Bitcoin Price Prediction as BTC Slips Under $29,000 Support – Where is the Next BTC Target?

As Bitcoin’s price dips below the $29,000 support level, market observers and investors are keen to forecast the cryptocurrency’s next target. In this Bitcoin price prediction article, we will examine the factors contributing to the recent decline and analyze potential scenarios for BTC’s future trajectory.

Twitter Introduces Live BTC Price Quotes

On April 13, Twitter and the Israeli cryptocurrency exchange eToro announced a new partnership that would enable the trading of equities and cryptocurrencies on social media. When Twitter users see other users tweeting about a cryptocurrency, they can click a button that directs them to the eToro site, where they can execute a transaction for that coin.

Additionally, on Tuesday, April 18, Twitter introduced Bitcoin price quotes on its social media platform, accessible through its search tool. TradingView, a charting application, supplies the price quotes. Notably, only BTC price quotes seem to be available, not those of other major cryptocurrencies.

Furthermore, a disclaimer stating “Your Capital Is At Risk” appears alongside the Bitcoin price chart. Bitcoin accounts for 46% of the global crypto market value, and the BTC/USD pair is anticipated to surge following the collaboration with Twitter. Please write in English language.

CME to Introduce Daily Expirations for Bitcoin Futures Options Contracts

The Chicago Mercantile Exchange (CME) Group stated that it plans to broaden its digital currency options by including more possibilities to its regular and micro-sized Bitcoin and Ether contracts. According to CME Group, this action intends to provide market players with greater precision and flexibility to handle the risk of short-term changes in Bitcoin values.

These new contracts will be accessible beginning May 22 after receiving regulatory approval, and expiries will be available every working day from Monday to Friday. Furthermore, CME Group’s Bitcoin futures and options trading volumes have surged.

It is an advantageous move for BTC/USD that a regulated platform like CME has introduced Bitcoin futures and contracts with daily expiries.

Unchained to Offer Joint Custody Services for Bitcoin

Unchained Capital, an Austin, Texas-based company providing financial services to Bitcoin holders, announced on April 18 that it has secured $60 million in fresh capital to expand its financial services amidst fluctuating markets.

The company plans to utilize the funds to enhance its product offerings, fortify its core suite of financial services, and attract new clients.

Valour Equity Partners, renowned for its early investments in SpaceX and Tesla, spearheaded the Series B funding round. Existing investors, including NYDIG, Trammell Venture Partners, Ecliptic Capital, and Highland Capital Partners, took part in the round, which closed earlier in April. This investment follows the $15 million the firm raised in the fall of the previous year, led by Ten31.

Bitcoin Price

The present Bitcoin price stands at $30,266, with a 24-hour trading volume of $19 billion. Over the past 24 hours, Bitcoin has experienced a 2.30% increase. The BTC/USD pair exhibits a bearish inclination and may encounter immediate support close to the $29,200 level.

A bearish breach below this $29,200 level could potentially drive the BTC/USD price toward $28,750, while a further decline might push BTC down to the $28,230 level.

On the upside, the BTC/USD pair is expected to encounter immediate resistance around $29,800, with further buying potentially driving BTC toward the $30,600 level.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

To stay up-to-date with the latest ICO projects and altcoins, it is recommended to frequently consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

By doing so, you will be better informed about emerging trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

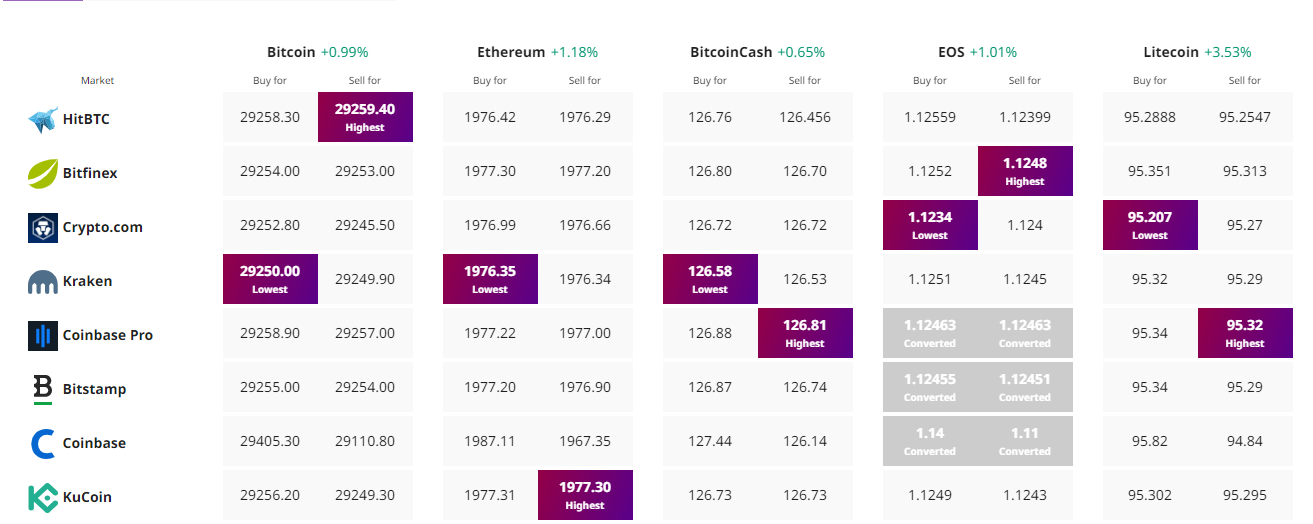

Find The Best Price to Buy/Sell Cryptocurrency