Bitcoin Price Prediction as October Gains Reach 30%: Is 2023’s Bull Market Finally Here?

October witnesses Bitcoin‘s impressive 30% surge, leading many to wonder if the anticipated 2023 bull market has finally arrived. Maintaining stability over the weekend, Bitcoin (BTC) held its ground at $34,000.

The crypto sphere’s Fear & Greed Index, a barometer of investor sentiment, registered a notable 72 on Monday, hinting at prevailing greed in the market.

Consequently, the global cryptocurrency market cap touched $1.26 trillion, reflecting a 24-hour increase of 0.85%. This comes amidst a broader positive sentiment in the crypto realm and an escalating interest from institutional players.

HABIBI WE ARE HITTING $35K IF #Bitcoin BREAKS THE LINE

BITCOIN ALREADY ABOVE $34K THIS IS BULLISH!!!

HOPEFULLY WE BREAK IT AND HIT $35K PRICE RANGE

ETF NEWS COMING?

WHAT YOU THINK LET ME KNOW IN COMMENT SECTION 👇💸 pic.twitter.com/bazq6HV3ao

— Wolf of crypto (@WolfOfCrypto07) October 30, 2023

Bitcoin held steady above the $34,000 mark, driven largely by optimism over the potential approval of Bitcoin Spot ETFs in the United States. This upbeat sentiment was bolstered by the ProShares Bitcoin Strategy ETF (BITO), which had its second-highest trading week, amassing a volume of $1.7 billion.

Additionally, the Grayscale Bitcoin Trust (GBTC) saw substantial trading activity, totaling $800 million.

Spot vs. Futures Bitcoin ETFs:

Spot ETFs hold real Bitcoin, adding legitimacy and attracting institutional investors, while Futures ETFs play the price prediction game through contracts. The choice is yours, but understanding the difference is key in the crypto investment world!… pic.twitter.com/eieJyQq8eT— Hamid (@HaMidOwAiSi3) October 30, 2023

In summary, the crypto market enjoyed a positive weekend, with investors increasingly bullish about Bitcoin and a growing interest in crypto-related investment vehicles.

Global Crypto Outlook & Institutional Growth

The global cryptocurrency market displays promising signs, surpassing $1.3 trillion in total value—a 1.1 percent rise from the previous day. Although the cryptocurrency Fear and Greed Index has seen a slight 4-point dip, it remains in the “greed” territory, standing at 68 out of 100.

Investors are gearing up for the forthcoming Federal Reserve meeting and the US jobs report. The widespread expectation is that the Fed will maintain the existing interest rate, fostering positive sentiment across financial markets, including the cryptocurrency sector.

The percentage of the total cryptocurrency market represented by #Bitcoin has gone over 50% marking the first time since April 20! #cryptocurrency #Bitcoin #CryptoNews #Bitcoinnews #cryptotrading #crypto pic.twitter.com/mH00Ji58XQ

— LitFXMogul 🇪🇸 (@LitFXMogul) October 28, 2023

Notably, institutional interest in Bitcoin is on the rise. In September, Bitcoin-centric products made up 73.3 percent of the market. Their assets under management (AUM) grew by 11.1 percent, totaling $23.2 billion.

Bitcoin’s Weekly Surge & Market Events

Bitcoin (BTC) showcased a stellar week, ending with a notable 15% uptick. Over the weekend, its momentum remained positive, though it stayed under the immediate resistance of $35,000, settling around $34,300.

Concurrently, Ethereum (ETH) trades just above its local support, marked at $1,765.

CRYPTO BREAKING NEWS

US Fed’s FOMC Meet: How Would BTC Price React To Powell Speech. Outcome from the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) meeting scheduled for October 31 and November 1, 2023 could likely ha… check us out @ https://t.co/8dh137aX4R pic.twitter.com/74qx62vKsg— InnovatekMobile (@Neome_com) October 28, 2023

The upcoming week is pivotal for the crypto landscape, underscored by major macroeconomic events. These include the US Federal Reserve (FOMC) meeting, the announcement of the US unemployment rate, job openings, and the non-farm Employment Change.

Such events can sway the crypto market, with alert investors keenly awaiting their implications.

Bitcoin Price Prediction

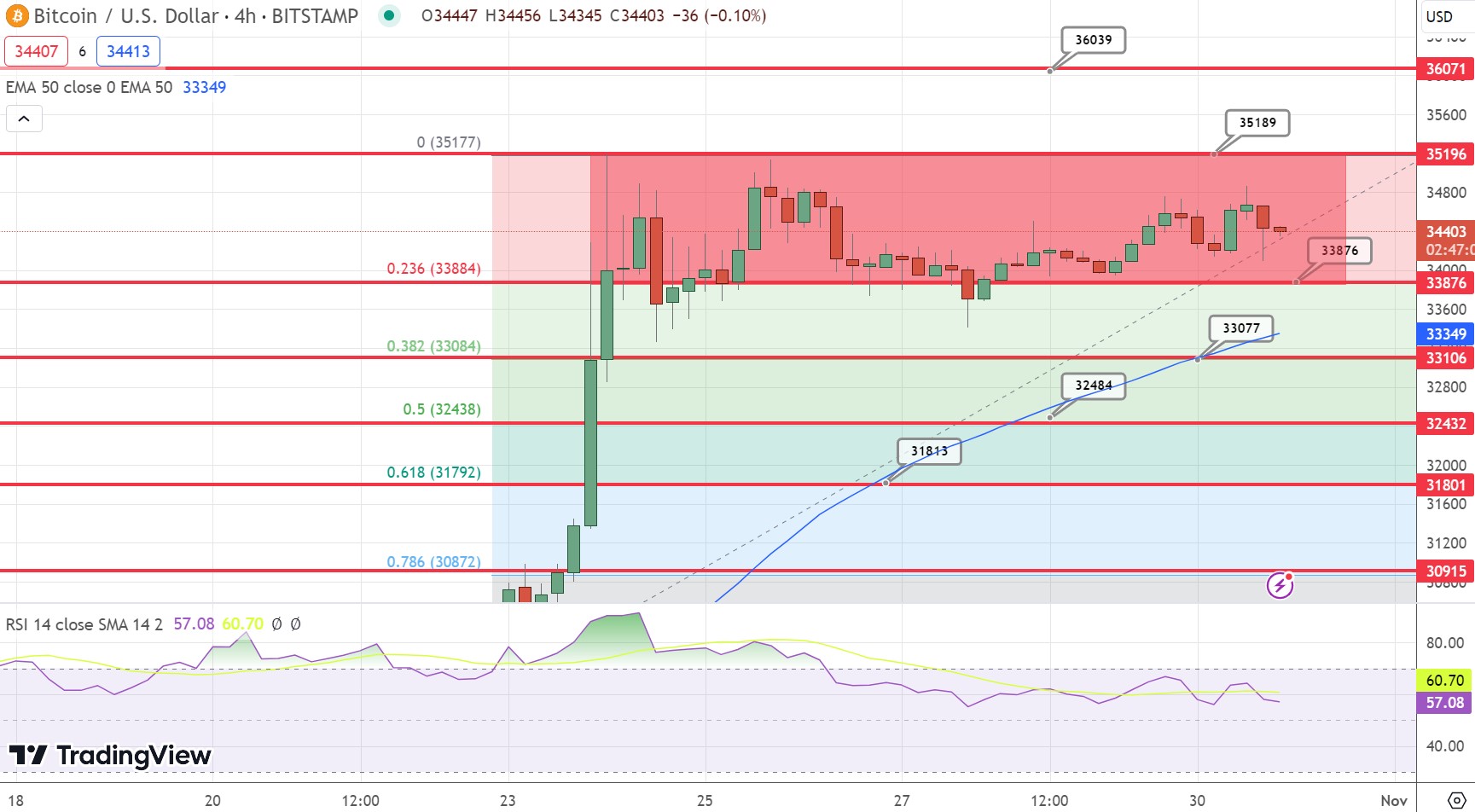

Examining the 4 hourly chart for Bitcoin, the pivot point appears at $33,920, aligning with the 23.6% Fibonacci level. Immediate barriers are at $34,500, then $35,250 and $36,150.

On the flip side, anticipated support is at $33,000, coinciding with the 38.2% Fibonacci level, with subsequent levels at $32,450 and $31,800, which match the 50% and 61.8% Fibonacci marks.

Bitcoin’s graphical trends show strength above a double bottom foundation at $33,450, safeguarded by the 23.6% Fibonacci mark against major declines. There’s an apparent consolidation period, hinting that investors are on the lookout for a decisive move.

To conclude, Bitcoin’s trajectory seems to be upward-trending, especially above $33,900. Dipping below this could hint at a downward shift.

Given the unpredictable nature of cryptocurrencies, it’s vital to weigh technical metrics and market dynamics. Bitcoin might approach the $34,500 barrier in the near future; however, traders should remain alert and base their actions on thorough analysis.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.