Bitcoin Price and Ethereum Prediction: BTC and ETH Surge Over 25% in Seven Days, How High Can They Go?

Bitcoin (BTC) and Ethereum (ETH) have seen significant price surges in the last seven days, with Bitcoin soaring by more than 35% and Ethereum by more than 25%. This boost in the crypto market has sparked the interest of investors, who want to know how far these cryptocurrencies can go.

The considerable increase in the value of Bitcoin can be attributed to actions aimed at improving the financial system. Moreover, increased investor optimism in the potential of the US decreasing interest rates later this year has also played a role in supporting Bitcoin’s gains.

Ethereum, ranked as the second-biggest cryptocurrency in terms of market capitalization, has witnessed a substantial rise in its value. Presently, it is being traded at $1,809.90, with a 24-hour trading volume amounting to $12,940,582,584. This upswing in ETH’s price indicates a bullish trend in the cryptocurrency market.

As of now in 2023, Bitcoin’s value has increased by an impressive 55%, which is quite a feat for such a short time. The current global crypto market capitalization has reached $1.17 trillion, which shows a 5.41% increase from the previous day.

Regulators Urge Credit Suisse and UBS to Merge, Bitcoin Prices Rise as Investors Seek Safe Haven

Credit Suisse Group AG is facing a critical weekend as authorities urge the failing Swiss lender to consider a merger with rival bank UBS AG. However, both banks have shown an unwillingness to merge, and the regulators do not have the power to force the merger.

It’s worth noting that over the weekend, Credit Suisse CFO Dixit Joshi and his team will gather to discuss potential futures for the firm from a strategic perspective.

The global financial market has been influenced by this news, which has sparked concerns about the health of the banking industry worldwide, and in Switzerland in particular.

There has been a flight to safety into commodities like gold and cryptocurrencies like Bitcoin as investors become more concerned about the current market environment.

A result is a significant rise in the value of Bitcoin, the cryptocurrency widely regarded as the digital equivalent of gold. It’s important to remember that this development probably won’t have a lasting effect on Bitcoin prices or the cryptocurrency market as a whole.

US Dollar Falls as Investors Seek Safe-Haven Assets like Bitcoin Amid Economic Uncertainty

The broad-based US dollar failed to stop its previous declines and dropped further as investors worried about contagion and recession after Credit Suisse and First Republic Bank’s shares tumbled.

It is worth noting that the fear of contagion caused US banks to seek a record $153 billion in emergency liquidity from the Federal Reserve. Unfortunately, the $54 billion loan for Credit Suisse and the $30 billion lifeline for First Republic did not stop their stock declines.

As investors become more concerned about the stability of the existing financial system, they are turning to alternative safe-haven assets like Bitcoin. This underscores Bitcoin’s role as a hedge against market uncertainty and volatility, particularly during times of economic instability.

Hong Kong Emerges as Global Crypto Hub, Boosting Bitcoin Adoption

Hong Kong is rapidly emerging as a crypto powerhouse, as its cryptocurrency-friendly policies continue to draw attention from global businesses in the industry.

In recent news, Signum Digital’s security token offering (STO) and subscription platform received approval in principle from the Hong Kong Securities and Futures Commission (SFC), highlighting Hong Kong’s potential to be a leading destination for crypto-related businesses.

These developments are likely to have a positive impact on the price of Bitcoin, as more businesses flock to Hong Kong, the demand for the cryptocurrency is likely to increase.

Additionally, the growing popularity of security tokens, which are built on blockchain technology and represent ownership of tangible assets, is expected to boost the adoption of cryptocurrencies, particularly Bitcoin.

Bitcoin Price

After a brief consolidation of around $26,500, Bitcoin’s price has experienced a sharp drop, leading to a short-term negative trend since it fell below the $25,000 and $25,500 support levels.

On Saturday, the BTC/USD pair is trading with a strong bullish bias and is encountering immediate resistance near the $27,750 level. Should there be a bullish breakout above the $27,750 level, it could propel the Bitcoin price toward the $30,750 milestone.

However, if it fails to surpass the $27,750 level, a sell-off may occur, potentially pushing the price down to $25,200 or even $23,020.

Buy BTC Now

Ethereum Price

On Saturday, the ETH/USD pair is trading with a strong bullish bias, as it has formed bullish engulfing candles which are supporting a buying trend. On the upside, the ETH/USD pair has surpassed the 1,795 level and is likely to face immediate resistance at the $1,900 mark.

On the lower side, the ETH/USD pair is likely to gain immediate support at either the $1,700 or $1,620 level.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s curated list of the top 15 altcoins to watch in 2023. The list is frequently updated with new ICO projects and altcoins, so make sure to visit often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

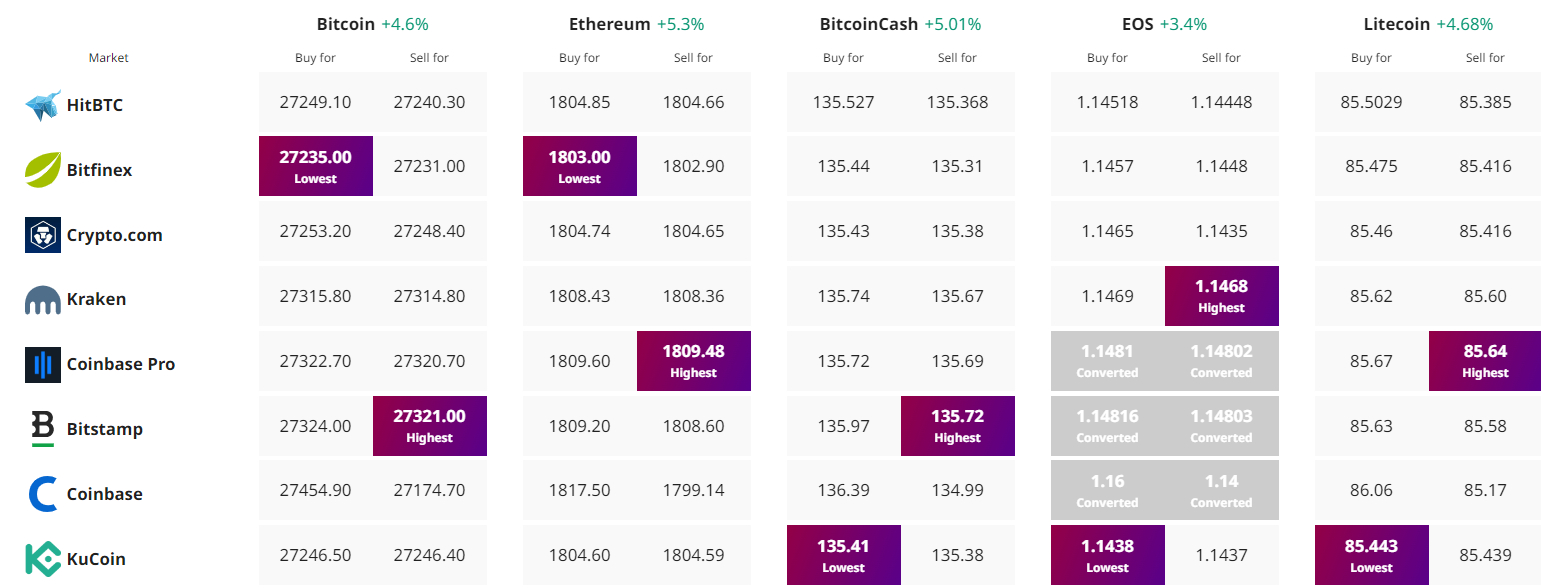

Find The Best Price to Buy/Sell Cryptocurrency