Bitcoin Price Prediction as Bulls Push BTC Back Toward $30,000 – Here Are The Key Levels to Watch

As the market observes the live Bitcoin price at $29,183, it remains closely monitored with a 24-hour trading volume of $11.9 billion.

Continuously updating in real-time, Bitcoin has experienced a slight 0.64% decline over the past 24 hours.

Holding the top spot on CoinMarketCap, its live market cap stands at $567.4 billion, supported by a circulating supply of 19,444,318 BTC coins, out of a maximum supply of 21,000,000 BTC coins.

The ongoing fluctuations have piqued the interest of investors, as they watch key levels and anticipate potential outcomes.

Bitcoin Steady Amidst Major DeFi Exploit, $24M Stolen

Bitcoin remained largely unchanged at the start of the week, unaffected by a significant DeFi exploit that targeted Curve Finance over the weekend.

The attack, involving a bug in smart contracts using the Vyper coding language, resulted in the theft of $24 million from several liquidity pools.

Consequently, the Curve DAO token experienced a sharp decline of over 12% to $0.63, signaling a loss of confidence in decentralized finance (DeFi) according to Ignas Defi Research.

As of now, there is no apparent direct impact on Bitcoin’s price due to the exploit and the resulting sentiment in the DeFi space.

Bitcoin Price Prediction

Bitcoin has displayed a sideways trading pattern, tightly bound between the $29,550 and $29,000 levels. The market’s lack of significant volatility has confined the BTC/USD pair within this narrow range.

However, traders are closely monitoring this situation, as a breakout from this range could signal potential shifts in Bitcoin’s overall trend.

Should a bearish breakout occur below the $29,000 level, BTC might face downward pressure and drop further, possibly testing support levels at $28,600 or extending to $28,200.

Conversely, a bullish breakout above the upper boundary of the range can pave the way for BTC to surge toward the psychologically significant resistance level of $30,000.

A successful breach of this level may trigger more bullish momentum, potentially leading Bitcoin to test the $30,350 mark.

To gain additional insights, analysts are examining the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators. Presently, both indicators are showing positive signals, holding within the buying zone.

Given this information, traders may consider looking for buying opportunities if the BTC/USD price surpasses $29,500, while considering selling positions if the price falls below $29,000.

In summary, Bitcoin’s sideways movement has captured the attention of the trading community, and the outcome of this consolidation period could dictate the next direction for the cryptocurrency’s price.

As market participants closely watch for significant price movements, they remain attentive to crucial support and resistance levels while considering the signals from key technical indicators.

Top 15 Cryptocurrencies to Watch in 2023

Explore our handpicked selection of the top 15 digital assets to keep up-to-date with the latest initial coin offering (ICO) projects and alternative cryptocurrencies.

This carefully curated list has been compiled by industry experts from Industry Talk and Cryptonews, guaranteeing that you receive professional recommendations and valuable insights.

Keep abreast of the ever-changing world of digital assets and uncover the potential of these cryptocurrencies.

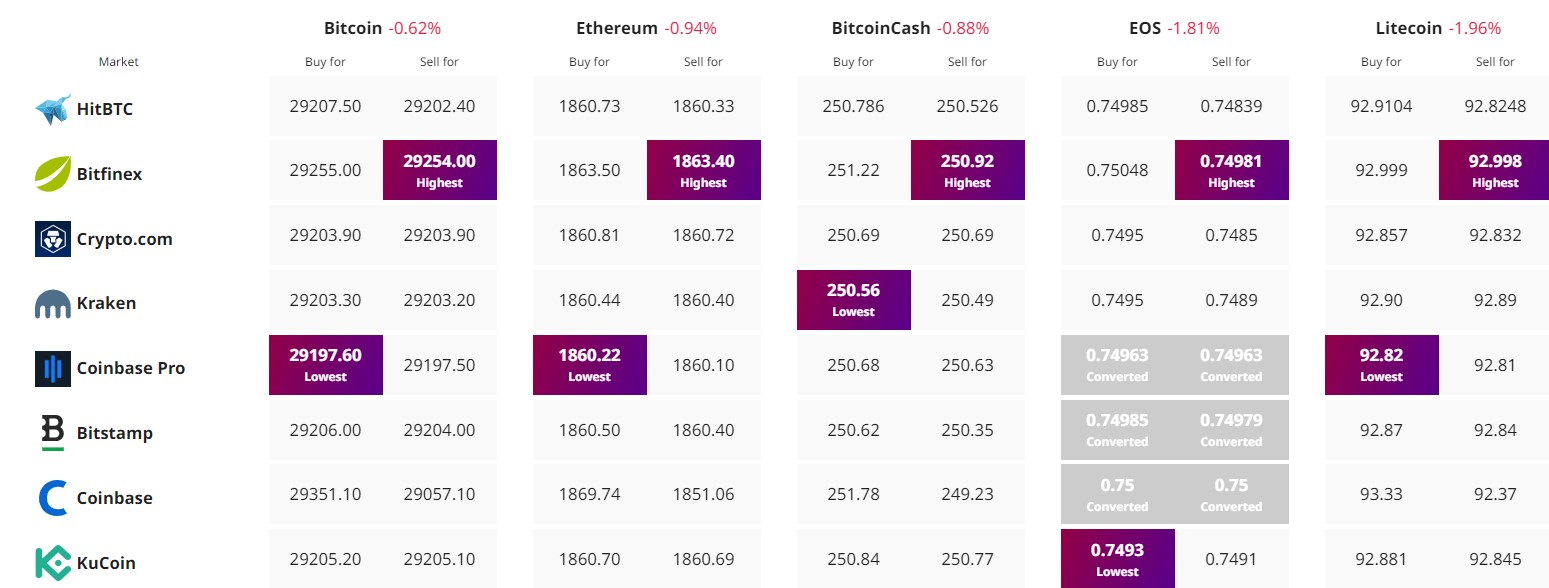

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.