Bitcoin Price Prediction: BTC Dips to $42,000, Ocean Pool Blacklist Stirs Debate, Snowden Critiques Warren

Last updated: December 11, 2023 02:22 EST

. 4 min read

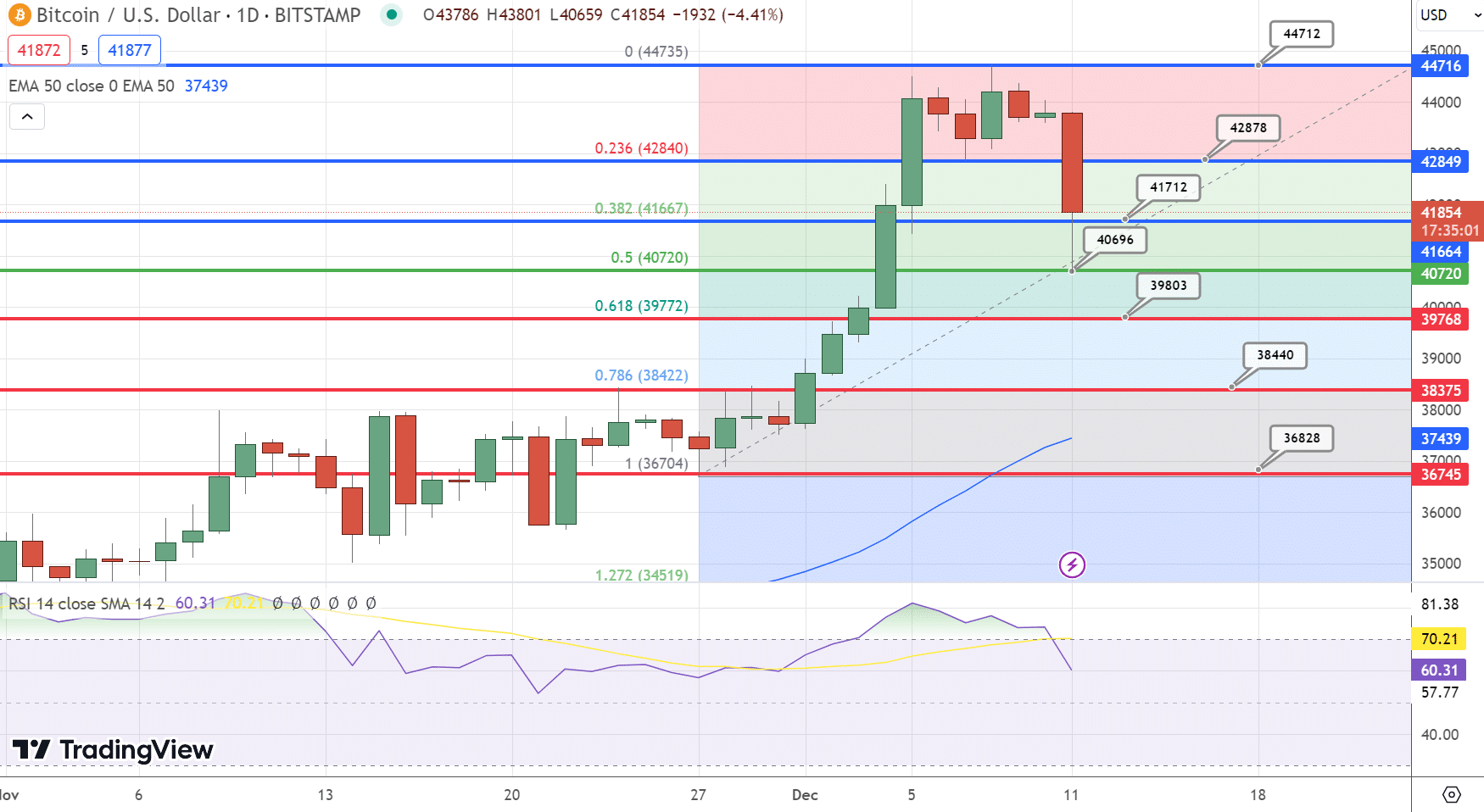

Bitcoin is currently experiencing a noticeable downturn, trading at $41,875 with a significant decline of approximately 4.50% as of Monday. This market shift coincides with a contentious development in the crypto sphere: the Transaction Blacklist of Ocean Pool, which has sparked widespread debate and concern within the industry.

Amidst these challenging market conditions, some analysts still believe that a rebound in Bitcoin’s value is in its early stages, indicating potential for future growth.

Adding to the mix of events affecting the market, former NSA contractor and whistleblower Edward Snowden criticizes Senator Elizabeth Warren’s stance on cryptocurrencies, labeling her as “pro-banker” and accusing her of being overly compliant with the interests of JPMorgan’s leadership.

This mix of market dynamics and political controversy paints a complex picture for Bitcoin’s immediate future.

Ocean Pool’s Transaction Blacklist Sparks Controversy in Bitcoin Community

The recent decision by the Ocean bitcoin mining pool to block transactions linked to BRC20 tokens, Ordinal inscriptions, and coinjoins has sparked a heated debate in the cryptocurrency community.

This move aligns with the anti-spam measures introduced in Bitcoin Core 0.9.0, released in 2014, which aimed to address blockchain data spam. Bitcoin Core developer Luke Dashjr, a key figure in the Ocean pool, points out that the roots of this controversy date back to this update.

Critics argue that Ocean’s selective approach to transaction processing could lead to significant revenue losses.

One analyst estimates a potential fee loss of 17% in a block template due to these exclusionary practices. In response, Dashjr has expressed a willingness to collaborate with others to seek a resolution to these concerns.

Ripples in the Bitcoin Sea: Ocean Pool’s Transaction Blacklist Sparks Industry Uproar https://t.co/7LNzmQpGDq via @BTCTN

— John Williams M.Ed. (@islandmotivates) December 10, 2023

The strong reactions, both in support and opposition, to Ocean’s policy highlight the complex interplay between censorship, economic considerations, and the broader ideals of the Bitcoin community.

As this debate unfolds, its indirect effects on market sentiment could influence both miner behavior and user confidence in the Bitcoin ecosystem.

Consequently, these developments could potentially impact the price of BTC, underscoring the sensitivity of the cryptocurrency market to internal community dynamics and policy decisions.

Analysts Claim Bitcoin Rebound Still in Initial Stages

The cryptocurrency market, as per Dow Jones Market Data Group, is showing signs of recovery and growth. Bitcoin has soared by 159% since the previous December, oscillating between $43,000 and $46,000.

Analysts suggest that this pattern might indicate the onset of a new cycle, distinguished from previous cryptocurrency rallies by the current subdued sentiment among retail investors.

Factors contributing to this optimistic outlook include the anticipated Federal Reserve rate cut in March 2024 and Bitcoin exchange-traded funds (ETFs) applications by BlackRock and Fidelity.

#BTC Bitcoin’s bounce ‘still early innings’ https://t.co/woxa2wnZb8 #FoxBusiness

— A.I.GOAL (@A_I_Gen) December 10, 2023

Approval of these ETFs would mark a significant milestone for Bitcoin. Despite skepticism from figures like Jamie Dimon, CEO of JPMorgan, the market is hopeful for a resurgence of investor interest, especially if Bitcoin surpasses the $50,000 threshold.

Overall, Bitcoin’s price trajectory is trending upwards, fueled by growing interest and potential regulatory developments.

Snowden’s Crypto Clash: Labels Warren as “Pro-Banker” in JPMorgan Debate

Massachusetts’ Edward Snowden, known for his advocacy for privacy, has openly criticized Senator Elizabeth Warren’s recent remarks on cryptocurrencies. Warren described cryptocurrencies as a potential threat, advocating for increased regulation.

Snowden rebuked Warren for seemingly siding with Jamie Dimon, JPMorgan’s CEO, and accused her of favoring large banking institutions. This stance marks a significant shift for Warren, who was previously viewed as a critic of big banks.

Snowden Blasts Elizabeth Warren as ‘Pro-Banker,’ Claims She ‘Rolls Over’ for JPMorgan Boss in Crypto Clashhttps://t.co/jmHQlXbwCx

— John Morgan (@johnmorganFL) December 10, 2023

Her participation in a Senate hearing alongside banking industry officials raised eyebrows and led to Snowden’s critique of her as hypocritical for adopting a pro-banker stance. Warren’s recent anti-crypto rhetoric has been met with disapproval from cryptocurrency supporters, who argue that she has been influenced by banking interests.

This situation highlights the evolving dynamics between traditional banking and digital currencies, underlining the significant impact of cryptocurrencies on both finance and politics.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.