Bitcoin Price Prediction: BTC Surges 5% as FOMC Insights & Fed Fund Rate Grab the Spotlight

In a remarkable turn of events, Bitcoin (BTC) witnessed a significant 5% upswing, aligning with growing anticipation surrounding the Federal Open Market Committee (FOMC) announcements and the Federal Fund Rate.

As financial markets keenly await insights from the FOMC and closely monitor the pivotal Fed Fund Rate, the world’s premier cryptocurrency, Bitcoin, rides this wave of attention, showcasing its dynamic interplay with traditional financial indicators.

This surge places a renewed spotlight on the digital currency’s resilience and its evolving relationship with global economic touchstones.

Nomura, a leading Japanese investment bank, recently launched a Bitcoin-focused fund targeting institutional investors, which could be a reason behind the surge in BTC.

Despite the positive news in the market, the current market sentiment is hovering between neutral and bullish.

Investors are eagerly anticipating the decision of the US Federal Reserve on federal interest rates during the FOMC meeting.

On the other hand, the crypto markets are showing consistent growth for another day.

The latest data indicates that the global crypto market cap has risen by 1.3%, inching ever closer to the significant $1.12 trillion milestone.

US Federal Reserve Meeting In Highlights

Traders in the Bitcoin market are currently exercising caution ahead of the US Federal Reserve’s decision on interest rates, scheduled to be announced today.

The Federal Open Market Committee (FOMC) meeting, which began yesterday, is expected to maintain the interest rates at their current level.

A rise in interest rates could potentially trigger a sell-off in riskier assets, such as cryptocurrencies, while a rate cut could result in a surge in prices.

Most traders expect the Federal Reserve to maintain the current interest rates, leaving the focus on their future plans.

However, it’s worth noting that strong economic data in the United States and ongoing inflation concerns have led some to anticipate a 0.25% rate hike by the end of the year.

Nomura Launches Bitcoin Adoption Fund, Fosters Increased Demand for BTC

Nomura, a Japanese investment bank, has launched a new Bitcoin adoption fund through its digital asset subsidiary, Laser Digital. The fund is designed to attract institutional investors, making it easier for large companies and investors to invest in digital assets.

However, the fund focuses only on Bitcoin as a long-term investment, with the aim of providing a safe and cost-effective option.

It is worth noting that the fund uses Komainu, a joint venture between Nomura, Ledger, and CoinShares, to enhance security.

This launch followed the acquisition of licenses in Dubai by Laser Digital and Komainu.

The Laser Digital Funds Segregated Portfolio Company (SPC) framework provides investors with protection against unnecessary risks.

It’s worth noting that the fund operates under this framework and is legally recognized and registered in the Cayman Islands.

Sebastien Guglietta, Head of Laser Digital Asset Management, believes that Bitcoin plays a crucial role in the long-term transformation of the economy.

Fiona King, Head of Distribution at Laser Digital Asset Management, is excited about the fund’s launch. She highlights how the fund offers institutional investors a secure way into the digital world, backed by significant financial support.

Nomura’s Bitcoin adoption fund for institutional investors is likely to increase demand for BTC, potentially leading to upward price pressure due to greater investment interest.

Bitcoin Price Prediction

Bitcoin’s price is poised to potentially break the significant $27,500 resistance. A successful close above this mark could propel BTC towards $28,200.

After surging past the $26,800 resistance, Bitcoin stabilized above the $27,000 benchmark. However, resistance remains around $27,500, with the most recent peak reaching $27,494.

The cryptocurrency is oscillating slightly below the 23.6% Fib retracement level from its recent swing, maintaining above the 100 hourly Simple Moving Average with a supportive bullish trend line near $26,800.

Key resistances lie at $27,500 and $28,200, with a potential rally leading to the $29,500 or even $30,000 zones.

Conversely, if BTC can’t surpass $27,500, a correction may ensue with supports at $27,050 and $26,800. Breaching the latter might push the price towards $26,200.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

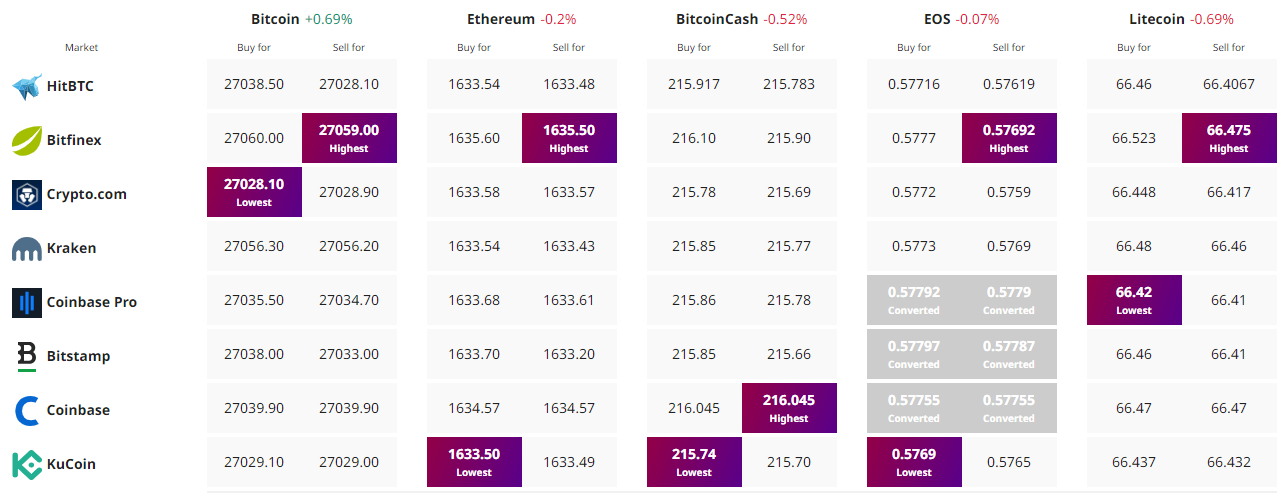

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.