Bitcoin Price Prediction as BTC Falls 6% – Is the Worst Yet to Come?

In the volatile world of cryptocurrency, Bitcoin continues to hold its ground as the foremost digital asset, despite facing a considerable dip recently.

As of today, Bitcoin’s live price hovers around $25,772, exhibiting a modest rise of roughly 0.25% over the past 24 hours. However, this minor uptick does not eclipse the 6% decline the cryptocurrency has experienced in the past week.

With a significant 24-hour trading volume of $12.3 billion, Bitcoin retains its prime position on CoinMarketCap’s rankings at #1.

The currency’s live market cap stands at an impressive $502 million, while its circulating supply nears 19,478,418 BTC, edging closer to its ultimate supply cap of 21,000,000 BTC coins.

Bitcoin’s worst yet to comeBut as BTC takes this momentary tumble, investors and market analysts are left wondering: is the worst yet to come for Bitcoin?

Bitcoin Price Prediction

Bitcoin ‘s price remains in a consolidation phase, maintaining its position just above the $25,500 mark. While there’s potential for a corrective rise, any significant upward movement may face resistance around the $26,200 threshold.

Previous endeavors to surpass the $26,000 resistance haven’t been successful, with Bitcoin lacking the momentum to breach the $26,000 to $26,200 range.

Following these unsuccessful attempts, the cryptocurrency witnessed a bearish pullback, sliding beneath the $25,650 mark. Nevertheless, the resilient bulls have upheld the $25,350 support, allowing Bitcoin to reclaim territory beyond $25,500.

Currently, its trading trajectory lies below both the $26,000 mark and the 100-hourly Simple Moving Average. Furthermore, a prominent bearish trend line has been identified, presenting resistance around $25,950 on BTC/USD’s hourly chart.

The immediate resistance hovers near the $26,000 region, paralleling the trend line and aligning closely with the 23.6% Fibonacci retracement of the significant plunge from the $28,150 apex to the $25,333 nadir.

The first substantial barrier stands at the $26,200 mark. A definitive surge past this resistance could pave the way for a potential rally towards $26,750, adjacent to the 50% Fibonacci retracement of the aforementioned major descent.

Beyond this, a resistance of $27,000 looms, where surpassing could provide the bulls with an opportunity for a consistent ascent, possibly targeting the $28,000 benchmark.

However, should Bitcoin struggle to transcend the $26,000 resistance, a downward trajectory may ensue. Immediate supports are charted around $25,500, followed closely by $25,350.

A decisive descent below the latter might intensify selling pressures, potentially driving the price toward the vicinity of $24,500 or even as low as $24,000.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

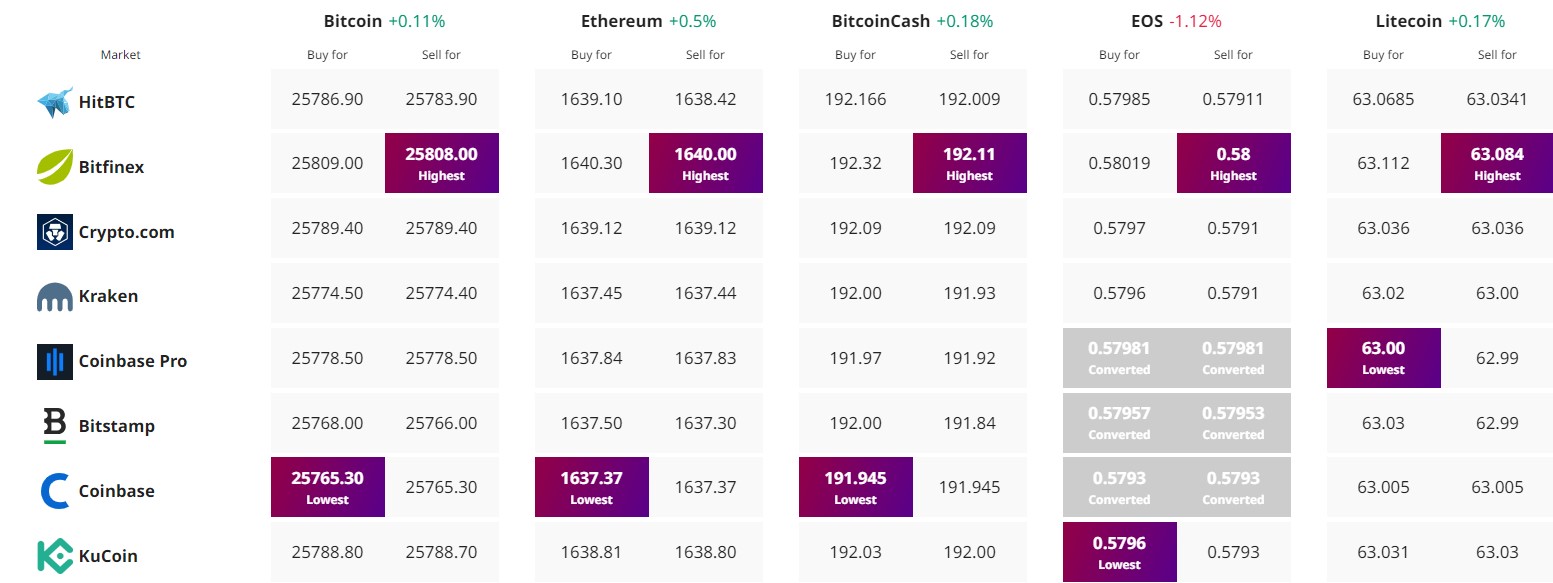

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.