Bitcoin Is Up Over 120% From 2022’s Lows – Here Is How High It Could Pump This Bull Market

Just under one year ago, the Bitcoin (BTC) market was in turmoil as panicky investors dumped their holdings in wake of the collapse of the cryptocurrency exchange FTX.

On November the 21st 2022, the BTC price hit its lowest level since late 2020 under $15,500, marking a 77% pullback from the all-time highs it hit in November 2021 at $69,000.

Whilst the collapse of FTX was the catalyst for Bitcoin’s final decline in 2022, an aggressive interest rate hiking cycle from the US Federal Reserve that caught the broader market off guard was arguably the main catalyst behind the 2022 bear market.

However, since late 2022, Bitcoin has enjoyed a stunning reversal of fortunes.

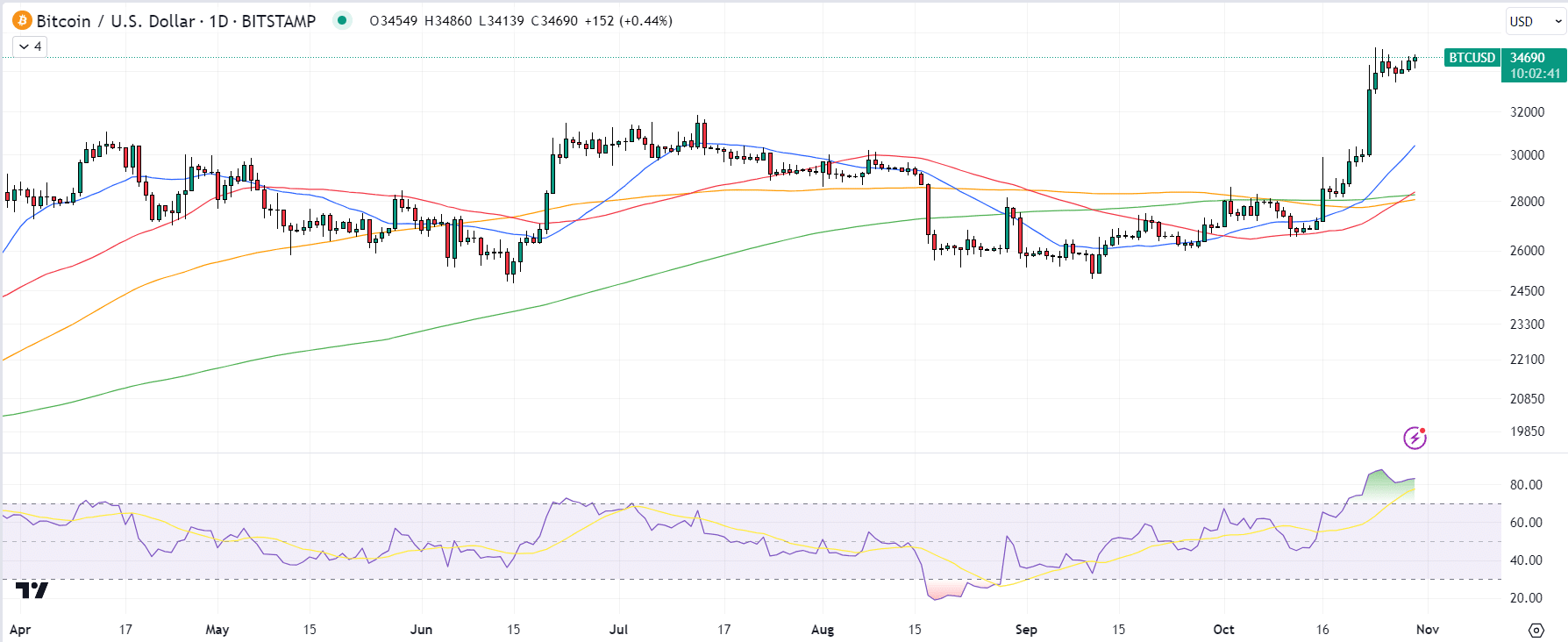

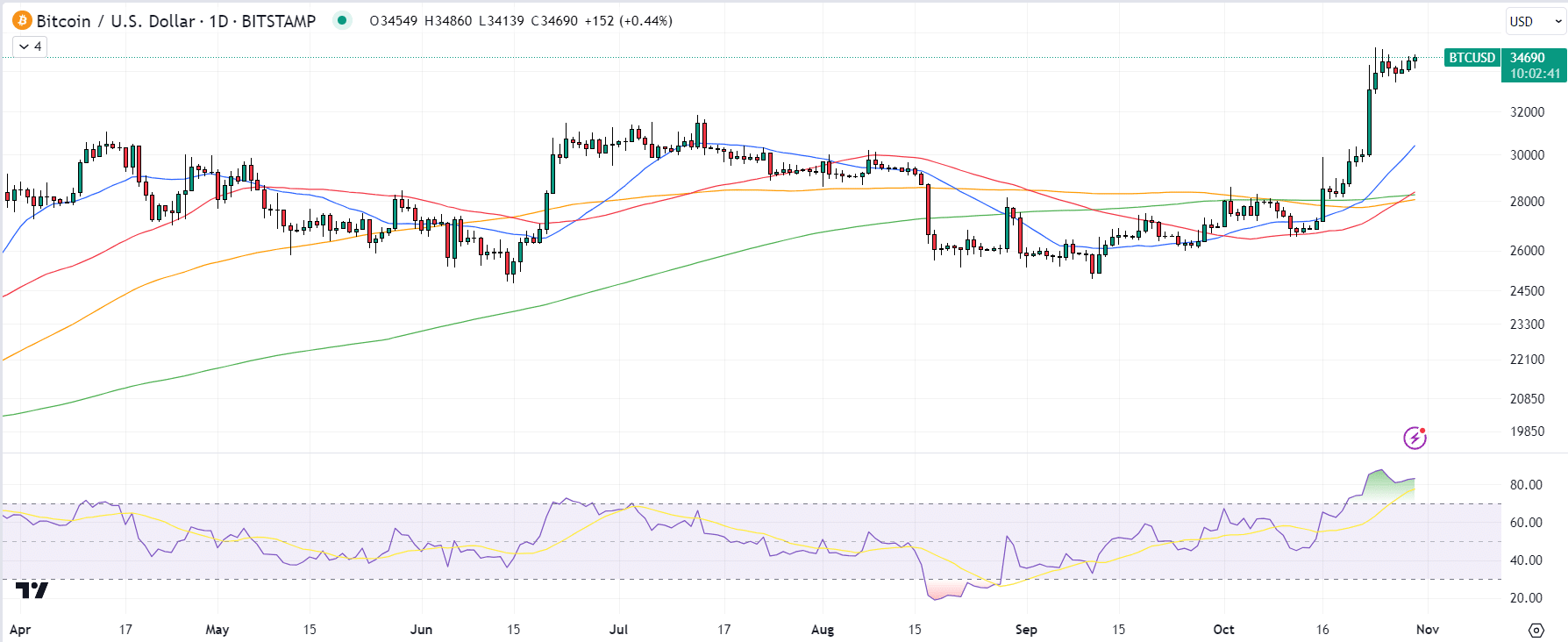

At current levels just under $35,000, its price is up more than 120% from the 2022 lows and the cryptocurrency’s pullback from its 2021 highs is now closer to 50%.

Bitcoin’s 2023 resurgence is striking given that the macro landscape hasn’t improved much this year.

Amid continued strong performance of the US economy, the Fed has continued to lift interest rates in 2023 (albeit, much more slowly and cautiously) and yields on long-term US government bonds are at multi-decade highs.

Whilst a sudden tightening of financial conditions in 2022 was a key reason for Bitcoin’s 2022 bear market, the cryptocurrency has seen a strong recovery in 2023 despite financial conditions not loosening.

Three Reasons Why Bitcoin (BTC) Has Recovered Strongly in 2023

Mean reversion is likely one reason why the Bitcoin market has recovered so much this year, with various metrics showing that the market became historically oversold in wake of the FTX implosion.

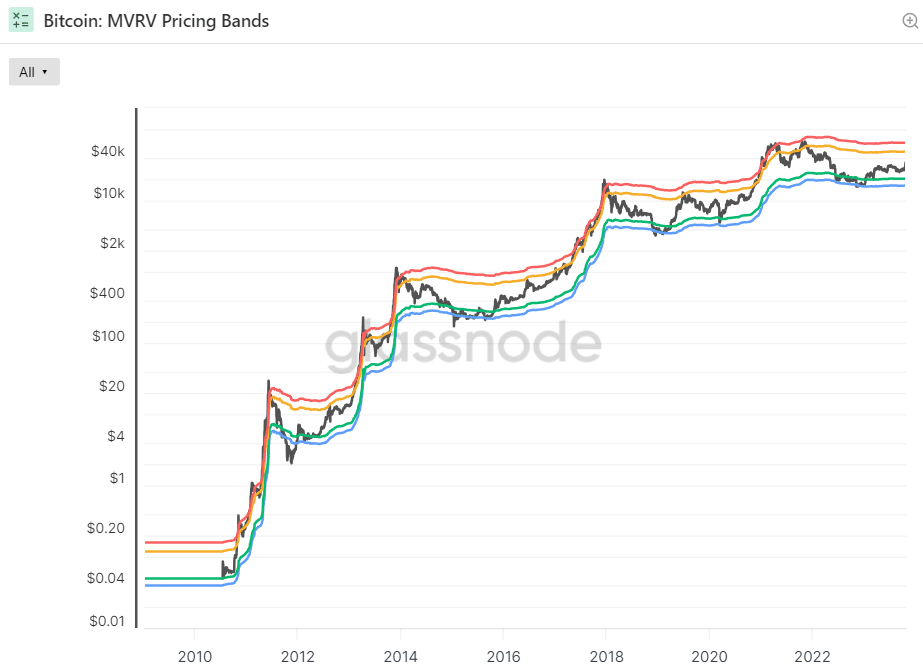

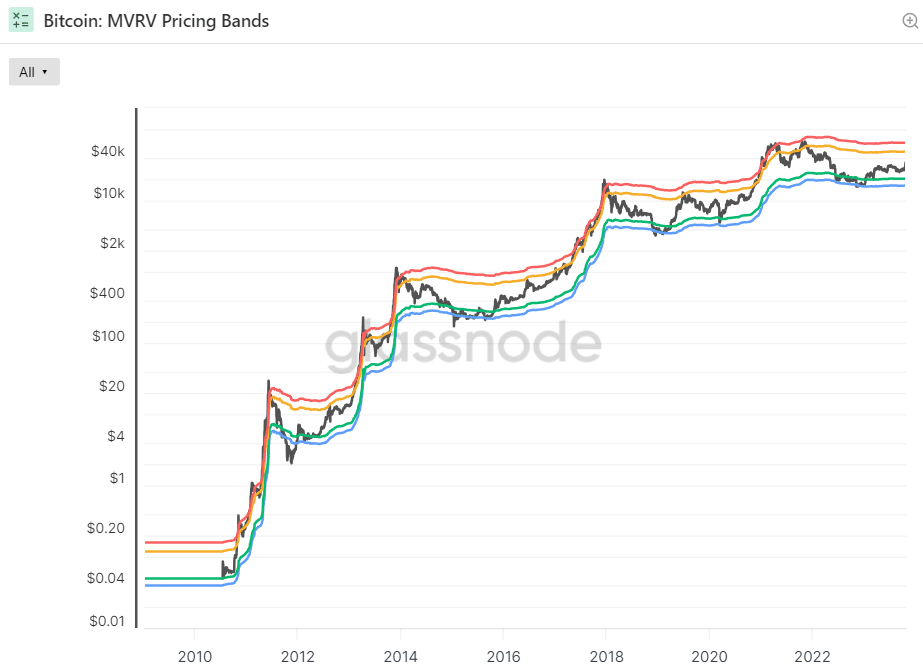

For example, as per Glassnode, Bitcoin’s Market Value Realized Value (MVRV) Ratio briefly fell under 0.8 last November, something which has rarely happened in the cryptocurrency’s history and has always previously signaled a historic buying opportunity.

The MVRV ratio is the current price of Bitcoin divided by its realized price (i.e. the price at which each coin last moved on the blockchain, which is taken as a proxy for the mean price investors paid for each coin).

The big 40% run up in Bitcoin’s price this January was largely a result of dip-buying by high conviction long-term Bitcoin bulls.

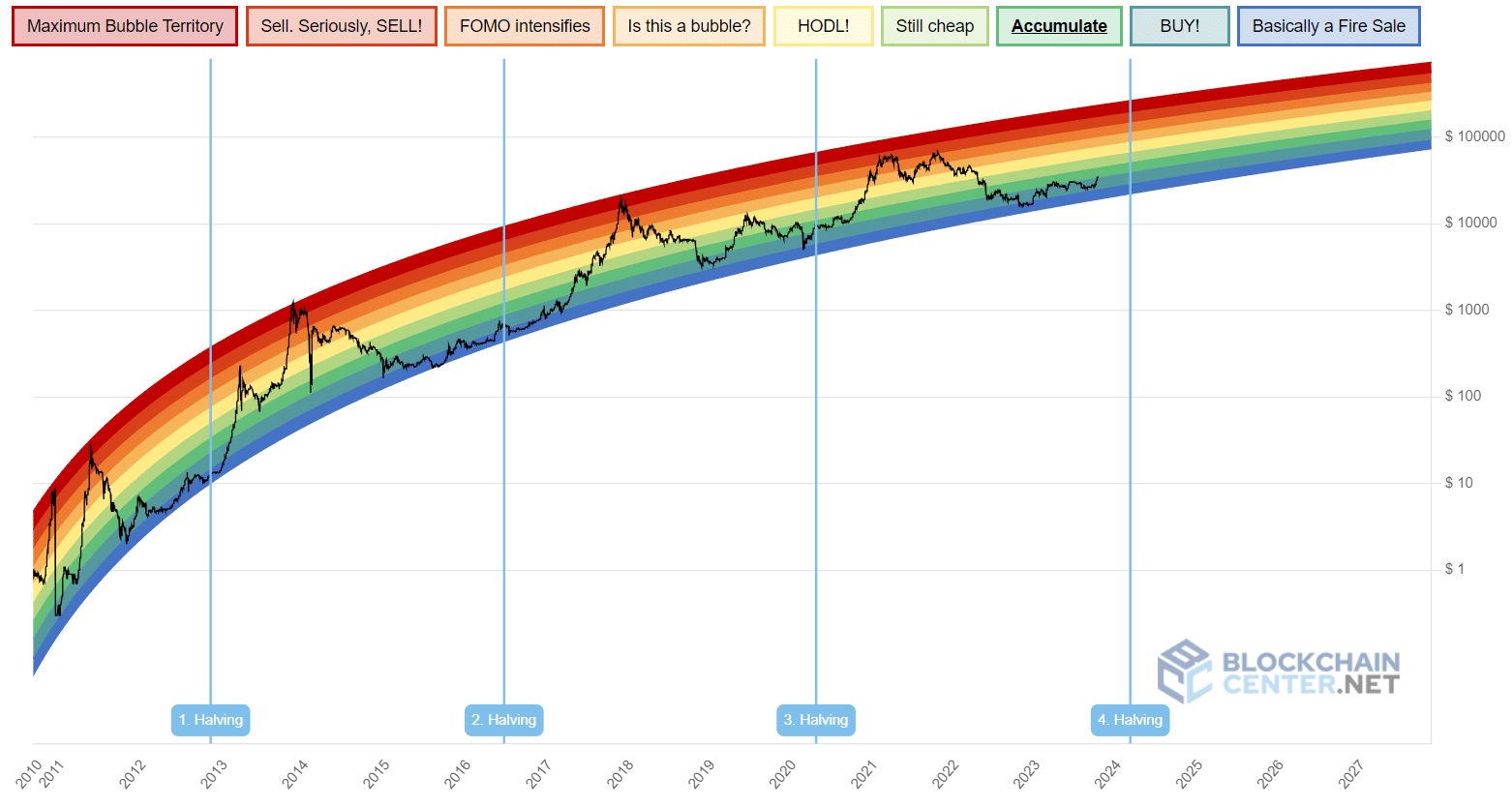

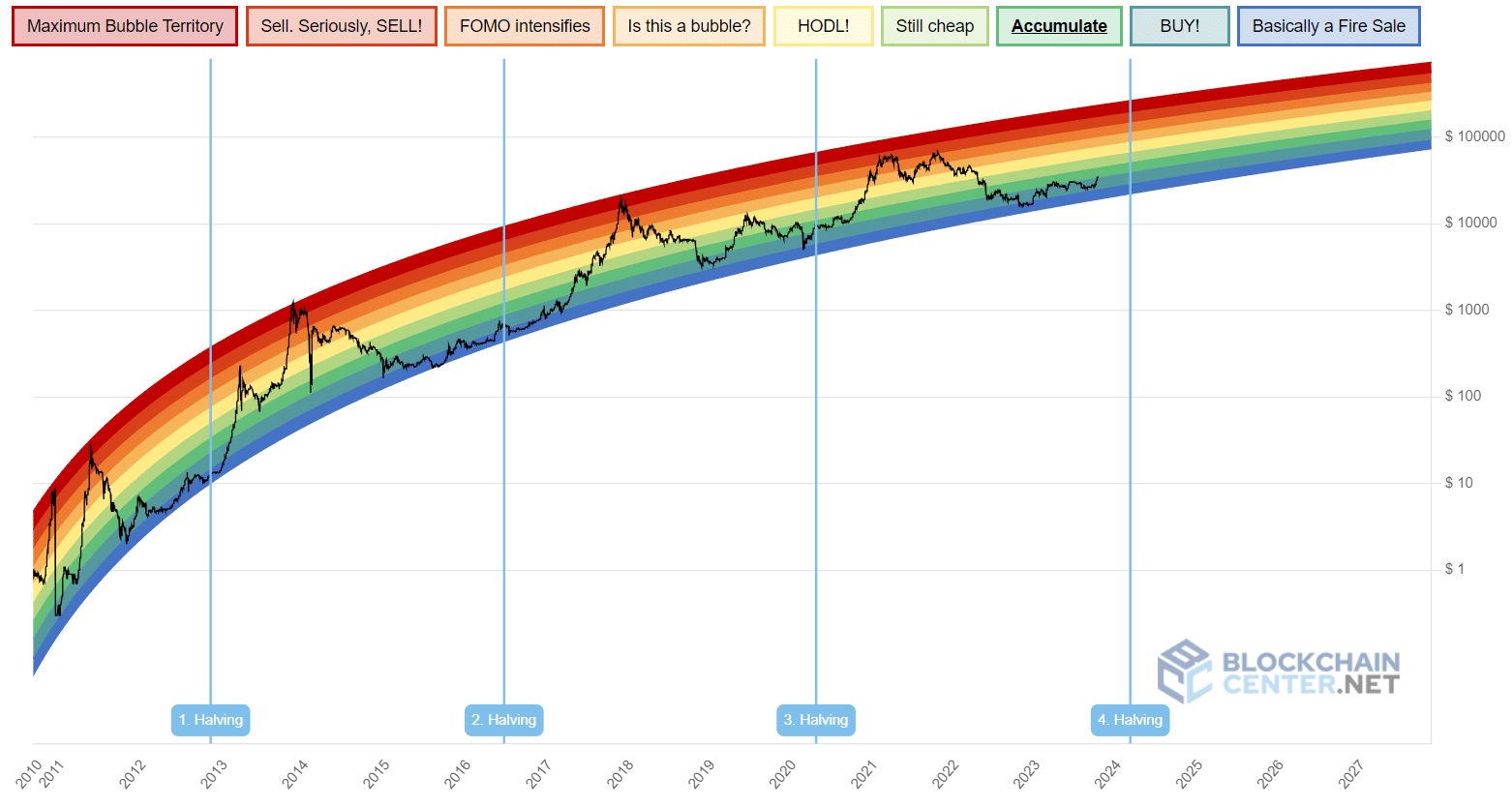

That makes sense with blockchaincenter.net’s Bitcoin Rainbow Chart showing that the BTC price had been in “basically a fire sale” territory for much of late 2022.

Whilst mean reversion got the 2023 bull market going, two further narratives powered it on.

Firstly, Bitcoin saw a sudden spike higher in March when fears of a US bank crisis began to affect the market.

This impressive performance alongside the prices of gold and bonds (which also pumped at the time) boosted the idea that, just as Bitcoin maximalists have been screaming for year, BTC is a safe haven against the failings of the current financial system and is not a risk asset.

In recent weeks, Bitcoin has again been flexing its muscles as a safe haven, gaining whilst US stocks and bonds perform poorly in unison amid concerns about 1) the still strong US economy implying higher interest rates for longer from the Fed and 2) amid geopolitical concerns amid the Israel/Hamas war.

Bitcoin has also been expanding its dominance within the crypto space, as worries about a US regulatory crack down drive a flight to quality – BTC’s dominance recently hit its highest since April 2021 above 53%.

Secondly, optimism about institutional adoption has flooded back to support the market ever since BlackRock and a wave of other major Wall Street asset managers filed to create spot Bitcoin ETFs back in June.

Indeed, growing optimism that approvals are coming late this year/in early 2023, has helped power the latest rise in the BTC price.

How High Can This Bitcoin Bull Market Run?

In prior Bitcoin bull markets, the MVRV ratio has consistently climbed to extreme levels above 3.2.

An MVRV ratio of 3.2 is currently around $65,800, but its worth noting that Bitcoin’s realized price has historically pumped during bull markets – in 2020 to 2021, the realized price ramped up from around $5,000 to a peak of around $25,000.

Let’s say the realized price (last just above $20,000) rises by 5x once again to around $100,000 during the upcoming bull market.

Well, if Bitcoin was to hit an MVRV ratio of 3.2 with a realized price of $100,000, that would imply a Bitcoin price of above $320,000, nearly 10x above current levels.

Assuming Bitcoin was to reach such levels in 2025 or 2026, that would be consistent with the BTC price returning to “sell. Seriously, SELL!” and “maximum bubble territory”, according to blockchaincenter.net’s Rainbow Chart.

A BTC price of more than $300,000 would imply a market cap of close to $6 trillion.

That may sound a lot given Bitcoin’s current market cap is around $676 billion.

But the view that Bitcoin can rival gold as a global reserve asset is becoming more mainstream, with major Wall Street leaders like BlackRock’s Larry Fink recently joining the throng of BTC supporters.

The market capitalization of all of the world’s gold was last over $13 trillion, as per CompaniesMarketCap.

Given Bitcoin’s touted benefits over gold – the fact transfers of large amounts of value are near instant and hardly cost anything and it is much easier to take self-custody of large amounts of the asset – a market cap in the trillions doesn’t seem too far-fetched.