Bitcoin Price and Ethereum Prediction: BTC Finds Support at $24,000, Will There Be a Bullish Rally?

The cryptocurrency market has been experiencing some fluctuations recently, with Bitcoin and Ethereum, the two most widely used cryptocurrencies, facing a slowdown. Bitcoin is currently being traded at $24,000, experiencing a slight drop from the previous day due to concerns over market liquidity.

The cryptocurrency market has been experiencing some fluctuations recently, with Bitcoin and Ethereum, the two most widely used cryptocurrencies, facing a slowdown. Bitcoin is currently being traded at $24,000, experiencing a slight drop from the previous day due to concerns over market liquidity.

Similarly, Ethereum has seen a 3% decline in the past 24 hours and is currently trading at $1,600.

The cryptocurrency market has recently experienced some ups and downs, with the two most widely used cryptocurrencies, Bitcoin and Ethereum, facing a slowdown.

Additionally, other popular cryptocurrencies such as Dogecoin, Solana, Ripple, and Litecoin have all lost ground.

However, the declines were driven by ongoing concerns about Credit Suisse, a bank in Europe that is facing challenges. Investors are worried that this could lead to a banking crisis, which could affect Bitcoin prices in the short term.

Bitcoin Drops to $24,000 as Crypto Market Faces Downward Stance Amidst Signature Bank Closure

Bitcoin’s price has experienced a significant decline, and the cryptocurrency market has been generally downward lately. Along with the decrease in Bitcoin’s value, there has been some news about the closure of Signature Bank.

Some investors were concerned that the closure might be related to cryptocurrency, which could have further impacted the market. However, the New York Department of Financial Services (NYDFS) has clarified that the closure is not linked to cryptocurrency.

The New York Department of Financial Services (NYDFS) has reassured investors that the recent closure of Signature Bank is not related to any cryptocurrency concerns.

Nevertheless, the cryptocurrency market has been struggling, with Bitcoin’s value experiencing a significant drop. Investors are monitoring the situation closely, but the market appears to be facing challenges in the short term.

US PPI and Economic Uncertainty Weigh on BTC

The recent US Producer Price Index data has been positive, but investors remain cautious due to concerns about global banks and the overall state of the economy. Despite a brief spike in value, Bitcoin and other cryptocurrencies experienced a price decline.

This downward trend can be attributed to several factors, including ongoing troubles with global banks, particularly concerns surrounding Credit Suisse, which has raised worries about market liquidity. As a result, some investors are becoming uneasy and selling their holdings, leading to a drop in the value of cryptocurrencies such as Bitcoin.

Furthermore, the macroeconomic environment remains sluggish, and economic uncertainty and banking concerns have created a cautious trading atmosphere. As a result, investors are becoming more careful about where they invest their money, which is contributing to the downward trend of Bitcoin and other cryptocurrencies.

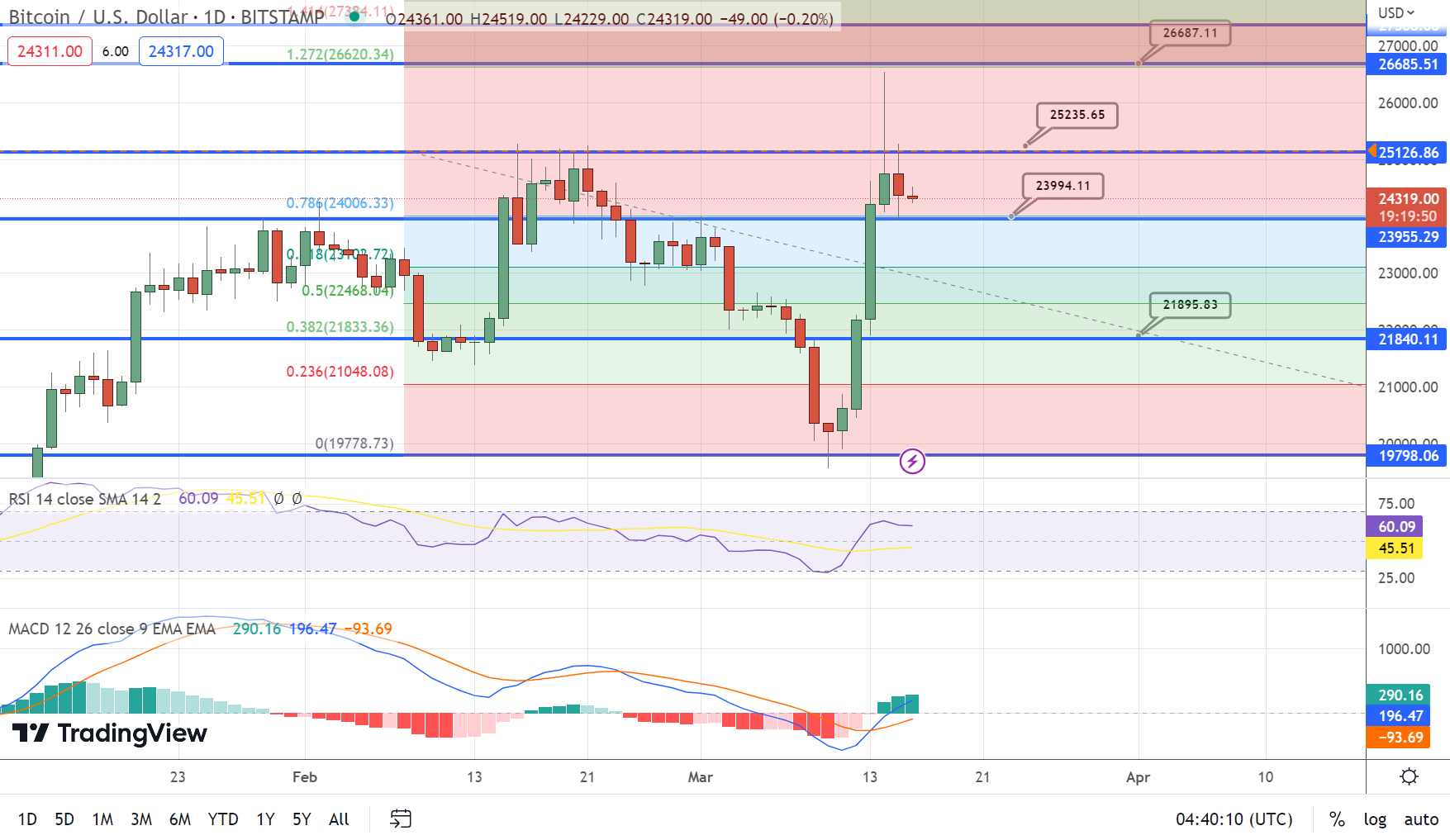

Bitcoin Price

Following a brief consolidation at $26,500, the Bitcoin price has experienced a sharp decline. As a result, it has been on a short-term negative trend since it broke below the $25,000 and $25,500 support levels.

If the price can close over $25,200, it may trigger a new uptrend above $26,000, with a critical resistance level at the $26,500 zone. If $26,000 is broken, $27,500 might not be far behind.

Yet, Bitcoin could see another dip if it cannot break through the $25,200 resistance level.

Currently, $24,000 is providing near-term support on the downside, with the $23,500 area and the 100-hourly simple moving average providing additional, more substantial support not far behind.

Whenever the price drops below $22,600, the selling pressure is likely to increase. If losses persist, the price might drop below $22,000.

Buy BTC Now

Ethereum Price

After breaking through the $1,600 barrier, Ethereum’s price began a significant ascent. For ETH to advance even farther into a positive zone, comparable to bitcoin, it had to break through the crucial $1,700 barrier zone.

The price finally broke through the $1,745 barrier and was trading toward $1,800. A peak was established close to $1,784, and then there was a retracement to the negative.

If Ethereum can’t break through $1,745, we could see another drop. In the short term, the trend line and the $1,695 price point will provide as early support for the market.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s curated list of the top 15 altcoins to watch in 2023. The list is frequently updated with new ICO projects and altcoins, so make sure to visit often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

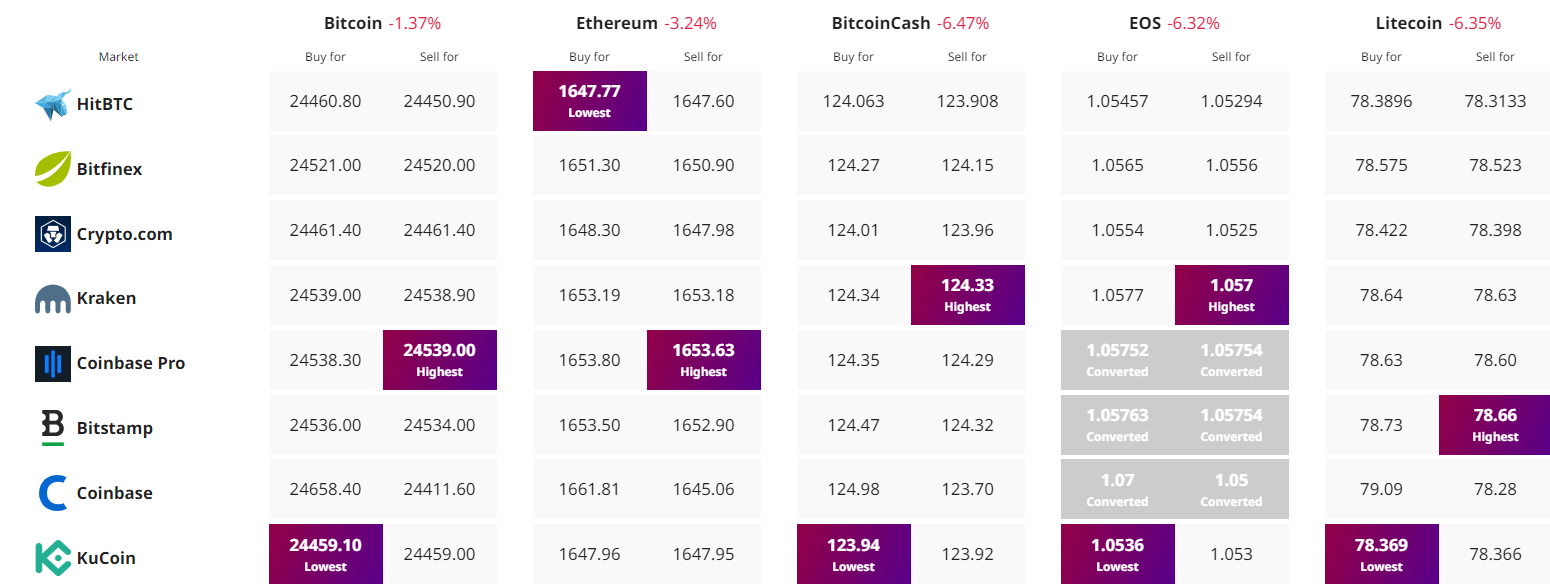

Find The Best Price to Buy/Sell Cryptocurrency