Bitcoin Price Prediction as BTC Rises Above $37,000 Amid Market Optimism – Is the Bull Market Back?

Last updated: December 18, 2023 22:16 EST

. 4 min read

In the ever-evolving landscape of digital currencies, Bitcoin (BTC) has once again taken center stage, breaking past the $37,000 threshold amid a wave of market optimism.

This recent surge is a testament to the cryptocurrency’s enduring appeal, as it edges closer to the pivotal $40,000 mark, potentially reaching its peak for the year 2023.

The global cryptocurrency market cap, now standing at a staggering $1.42 trillion, reflects a 24-hour gain of over 0.50% underscoring the growing investor confidence in this sector.

This bullish trend is further bolstered by Grayscale’s updated Bitcoin ETF plans and a notable ticker change, signaling a positive shift in market dynamics.

$BTC has officially bounced back to the $37K mark today, a positive signal for the market amidst recent FUD related to CZ and Binance.

Altcoins are also showing strong gains, so if you bought them at a lower price, now might be a good time to consider selling some at this price.… pic.twitter.com/Fsn2xlTenO

— BumbleBee 🐝 (@BumbleBee_0x) November 23, 2023

Meanwhile, the Bitcoin network is experiencing a surge in high gas fees, a development that highlights both the increased activity and the challenges within the blockchain ecosystem.

Grayscale’s Revised Bitcoin ETF and Ticker Update Boost Market Sentiment

Grayscale, a leading crypto asset manager, has recently announced a revised version of its Bitcoin exchange-traded fund (ETF) plan, following discussions with the US Securities and Exchange Commission (SEC).

A significant aspect of this update is the proposed change of their Grayscale Bitcoin Trust (GBTC) ticker symbol to BTC.

Update: New Grayscale S-3/Prospectus #Bitcoin ETF filing to convert to $SPX. Right off the bat the biggest update is the plan to change $GBTC ticker to $SPX (which was expected). Skimming through the rest now. https://t.co/HPC23mvLsl pic.twitter.com/AIs2H5BT9z

— TechFocus 🐻🍯 (@TechFocused) November 22, 2023

Bloomberg researcher James Seyffart’s insights suggest that the updated filing indicates ongoing negotiations with the SEC. The revised prospectus notably contains less information about cash orders and omits certain “risk disclosure” pages, directing investors to previous documents for reference.

This development comes in the wake of meetings between Grayscale executives and the SEC’s Division of Trading and Markets. It aligns with broader industry trends, exemplified by BlackRock, another major ETF player, exploring the launch of a Bitcoin ETF and seeking SEC approval.

The announcement of Grayscale’s updated Bitcoin ETF and the anticipated ticker symbol change to BTC are poised to positively influence Bitcoin’s price.

This move is expected to enhance Bitcoin’s accessibility and legitimacy, potentially attracting more institutional investors and bolstering overall market confidence.

Surge in Bitcoin Transaction Fees Raises Questions

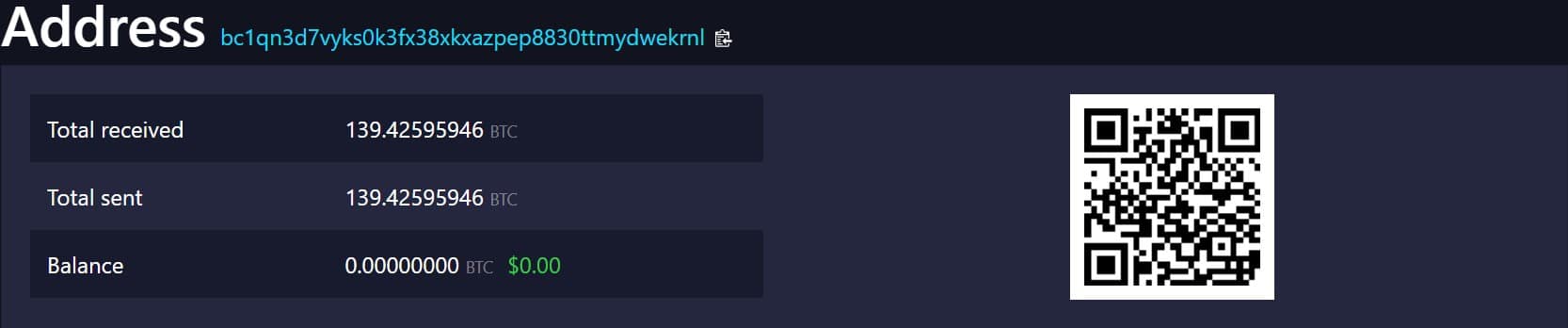

The Bitcoin network is currently experiencing a significant increase in transaction fees. In a striking example, a trader recently paid an exorbitant fee of 83.65 BTC, approximately $3.14 million, for a single transaction.

This occurred during an attempt to transfer 139.42 BTC, valued at $5.23 million, which resulted in the sender receiving only 55.77 BTC after the hefty fee deduction.

This incident, highlighted on Twitter, underscores the unpredictability of Bitcoin’s network fees, which lack a standardized rate. While such extreme fees are rare, their occurrence brings renewed attention to the issue. It remains uncertain whether this is indicative of a larger trend within the network.

Bitcoin (BTC) Gas Skyrocketing as Trader Spends $3.14 Million in Fees#bitcoin #BTC #gas #GAS #tafouio #cryptonews pic.twitter.com/3l7ZaMT92k

— tafou.io (@tafouio) November 23, 2023

Bitcoin’s historically high transaction costs have long been a source of frustration for many users. This issue has been exacerbated recently by the growing popularity of ordinal inscriptions and BRC-20 tokens.

In response, the Lightning Network, a Layer-2 scaling solution, is being developed to reduce fees and increase transaction speeds. The integration of this technology by Coinbase Global Inc has been lauded by Bitcoin proponent Cathie Wood, who views it as a significant step towards broader cryptocurrency adoption.

Consequently, the recent spike in Bitcoin transaction fees and the ongoing development of solutions like the Lightning Network are likely to influence BTC’s price.

These developments could drive demand for more efficient transaction methods within the Bitcoin ecosystem.

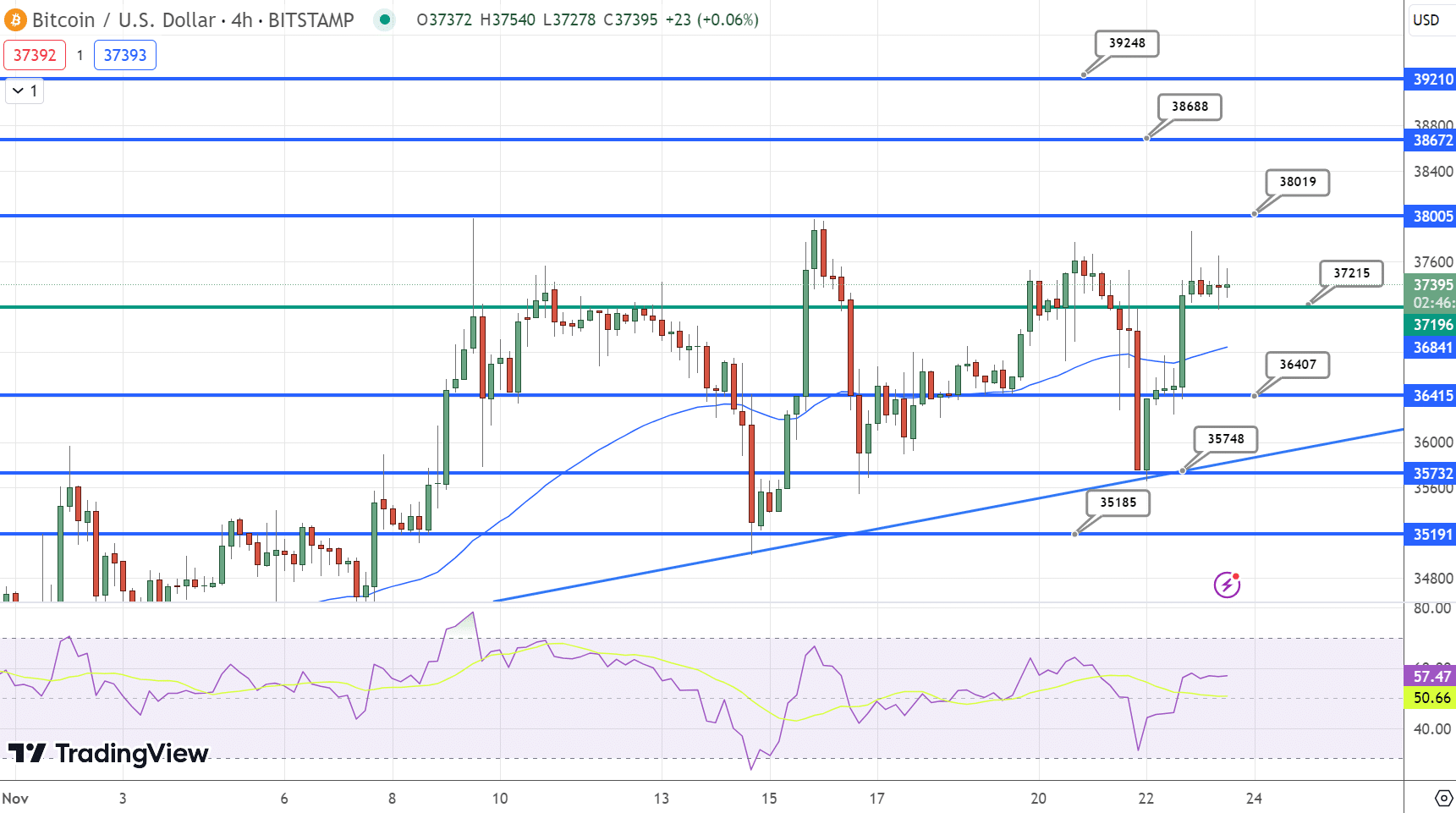

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.