Bitcoin Dominance Reaches Two-Year High Amid Regulatory Challenges for Altcoins

Bitcoin’s share of the overall crypto market capitalization, the so-called Bitcoin dominance, is nearing a two-year high amid a regulatory crackdown on altcoins and crypto companies in the US.

As of Friday at press time, the Bitcoin dominance stood at 47.8%, just below a short-lived peak from July of 2021 that reached 48.2%.

The steady rise in dominance seen this year comes as crypto companies have faced tougher scrutiny by regulators, particularly in the US.

SEC names tokens as “securities”

In its recent lawsuits against Coinbase and Binance, the US Securities and Exchange Commission (SEC) even went so far as to name specific tokens as “investment contracts, and thus as securities.”

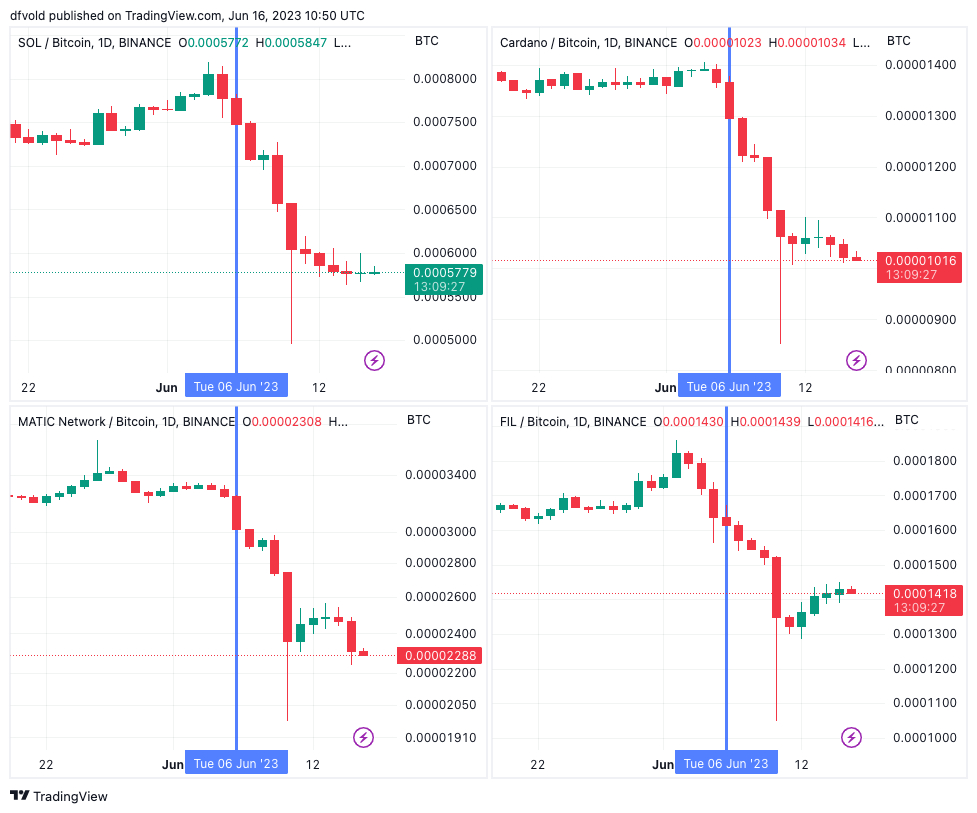

The tokens named by the SEC were SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO.

Since the lawsuit against Coinbase, all of the altcoins named as securities have fallen sharply in BTC terms.

“SOL is not a security”

Among those who have responded to their token being named as a security by the SEC was the Solana Foundation, which in a statement, insisted that “SOL is not a security.”

“SOL is the native token to the Solana blockchain, a robust, open-source, community-based software project that relies on decentralized user and developer engagement to expand and evolve,” the Solana Foundation said.

For now, however, both the SEC and other regulators such as the Commodity Futures Trading Commission (CFTC) appear to be in agreement that at least Bitcoin is a commodity, and therefore not a security.

Meanwhile, the situation for Ethereum’s native ETH token is less clear, and there is a real fear in the community that ETH could also be declared a security along with other altcoins.

If Ethereum (ETH) is officially recognized as a security by regulatory authorities, it is highly likely that there will be a more severe regulatory crackdown on almost all cryptocurrencies, excluding Bitcoin. Consequently, this could lead to a significant increase in Bitcoin’s dominance within the overall market.