Bitcoin Price Prediction: Marathon’s Record, Kraken Deposits, Uzbekistan Regulations

Bitcoin continues to trade at $27,698 with a nearly 1% increase. Marathon Digital Holdings boosted its Bitcoin production by 16% monthly and Kraken experienced its highest Bitcoin deposit activity in half a decade due to surging prices and growing ETF confidence.

Uzbekistan has implemented strict guidelines allowing only legal entities to engage in Bitcoin mining. These developments could impact Bitcoin’s future trajectory.

Marathon Digital Sets Record for Monthly Bitcoin Production

Marathon Digital Holdings Inc. reported a significant 16% increase in monthly Bitcoin production in September 2023, mining a total of 1,242 bitcoins.

This growth can be attributed to the company’s improved operations at its Texas facility, as well as the success of a joint venture in Abu Dhabi, which added an additional 50 bitcoins to the total.

Despite positive production figures, the company’s stock price dipped slightly by 1% on Wednesday.

Nonetheless, news of increased Bitcoin production could enhance positive sentiment in the broader cryptocurrency market, which could potentially impact Bitcoin’s price positively.

Marathon’s successful mining operations may be interpreted by investors as an indicator of the overall strength of the cryptocurrency industry, potentially leading to increased demand for Bitcoin and driving its price higher. However, this depends on various other market factors and investor sentiment.

Kraken Sees Highest BTC Deposit in 5 Years Amid Rising Prices and ETF Confidence

Kraken, a top US-based crypto exchange, has received a massive Bitcoin deposit of 14,924 BTC, the largest since 2018. This comes as Bitcoin’s price has risen by 5% week-over-week, leading to speculation that it may breach the $30,000 milestone soon.

Recent developments, such as the SEC’s legal setbacks against Grayscale and Ripple XRP, have further fueled market optimism. Other factors, including macro events and the upcoming 2024 Bitcoin Halving, are also being closely monitored by investors.

Regarding BTC prices today, this news may have contributed to bullish sentiment and driven Bitcoin’s price higher, due to increased optimism and demand in the market.

Uzbekistan’s Bitcoin Mining Policy: Only Legal Entities Allowed

Crypto mining in Uzbekistan is going through significant changes. The National Agency for Perspective Projects (NAPP), which regulates the country’s crypto market, has introduced a licensing framework for crypto mining operations.

As per the new regulations, only legal entities are permitted to engage in crypto mining, while individual miners are not allowed to participate.

The NAPP has made it mandatory for cryptocurrency mining operations in Uzbekistan to rely on solar power. However, exceptions exist in specific circumstances, as defined by legislation, allowing the use of the unified power system of Uzbekistan.

Additionally, miners are required to establish dedicated facilities for mining equipment installation, conduct mining activities solely at registered addresses, and pay mining fees on time as set by regulatory authorities.

The NAPP has also prohibited the mining of anonymous cryptocurrencies, including privacy-focused coins like Monero (XMR).

It is still uncertain whether these regulations will represent the final framework for crypto mining in Uzbekistan, but they are expected to have a significant impact on the country’s cryptocurrency mining industry.

Despite this news, the rising prices of BTC have not been affected due to positive developments in the market.

Bitcoin Price Prediction

Noting the 4-hour chart timeframe, Bitcoin’s price displays key price levels that require attention. The pivot point for the asset is situated at $27,500.

Key Trading Levels

- Resistance levels comprise immediate resistance at $28,427, followed by subsequent resistances at $29,222 and $29,997.

- As for the downside, the immediate support is identified at $26,775, accompanied by the subsequent supports at $25,900 and $25,000, respectively.

Analyzing technical indicators reveals that the Relative Strength Index (RSI) currently stands at 59, signaling a bullish sentiment as the RSI is above 50.

Meanwhile, the 50-day Exponential Moving Average (EMA) is registered at $27,260, indicating a short-term bullish trend since the price is above this EMA.

An observed chart pattern suggests that the 50-day EMA holds firm at $27,300, leading to speculation: is it a favourable moment to purchase above this level? In this instance, the significance is on the support from the 50-day EMA at $27,300.

If Bitcoin manages to remain above this level, it could indicate positive momentum in the market.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

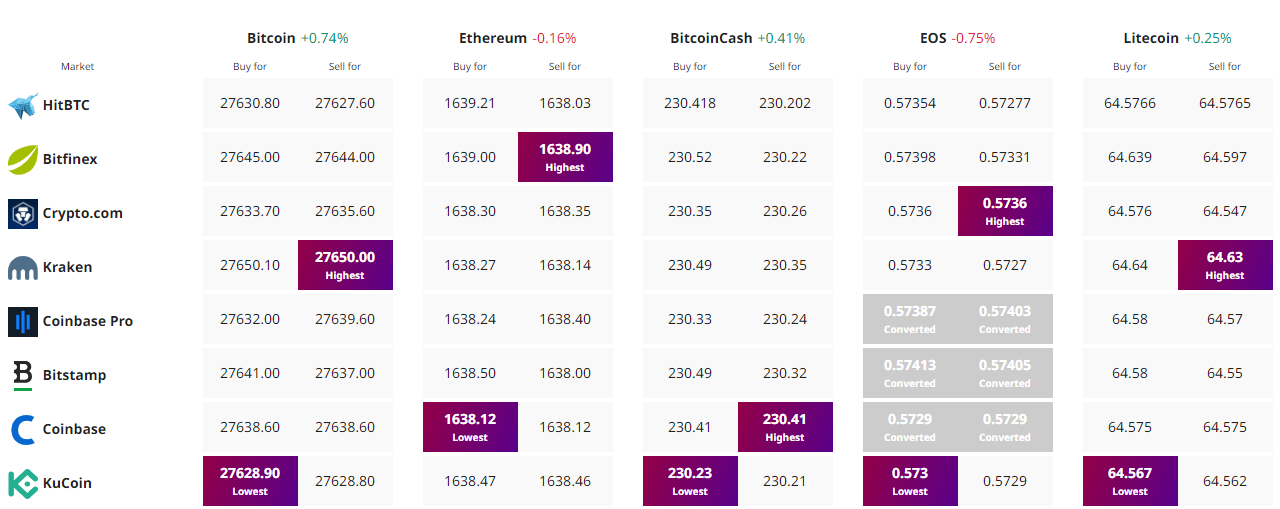

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.