Bitcoin Price Prediction as Minor Correction Occurs – Is a Rebound Imminent?

Last updated: December 7, 2023 22:16 EST

. 3 min read

Bitcoin (BTC), the dominant force in the cryptocurrency market, has impressively held its ground, with its price oscillating around the $43,500 level.

This resilience is primarily fueled by a buoyant sentiment pervading the crypto market, drawing on a mix of anticipation and optimism.

#Bitcoin just hit $43K🚨 pic.twitter.com/4aXzjeluvH

— King 100x Gems (@King100xGem) December 7, 2023

Investors are particularly enthused by the prospect of the U.S. Securities and Exchange Commission (SEC) greenlighting Bitcoin Spot ETFs, a move that could substantially alter the crypto landscape. This potential regulatory shift is driving a wave of positive market expectations.

VanEck’s 2024 Bitcoin Forecast: New Highs and ETF Impact

VanEck, a prominent fund manager, foresees Bitcoin (BTC) reaching new all-time highs by November next year, influenced by a favorable outcome in the US elections. They project an influx of $2.4 billion into the crypto market via ETFs in the first quarter of 2024, which could catalyze BTC’s rise.

VanEck also anticipates shifts in the exchange landscape, with Binance potentially losing its top position due to ongoing legal challenges, paving the way for Coinbase’s ascension.

Despite the expected Bitcoin halving, VanEck predicts minimal market impact from this event, foreseeing a possible BTC selloff thereafter. However, they expect a recovery above $48K, maintaining that a drop below $30K in 2024 is unlikely.

BREAKING NEWS 🚨

🇺🇸 VanEck predicts that spot #Bitcoin ETFs will be approved and #BTC will hit a new ATH in 2024 pic.twitter.com/pRF3Ev4Zlf

— BITCOINLFG® (@bitcoinlfgo) December 7, 2023

These predictions by VanEck, including a new BTC high, significant ETF investments post-US elections, and a stable market despite the halving and exchange shifts, could bolster investor confidence, potentially propelling BTC to higher valuations.

SEC’s Bitcoin ETF Decision: Analysts Predict Market Boost

The cryptocurrency community is keenly awaiting the potential approval of Bitcoin Spot ETFs by the SEC, generating significant anticipation in the market. Esteemed Bloomberg analyst Eric Balchunas has been providing expert insights into the regulatory process and its likely timeline.

Market speculation is rife regarding the SEC’s decision date, with January 8th emerging as a key focus for when regular investors might begin trading Bitcoin ETFs.

Legal expert in finance, Scott Johnsson, suggests a launch could happen within one week to two months following approval. Balchunas reinforces this outlook, pointing to the detailed nature of the S-1 filings as indicative of a rapid launch post-approval.

This increasing anticipation of the SEC’s decision on Bitcoin Spot ETFs is creating a buzz in the investment community. Positive indications from regulatory filings and expert analyses are adding to the optimism, which may have a beneficial impact on Bitcoin’s price trajectory.

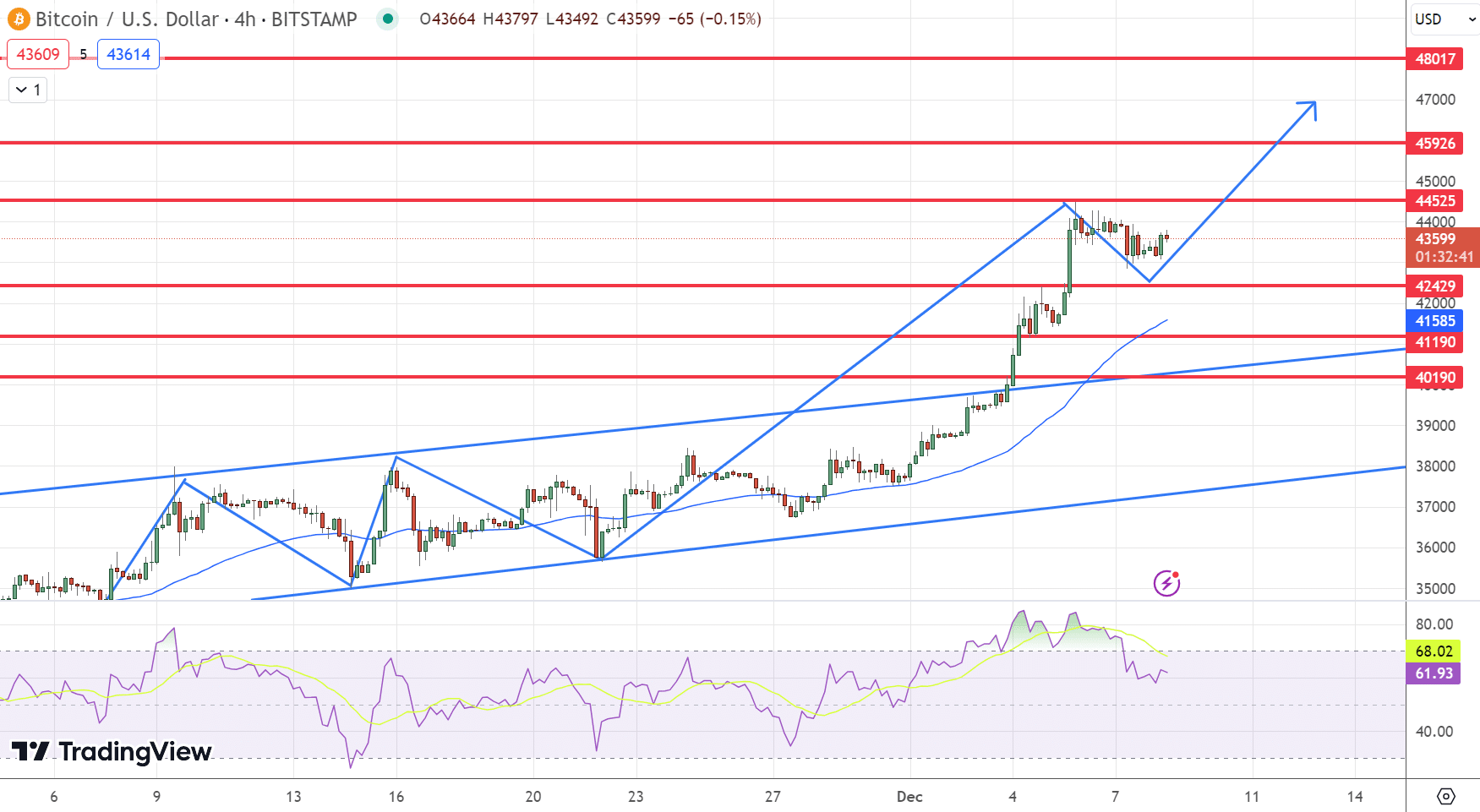

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.