Bitcoin Price Prediction as US Interest Rate Decision is Announced – Is the Bear Market Over?

As the United States Federal Reserve announces its latest interest rate decision, the world watches with bated breath to see how the cryptocurrency market will react, particularly Bitcoin.

In recent months, the highly volatile digital currency has been stuck in a bearish trend, leaving investors questioning whether this downturn will persist or if a bullish reversal is on the horizon.

In this price prediction, we will explore various factors influencing Bitcoin’s price, analyze expert predictions, and delve into market indicators to shed light on whether the bear market may finally be coming to an end.

US Interest Rate Decision is Announced

To combat inflation, the Federal Reserve of the United States has raised interest rates to their highest level in 16 years.

The benchmark rate has been increased by 0.25 percentage points, the eleventh increase in the past 14 months, and is now between 5% and 5.25%, up from almost zero in March 2022.

Significantly higher interest rates are a direct result of this development, which has slowed down industries like the housing market and contributed to the recent failure of three American banks.

Jerome Powell, chairman of the Federal Reserve, said that it was possible that interest rates might not need to be raised further at this time, calling the announcement a “significant change.”

However, he did not rule out the introduction of new policies, saying that the bank’s decisions would be evidence-based.

Last year, when US prices were rising at their fastest rate in decades, the Federal Reserve Board began its aggressive interest rate hikes, prompting central banks around the world, including those in the UK and Europe, to take similar measures.

When interest rates rise, it raises the cost of taking on debt for things like buying a home or expanding a business, which can reduce demand and bring down prices.

Since the Fed’s campaign began, inflation in the United States has slowed. Despite being at its lowest point in nearly two years in March, inflation of 5% is still well above the Fed’s 2% target.

Bitcoin Price

During the Asian session, Bitcoin bounce-off above the $28,100 level to trade near $28,766 however this level is also not looking very solid today. A breakout of above this level has the potential to lead BTC price toward $29,295

At the moment, Bitcoin is facing considerable resistance near the $29,295 mark. A positive breakthrough above this particular level could propel Bitcoin’s value toward the subsequent target of $29,975. If the upward trend persists, BTC might target the $30,000 mark, which also serves as a psychological barrier.

In the four-hour chart, Bitcoin has slipped below the 50-day exponential moving average, which had earlier acted as a support area around the $28,800 level.

Candlestick patterns currently indicate a strong bearish sentiment in the market, while the RSI and MACD indicators suggest a possible downtrend for Bitcoin’s price today.

Bitcoin may encounter immediate support close to the $27,600 level, as indicated by a trendline on the 4-hour chart. If the price breaks through this crucial $27,600 level, BTC could head towards the next support level at $27,200.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

In addition to Bitcoin, the market offers a variety of promising cryptocurrencies, including emerging altcoins and presale tokens that have the potential for substantial returns.

With this in mind, the Cryptonews Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, each showcasing significant growth potential in both the short and long term.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

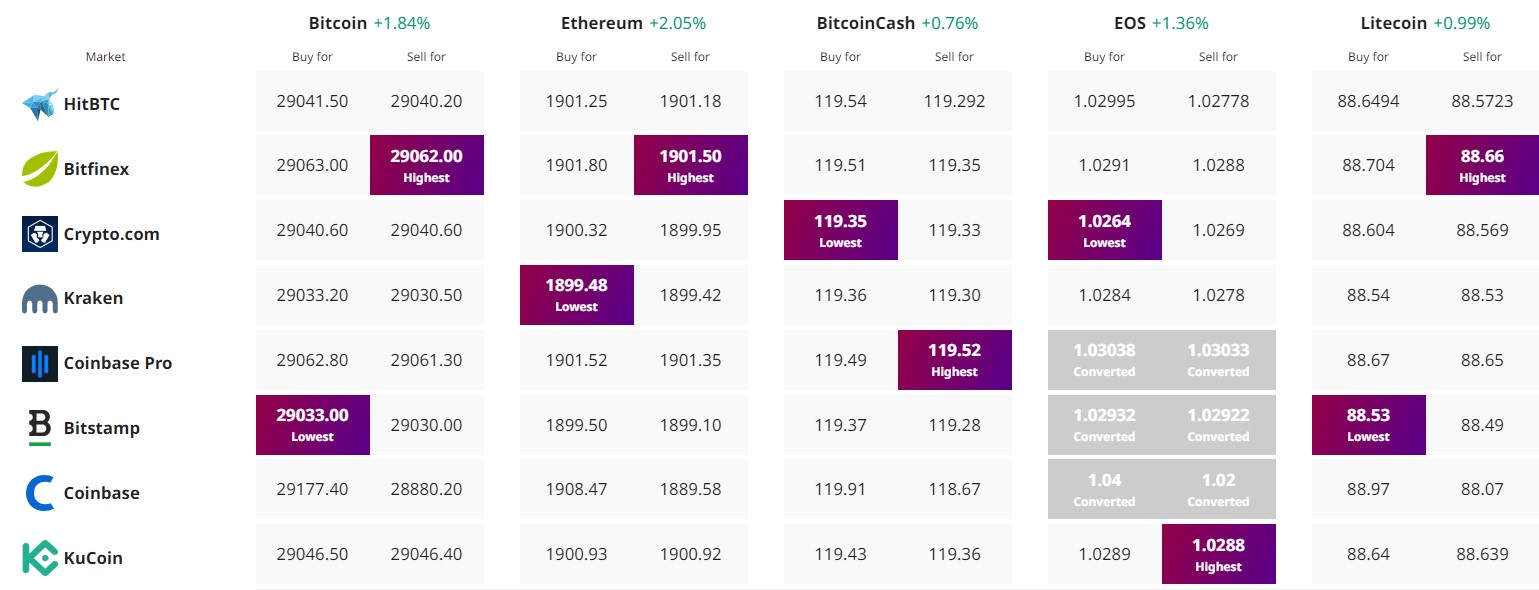

Find The Best Price to Buy/Sell Cryptocurrency