Binance Sale of USDC for BTC and ETH Raises Fresh Concerns In Latest Proof-of-Reserves Report

Binance’s latest proof-of-reserves (PoR) report has come under scrutiny following its depleting USDC reserves after the collapse of Silvergate Bank.

The report released on Aug 1 to show transparency in the exchange’s dealings with user assets has sparked arguments across social media spaces heightened by Brian Armstrong’s witty comment at the company’s latest earning call.

Per the report, the exchange’s USDC balance plummeted from $3.4 billion to $23.9 million between March 1 and April 1, 2023.

Recall that Binance began implementing its USDC to Binance USD (BUSD) swap in September 2022 leading to diminishing USDC issuance but at the time, the exchange held a fair amount of the stablecoin.

On-chain data points to the fact that the exchange began converting its USDC reserve to Ethereum (ETH) and Bitcoin (BTC) after the collapse of the Silvergate Bank and the subsequent de-pegging of the stablecoin.

Aleksandar Djakovic explained on Twitter that between March 12 and May 1, the exchange bought around 100,000 BTC and 550,000 ETH for approximately $3.5 billion, around the same value as the declined USDC reserve.

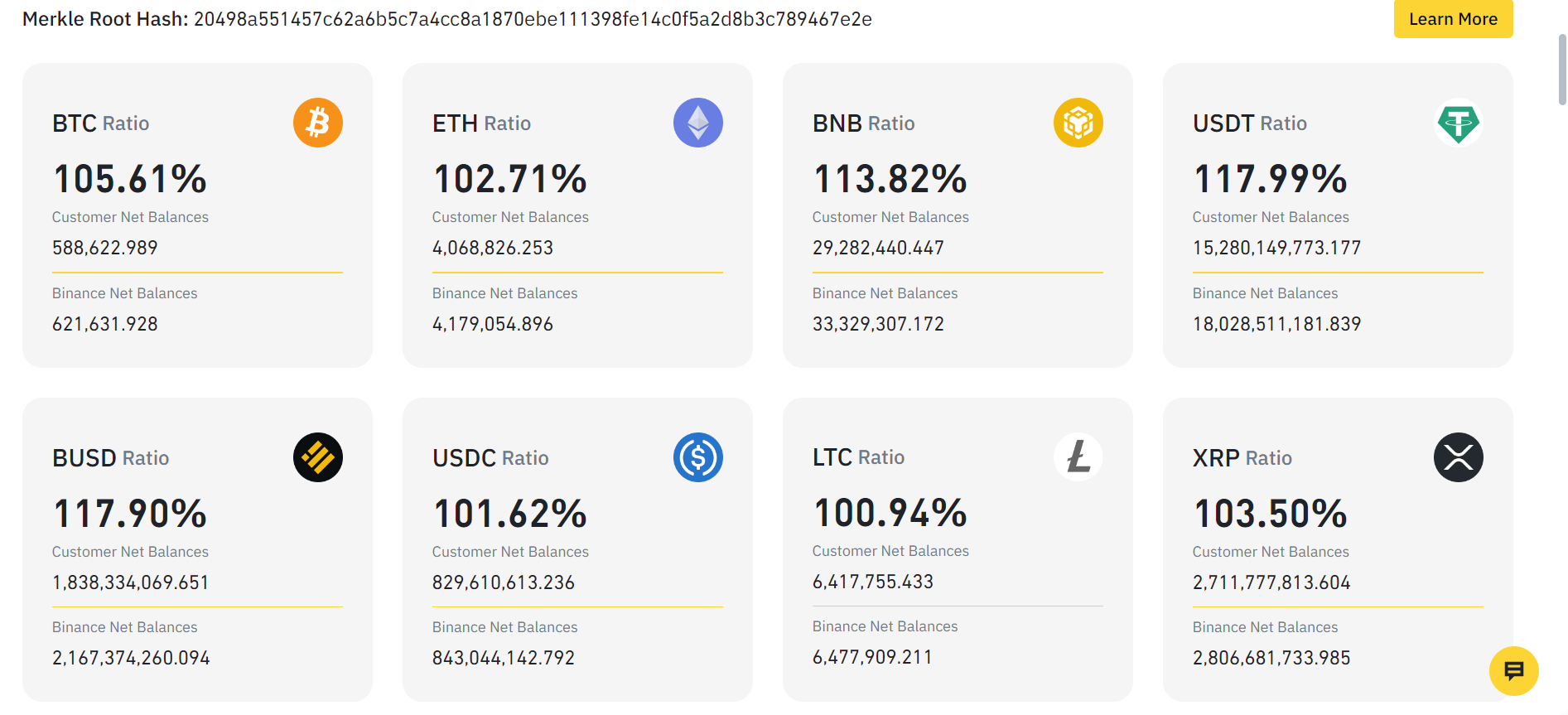

While there was controversy around the selling of USDC, a major takeaway was the overall health of the exchange. Its posting suggests that Binance’s financials is safe as its net balance covers all user assets.

The ratio of each asset’s net balance is well over customer-held assets notably BTC, ETH, and USDT which show a 105.61%, 102.71%, and 117.99% ratio respectively.

Proof-of-reserves have become more popular as a way to show an exchange of financials popularly after the collapse of FTX in Nov 2022.

Brian Armstrong adds pressure

Coinbase’s chief executive dropped a few comments that raised eyebrows on Binance USDC sales for other assets.

At the company’s Q2 meeting calls, he noted that Binance has been selling off its USDC reserve for a lesser popular stablecoin. Still, despite the occurrence, the market capitalization of USDC has remained stable.

USDC remains the preferred stablecoin for Coinbase as the company is a member of the organization that owns Circle.

“Binance moved some of their funds from USDC into another stablecoin. I think the data we have in the last six or seven weeks, I believe, that the USDC market cap is up net of that. And so that’s an important data point.”

Although USDC is still the second largest stablecoin, its market cap has shrunk over the years sliding from $44 billion in January to $26 billion this month.

Reports have also made rounds that Binance has turned to a new stablecoin FDUSD, issued by a Hong Kong-based company after the exchange offered multiple trading pairs and zero trading fees.