Bitcoin Price Prediction as the Crypto Markets See Huge Selling Volume Coming In – Where is the BTC Bottom?

Amidst the Crypto Markets’ huge selling volume, Bitcoin’s position has been questioned.

Amidst the Crypto Markets’ huge selling volume, Bitcoin’s position has been questioned.

As investors grapple with significant selling pressure, they seek answers: where is the bottom for Bitcoin?

In this Bitcoin price prediction, we delve into market trends and technical indicators to identify potential support levels for BTC and provide insights into its future price movements.

Bitcoin is currently trading at $25,823, with a 24-hour trading volume of $13 billion. With its #1 CoinMarketCap ranking, Bitcoin’s current market cap is $500.9 billion.

Russian Banker Predicts Decline of US Dollar as Global Power Dynamics Shift

The chairman of Russia’s second-largest bank predicts a shift in global currency dynamics, signaling the decline of the US dollar’s dominance.

He says China’s yuan is poised to surpass the dollar as the world’s reserve currency.

He emphasizes that China recognizes the necessity of making the yuan a convertible currency to attain its aspirations of becoming the top global economic power.

He believes that the time has come for China to gradually eliminate currency restrictions, paving the way for wider acceptance of the yuan.

This forecast reflects the chairman’s view on the evolving role of currencies in the global economic landscape.

Andrey Kostin, the chairman of state-controlled VTB bank, has expressed his belief that the era of US dollar dominance is nearing its end.

He attributes this shift to the growing prominence of the Chinese yuan and the widespread acceptance of the effects of Western sanctions, which failed to undermine Russia during the Ukraine crisis.

Kostin acknowledges the negative impact of sanctions on the economy and highlights the changing economic landscape.

He anticipates that while penalties may increase and certain opportunities may close, new possibilities will also emerge.

This perspective reflects Kostin’s assessment of the evolving global financial dynamics.

Economist Peter Schiff Argues that the Fed Ruined the US Banking System

Famous economist Peter Schiff asserts that the American financial system is bankrupt.

He highlights the role of the Federal Reserve in damaging the American banking sector by keeping interest rates near zero, despite the Fed funds rate being 5.25% and the real inflation rate being considerably higher.

Schiff has previously warned of an impending collapse in the American financial sector, which he believes will be even more severe than the 2008 crisis.

Bank of America’s offering of no interest on checking accounts and a meager 0.05% interest on savings accounts is met with criticism by economist Peter Schiff.

He argues that the real inflation rate surpasses the Fed funds rate of 5.25%, highlighting how the Federal Reserve has negatively impacted the American financial system.

Schiff suggests that the system is bankrupt and vulnerable to collapse without government protection.

Schiff further criticized the Federal Reserve’s actions when they saved Silicon Valley Bank and Signature Bank in March, claiming that they are exacerbating inflation rather than resolving it.

He believes that bailing out failed banks increases the banking system’s instability and unfairly spreads current losses through inflation.

Schiff has recently issued warnings about potential problems with the US dollar, economic depressions, and Congress’s suspension of the debt ceiling to avoid a government default.

He argues that ongoing reckless government spending and borrowing will continue until a crisis in sovereign debt and the US dollar brings it to a catastrophic end.

The mention of the SEC filing litigation against Binance Holdings Ltd. has heightened investor concerns, as even minor deals can have a significant impact on the crypto market, particularly during weekends when trading activity is usually lighter.

Bitcoin Price Prediction

Bitcoin is currently priced at $25,777, indicating a 1% increase in the last 24 hours. The surge in Bitcoin’s value during the weekend can be attributed to the weakening of the US dollar.

At present, Bitcoin has formed a bullish candlestick pattern and is hovering around the $25,670 mark.

It may target the next support level at $25,450, and if it breaks below that level, a further decline towards $24,900 could occur.

When examining the technical indicators, both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicate oversold conditions, suggesting a potential easing of selling pressure. It is important to monitor the $25,400 level closely.

A bullish confirmation above this level could trigger a continued rally toward the next resistance level at $26,150, which previously was a support level.

Conversely, if the price closes below $25,400, the bearish momentum may persist, potentially leading to a downward movement toward $24,950.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

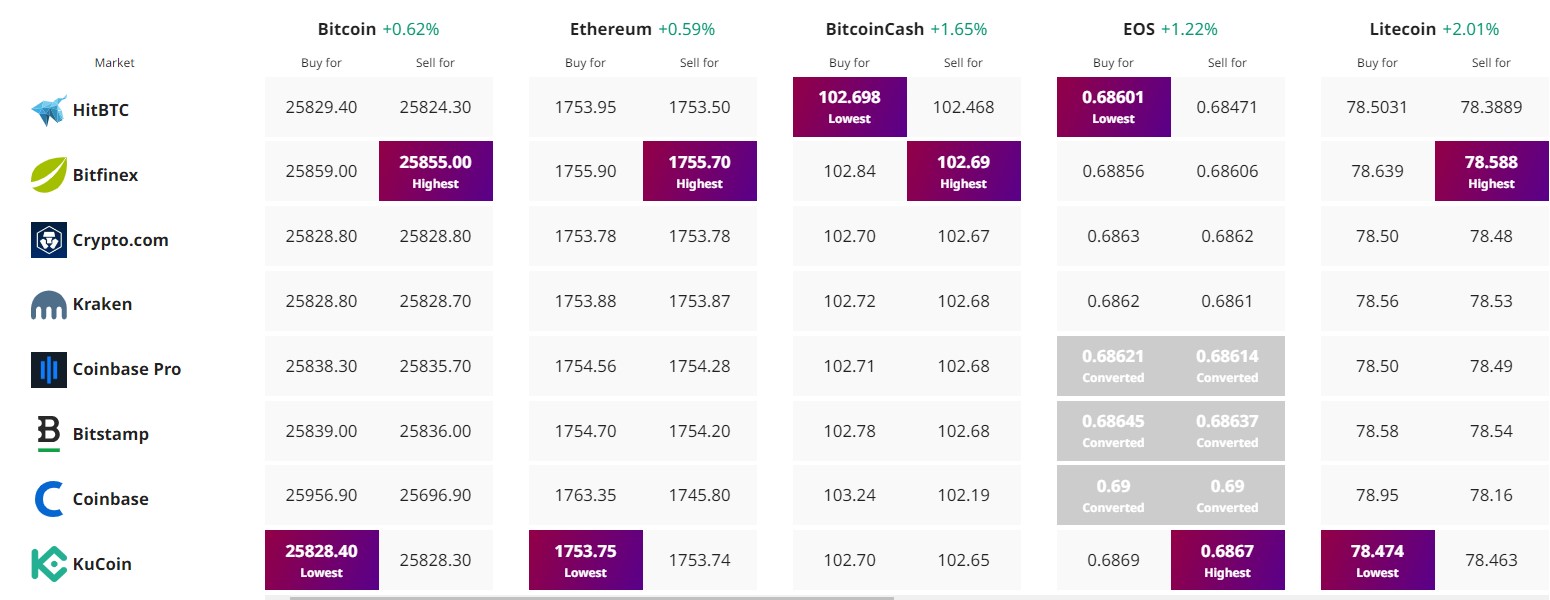

Find The Best Price to Buy/Sell Cryptocurrency