Bitcoin Price Prediction as Rumors Emerge Regarding the US Government and Bitcoin Wallets – What’s Going On?

The crypto community is abuzz with speculation as rumors circulate about the US government’s potential involvement with Bitcoin wallets. These whispers have left many wondering how this development could impact the price of Bitcoin and the overall market.

In this Bitcoin price prediction, we will delve into the origins of these rumors and assess their potential implications on Bitcoin’s value.

Join us as we explore the unfolding narrative surrounding the US government’s rumored connection to Bitcoin wallets and the potential consequences for the world’s leading cryptocurrency.

Arkham Analytics: Unraveling the Mt. Gox, US Gov’t-linked Wallets, and Bitcoin Movement Confusion

Following recent reports from blockchain analytics firm Arkham, it was claimed that wallets associated with the now-defunct crypto exchange Mt. Gox and the US government had transferred substantial amounts of Bitcoin.

Arkham CEO Miguel Morel informed that the wallet activities were not connected, implying that the US was not necessarily responsible for moving or selling Mt. Gox-related assets.

An hour later, Arkham announced on Twitter that the alert was mistakenly sent to a “small subset of users,” including Crypto Twitter user @tier10k, also known as DB.

Arkham explained that a bug fix “related to Bitcoin alerts” in their system led to the error but did not offer further specifics. Late Wednesday, Arkham revised its findings once more.

“We have investigated the DB Alert situation and determined that the Arkham alerts were accurate in this case,” Arkham stated. “DB set two alerts on all Bitcoin transactions above $10k, with no counterparties set, then named the alerts ‘Mt Gox’ and ‘US Gov.'”

The bug fix activated previously set alerts, and “no one received inaccurate alerts.” Arkham also clarified that neither its alerts nor the Twitter attention impacted Bitcoin’s sudden price drop.

Arkham clarified that neither their alerts nor the attention on Twitter had any effect on the sudden dip in the price of Bitcoin. The timing of the alerts and tweets did not correspond to the period of the price drop, indicating that other factors were at play.

As the situation was resolved and it became clear that the wallet movements were not connected and that the US government was not involved in moving or selling Mt. Gox-related assets, any potential negative impact on Bitcoin’s price was minimized.

In the future, accurate information needs to be disseminated quickly to prevent market sentiment from being unduly influenced by misinformation or speculation.

Bitcoin Price

The BTC/USD pair is presently trading at $28,878, showing a 2.50% rise in the last 24 hours. On April 26th, Bitcoin’s value witnessed a steep decline of roughly 8% within just one hour, dropping to $27,242. Nonetheless, BTC/USD managed to recover its momentum due to growing concerns about the vulnerability of the US economy and the banking sector.

At the moment, Bitcoin is facing immediate resistance at the $29,350 mark, which could propel its value toward the subsequent resistance level of $30,000. A surge in Bitcoin demand may potentially trigger a breakout above $30,000, paving the way for more buying opportunities up to the $30,800 level.

In the meantime, both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators point to a bullish outlook for Bitcoin. Furthermore, the 50-day exponential moving average is reinforcing a buying trend around the $27,900 mark.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

In addition to Bitcoin, the market is offering numerous promising cryptocurrencies, including emerging altcoins and presale tokens, which hold the potential for substantial returns.

In response, the Cryptonews Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, each exhibiting strong prospects for both short-term and long-term growth.

This list is continually updated to include new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

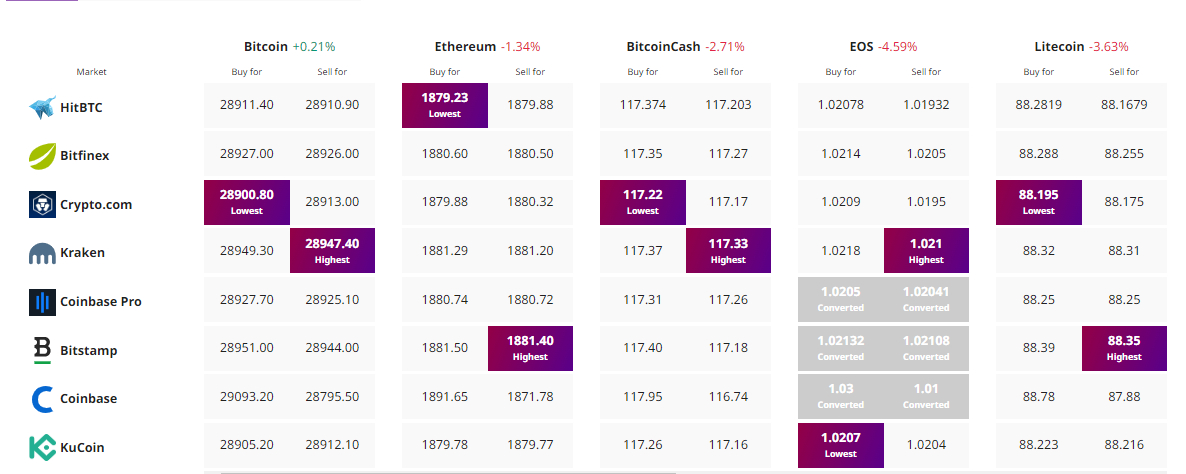

Find The Best Price to Buy/Sell Cryptocurrency