Bitcoin Price Pressured as Fed Official Says “Premature to Even Be Thinking About” Rate Cuts – Where Next For BTC?

The Bitcoin (BTC) price has come under pressure on Friday, dipping 2% from around $43,000 to the low $42,000s in wake of hawkish commentary from a leading US Federal Reserve monetary policymaker John Williams.

Williams, who is the president of the influential New York Federal Reserve, appeared on CNBC’s Squawk Box show and commented that it is “premature to even be thinking about” rate cuts.

That marks a hawkish shift from the much more dovish message sent by Fed Chair Jerome Powell at the Fed’s policy announcement earlier this week, and versus the Fed’s latest economic and interest rate projections, which forecast falling inflation in 2024 and three rate cuts.

Powell remarked at the meeting that he sees the peak in interest rates as likely having been reached, with rate cuts ahead.

This dovish lean to the latest Fed meeting at the time triggered an aggressive rally in the US stock market, a sharp drop in US government bond yields and a drop in the US Dollar Index (DXY) as markets amped up bets for as many as six rate cuts next year.

Bitcoin also rallied at the time.

Fed Miscommunication?

However, Williams’ comments on Friday suggest that, after observing the latest dovish market reaction, the Fed has realized it miscommunicated to the market.

Williams added in his CNBC interview that the Fed’s main focus right not is on whether the bank has gotten policy to sufficiently restrictive levels in order to ensure that inflation falls back to the Fed’s 2% target.

He added that the Fed must be ready to hike again if needed.

This is very much in line with the message the Fed had been sending to the market for most of 2023 prior to Wednesday’s dovish pivot that got investors so excited.

Looking ahead, after realizing its communication hiccup at Wednesday’s meeting that clearly prompted a larger-than-they-were-expecting dovish market reaction, Fed officials may attempt to continue pushing back against dovish market bets, just as Williams just did.

Of course, as noted by Pantheon Macroeconomics’ Chief Economist Ian Shepherdson, it will be the next three Core PCE inflation reports out of the US that determine whether the Fed starts interest rate cuts next March, as the market is currently betting, not current Fed commentary.

What John Williams said on CNBC this morning will not determine whether the Fed eases in March. The next three core PCE numbers will.

— Ian Shepherdson (@IanShepherdson) December 15, 2023

Where Next for Bitcoin (BTC)?

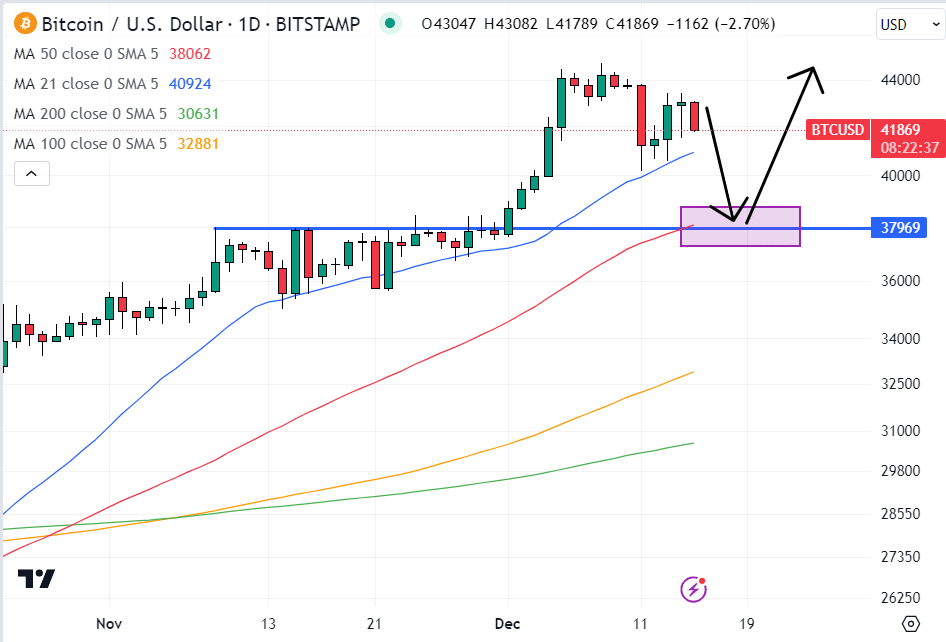

Hawkish Fed messaging has seen the bears regain control on Friday, hence the latest BTC price dip back to the low $42,000s.

That leaves Bitcoin around the mid-point of this week’s $40,000-$44,000ish range and the price still around 6% lower versus the yearly highs it printed last week near $45,000.

Long-term price predictions are likely to remain bullish, with the near-term approval of spot Bitcoin ETFs in 2024 expected to spur institutional adoption, the Bitcoin issuance rate halving coming up in March and an eventual easing of US financial conditions (i.e. Fed rate cuts) on the horizon.

But with spot Bitcoin ETF optimism now likely mostly priced in and no news expected for a few weeks, and with the market grappling with conflicting Fed messaging, which is somewhat confusing the expected timing of upcoming rate cutes, BTC is at risk of a further short-term setback.

Bears will be eyeing whether key short-term support in the form of the 21DMA (last at $40,900) and this week’s lows (just above $40,000) are able to hold.

If not, a dip back to $38,000, a prior strong resistance zone and where the 50DMA current is, maybe on the cards.

But expect longer-term Bitcoin investors who are less sensitive to short-term market dips to jump on any opportunity to secure BTC for less than $40,000.