Best Crypto to Buy Now September 29 – Compound, ApeCoin, Pepe

The fate of a spot bitcoin exchange-traded fund (ETF) in the U.S. remains in limbo as the Securities and Exchange Commission (SEC) continued to delay decisions on several high-profile applications on September 28.

The regulator postponed judgments on filings from financial giants BlackRock and Invesco, along with crypto asset managers Bitwise and Valkyrie. This marks the second extension for these applicants in the past month.

Given the latest news on Bitcoin ETFs, what is the best crypto to buy now?

The delays come ahead of a looming U.S. government shutdown which could disrupt operations at several federal agencies, including halting work at the SEC. With the shutdown slated to start October 1, the SEC expedited its ETF delay announcements this week.

The postponements have intensified speculation around if and when the first spot Bitcoin ETF will be approved. Earlier this year, the SEC rejected an application from Grayscale to convert its popular Bitcoin Trust into an ETF. However, a recent court ruling overturned that decision in a move that could pressure the SEC to approve other filings.

In addition to the delayed applications, at least seven firms have submitted new Bitcoin ETF filings in 2022. Major financial players Fidelity and Ark Invest are among those awaiting decisions this month.

According to James Seyffart, ETF analyst at Bloomberg, additional delays are likely given the disrupted regulatory environment. “With the government shutting down, the SEC is inclined to put off any final rulings until full operations resume,” he said.

Sources say the repeated delays highlight the cautious stance of SEC Chairman Gary Gensler towards cryptocurrency-based funds. In a recent interview, Gensler said the agency is focused on ensuring investor protections are in place before approving any bitcoin ETFs.

For advocates, the lack of approval keeps the U.S. behind countries like Canada and Brazil where spot bitcoin ETFs already trade. However, the SEC remains adamant about gathering sufficient input before giving any applications the green light.

With deadlines passed and no consensus in sight, investors anxiously wait to see the SEC’s next move. But for now, the road to the first spot bitcoin ETF remains filled with uncertainty.

As the Bitcoin ETF saga continues, other cryptocurrencies such as Compound, Bitcoin Minetrix, ApeCoin, Meme Kombat, and Pepe are competing as worthwhile contenders for the best crypto to buy now thanks to their technological foundation and/or positive technical analysis.

Compound (COMP) Consolidates Around $47 After Breakout Rally

Compound (COMP) is taking a breather around the $47 level following its significant 19.70% breakout rally yesterday.

With the price stabilizing above key exponential moving averages, COMP appears well-positioned for continued upside after firmly resetting its technical indicators in a bullish direction.

The 20-day EMA for COMP currently stands at $41.59, with the 50-day EMA at $43.65 and the 100-day EMA at $47.52.

While the 20-day EMA remains below the longer-term EMAs, COMP has broken decisively above all three following yesterday’s substantial upside move.

This price action signals a shift to bullish momentum despite the shorter-term EMA still lagging.

The RSI for COMP has pulled back to 64.81 from yesterday’s overbought reading of 71.42. This cooldown from extreme overbought territory allows more room for additional upside as long as COMP holds support around current levels.

The MACD histogram now shows a value of 1.24, up from 1.07 yesterday. The upward trajectory on the MACD confirms increasing bullish momentum.

At current levels, COMP appears positioned for a potential continuation of the rally after resetting its technical indicators. But traders looking to buy the dip will need to exercise some patience as the price stabilizes.

On the downside, initial support lies between $46.70 and $48.56, aligning with the Fib 0.382 level at $47.33. COMP is currently retesting this area after breaking out above it yesterday.

A failure to hold here would put the 100-day EMA at $47.52 back in play as the next support level to watch.

On the upside, resistance appears around $51.80 to $54.66, with the Fib 0.5 level at $54.70. A daily close above this zone could provide the catalyst for COMP to extend its uptrend.

Despite a 2.55% drop in market cap to $374.8 million and a 23.59% decline in 24-hour volume to $100.8 million, COMP has held up relatively well after its breakout.

This consolidation sets the stage for possible continuation once buyers regain control. With the RSI and MACD signaling room for additional upside, the path of least resistance still appears to be the upside for COMP at current levels.

Bitcoin Minetrix’ Mine to Stake Mechanism: A Fresh Approach to Cryptocurrency Mining

Bitcoin Minetrix ($BTCMTX), a newly launched cryptocurrency, has raised over $210,000 in less than 72 hours through its crypto presale.

The cryptocurrency employs a Stake-to-Mine mechanism, allowing users to mine Bitcoin by staking $BTCMTX tokens from their Ethereum-compatible wallets.

Bitcoin Minetrix departs from traditional cryptocurrencies by introducing a no-cost, hassle-free approach to Bitcoin mining.

Unlike other systems that require specialized hardware or technical know-how, this new cryptocurrency makes it simple for anyone to start mining Bitcoin.

Users receive “mining credits,” non-transferable ERC-20 tokens, which can be burnt to earn Bitcoin mining power. The mining power can then be used to mine Bitcoin on cloud servers.

In its presale, Bitcoin Minetrix has priced its token at $0.011, with a total maximum supply of 4 billion tokens. The token allocation is divided among Bitcoin mining (42.5%), marketing (35%), community rewards (15%), and staking rewards (7.5%).

The presale is structured in stages, with the token price set to increase by 10% in each subsequent stage. The next stage of the crypto presale is set to commence once the total raise hits $3,080,000, and the soft cap for the presale is $15.6 million.

Price Predictions and Market Trends

While it is too early to accurately predict the long-term success of Bitcoin Minetrix, some early estimates suggest good potential.

According to the company, the token could be priced at $0.045 by the end of 2023. Looking further ahead, the price could reach $0.11 by the end of 2025 and $0.17 by the end of 2030, based on factors like investor sentiment and market trends.

The unique mine-to-stake feature of Bitcoin Minetrix may make it an attractive option for a wide range of investors, especially those new to the cryptocurrency market.

While the price of Bitcoin Minetrix is closely tied to that of Bitcoin, its unique utility and lower market cap could offer more upside potential.

Visit Bitcoin Minetrix Now

ApeCoin’s (APE) Bullish Momentum Pushes APE Price Above 20-day EMA

After five months of consistent lows, APE is showing signs of resilience. APE price marked a significant 7.89% uptick yesterday, closing above the 20-day EMA for the first time since August 16th.

This bullish momentum persisted into today, with APE hitting an intraday high of $1.283 before experiencing a pullback due to selling pressure at the immediate resistance level, leaving the cryptocurrency currently trading at $1.216.

In terms of technical analysis, the APE price’s 20-day EMA stands at $1.181, which is currently acting as a dynamic support level. The 50-day EMA is at $1.374, indicating that a sustained rally could push the APE price towards this level.

However, the 100-day EMA is significantly higher at $1.761, suggesting that a long-term bullish trend reversal is yet to be confirmed.

APE’s RSI is currently at 49.44, up from yesterday’s 47.41. This suggests that the APE price is currently in neutral territory, neither overbought nor oversold. However, watch for any sharp movements in the RSI that could signal a potential trend change.

The MACD histogram is at 0.027, up from yesterday, indicating bullish momentum. This could signal a potential continuation of the upward trend in the APE price, especially if the MACD line crosses above the zero line in the coming days.

The APE price is currently facing a significant resistance zone between $1.280 to $1.333. This coincides with the Fib 0.236 level at $1.311, making it an important area to watch. A break and close above this resistance zone could potentially signal a stronger bullish trend.

On the downside, the immediate support is at the dynamic 20-day EMA level of $1.181. If the APE price fails to maintain its recovery and falls below this level, the next support lies between $1.059 to $1.107. A break below this support could expose the APE price to further downside risk.

The recent positive movements in the APE price suggest the potential for a short-term recovery.

However, traders should keep an eye on key technical indicators and price levels for a clearer indication of the trend.

A break above the immediate resistance could signal a bullish trend, while a drop below the immediate support could indicate a bearish scenario.

Earn Up to 112% APY on Staking $MK Tokens With Meme Kombat

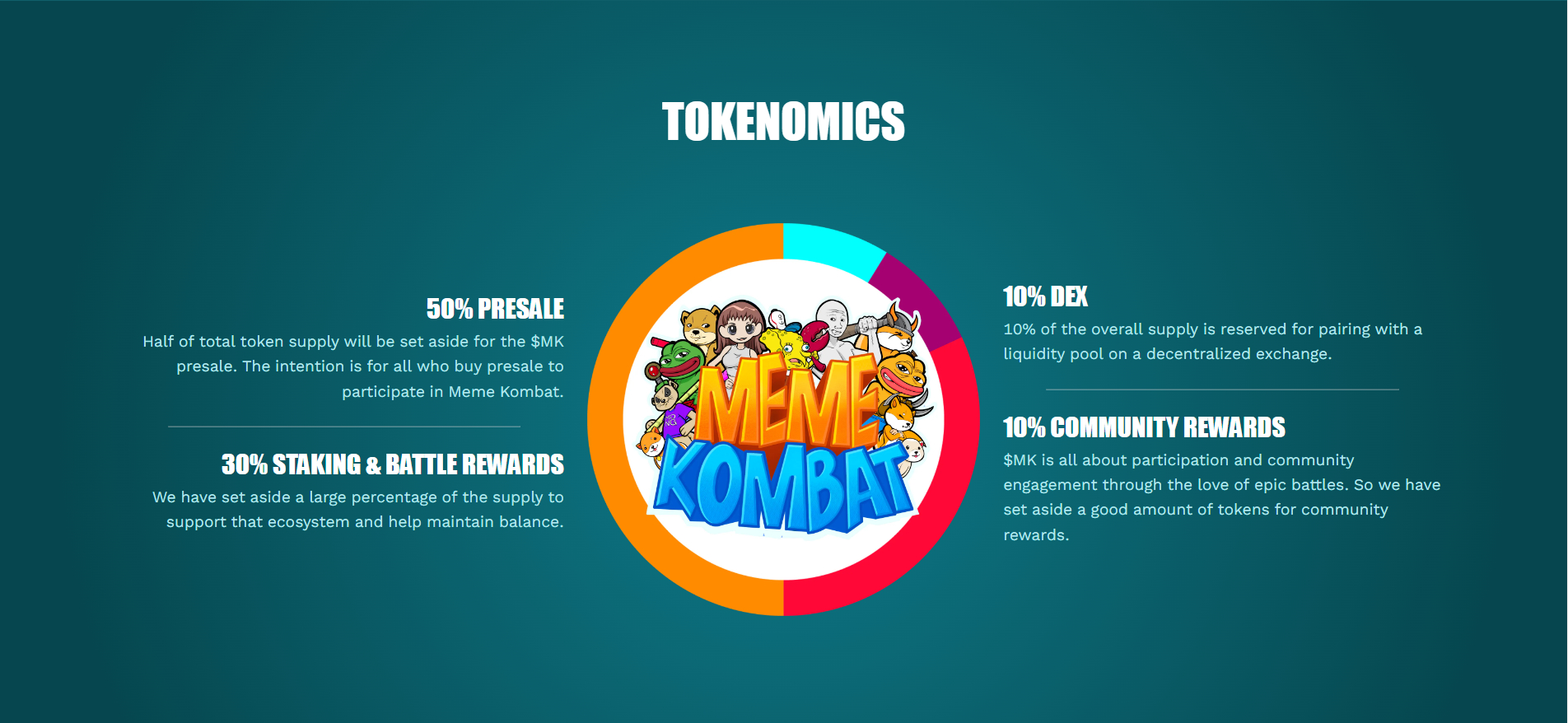

Meme Kombat, an Ethereum-based platform blending memes with competitive gaming, successfully raised over $120,000 in its ongoing crypto presale.

The platform also revealed ambitious price predictions for its native meme coin, $MK, extending through the year 2030.

Meme Kombat initiated its crypto presale with a hard cap of $10 million. The token was introduced at a rate of $1.667 per unit, and investors rapidly took notice.

According to the platform’s whitepaper, the total token supply stands at 12 million $MK, with 50% allocated for the presale. This allocation strategy focuses on community involvement to increase liquidity and stability in the ecosystem.

The platform released a roadmap detailing its plans for enhancing the utility of the $MK token. Additionally, it offers an annual percentage yield (APY) of 112% on staking.

By the end of 2023, Meme Kombat predicts that its native token will reach $4, attributing this to the platform’s official launch scheduled for October or November 2023, in-game utility features, and staking mechanisms.

Looking further down the line, the $MK token is forecasted to hit $9 by the close of 2025.

This projection is contingent upon the successful deployment of Seasons 1 and 2, with the goal of bolstering user engagement and expanding platform features.

By the end of 2030, given the expected growth of the blockchain market to $469.49 billion, the token could potentially reach a valuation of $20.

Visit Meme Kombat Now

Pepe Coin Faces Crucial Resistance Levels: Will Bulls Prevail?

While Bitcoin is seeing mostly rangebound price action today, meme coin Pepe (PEPE) has been surging impressively.

PEPE rallied 5.69% over the last 24 hours to $0.0000007750, capping off a significant 26.82% gain for the last week.

With the Pepe price testing key resistance levels, traders are wondering whether this rally has further room to run. Let’s examine some key technical indicators to gauge Pepe’s next potential move.

The 20-day EMA for Pepe currently stands at $0.0000007203, just below the 50-day EMA of $0.0000008560.

Typically, the price trading above these short and long-term EMAs is seen as a bullish sign. However, with the EMAs in close proximity, this signals high volatility and uncertainty ahead for the Pepe price.

Meanwhile, the RSI for Pepe is currently at 54.17, up from 48.50 yesterday. This shows gathering bullish momentum, with the RSI moving away from oversold territory.

Additionally, the moving average convergence divergence (MACD) histogram sits at 0.0000000265, slightly higher than the previous day’s 0.0000000237. The positive momentum on this indicator aligns with the strengthening RSI.

With Pepe stabilizing above the 20-day EMA support, technicals currently lean bullish. However, a break below $0.0000007203 could quickly reverse the trend.

On the upside, Pepe faces immediate resistance between $0.0000007545 and $0.0000008295.

Clearing this would likely spark an extended rally, whereas rejection could lead to a retest of swing low support around $0.0000005941 to $0.0000006112.

As Pepe contends with crucial technical levels, conviction appears to be growing amongst bulls.

Maintaining defined risk allowances while awaiting confirmation remains key. A daily close above resistance or drop below the 20-day EMA should set the near-term trend.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.