Bitcoin Price and Ethereum Prediction: A Packed Week Ahead – Potential Breakout Catalysts for BTC and ETH

Bitcoin (BTC), the world’s largest cryptocurrency, has gained popularity and experienced a spike in recent days, hitting over $28,000, a 22 percent increase this month and a 65 percent increase since the beginning of the year. Meanwhile, Ethereum (ETH), the second largest cryptocurrency, has been strongly bid around the $1,750 mark.

However, the reason for their winning streak might be tied to the ongoing US banking crisis, which has prompted some customers to lose faith in traditional banks and turn to crypto trading instead. This is evidenced by the strong price rally of Bitcoin.

It’s worth noting that approximately $100 billion was withdrawn from deposits in the week ending March 15.

Despite this, the cryptocurrency market has maintained a value of over $1.16 trillion and continues to be an attractive investment option.

US Banking Crisis Causes Customers to Turn to Bitcoin

The ongoing US banking crisis has caused many customers to lose faith in traditional banks and turn to crypto trading instead. It’s worth mentioning that the deposit of US banks fell significantly from March 8 to March 15 due to worries of a banking collapse.

Meanwhile, Bitcoin has risen 35% in the last two weeks, reaching as high as $28k. This indicates that consumers are shifting their savings from banks to cryptocurrencies.

Bitcoin: The Emerging Alternative to the US Dollar

However, the rise in BTC prices is because many Americans, including institutional investors, have been buying Bitcoin in large quantities recently, believing that Bitcoin will eventually replace the US dollar as the world’s reserve currency.

This can be attributed to the fact that the value of the dollar tends to decrease during times of financial crisis. Hence, Bitcoin seems to be a popular choice for investors when things are uncertain.

Global Banking Sector in the Spotlight: Traders and Authorities on Alert

Moving on, traders and authorities are keeping a careful eye on the global banking sector after the sudden collapse of two US lenders and the rescue of Swiss bank Credit Suisse. This has prompted concern, resulting in a drop in global financial equities. Despite the authorities’ assurances, investors remain wary, and the Fed is keeping a careful eye on the situation.

The broad-based US dollar managed to recover some of its ground was up on Monday, indicating investor confidence in the currency.

Meanwhile, the price of Bitcoin remains unaffected by changes in the traditional financial system. Bitcoin’s price is constantly rising as investors seek safe-haven assets.

Core PCE Price Index: A Key Inflation Indicator for Investors and the Fed

Moving forward, the cryptocurrency market may be impacted by upcoming risk factors, since there isn’t much on the economic calendar.

Investors will pay special attention to the Core Personal Consumption Expenditure (PCE) Price Index, which is the Federal Reserve’s preferred inflation indicator. If the inflation figures are robust, the US dollar may rebound.

Bitcoin Price

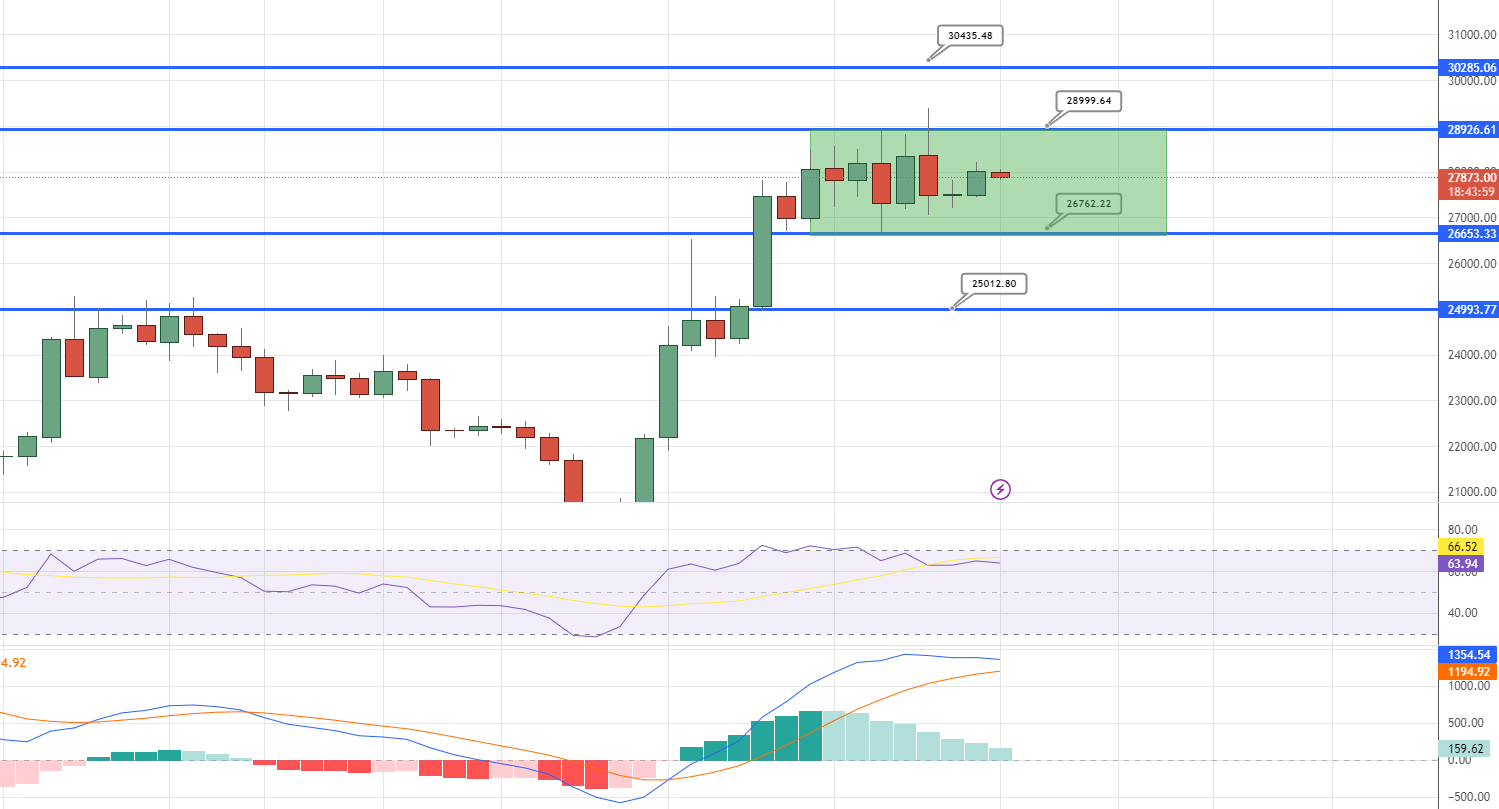

The current price of Bitcoin is $27,800, with a 24-hour trading volume of $14.3 billion. Bitcoin has increased by 1.5% in the past 24 hours.

According to technical analysis, the BTC/USD pair is exhibiting a bullish trend at present. However, it could face some resistance when it reaches the $28,950 level.

If Bitcoin succeeds in surpassing the resistance level of $28,950, it could potentially drive its value higher to $29,200 or even $30,700.

However, if a bearish trend emerges, the support levels of around $26,600 and $25,200 are expected to offer significant support.

Buy BTC Now

Ethereum Price

At present, the live Ethereum price stands at $1,760, with a 24-hour trading volume of $7.1 billion. In the last 24 hours, Ethereum has recorded a gain of 1%. Presently, Ethereum is facing difficulty in surpassing the resistance level of $1,800 and is trading consistently near the support zone of $1,700.

If the ETH/USD pair successfully breaches the $1,800 level, it is anticipated to face resistance at the $1,900 mark.

It is anticipated that support levels for the ETH/USD pair will be found at either $1,700 or $1,620.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself informed about the latest ICO projects and altcoins by frequently referring to the handpicked selection of the 15 most promising cryptocurrencies to monitor in 2023, which has been suggested by the specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

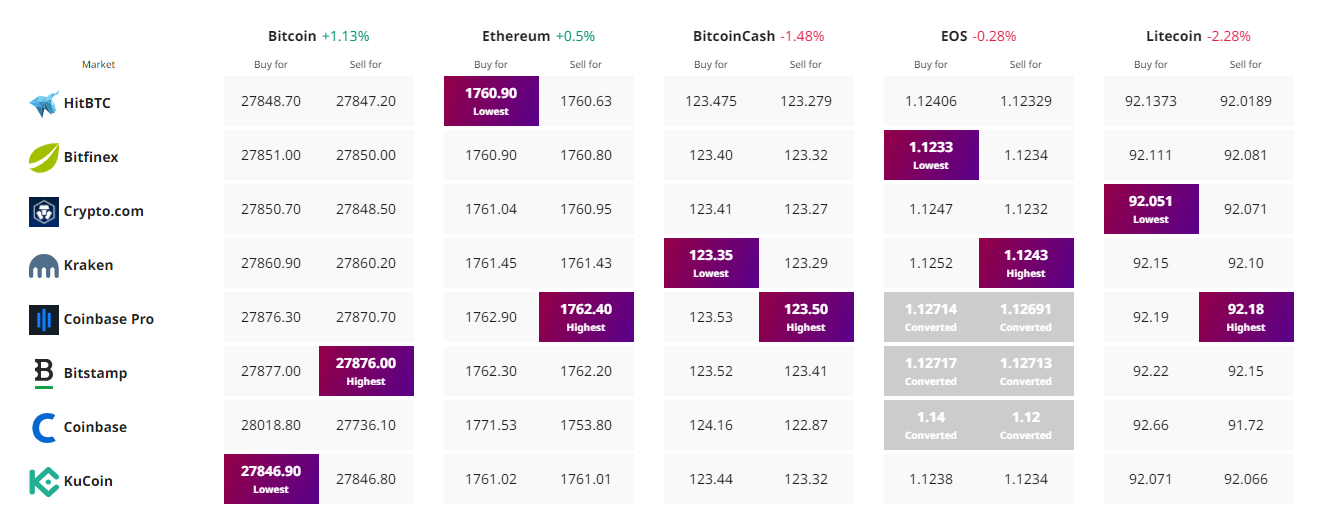

Find The Best Price to Buy/Sell Cryptocurrency