Bitcoin Price Prediction as BTC Blasts Past $30,000 Critical Level – What Happens Next?

Bitcoin’s meteoric rise continues to captivate the financial world as the leading cryptocurrency has recently blasted past the critical $30,000 milestone. With this unprecedented surge in value, crypto enthusiasts are keenly watching the market, seeking to predict the future of Bitcoin.

As the digital asset’s price trajectory defies traditional market analysis, we delve into the factors driving its growth, explore the potential risks and rewards, and attempt to forecast Bitcoin’s next moves in this rapidly evolving landscape.

Key Fundamentals Driving BTC Prices

In the US, 236,000 more jobs were added than anticipated in the nonfarm payroll establishment survey, exceeding expectations of 230,000. Moreover, wage growth has persisted at a rate that deviates from a 2% inflation rate.

Investor Focus Shifts to Inflation and Upcoming CPI Report

Investor attention now shifts from the job market to inflation, with the CPI report scheduled for Wednesday, April 12. This report is one of the most critical economic data points ahead of the US Federal Reserve’s meeting.

Several market experts believe the meeting will signal the end of the central bank’s long cycle of rate hikes.

US Inflation Shows Signs of Slowing Down

Inflation in the US decreased to 0.4% in February from 0.5% the previous month and 6% annually from 6.4% the month before. However, the upcoming data will likely reveal a significant increase, as core CPI might have grown higher than headline CPI for the first time in a long time.

US Dollar Index Drops Amid Strong Labor Market

Nevertheless, the US Dollar Index (DXY) declined by 0.19% to 102.05. The US Dollar took a break after its largest month-to-date gain against major rivals, as a robust US labor market bolstered the need for a Fed rate hike next month.

Bitcoin Rises as Traders Anticipate Fed’s Response to CPI Report

Bitcoin’s value increases as traders discuss whether the Fed will change course after the crucial CPI report. If the data indicates that inflation is declining, this might be the next potential trigger for the upward movement of BTC/USD.

Impact of Fed Rate Hikes on Bitcoin Prices

According to the CME FedWatch Tool, the market expects a 71% probability of the Fed raising rates by 25 basis points at its May meeting. A tighter labor market may be responsible for this, giving the Fed reason to continue raising interest rates in the future.

However, these odds are highly flexible and quickly react to any new macro data releases, such as CPI. A decline in headline CPI could increase the possibility of a shift in Fed policy towards dovishness. Conversely, persistent inflationary pressures would encourage markets to predict further interest rate hikes in May.

Furthermore, the upcoming Fed minutes expected on Wednesday will be another significant trigger for the BTC/USD exchange rate. These minutes will illuminate what Fed officials discussed last week and what to expect.

Crypto-Related Stocks Rises

Stocks of companies with significant ties to cryptocurrencies are experiencing notable gains, including Marathon Digital (MARA), Coinbase (COIN), which grew by more than 7%, and MicroStrategy (MSTR), which increased by over 7.5%.

Additionally, Monday’s highest percentage of stock increases belong to Bitcoin miners. Besides Marathon Digital’s 12% gain, other Bitcoin miners such as Riot Blockchain (RIOT) and Hut 8 Mining (HUT) are up 13% and 10%, respectively.

The crypto-related stocks soar as BTC/USD reaches its highest level since June 2022.

Bitcoin Price

The current live Bitcoin price stands at $30,257, with a 24-hour trading volume of $20.8 billion. Bitcoin has risen 3.50% in the last 24 hours. It holds the #1 position on CoinMarketCap, with a live market capitalization of $585 billion.

From a technical analysis perspective, the BTC/USD pair displays a definite bullish trend at the $30,000 milestone. If this level is overcome, resistance may be encountered at $30,000 before the BTC price advances toward $31,000 or possibly even $32,250.

Conversely, Bitcoin’s support continues to hold steady around the $28,900 mark.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

To stay up-to-date with the latest ICO projects and altcoins, it is advisable to regularly consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

Doing so will help you remain well-informed about emerging trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

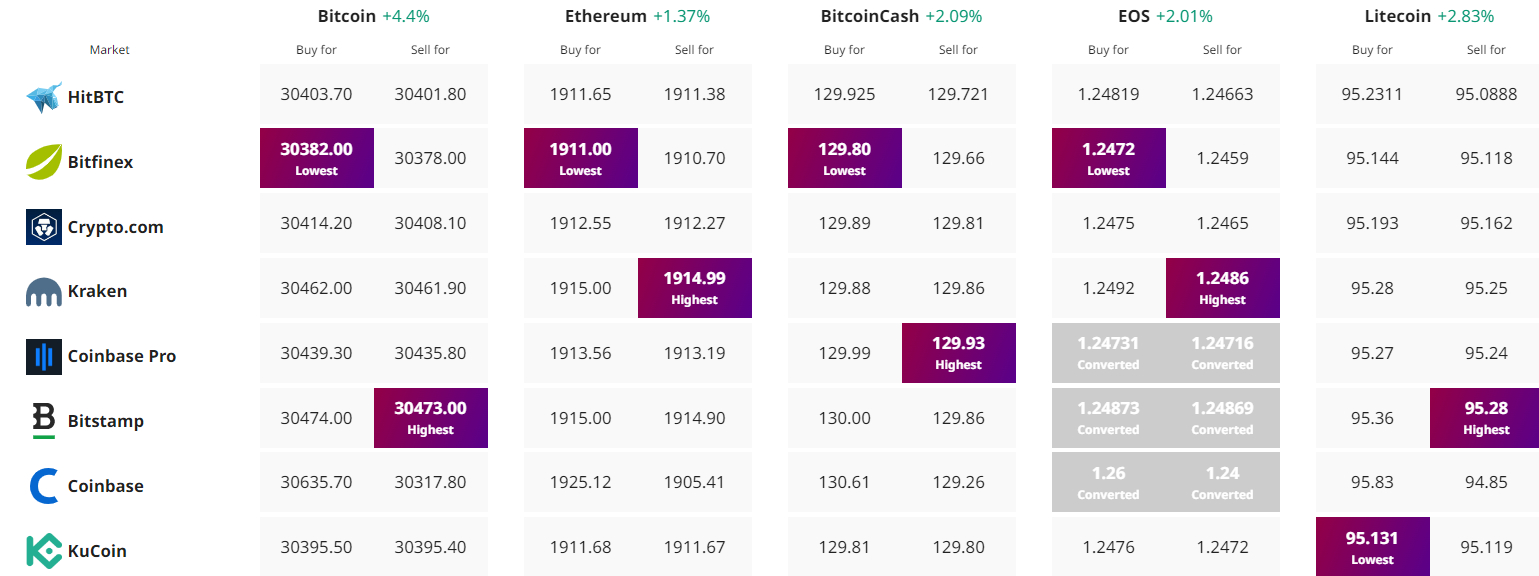

Find The Best Price to Buy/Sell Cryptocurrency