Bitcoin Price Prediction: BTC’s Bullish Dance Aiming for $36,500 Amid Overbought Alerts

In the midst of overbought signals, Bitcoin price shows no signs of slowing down as it remains on a bullish trajectory, with technical indicators predicting a target of $36,500.

Join us as we delve into the factors driving this surge and explore the potential implications for investors.

Bitcoin Price Update

Bitcoin, the renowned digital gold of the cryptocurrency world, has presented an intriguing play on its charts as of October 25. Currently priced at $34,122, BTC’s 24-hour movement reveals a slight dip of nearly 0.75%.

However, this movement is set against a robust trading volume of $35 billion in the last 24 hours, which underscores the prevailing dynamism and activity in the Bitcoin market.

Bitcoin Price Prediction

Drilling down to the Bitcoin‘s 4-hour chart provides a more granular view of the price action. The pivot point, a crucial metric for traders, stands firm at $32,462.

Resistance levels have been charted out with precision, with the immediate one placed at $34,501.

If Bitcoin bulls keep the momentum, the next hurdles align at $36,507 and further at $38,579.

On the flip side, if the bears wrest control, immediate cushioning is found at $31,212, followed by subsequent supports at $29,172 and a more profound level at $27,956.

Diving into the technical indicators, the Relative Strength Index (RSI) stands at a high of 78.

This is significant as any value above 70 typically indicates overbought conditions. It’s a potential sign that the market might be due for a correction, but it’s also reflective of the strong bullish sentiment surrounding Bitcoin at this juncture.

The 50-day Exponential Moving Average (EMA), a trusted indicator for many traders, is currently pegged at $30,673. The fact that Bitcoin’s price hovers above this EMA paints a short-term bullish picture.

It suggests that the buying pressure has been dominant, at least in the recent past.

From a chartist’s perspective, there’s an interesting pattern unfolding. The presence of the ‘Three White Soldiers’ on the 4-hour timeframe is a bullish candlestick pattern that could suggest a reversal of the preceding downtrend.

This bullish bias has been further cemented since Bitcoin broke through the Triple top pattern at $31,655.

Currently, however, Bitcoin seems to be grappling with the $34,705 mark, which represents the 141.4% Fibonacci extension level.

A successful breach above this could potentially usher in a fresh wave of buying. The 50 EMA, too, reinforces the buying sentiment.

In Conclusion

The overall trend for Bitcoin appears bullish. However, traders should keep a vigilant eye on the $34,700 level. This price point is shaping up to be a trendsetter. A slide below it could entice sellers to jump in, while a decisive move above could signal a continuation of the bullish rally.

Short Term Forecast: Bitcoin seems poised to test the resistance at $36,507 in the forthcoming days, provided the current bullish sentiment persists.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

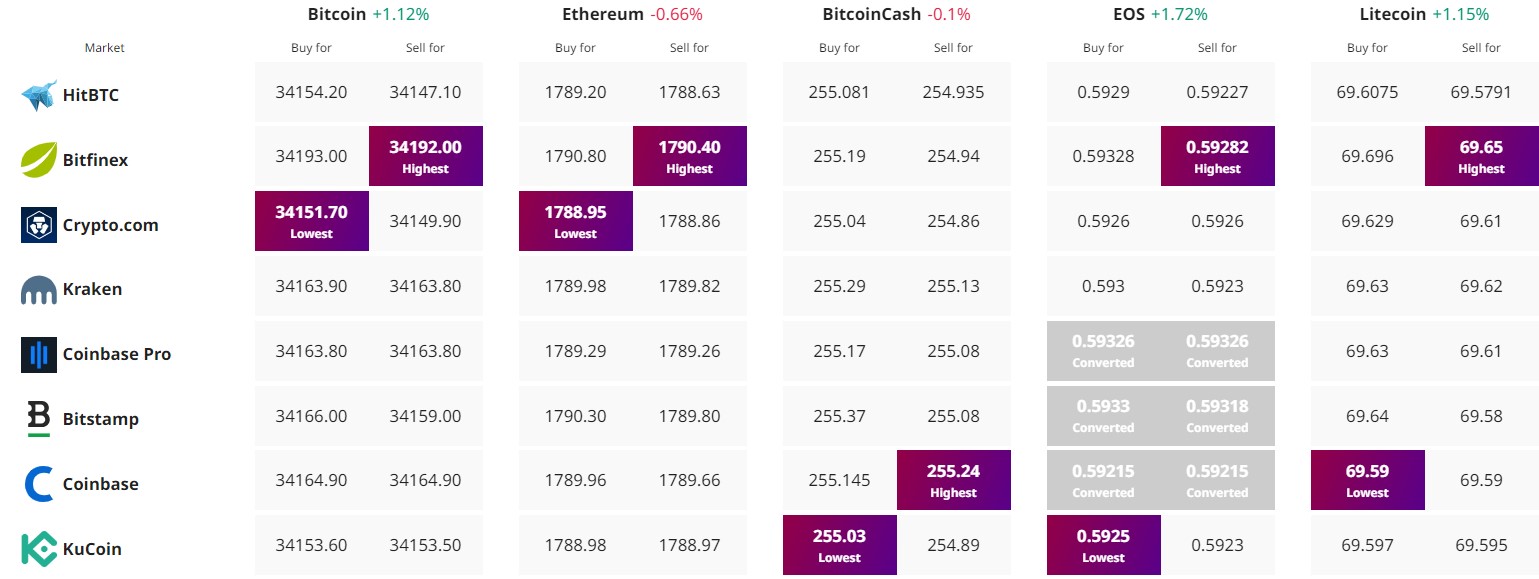

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.