit last Thursday around $31,800.

News that a district judge had ruled that they did not view XRP as a security, at least outside of the context of Ripple’s sales of the token to financial institutions, had sent crypto markets surging last week.

But profit-taking in wake of this year’s spectacular bitcoin rally (BTC was last up more than 80% year-to-date) prevented BTC from breaking convincingly to the north of its recent mid-$29,000 to $31,000ish range.

Some analysts said that concerns about the financial health of the world’s largest crypto exchange Binance, which was last week reported to be looking at letting up to a third of its workforce go, and this week was reported to be scaling back on employee benefits, could be weighing on sentiment.

Binance’s troubles suggest the much-discussed “crypto winter” that saw a big contraction for the industry in 2022 is yet to fully thaw.

However, the fact that bitcoin is finding strong support in the mid-$29,000s and is yet to break convincingly to the south of its 21-Day Moving Average are both good signs that the bulls have completely relinquished control just yet.

Indeed, various other metrics suggest that bulls are still anticipating further upside.

These Metrics Show BTC Bulls Still Anticipating Further Upside

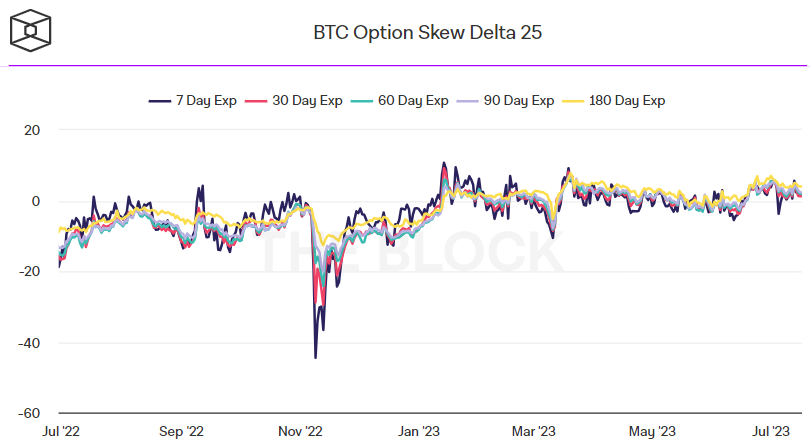

Bitcoin options markets still suggest that investors are paying a premium for BTC options that pay out in case of further upside, a sign of still strong sentiment.

While the bitcoin price may be at one-month lows, the 25% delta skew of bitcoin options expiring in 7, 30, 60, 90 and 180 days all remain at fairly elevated levels between 1 and 4, as per data presented by The Block.

Indeed, with the 180-day delta skew the highest at 4, the message from options markets is that investors are expected a continued crawl higher for bitcoin in the coming months, rather than explosive short-term rallies.

A 25% delta skew of below zero means that bullish Bitcoin call options are trading at a premium versus equivalent bearish put options, suggesting investors disproportionately demand the former.

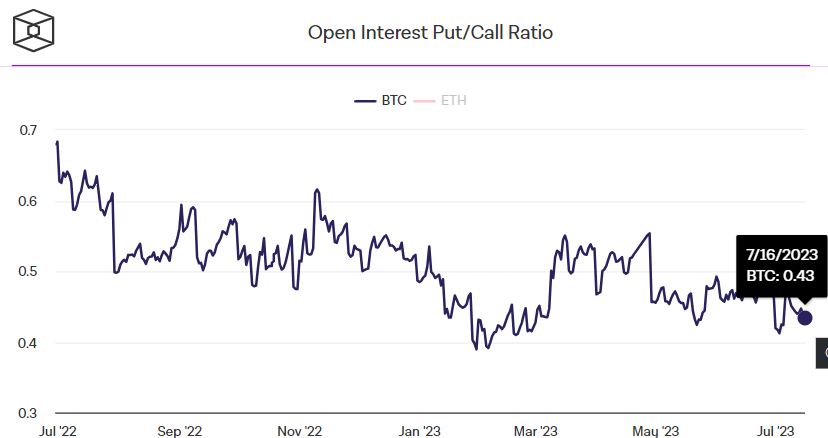

Elsewhere, at 0.43, the ratio of open interest in bitcoin put/call options also remains at low levels.

A ratio in open interest of put and call options below 1 means that investors favor owning call options (bets on the price rising) over put options (bets on the price dropping).

Meanwhile, a falling ratio suggests this mismatch in demand between the two options types is rising (i.e. bullish sentiment is going up).

While an abrupt drop back under mid-$29,000s support and subsequent decline back to the late May highs in the mid-$28,000s is a possibility as short-term bullish momentum continues to fade, it would certainly come as a surprise to the options market.

In terms of potential volatility triggers for the week, things are fairly quiet on the macro front, with little by way of tier 1 data out of the US this week aside from Thursday’s release of June Retail Sales figures.

Ongoing themes in the crypto industry like regulation, the XRP lawsuit, the crypto winter and institutional adoption hopes (in wake of last month’s spot bitcoin ETF filings from Wall Street heavyweights) will remain front and center.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.