Bitcoin Halving 2024 – Everything You Need to Know

The 2024 Bitcoin Halving event has been in the cryptocurrency conversation for a while, and has long been earmarked as the event that could help to end the “Crypto Winter” and start the next bull run. But, for many, the Bitcoin Halving 2024 is still a phrase shrouded in mystery.

In this post, we explain what a Bitcoin Halving is and look back at previous Bitcoin halving events to help us understand what might happen after the Bitcoin Halving in 2024.

Key Points

- During a Bitcoin halving event, the rewards miners receive for mining Bitcoin blocks are cut in half.

- Halvings are an integral part of Bitcoin’s economic structure and reduce the rate at which new Bitcoins are created.

- Bitcoin Halvings take place every 4 years, and the last Halving will take place in 2140. At which time, the block reward will be just 0.00000001 BTC (it is currently 6.25 BTC).

- The last Bitcoin Halving happened in May 2020, reducing Bitcoin rewards from 12.5 BTC to 6.25 BTC.

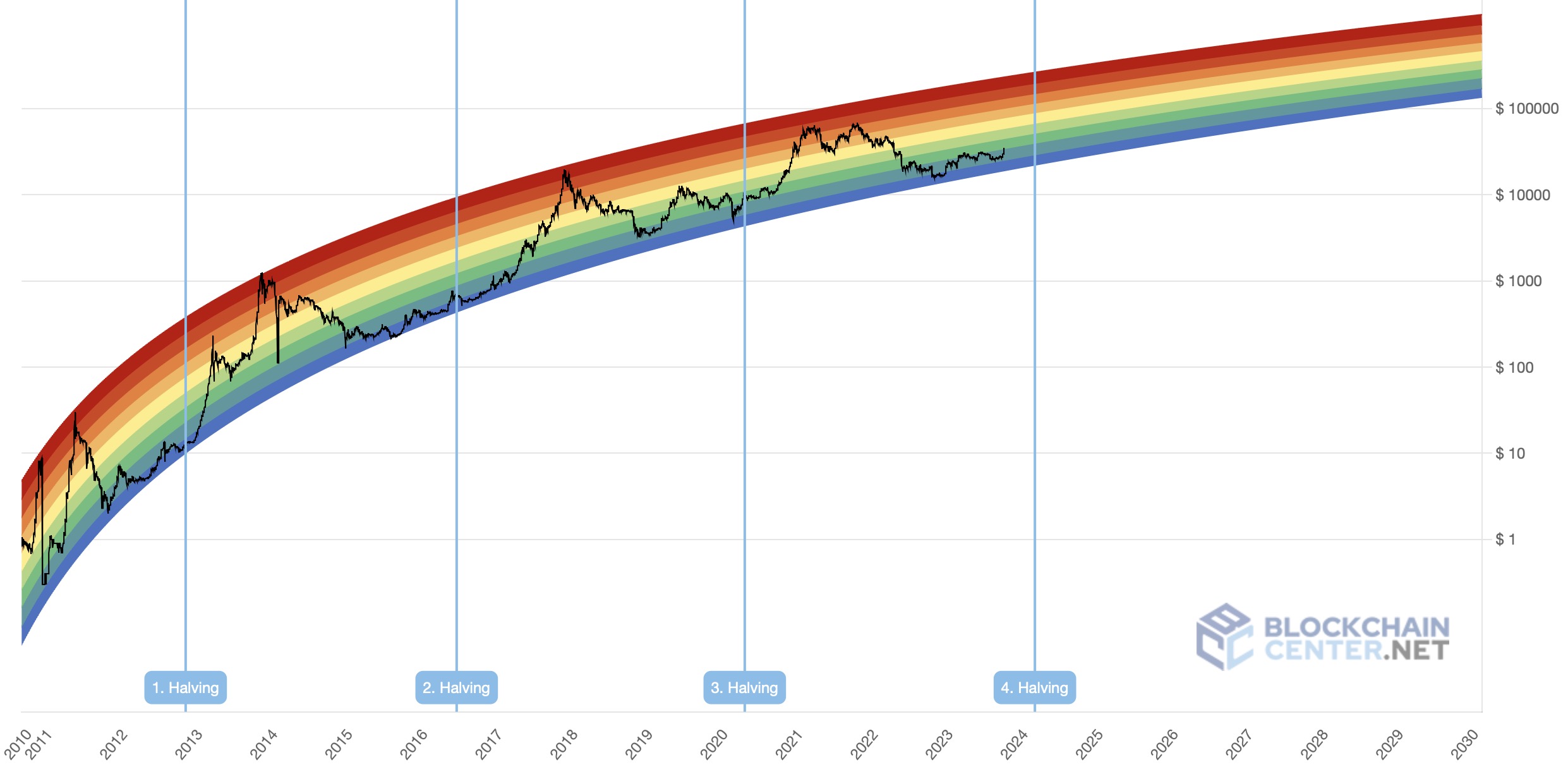

- Historically, Bitcoin Halving events have been followed by bull market markets and new ATHs.

- Due to multiple external factors, the Bitcoin Halving in 2024 is going to be different from all the previous halving events.

What is a Bitcoin Halving?

A Bitcoin Halving is when the reward received by miners for creating a block on the Bitcoin blockchain is cut in half. These are pre-planned events that are coded into the Bitcoin protocol. To properly dive into the mechanism of the Halving event, we first need to know how the Bitcoin blockchain operates.

How Bitcoin Works

The protocol that governs the Bitcoin blockchain was outlined in the Bitcoin whitepaper, released in 2008. It is a decentralized network where cryptography (hence the term cryptocurrency) is used to confirm and verify transactions, and consensus on what has occurred on the network is achieved through a proof-of-work consensus algorithm.

In the Bitcoin protocol, a copy of all past transactions, called the ledger, is kept and verified by each node in the system. New transactions are added to the ledger in increments, called blocks. When a new block is added to the blockchain, all the nodes read it and verify the transactions. Blocks are created, also called mined, by miners. This process happens roughly every 10 minutes.

The Process of Mining

A network like Bitcoin cannot be built on trust alone— the whole goal of Bitcoin is to do away with the trusted middleman. It is for this reason that we have miners and the proof-of-work algorithm.

In a proof-of-work algorithm, miners must expend energy to solve a difficult mathematic computation to “discover” a Bitcoin block. The first one to find the answer to the mathematical computation—which is a hash of a number (called a nonce) that is included in each block—adds the block to the chain, locking the block in the process and collecting the reward for doing so.

The transactions in this block are verified by the nodes and other miners of the network—this is the decentralized part, because everyone else checks to make sure the miner is honest and not including any invalid transactions in their block.

As more miners join the network, it gets harder to mine Bitcoin, meaning that more energy needs to be expended to find the answer and create a block. If miners leave the network, it becomes easier to mine Bitcoin. This expenditure of energy is what helps to keep miners honest, and keeps anyone from spamming the network with incorrect blocks and transactions.

Note that the process is called mining as it is said to be akin to how an exceptional amount of work needs to be put in to mine precious metals from the earth. Except Bitcoin miners use electrical energy to extract Bitcoins.

Why Halve the Bitcoin Block Reward?

Bitcoin was designed to be a peer-to-peer digital cash, meaning that it is aiming to be used like we do any currency today.

Bitcoins vs Satoshis

Even though 1 Bitcoin is currently worth tens of thousands of dollars, it actually has 8 decimal places, meaning you can buy as little as 0.00000001 of a Bitcoin. This 0.00000001 of a Bitcoin is 1 Satoshi.

For 1 satoshi to be worth 1 dollar, 1 Bitcoin would have to reach a value of $100m. There are some people who say we should actually be calculating things in satoshis, so, instead of saying, “I bought 0.01 BTC,” we should instead be saying “I bought 1 million satoshis.”

The currencies we use today are issued by a central bank. They are also typically inflationary, meaning that the bank issues more currency, which, in turn, devalues the value of the pieces of currency already out there, meaning that prices rise.

As Bitcoin is decentralized, there needs to be a way of controlling the overall supply and the issuance of these coins. This is done by distributing them to the miners who create the blocks and secure the network.

The Halving mechanism is a factor in Bitcoin’s monetary policy and is built into the code. It serves many purposes in the Bitcoin ecosystem.

- Controlled Inflation: Halving limits excessive inflation and ensures that the rate of Bitcoin inflation decreases steadily over time, essentially making it a deflationary asset. The final Bitcoin will be mined at some point in 2140. This is in complete contrast to the currencies we use today, which are inflationary assets.

- Capped Supply: Bitcoin was created with a finite total supply of 21 million Bitcoins. The Halvings allow it to issue this supply over an extended period of time, which enables it to achieve the other goals listed here.

- Market Forces: Each halving event reduces the profitability of mining Bitcoin, forcing miners to streamline their business models while removing less productive miners from the ecosystem.

- Extended Timeline for Adoption: Eventually, there will be no Bitcoin left to mine. After this point, sometime around 2140, miners will only earn from transaction fees. This requires enough transactions that only come from a high level of network adoption. Having new Bitcoins being distributed well into the future allows an adequate amount of time for that adoption to happen.

How Do Bitcoin Halvings Work?

The Bitcoin halving cycle is programmed into the Bitcoin protocol. No one individual or group of people has to step in to make a network change; it is done automatically.

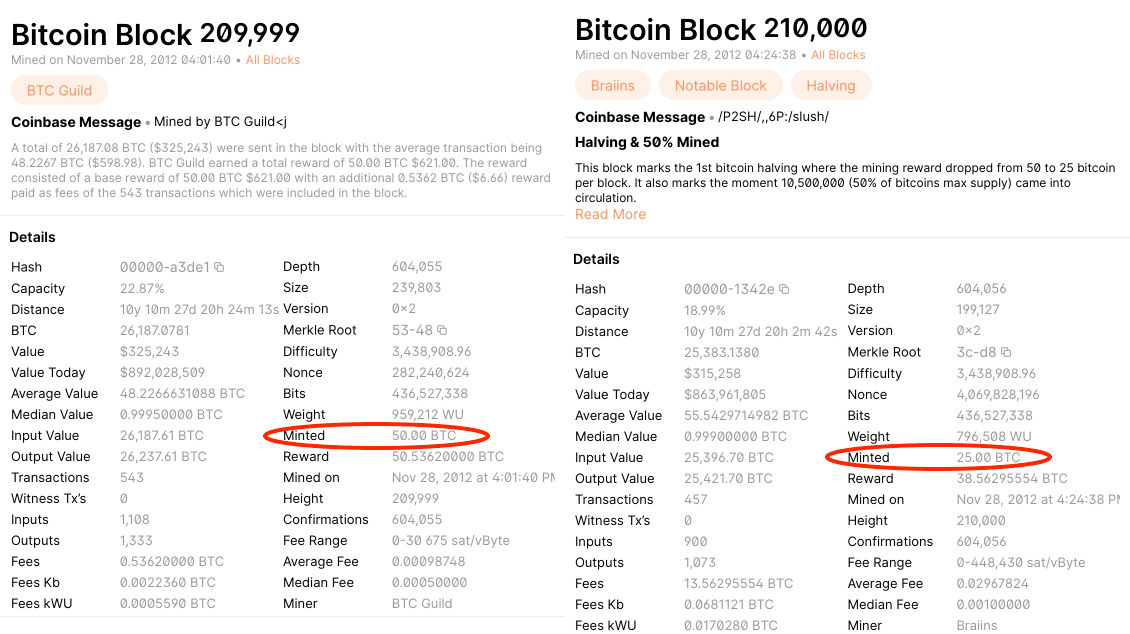

If we use a block explorer to look back at the blocks in Bitcoin’s history at the first Halving event at block 210,000, we can compare this with block 209,999 and see the evidence of the Halving ourselves.

For block 209,999, the amount of minted Bitcoin was 50 BTC. For block 210,000, it was 25 BTC. This Halving of rewards can also be seen at blocks 419,999 and 420,000, and again at blocks 629,999 and 630,000, and again at the next Bitcoin halving in 2024, at block height 840,000.

Does a Bitcoin Halving Affect the Price of Bitcoin?

The Halving of Bitcoin is a protocol event on the Bitcoin blockchain that reduces the amount of rewards miners receive for mining a block by half, e.g., from 50 BTC to 25 BTC. It has nothing to do with the price of Bitcoin, and any price movements attributed to the Halving are, just that, an association.

There have, however, been observations made about a correlation between the price of Bitcoin and the occurrence of halving events. We cover these in detail in the section below, but the general observation is that a Bitcoin halving event has no direct impact on the price of Bitcoin at the time of the event.

It is also noted that the Bitcoin Halving event has implications for the price of Bitcoin in the months after the event. Previous Halving events have been followed by precipitous price rises of the following size:

| Halving | Date of Halving | Period | Price at Halving | Price 1 Year Later | Percentage Change | ATH Reached | Percentage Change |

| 1st | November 28th 2012 | 2012–2016 | $12.20 | $1,242.00 | 10,080% | $1,242.00 | 10,080% |

| 2nd | July 9th 2016 | 2016–2020 | $666.00 | $2,551.44 | 283% | $19,785.22 | 2,970.75% |

| 3rd | May 11th 2020 | 2020–2024 | $8,730.70 | $55,873.74 | 540% | $68,997.75* | 643%* |

* The 3rd Halving period has not yet been finished so the ATH reached figure and its percentage change can both change before the Bitcoin Halving occurs.

When is the Next Bitcoin Halving?

The next Bitcoin Halving event will occur in April. It is currently expected to occur in April 2024. Predictions range between April 13th and April 24th.

The exact date for the Bitcoin Halving is not set in stone because it occurs at a specific block height of the Bitcoin blockchain. Let’s explain.

A blockchain is exactly what it says on the box: a chain of blocks. A block is akin to a page on a ledger. It is filled with transactions and then added to the chain. It also contains a reference to the previous block, further cementing the factual proof of that block as the next block in the chain—it is also this reference that makes it impossible to alter transactions already recorded on the blockchain.

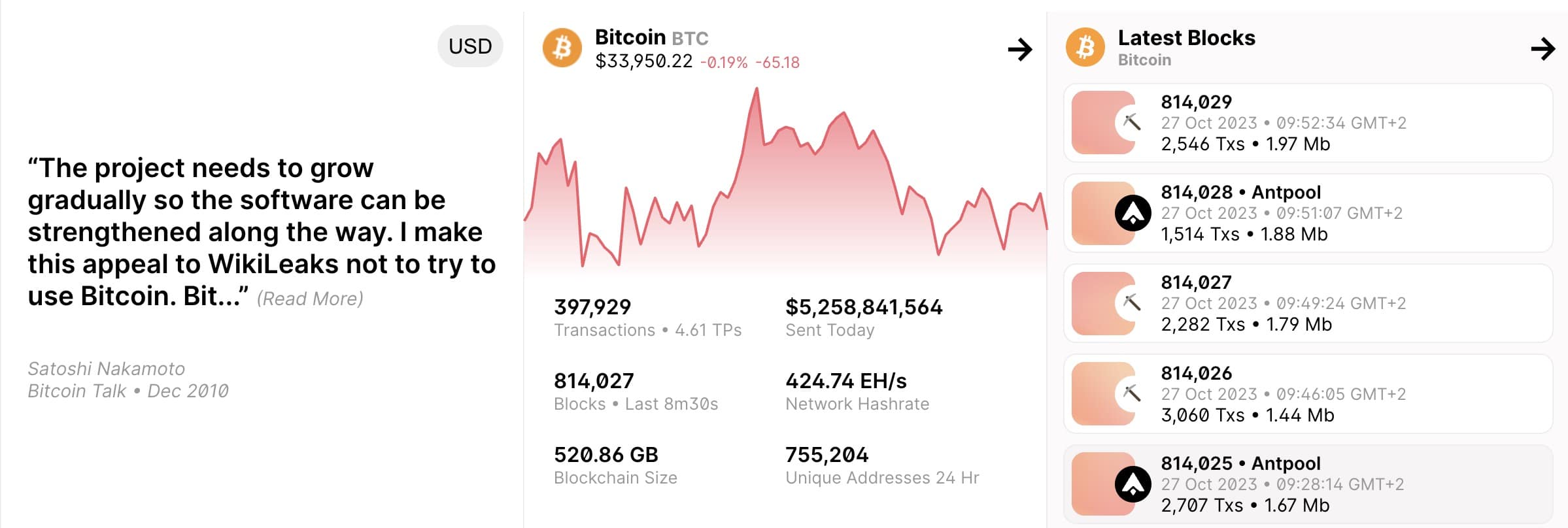

These blocks are numbered, as a page in a ledge would be. Instead of “go to page …” we would say “go to block …” or “go to block height …”. At the time of writing, we were at block 814,027. The current block height, and the content of all previous blocks, can be seen by looking at any Bitcoin blockchain explorer.

Each Bitcoin Halving event occurs every 210,000 blocks, and the next Halving is set to occur at a block height of 840,000, which is expected to be reached on April 24th, 2024.

Miners fill blocks with transactions and then need to compute a hash to mine the block. This requires solving a complex mathematical problem using computer power. This target time for solving this equation is 10 minutes. However, the more miners, i.e., the more computing power, that are working to try and solve this equation, the quicker it is solved.

Every two weeks, a parameter called the mining difficulty adjusts itself automatically to keep block times around 10 minutes. If more miners have joined the network, and blocks are being produced in less than 10 minutes, then Bitcoin’s mining difficulty goes up so that it takes 10 minutes to make a block. The opposite is also true when miners leave the network. The delay in the change of mining difficulty is why Bitcoin block times vary slightly, and this is why we cannot predict the exact time when the Bitcoin Halving event in 2024 will occur.

Calculating the Next Bitcoin Halving Date

Because the Bitcoin Halving process is baked into the protocol to happen at regular intervals, every 210,000 blocks, we can use this information to determine when the next Bitcoin Halving event will occur. It takes approximately 10 minutes to mine a Bitcoin block, meaning that a halving event occurs once every 2,100,000 minutes.

This is 1458.33 days, which is 3.995 years, which is often rounded up to 4 years. Because blocks are created approximately every 10 minutes, these numbers will vary. But, using these figures, we can determine that the next Bitcoin halving date will fall in April 2024.

Most of the current estimates for the next Bitcoin halving date suggest that the next Bitcoin halving date is either the 24th or 25th of April 2024. However, there are others that place it around April 13th, 2024.

If we look more closely at the last 3 halving periods, we find the following:

| Period | Time in Days | Time | |

| Genesis | 2009–2012 | 1,425 Days | 3y 10m 26d |

| 1st Halving | 2012–2016 | 1,319 Days | 3y 7m 12d |

| 2nd Halving | 2016–2020 | 1,402 Days | 3y 10m 2d |

We have to remember that this is a small sample, but if we average these out, we get a period of 1,382 days, which is 3 years, 9 months, and 11 days. When we add to the last halving date, May 11th, 2020, we get February 22nd, 2024. Very different from the above estimates.

As we get closer to block height 840,000, it’ll be much easier to zone in on an exact date and time for the Bitcoin Halving 2024. Until then, approximations are the best we have.

A Look at Previous Halvings

The Bitcoin network launched in 2009. Since then, there have been three halving events, and 2024’s will be the fourth. If we’re to try and predict what will happen after the next one, we should look at history and the Bitcoin Halving dates that have been and gone.

2009: January 3rd, Bitcoin’s Genesis

| BTC Price: | $0.00 |

| Block Height: | 0 |

On January 3rd 2009, someone with the pseudonym Satoshi Nakamoto set the Bitcoin blockchain in motion with the creation of Bitcoin’s genesis block.

Between this and the first halving event, the miner of each Bitcoin block received a 50 Bitcoin reward.

2012: November 28th, Bitcoin’s 1st Halving

| BTC Price: | $12.20 |

| Block Height: | 210,000 |

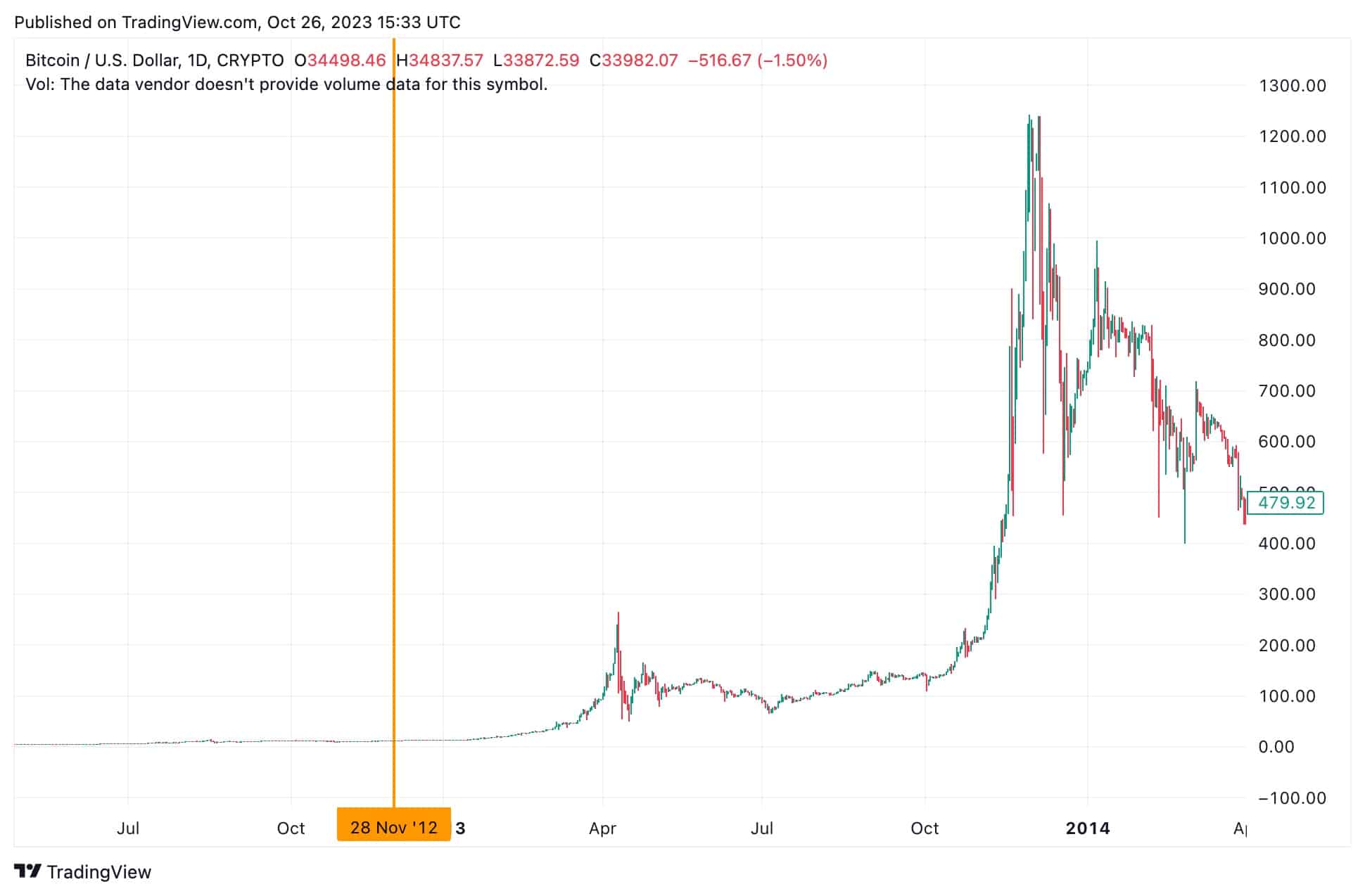

Here, Bitcoin’s block reward is halved from 50 BTC to 25 BTC. This first halving event occurred at the point where exactly half of the total Bitcoin supply had been minted. At this time, there was not a lot of hype around Bitcoin, and the highest price it had hit was $31.91. However, in the year after Bitcoin’s first Halving, Bitcoin fitted itself with some rocket boosters and went flying through the price charts and the mainstream media, with CNN exclaiming that it is almost worth as much as gold.

In April 2013, Bitcoin hit a high of $188.70, but the best was yet to come. On November 29th, 2013, one year and a day after the Halving event, Bitcoin hit a high of $1242.00. A 10,080% increase since the Halving.

After this November 29th high, the price of Bitcoin trickled towards over the next few years, to a low of $162.00 on August 18th, 2015—an 87% decrease from its high, but still a 1,228% increase on its value at the time of the Halving.

2016: July 9th, Bitcoin’s 2nd Halving

| BTC Price: | $666.00 |

| Block Height: | 420,000 |

At Bitcoin’s second Halving event, block rewards were cut from 25 BTC to 12.5 BTC. In the months before the Halving event, maybe in speculation of the event, Bitcoin pumped 81% from $435 to a high $790. However, the best was yet to come, as seen on the below Bitcoin Halving chart.

One year after the Halving, Bitcoin was up 283%, to $2551.44. But it didn’t stop there. On December 17th, 2017, Bitcoin hit a new high of $19,785.22—a 2970.75% increase on its price at the time of the Halving.

After this high, the price of Bitcoin declined more dramatically, bottoming out at just under $6000 at the start of February 2018. From here, it trickled to lows of $3,125.90 in December 2019—an 85% decrease from its high, but still 369% up from its price at the time of the Halving.

2020: May 11th, Bitcoin’s 3rd Halving

| BTC Price: | $8,730.70 |

| Block Height: | 630,000 |

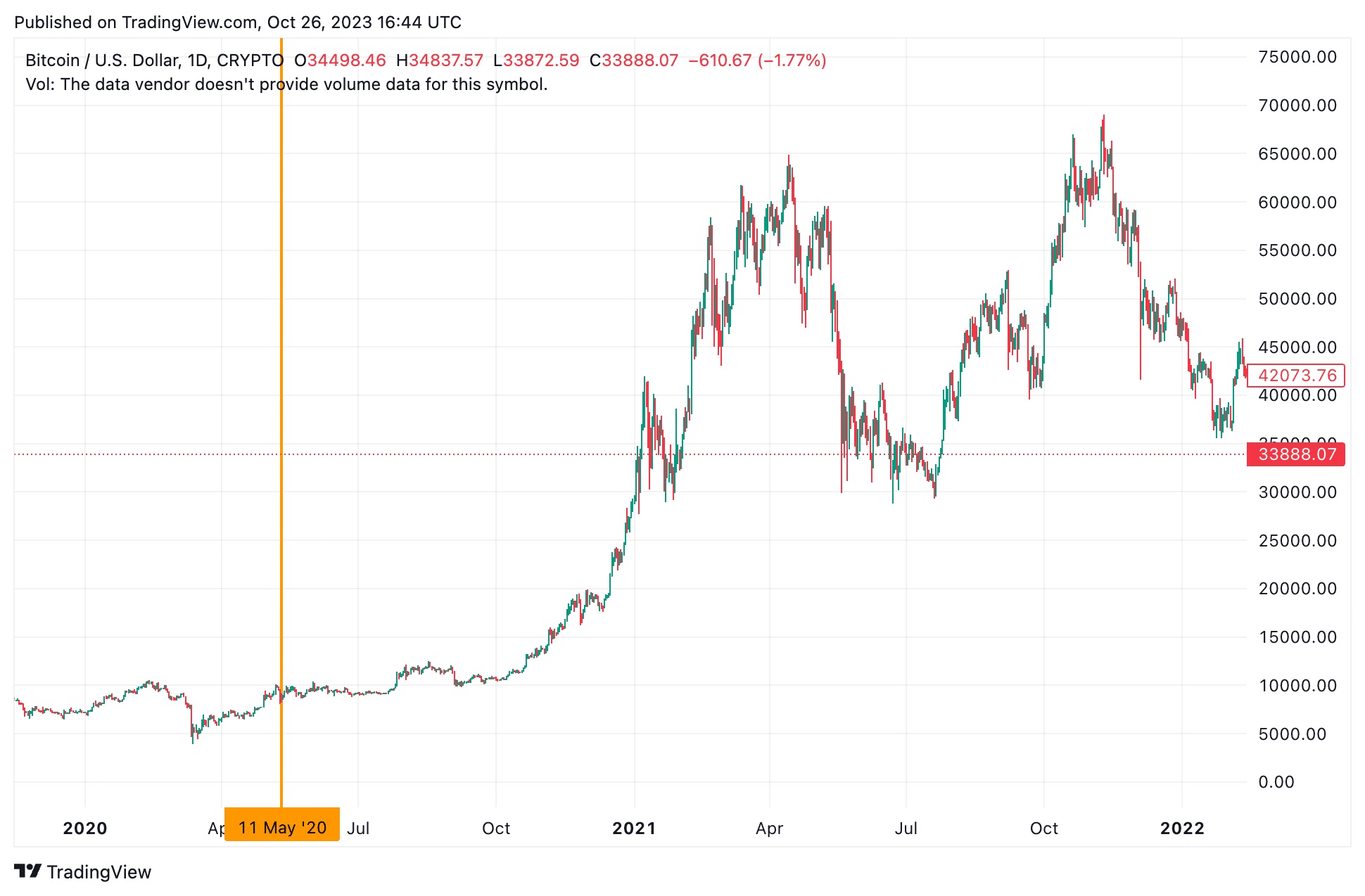

Exactly 2 months after the World Health Organization (WHO) declared COVID-19 a Pandemic, the Bitcoin code, unperturbed by the real-world situation, executed the last Bitcoin halving, its third in total. This time, block rewards were reduced from 12.5 BTC to 6.25 BTC. It was already up 10% since the WHO’s announcement.

In December that year, Bitcoin broke through $20,000 and continued its journey upwards. One year after the Halving, May 11th, 2021, Bitcoin was trading at $55,873.74, and had recently hit a high of $64,898.56. These are, respectively, 540% and 643% above Bitcoin’s price at the time of the Halving.

Despite declining to almost half this value in June 2021, $28,804.40, Bitcoin again rose to hit highs of $68,997.75. After that, it fell into a steady decline, hitting lows of $15,479.42 on November 21st, 2022—a 78% decline from its high, but still 77% up from the price at the time of the Halving.

2024: April, Bitcoin’s 4th Halving

| BTC Price: | $??,???.?? |

| Block Height: | 840,000 |

As noted, in this halving Bitcoin’s block rewards will be cut in half, from 6.25 BTC to 3.125 BTC. What will happen post halving? From what we’ve seen above, we can infer that nothing will happen in the immediate aftermath of the halving event.

However, from the above, we can also see that it is very possible Bitcoin will hit new ATHs within 1 year to 18 months of the Halving event. We can also infer from the above that, while it might hit achieve new ATHs 12–18 months after the Halving event, it is likely to have decreased by 70%+ from these highs while still remaining 70% up from its price at the time of the Halving.

It is good to be able to draw conclusions from past events, but, so far, there have only been three halving events, which isn’t a large sample size to draw a strong conclusion from. On top of that, there are other factors that might make things different this time around.

Should You Buy Bitcoin Before the Next Halving?

For a long time, especially since we’ve been in a prolonged Crypto Winter, price speculators and even investment banks have pointed to the 2024 Halving as a time when Bitcoin and the crypto markets will rebound. As we just saw, Bitcoin’s price seems to wait until a few months after the Halving has occurred before making any large swings in any direction, and once the dust settles, the Bitcoin price is typically up 70%+ from its price at the time of the Halving.

Judging by this historical data, Bitcoin should be a buy before the Halving, so long as you’re happy to hold onto it for 12–18 months and ride the waves of the market. However, since the last Halving a lot has happened:

- Bitcoin is growing in popularity and is probably more popular, and well known now than it ever has been.

- El Salvador has made Bitcoin legal tender.

- Hong Kong has opened Bitcoin and crypto trading to retail investors.

- Regulatory structures are being implemented around the world, fostering Bitcoin adoption.

- The SEC in the USA seems to be being steered toward approving a Bitcoin ETF, which would make Bitcoin available to institutional investors.

All of these advances in the world of Bitcoin and cryptocurrencies make this Halving event, and the months after it, a new one. There is more attention than ever on this Halving event, which, given that everyone is reading the historical data, means more expectation.

While this is all new for Bitcoin and the Bitcoin Halving, this attention and expectation has the potential to make all talk of new all-time highs a self-fulfilling prophecy, meaning, again, that Bitcoin should be a buy before this halving event should you be happy to Hodl.

Future Bitcoin Halving Dates

The next Bitcoin halving will take place in 2024, with most estimates placing it mid- to late April. A Bitcoin halving occurs once every 210,000 blocks, or roughly every 4 years. From that, we can expect future Bitcoin halving to occur in the following years:

| Halving Number | Year | Block Height | Previous Reward | New Reward |

| 4 | 2024 | 840,000 | 6.25 BTC | 3.125 BTC |

| 5 | 2028 | 1,050,000 | 3.125 BTC | 1.5625 BTC |

| 6 | 2032 | 1,260,000 | 1.5625 BTC | 0.78125 BTC |

| 7 | 2036 | 1,470,000 | 0.78125 BTC | 0.390625 BTC |

| 8 | 2040 | 1,680,000 | 0.390625 BTC | 0.1953125 BTC |

| … | … | … | … | … |

| 32 | 2136 | 6,720,000 | 0.00000002 BTC | 0.00000001 BTC |

Bitcoin Halving events will keep happening every 210,000 blocks until all 21m Bitcoins have been minted. At the time of the Bitcoin Halving 2024, 96.87% of all the Bitcoin that will ever exist will be in circulation. It took just over 15 years to mint this much of the supply, but it will take 116 years to mint the last 3.13% of the Bitcoin supply.

You can find a deeper dive into the exact reward schedule for all future Bitcoin halving events here.

Conclusion

The Bitcoin Halving is an integral part of how the Bitcoin protocol is designed to function and, arguably, as many believe, an integral part of how it is going to help reset the global financial system. These halving events are set to continue roughly every four years until they finally stop in 2140.

Looking at past data, from just three halving events, the time to buy Bitcoin is in the months leading up to, or just after, the Bitcoin Halving 2024. We recommend eToro as the best and easiest place to buy Bitcoin, and you can sign up and buy BTC in as little as 5 minutes, just in time to HODL it for the aftermath of the 2024 Bitcoin halving event.

References

- https://bitcoin.org/bitcoin.pdf

- https://www.blockchain.com/explorer/blocks/btc/630000

- https://www.blockchain.com/explorer

- https://ycharts.com/indicators/bitcoin_average_difficulty

- https://www.coindesk.com/tech/2023/01/03/the-genesis-block-the-first-bitcoin-block/

- https://www.bbc.com/news/magazine-25332746

- https://money.cnn.com/2013/11/29/investing/bitcoin-gold/index.html

- https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19—11-march-2020

- https://trends.google.com/trends/explore?q=bitcoin usd&date=2009-01-01 2023-10-27

- https://www.bbc.co.uk/news/world-latin-america-57398274

- https://www.coindesk.com/policy/2023/08/03/hashkey-wins-hong-kongs-first-crypto-exchange-license-to-serve-retail-customers/

- https://www.chainalysis.com/blog/2023-global-crypto-adoption-index/

- https://www.kraken.com/learn/hodl

- https://docs.google.com/spreadsheets/d/12tR_9WrY0Hj4AQLoJYj9EDBzfA38XIVLQSOOOVePNm0/pubhtml?gid=0&single=true

FAQS

What does Bitcoin halving mean?

A Bitcoin Halving is when the rewards received for mining a Bitcoin block are cut in half. This occurs approximately every four years, is an important part of Bitcoin’s economic structure, and is written into the Bitcoin protocol.

Is there a Bitcoin halving in 2024?

Yes. Bitcoin Halvings happen every 210,000 blocks, which is approximately every 4 years. The next Bitcoin Halving occurs at block 840,000, and many analysts predict this will occur in April or May of 2024.

What date is the next Bitcoin halving?

The next Bitcoin Halving is scheduled to take place at block 840,000. This is predicted to occur sometime in April or May of 2024. Many analysts are estimating April 24th or 25th.

Will BTC go up after the next halving?

All the previous Bitcoin Halvings have been followed by rallies and new ATHs, and many predict that things will be the same this time around. Some analysts even predict Bitcoin will surpass $100,000 in value.

What happens to the Bitcoin halving with halving?

In a Bitcoin Halving, the reward for mining a Bitcoin block is halved. At the first Halving, the 50 BTC mining reward was halved to 25 BTC. In the next 2 Halving events, 2016 and 2020, it was cut to 12.5 BTC and then 6.25 BTC. In the next Halving, April/May 2024, Bitcoin mining rewards will be cut to 3.125 BTC.