Bitcoin Price Prediction as BTC Blasts Up 15% – Is a New Bull Market Starting

The price of Bitcoin has experienced a remarkable surge, skyrocketing by 15% in recent days.

This significant uptick in value has sparked speculation and excitement among cryptocurrency enthusiasts and investors alike.

Many are now wondering if this surge indicates the start of a new bull market for Bitcoin.

However, it is worth noting that Bitcoin faces a major challenge in breaking above the $31,000 double-top pattern.

Additionally, despite the implementation of new tax rules in Japan, Bitcoin faced some pressure on Monday amid mixed market sentiment.

In this Bitcoin price prediction, we will delve into the factors driving the recent surge, and explore the struggle to break the double-top pattern.

Bitcoin Faces Pressure Despite Japan Implementing New Tax Rules

Japan’s new tax rules exempt self-issued cryptocurrency from unrealized profit taxes, creating a favorable environment for cryptocurrency entrepreneurs. Stakeholders have welcomed this regulatory adaptability.

The recent mini-bull market and increased applications for spot Bitcoin ETFs have driven significant gains for Bitcoin.

Despite market volatility, Bitcoin surpassed the $30K hurdle and maintained its position above it. Japan’s National Tax Agency introduced tax regulations that exempt token issuers from paying corporate taxes on unrealized cryptocurrency gains.

These revisions align with the Japanese government’s earlier approval to eliminate taxes on paper gains for crypto firms that issue and hold tokens.

Discussions regarding new crypto tax rules began in Japan last August as part of broader tax reform for 2023, and the tax authority recently granted final approval.

Under the revised rules, Japanese companies issuing tokens are exempt from the standard 30% corporate tax rate on their holdings, including unrealized gains.

Japan is widely recognized for having one of the most stringent crypto regulatory frameworks globally.

It was among the first countries to legalize cryptocurrencies as private assets. Following the notable incidents involving Mt. Gox and Coincheck, Japan’s financial regulator tightened crypto exchange regulations.

These local regulations facilitate the efficient return of assets to FTX users in Japan after the exchange’s global collapse, providing a clear refund deadline, unlike users in other countries.

Positive Sentiment: The favorable regulatory measures in Japan, including the tax exemptions for token issuers, can generate positive sentiment among cryptocurrency investors and market participants.

This positive sentiment may contribute to increased confidence in Bitcoin and potentially lead to higher demand, positively impacting its price.

First-ever Leveraged Bitcoin Futures ETF approved by the SEC

The Volatility Shares 2X Bitcoin Strategy ETF (BITX), the first leveraged Bitcoin futures exchange-traded fund (ETF), has received approval from the US Securities and Exchange Commission (SEC).

It is expected to commence trading on the Chicago Board Options BZX Exchange on June 27, 2023.

The fund’s investment objective is to achieve returns that are double the return of the CME Bitcoin Futures Daily Roll Index.

ETFs allow investors to gain exposure to securities like stocks and commodities without directly holding them by purchasing shares of the ETF, which pools these securities.

Bitcoin ETFs can be categorized into bitcoin futures and bitcoin spots. BITX, being a leveraged ETF, will utilize Bitcoin futures to amplify the returns of a benchmark index.

While most cryptocurrency supporters have welcomed this development, some have questioned why a straightforward spot ETF was introduced before a 2X leveraged futures offering.

The SEC’s approval of the BITX fund comes as major traditional financial institutions seek to enter the Bitcoin industry. Despite the SEC approving a leveraged Bitcoin ETF, the BTC/USD cryptocurrency remained under pressure on Monday.

Bitcoin Price Prediction

Based on the daily timeframe, BTC/USD is facing strong resistance at the $31,000 level, which is supported by a double-top pattern.

The presence of doji and spinning top candles and this resistance indicate a decrease in bullish sentiment and exhaustion among buyers.

As a result, a minor corrective pullback in Bitcoin’s price is expected.

It is essential to highlight that immediate support for BTC can be found at around $29,600.

If this support level is breached, it could lead to the further downside towards the key support level of $28,250, which aligns with the 50-day exponential moving average.

If a drop is below $28,200, the subsequent support level will likely be around $26,750.

Looking at the relative strength index (RSI) and moving average convergence divergence (MACD), both indicators are currently in the neutral zone, suggesting that Bitcoin is not overbought or oversold.

This further supports the possibility of a corrective move in the near future.

Conversely, if Bitcoin successfully breaks above the $31,000 level, the next target to monitor is approximately $32,500.

If momentum continues, the subsequent target could potentially be around $34,000.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

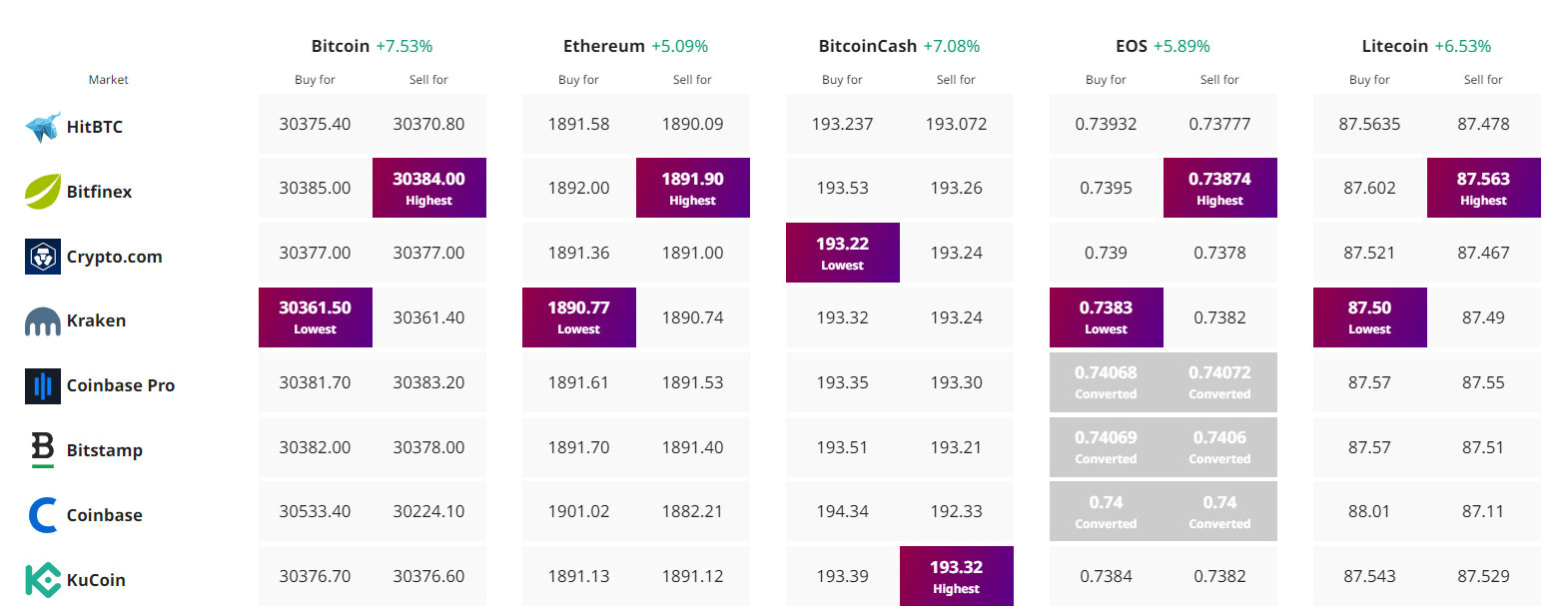

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.