Bitcoin Price Prediction: BTC Up 1.5% as Market Focus Shifts to June CPI and PPI Readings

Bitcoin price is trading at $30,492 in today’s market, marking an over 1% rise on Tuesday.

The cryptocurrency market continues to draw attention as Gary Gensler, the chair of the US Securities and Exchange Commission (SEC), faces criticism from a Ripple attorney, who refers to him as a “bad faith regulator” following the SEC’s acceptance of Grayscale’s Bitcoin Futures Exchange-Traded Fund (ETF).

Investors are closely watching the June Consumer Price Index (CPI) and Producer Price Index (PPI) readings, which have come into focus.

These economic indicators will provide valuable insights into inflationary pressures and overall economic performance, influencing market sentiment and potentially impacting Bitcoin’s price movement.

Ripple Attorney Accuses Gary Gensler of Being a “Bad Faith Regulator” as SEC Approves Grayscale’s Bitcoin Futures ETF

The SEC has approved Grayscale’s Bitcoin Futures ETF, adding it to the list of permitted products alongside the Leveraged ETF and BTC Short ETF.

This decision has sparked a debate regarding the SEC’s stance on spot Bitcoin ETFs, which carry fewer risks.

Ripple’s lawyer has accused SEC Chair Gary Gensler of being a “bad faith regulator” compared to his predecessor, Jay Clayton, who offered more insightful advice.

The SEC has approved Grayscale’s Bitcoin Futures ETF, adding it to the list of permitted products alongside the Leveraged ETF and BTC Short ETF.

This decision has sparked a debate regarding the SEC’s stance on spot Bitcoin ETFs, which carry fewer risks.

Ripple’s lawyer has accused SEC Chair Gary Gensler of being a “bad faith regulator” compared to his predecessor, Jay Clayton, who offered more insightful advice.

To address concerns of manipulation and fraud, the SEC deemed the proposal for listing and trading the trust’s shares as unclear, despite similar vulnerabilities existing in BTC Futures ETFs that were approved.

Grayscale has sought clarification from the court on the notion of “unfairness,” while Craig Salm, Grayscale’s chief legal officer, has put forth three potential resolutions.

These include approving the earlier Grayscale application to convert GBTC to spot BTC ETFs before approving the latest Spot Bitcoin ETF filings.

Salm proposes that the SEC either provide a different justification for rejecting Spot BTC ETFs or treat Spot and Futures Bitcoin ETFs equally, which would require a comprehensive reorganization of BTC Futures ETFs.

The SEC’s approval of Bitcoin Futures ETFs, combined with the growing market accessibility and mainstream acceptance of Bitcoin-related products, has led to speculation about potential regulatory approval for Spot ETFs, contributing to the upward trend of BTC.

Focus on June CPI and PPI Readings: Key Inflation Indicators to Watch

This week focuses on releasing the US June Consumer Price Index (CPI) and the Producer Price Index (PPI), bringing inflation data back into the spotlight.

These reports are significant as they can potentially impact the Federal Reserve’s decision on interest rates.

Investors will closely monitor any indications of rising inflation that could lead the Federal Reserve to reconsider its plans for a 25 basis points interest rate hike.

After pausing rate increases last month, the Fed’s shift towards a more hawkish stance will depend on the inflationary pressures in the economy.

While the Fed’s measures have helped lower the CPI from 9% in August 2022 to 4% in May, concerns about a possible breach that could have severe consequences on the economy are rising.

The anticipation of the CPI release on Wednesday is somewhat influencing BTC prices on Tuesday.

Bitcoin Price Prediction

Bitcoin is currently facing resistance around the $31,000 level, but it is managing to hold slightly above it, around $31,050.

The presence of a bullish engulfing candle on the daily timeframe indicates a strong potential for a bullish trend.

Resistance is observed near $31,350, and a successful break above this level could propel Bitcoin towards the next target at around $32,500 or potentially even higher around $34,150.

On the downside, immediate support levels can be found around $30,300 or possibly around $29,650. A break below $29,650 might result in a decline towards $28,650 or even lower towards $27,900.

Therefore, close monitoring of the $31,000 level is crucial as it could serve as an indication for a buying opportunity in Bitcoin.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

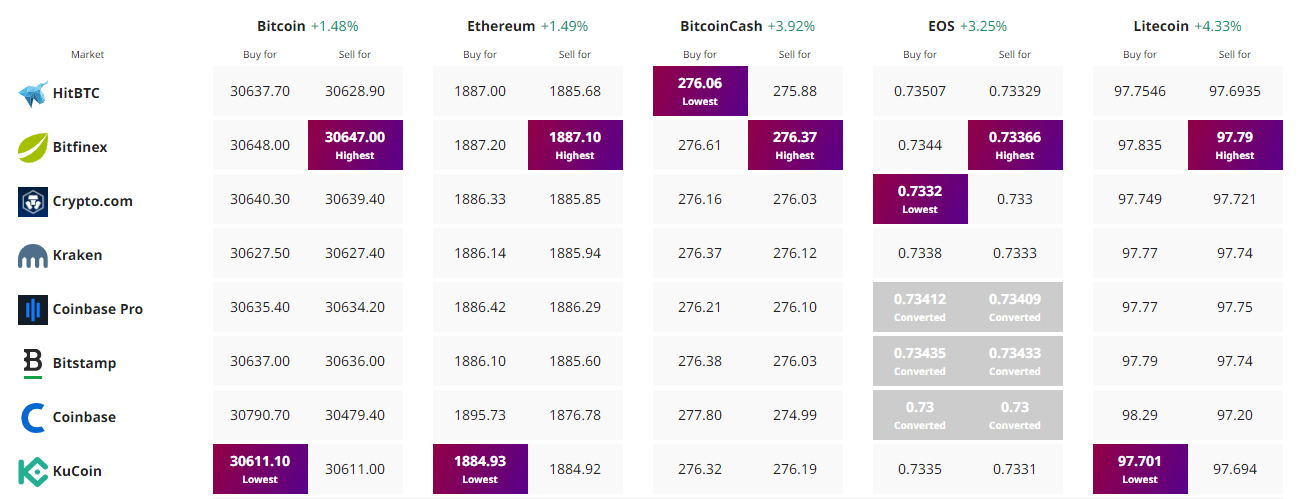

Find The Best Price to Buy/Sell Cryptocurrency