Bitcoin Price Prediction as BTC Rally Intensifies with $20 Billion Trading Volume – Can BTC Reach $30,000 This Week?

Bitcoin, the world’s largest cryptocurrency, has been experiencing an uptick in its price, surging by over 4% in the last few hours. However, the gains in Bitcoin’s price seem to be fading, and it has lost some of its recent increases.

Bitcoin, the world’s largest cryptocurrency, has been experiencing an uptick in its price, surging by over 4% in the last few hours. However, the gains in Bitcoin’s price seem to be fading, and it has lost some of its recent increases.

This could be because some experts, like Gareth Soloway from InTheMoneyStocks.com, predict that Bitcoin will drop to below $13,000, which has had a negative impact on investor sentiment and contributed to the latest modest losses.

At the same time, the future of Bitcoin still appears bright, with experts forecasting a price surge. Balaji Srinivasan, a former Coinbase executive, has bet $2 million that Bitcoin will reach a value of $1 million within 90 days.

Meanwhile, Marshall Beard, the Chief Strategy Officer of US cryptocurrency exchange Gemini, anticipates that Bitcoin will reach $100,000 this year.

Consequently, this positive outlook is considered one of the important factors that may help BTC in limiting its minor losses.

Impact of Jobless Claims and GDP Growth Data on the Cryptocurrency Market

The global cryptocurrency market has gained momentum and experienced a spike in value as fears about a financial crisis have eased, leading to increases in both the crypto market and other market stocks.

Furthermore, investors are awaiting the release of the Personal Consumption Expenditures (PCE) price index, which is the Federal Reserve’s preferred inflation gauge, on Friday.

According to data released on Thursday, jobless claims rose more than expected, and fourth-quarter GDP growth was slightly lower, both indicating a cooling labor market and supporting the case for a softer Fed policy. As a result, the softer Fed policy could lead to a weaker dollar, which may benefit BTC.

Additionally, the cooling labor market and lower GDP growth may lead investors to seek alternative investments such as cryptocurrencies, which could lead to an increase in demand and potentially drive up BTC prices.

In addition to that, the banking instability that began earlier this month raised fears of a broader financial crisis and resulted in a significant shift in the Fed’s monetary policy expectations.

As a consequence, the impact of this news on Bitcoin is uncertain, as it may vary depending on various factors such as investor sentiment, market trends, and macroeconomic conditions.

Bitcoin’s Future Outlook: Mixed Predictions for Bitcoin

Bitcoin (BTC) has performed exceptionally well this year, growing by 70% and currently trading at over $28,400. However, other experts predict that the value of BTC will drop, with Gareth Soloway of InTheMoneyStocks.com anticipating a dip to less than $13,000. This bearish forecast may limit future price increases in Bitcoin.

On the other hand, some experts have optimistic predictions for BTC’s future value, with Balaji Srinivasan betting that it will be worth $1 million within 90 days and Marshall Beard predicting that it will reach $100,000 this year.

Bitcoin Price

The current Bitcoin price is $28,258, with a 24-hour trading volume of $21.4 billion. Bitcoin has lost nearly 0.20% in the previous 24 hours. Bitcoin is ranked first in the market, with a live market cap of $546.3 billion.

Based on technical analysis, the BTC/USD pair is currently exhibiting a volatile trend, with potential resistance expected around the $28,900 mark.

Thus far, the technical outlook remains fairly stable as Bitcoin continues to fluctuate around the $27,900 price level.

If the BTC/USD pair successfully breaks through the resistance level at $28,950, it could result in an increase in Bitcoin’s value, potentially reaching $29,200 or even $30,700.

Conversely, if a downward trend materializes, Bitcoin’s price is expected to find strong support levels around $26,600 and $25,200.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

To stay up-to-date with the latest ICO projects and altcoins, it’s advisable to regularly consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

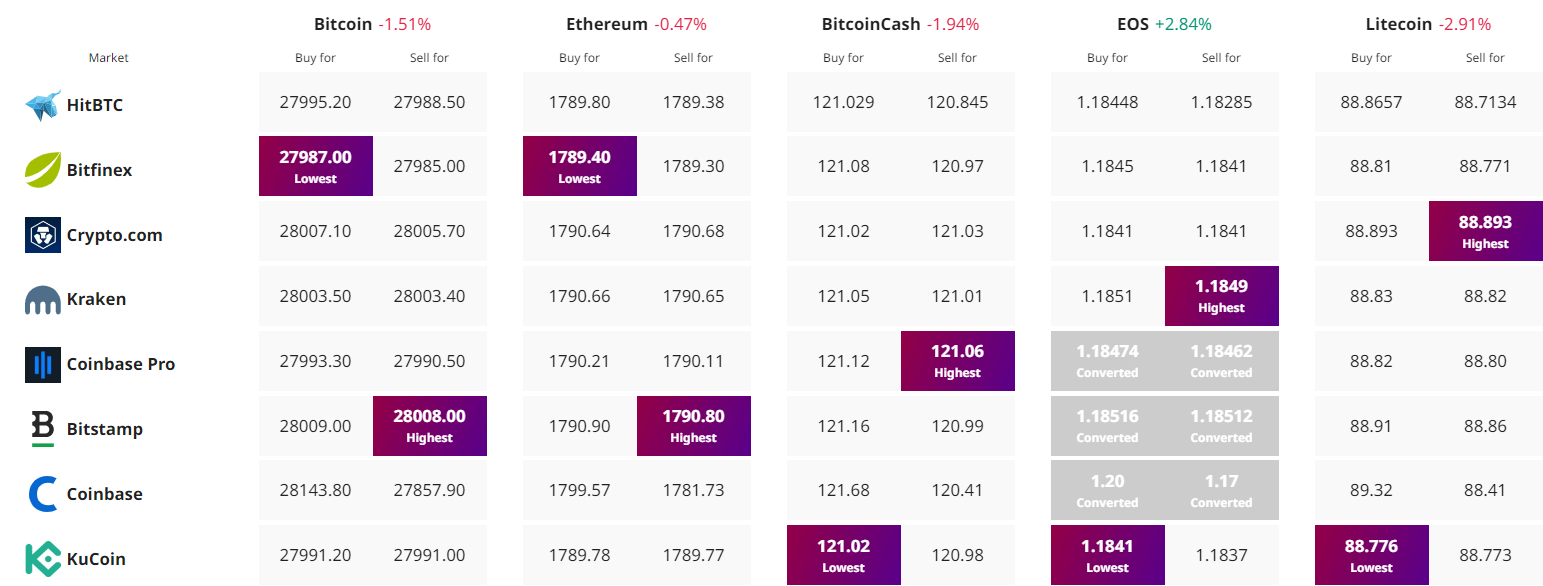

Find The Best Price to Buy/Sell Cryptocurrency