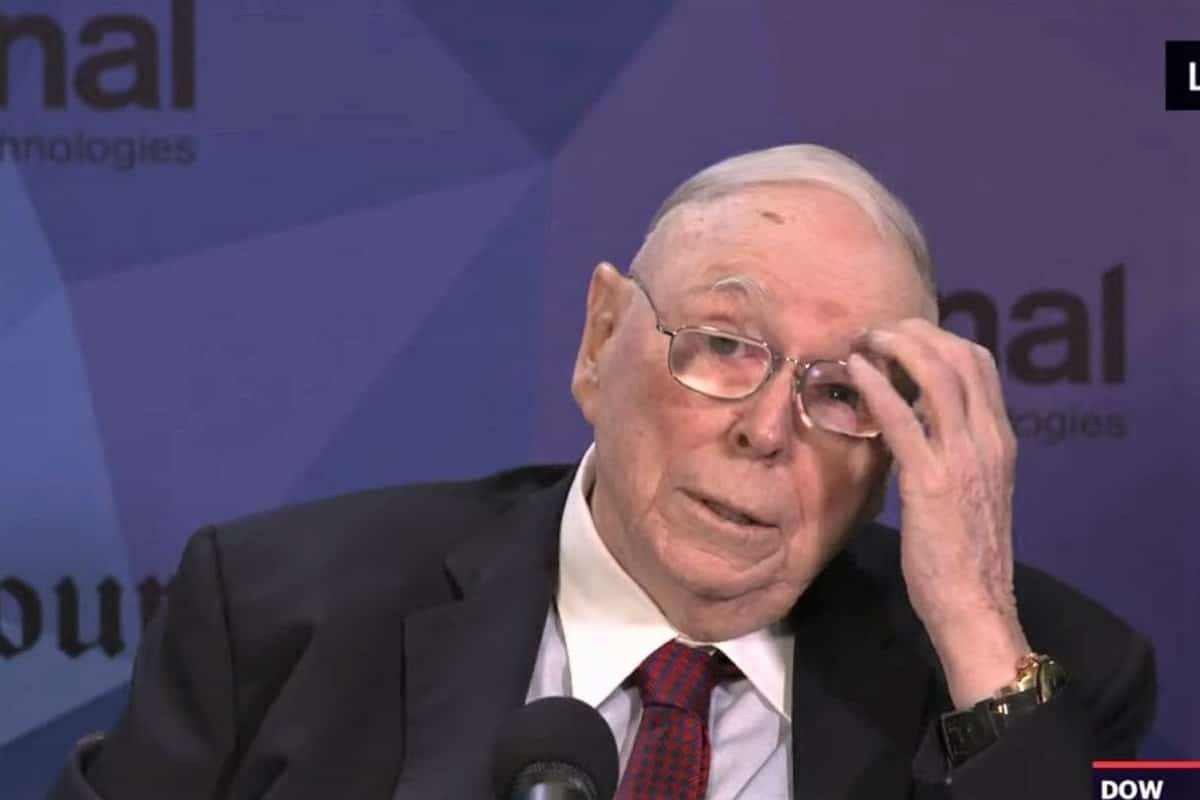

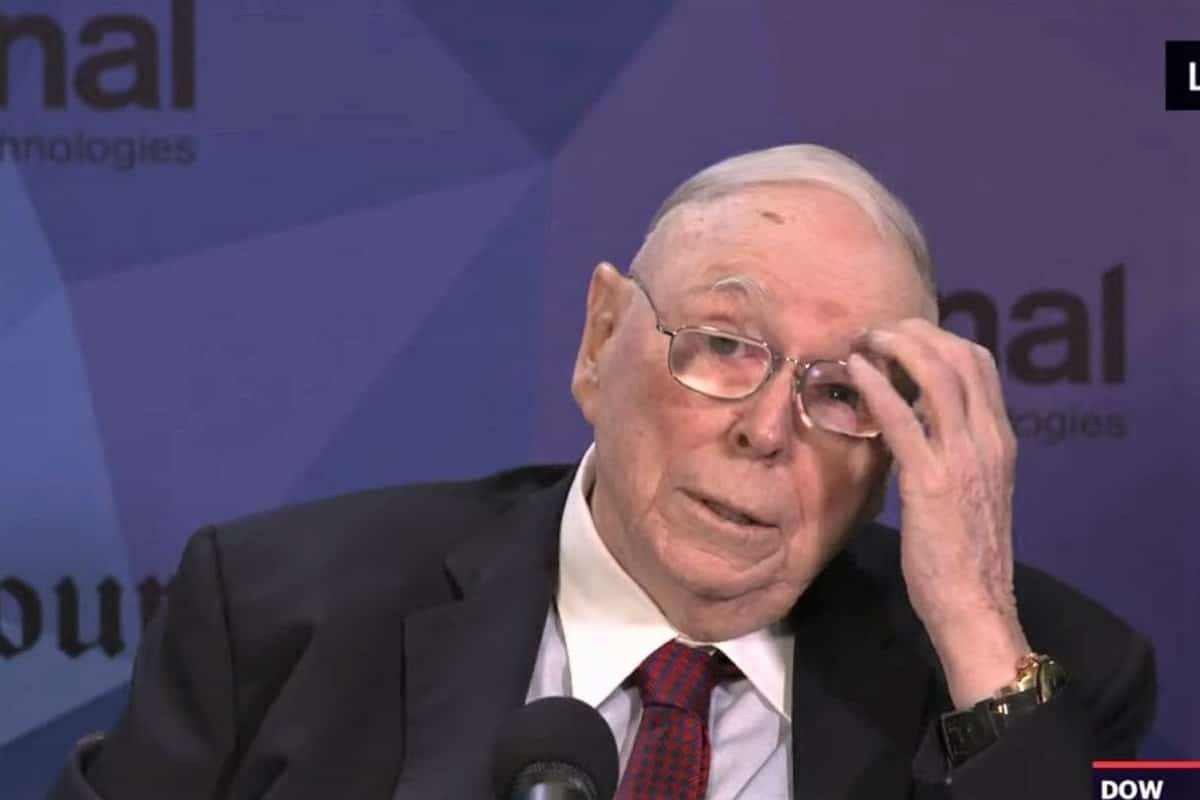

Billionaire Investor Charlie Munger Sees Bitcoin’s Rise as Disruptive Threat to Traditional Finance

Berkshire Hathaway’s Vice Chairman, Charlie Munger, recently reiterated his harsh critique of Bitcoin, labeling it as a threat to traditional finance in an interview with the Wall Street Journal.

Munger, the long-time business partner of Warren Buffett, didn’t mince words in expressing his concerns about the surging popularity of the cryptocurrency.

The 99-year-old billionaire investor voiced his concern regarding the recent rise in Bitcoin’s price.

Role of Currency in a Civilized Society

Munger conveyed his belief in fundamental economic principles, citing the teachings of economist Adam Smith. According to Munger, a stable currency is a cornerstone for facilitating exchanges and achieving prosperous economic outcomes. For a currency to gain wide acceptance, governments’ sovereign backing has historically played a crucial role.

Munger drew a historical parallel, emphasizing that throughout the transition from hunter-gatherer societies to advanced civilizations, a robust and reliable currency has always been pivotal. Whether it’s been seashells, corn kernels, gold coins, or modern banking systems, the credibility of a currency is indispensable.

The Berkshire Hathaway executive used vivid language to convey his disapproval of Bitcoin (BTC). He likened it to “throwing a stink ball into a recipe that’s been around for a long time.”

Munger’s argument is that Bitcoin, as an artificial and unregulated currency, disrupts a well-established financial system that has served the needs of societies for centuries.

Munger Continues his Criticism of Bitcoin

Charlie Munger’s skepticism towards cryptocurrencies, particularly Bitcoin, is nothing new.

He has consistently voiced strong criticisms, even going so far as to call it “the stupidest investment” he has ever seen. In the past, he has referred to Bitcoin as “rat poison,” compared its trading to “trading turds,” and expressed his disbelief in its value. Munger has been an advocate for banning cryptocurrencies, once likening them to “a venereal disease.”

In light of his steadfast stance against digital currencies, Munger offered investment advice in the interview. He recommended that the average investor would be better served by putting their money into index funds.